Daily Market Outlook - Tuesday, July 2

Image Source: Pexels

Japanese equities in Asia surged, particularly in the banking sector, as lending rates are expected to rise, bringing the Japan equity benchmark closer to a record high. Bank and insurance companies in Japan contributed significantly to the advance, while the MSCI Asia Pacific Index rose to its highest level since late May. Hong Kong-listed property and electric car maker companies also saw a surge. Traders are considering the likelihood of another Donald Trump administration following his debate with Joe Biden last week. US stock futures dipped during Asian hours, despite Wall Street pushing higher on Monday due to a surge in tech megacaps.

France's quickly assembled anti-far-right coalition's effectiveness will be evident today, as candidates have until Tuesday evening to withdraw from Sunday's pivotal second-round vote, leaving only those with the best chance of winning. After the anti-immigrant, eurosceptic National Rally's strong performance in the first round, the focus among its opponents is to prevent Marine Le Pen's party from gaining a majority. This means supporting only the most viable rival candidate to the National Rally, regardless of party affiliation, even if that candidate is from the equally controversial far-left France Unbowed party. Currently, the market expects a hung parliament, which could lead to political gridlock for the remainder of President Emmanuel Macron's term until 2027.

Despite renewed strength in the dollar, the euro remains resilient. Other currencies are not as strong, especially the yen, which is still near a 38-year low, prompting traders to be on high alert for potential intervention by Japanese authorities. The dollar-yen pair is particularly sensitive to long-term U.S. yields, which have risen due to the increasing risk of a second Donald Trump presidency, associated with higher tariffs and increased spending. The U.S. dollar and yields are also elevated due to the expectation that Federal Reserve policy will not be loosened rapidly, as inflation remains stubborn and the job market remains tight. A series of important employment data releases begins on Tuesday with the JOLTS job openings report, followed by ADP numbers a day later and the crucial monthly payrolls figures on Friday. Fed Chair Jerome Powell will have the opportunity to present his latest assessment of the economy.

Overnight Newswire Updates of Note

- RBA Continues To Sound Warnings About Upside Inflation Risks

- Inflation In UK Shops Falls Close To Zero

- US To Fight Labour Shortage With New Chips Act Worker Program

- China’s Plastics Boom Is Set To Create Another Trade Headache

- Chinese Exporters Raise Fears Of Christmas Freight Crisis

- New Zealand Building Permits Print Another Decline

- AUD/USD Trims Losses To Retake 0.6650 After RBA Minutes

- USD/JPY Advances Further Above 161.50, Possible FX Intervention

- 10-Yr Treasury Yield Climbs As Investors Look To Data In Week Ahead

- Oil Trades Near Two-Month High On Israel, Hurricane Concerns

- Japanese Shares Pull Asia Higher As Yields Rise

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0700 (861M), 1.0715-25 (403M), 1.0750 (220M), 1.0775 (365M)

- USD/CHF: 0.8900 (550M), 0.8950 (300M), 0.9020 (400M)

- EUR/CHF: 0.9635 (423M), 0.6655 (690M)

- GBP/USD: 1.2665 (315M). AUD/USD: 0.6700 (541M)

- USD/CAD: 1.3625-35 (1.4BLN), 1.3725 (270M), 1.3775 (314M)

- 1.3750 (212M), 1.3775 (344M)

CFTC Data As Of 25/06/24

- Euro net short position is -8,431 contracts

- Japanese Yen net short position is -173,900 contracts

- Swiss Franc posts net short position of -35,057 contracts

- British Pound net long position is 44,048 contracts

- Bitcoin net short position is -624 contracts

- Equity fund managers raise S&P 500 CME net long position by 17,079 contracts to 977,134

Technical & Trade Views

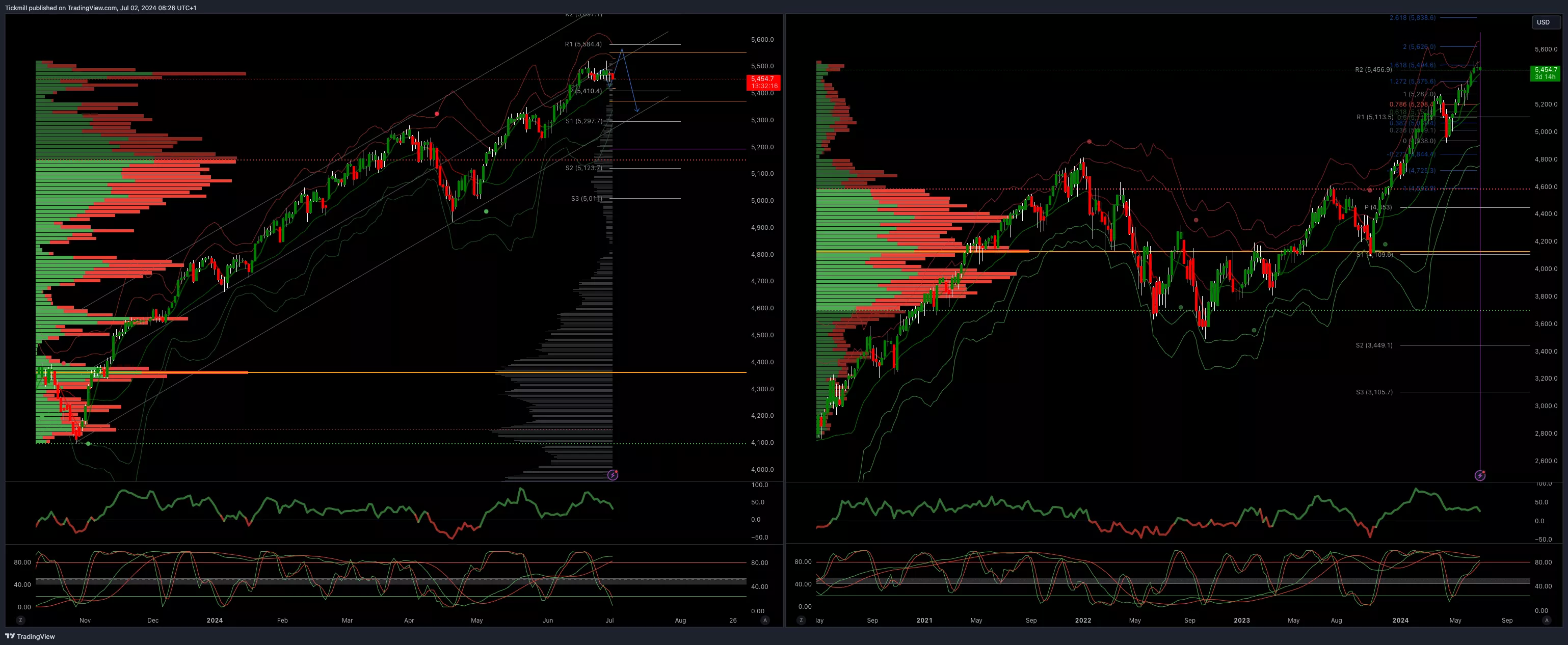

SP500 Bullish Above Bearish Below 5450

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 5475 opens 5450

- Primary support 5370

- Primary objective is 5580

(Click on image to enlarge)

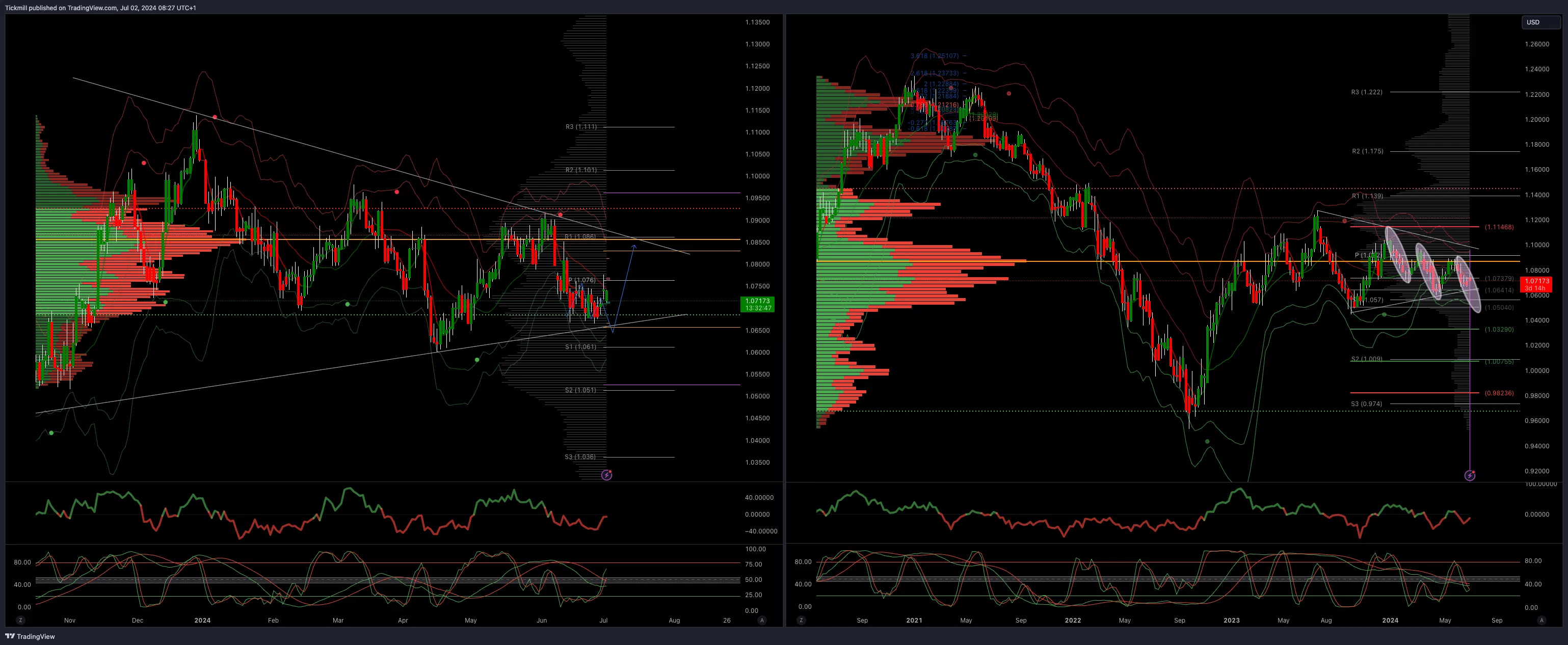

EURUSD Bullish Above Bearish Below 1.0750

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.880 opens 1.0940

- Primary resistance 1.0981

- Primary objective is 1.0650

(Click on image to enlarge)

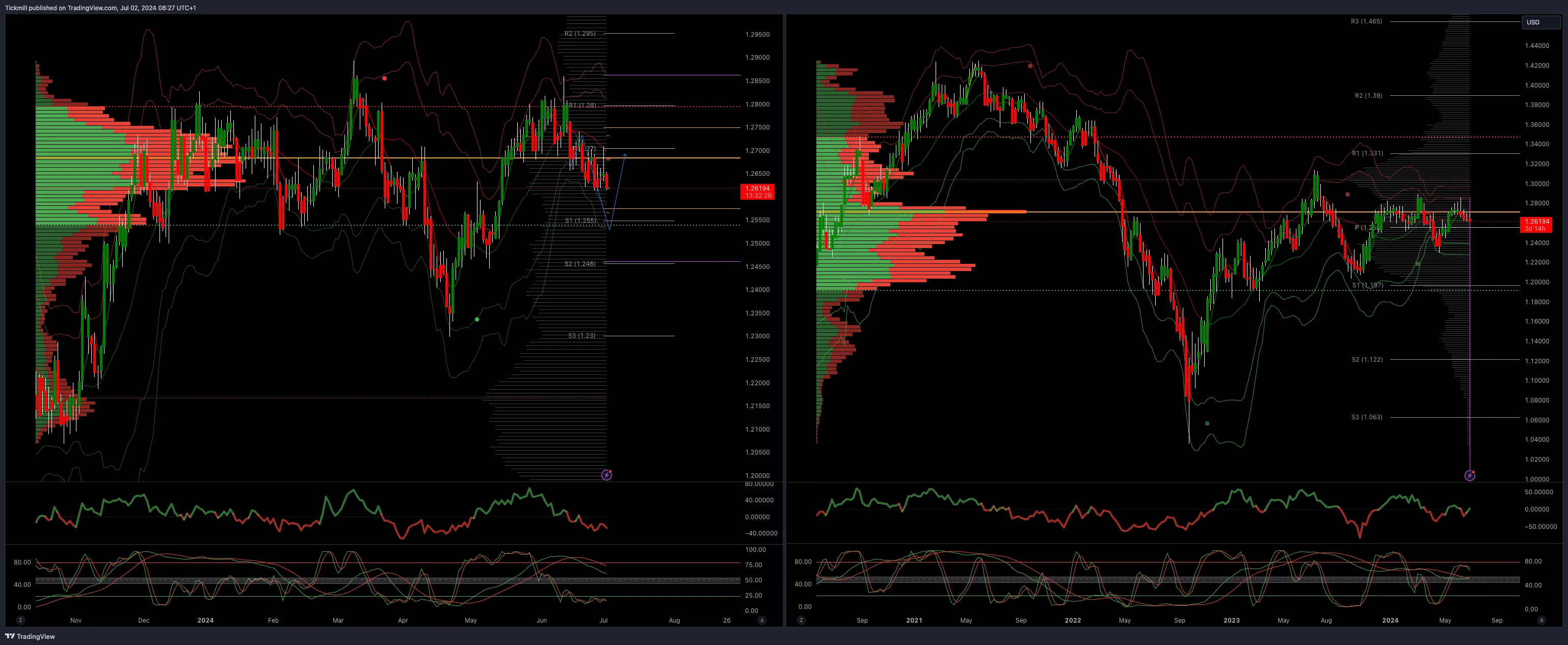

GBPUSD Bullish Above Bearish Below 1.27

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 1.27 opens 1.2730

- Primary resistance is 1.2890

- Primary objective 1.2570

(Click on image to enlarge)

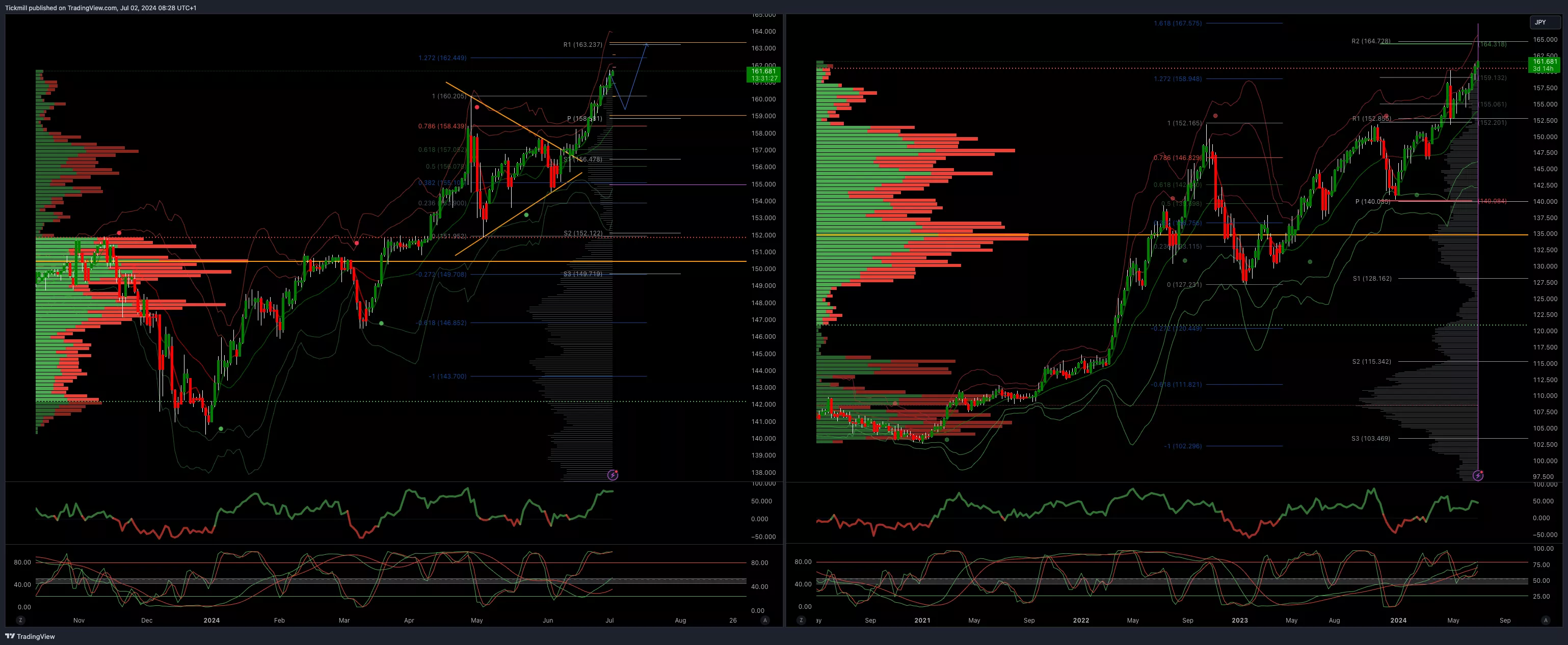

USDJPY Bullish Above Bearish Below 159.50

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 157.60 opens 157.10

- Primary support 152

- Primary objective is 164

(Click on image to enlarge)

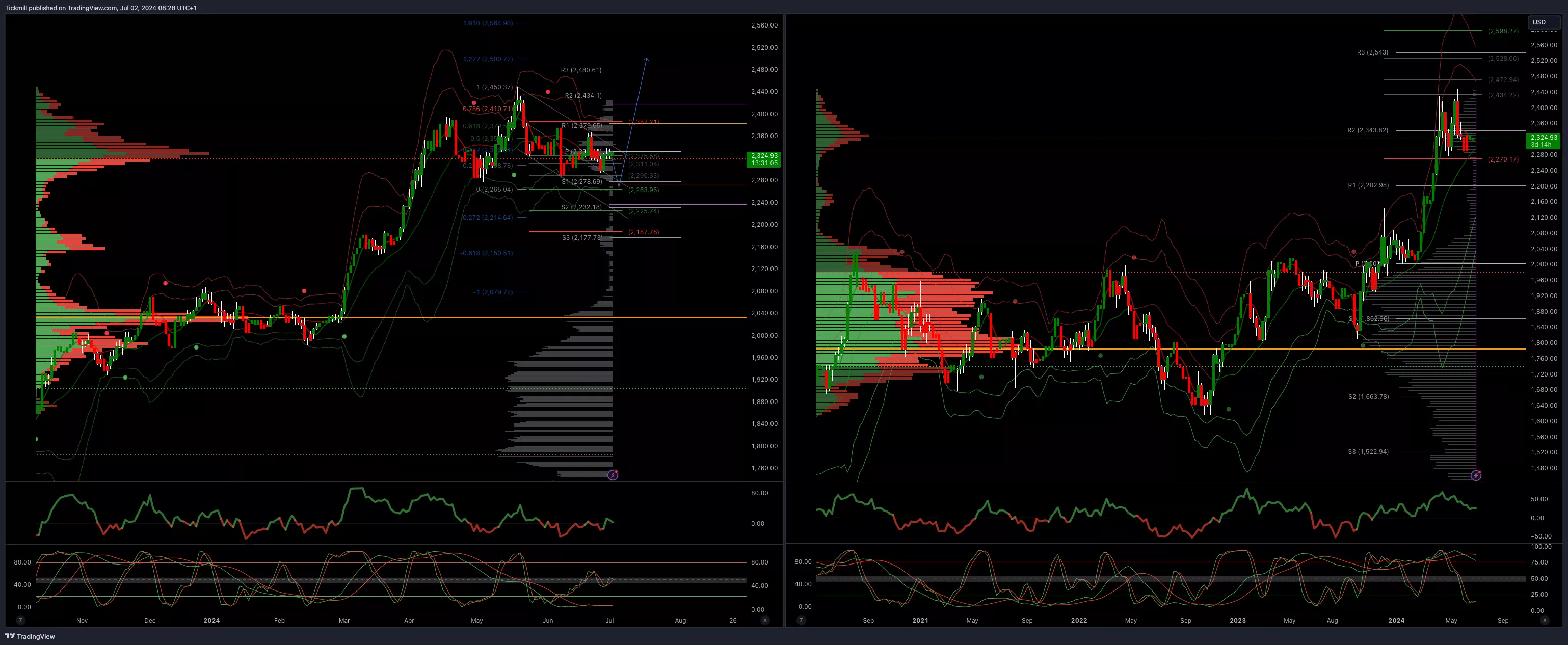

XAUUSD Bullish Above Bearish Below 2345

- Daily VWAP bullish

- Weekly VWAP bearish 2355

- Above 2365 opens 2390

- Primary resistance 2387

- Primary objective is 2262

(Click on image to enlarge)

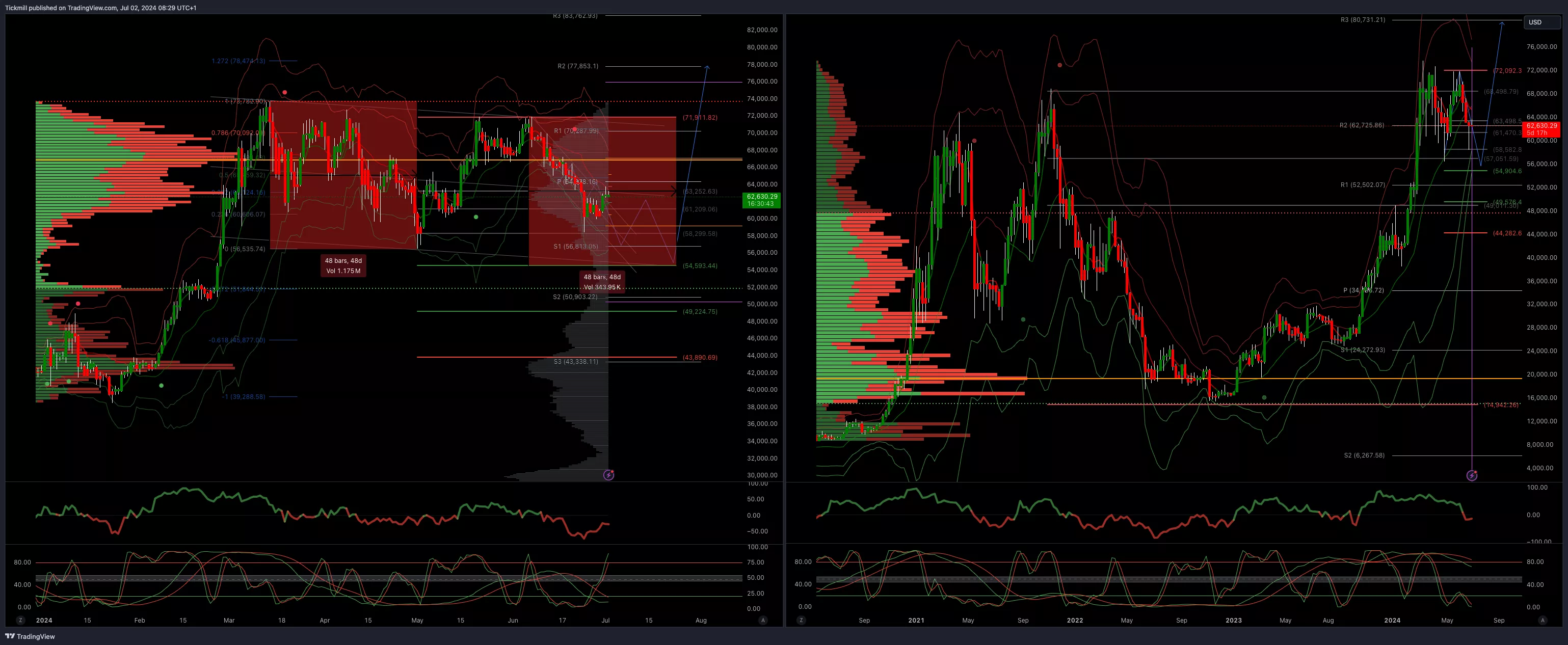

BTCUSD Bullish Above Bearish below 65840

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 67000 opens 70000

- Primary support is 64481

- Primary objective is 54500

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Monday, July 1

FTSE Another Modest Decline Ahead Of US Data & UK Elections

Daily Market Outlook - Thursday, June 27