Daily Market Outlook - Tuesday, July 11

Image Source: Unsplash

Asian equity markets experienced positive performance, driven by modest gains on Wall Street. Cyclicals benefited from promising inflation indicators ahead of the upcoming US CPI data, while market participants also considered China's support measures. The Nikkei 225 remained flat and struggled to maintain its early momentum due to a stronger currency. However, Sumco stood out as it outperformed other stocks following reports that the government would potentially provide the company with a subsidy of up to USD 530 million to enhance wafer capacity. Nonetheless, Industry Minister Nishimura later denied these reports. In contrast, the Hang Seng index and the Shanghai Comp. posted gains. This positive sentiment was primarily driven by developers who benefited from the news that China would extend two financial policies supporting the stable and healthy growth of the real estate market until the end of 2024.

This morning, the latest UK employment market report was released, providing crucial insights into domestic inflationary pressures. The report revealed that regular wage growth (excluding bonuses) for the three months up to May exceeded expectations, standing at 7.3%. This figure is likely to be viewed as too hot by most Bank of England policymakers. While employment growth slowed, it was not as significant as anticipated. However, the unemployment rate rose from 3.8% to 4.0%, partly due to previously "economically inactive" individuals reentering the job market. This influx is expected to alleviate some of the tightness in the employment market. Nonetheless, the headline read on the report is the stronger-than-expected wage growth.

For European investors, the German ZEW survey will give an early indication of economic trends for July. Although this survey targets financial experts rather than businesses, it aims to gauge both current economic conditions and expectations for the next six months. For the July ZEW survey, it is anticipated that both the current situation will print -63 and expectations -19. Other surveys have indicated a slowdown in activity in Germany, particularly in manufacturing, as companies grapple with rising interest rates.

Stateside, the NFIB small business optimism index is expected to show a slight increase from 89.4 to 89.9, according to consensus forecasts. However, all attention will be focused on tomorrow's Consumer Price Index (CPI) inflation report, which is expected to indicate a decline in the headline measure but reveal more persistent underlying "core" inflation.

CFTC Data As Of 07-07-23

- USD net spec short pared in Jun 28-Jul 3 period, $IDX +0.58% in period

- EUR$ -0.77% in period, specs -2,191 contracts into dip, now +142,837

- $JPY +0.3% in period, specs -5,050 contracts on diverging rates now -117,920

- GBP$ -0.29%, specs -1,729 contracts, now +50,265; less-dovish Fed lifts USD

- $CAD +0.21% specs +7,374 contracts flip position to +4,527

- AUD$ +0.09% in period, specs -5,158 contracts now -44,582

- BTC +0.5% in period specs +18 contracts now short 2,076 contracts(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0890-1.0900 (2BLN), 1.0925 (466M), 1.0950-55 (1BLN)

- 1.0970-80 (691M), 1.1050 (307M)

- USD/CHF: 0.8980-0.8900 (458M)

- GBP/USD: 1.2720-25 (312M), 1.2760-70 (358M)

- USD/JPY: 142.50 (250M), 143.00 (420M)

Overnight News of Note

- Australia June Business Conditions Steady In Sign Of Resilience

- China To Accelerate Policy Roll-Out To Aid Property Sector - CSJ Citing Analysts

- Japan FinMin Suzuki: Arranging G7 Meet On Sidelines Of G20

- Fed’s Williams Says He Does Not Have A Recession In His Forecast

- Fed’s Bostic: Should Wait Before More Interest-Rate Hikes

- Fed's Mester: More Hikes Needed To Bring Inflation Back Down To Target

- ECB's Nagel Sees Hard Landing Avoided Though Growth May Slow

- UK Chancellor Hunt Says Government And BoE Will Tame Inflation

- French Central Bank Keeps Forecast For 0.1% Q2 Growth

- USD/JPY Plummets To Fresh Multi-Week Low, Amid Broad-Based USD Weakness

- Microsoft Confirms More Job Cuts On Top Of 10K Layoffs Announced In Jan

- Wall Street Banks Court Sovereign Funds For Syngenta’s Mega IPO

- Uber CFO To Step Down In Most Senior Executive Exit Since IPO

- TSMC To Start Building Second Japan Plant In April

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

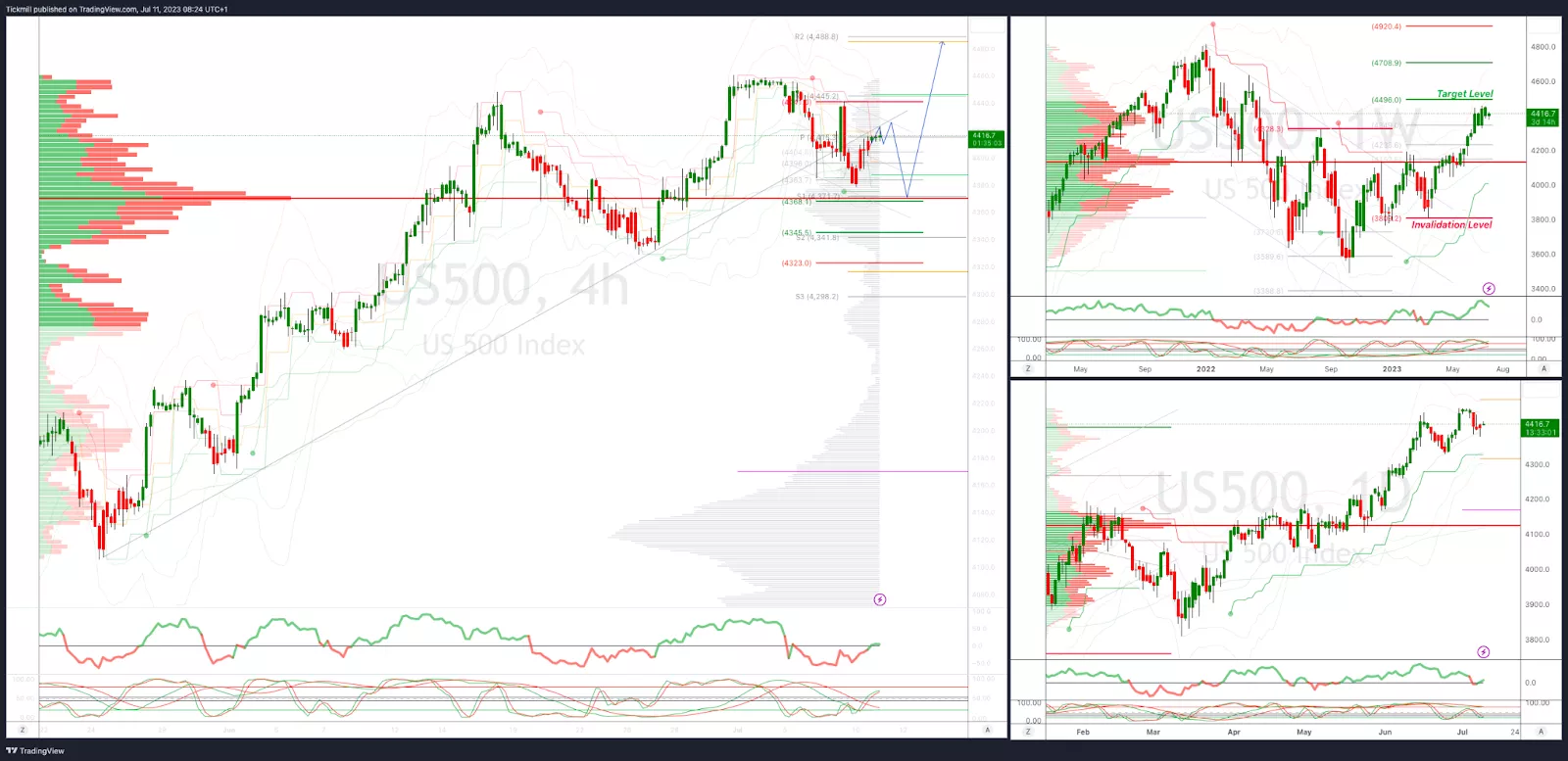

SP500 Bias: Intraday Bullish Above Bearish Below 4365

- Below 4350 opens 4330

- Primary support is 4300

- Primary objective is 4540

- 20 Day VWAP bullish, 5 Day VWAP bearish

(Click on image to enlarge)

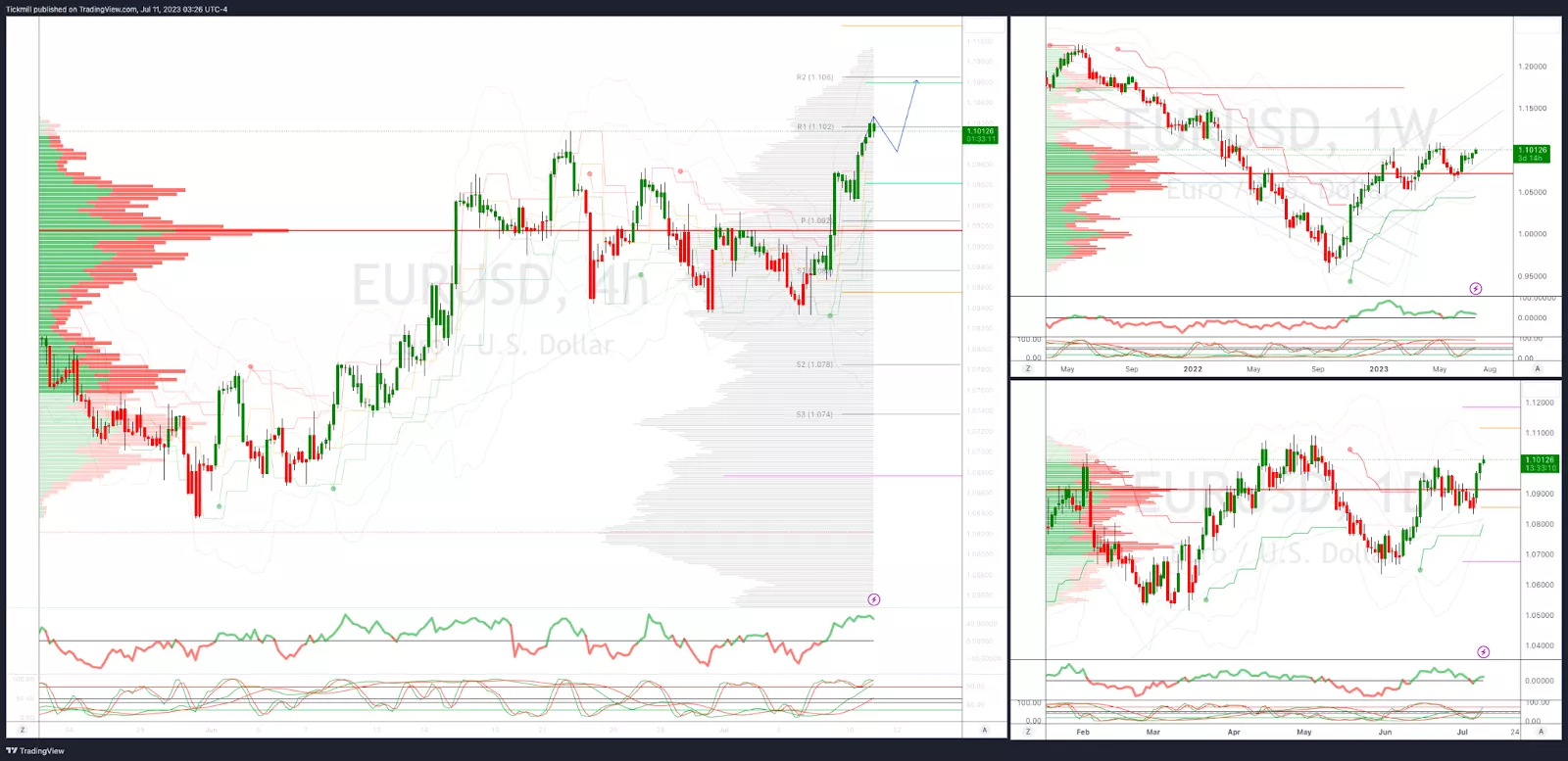

EURUSD Intraday Bullish Above Bearsih Below 1.0950

- Below 1.0890 opens 1.0830

- Primary support is 1.07

- Primary objective is 1.1050

- 20 Day VWAP bullish, 5 Day VWAP bullish

(Click on image to enlarge)

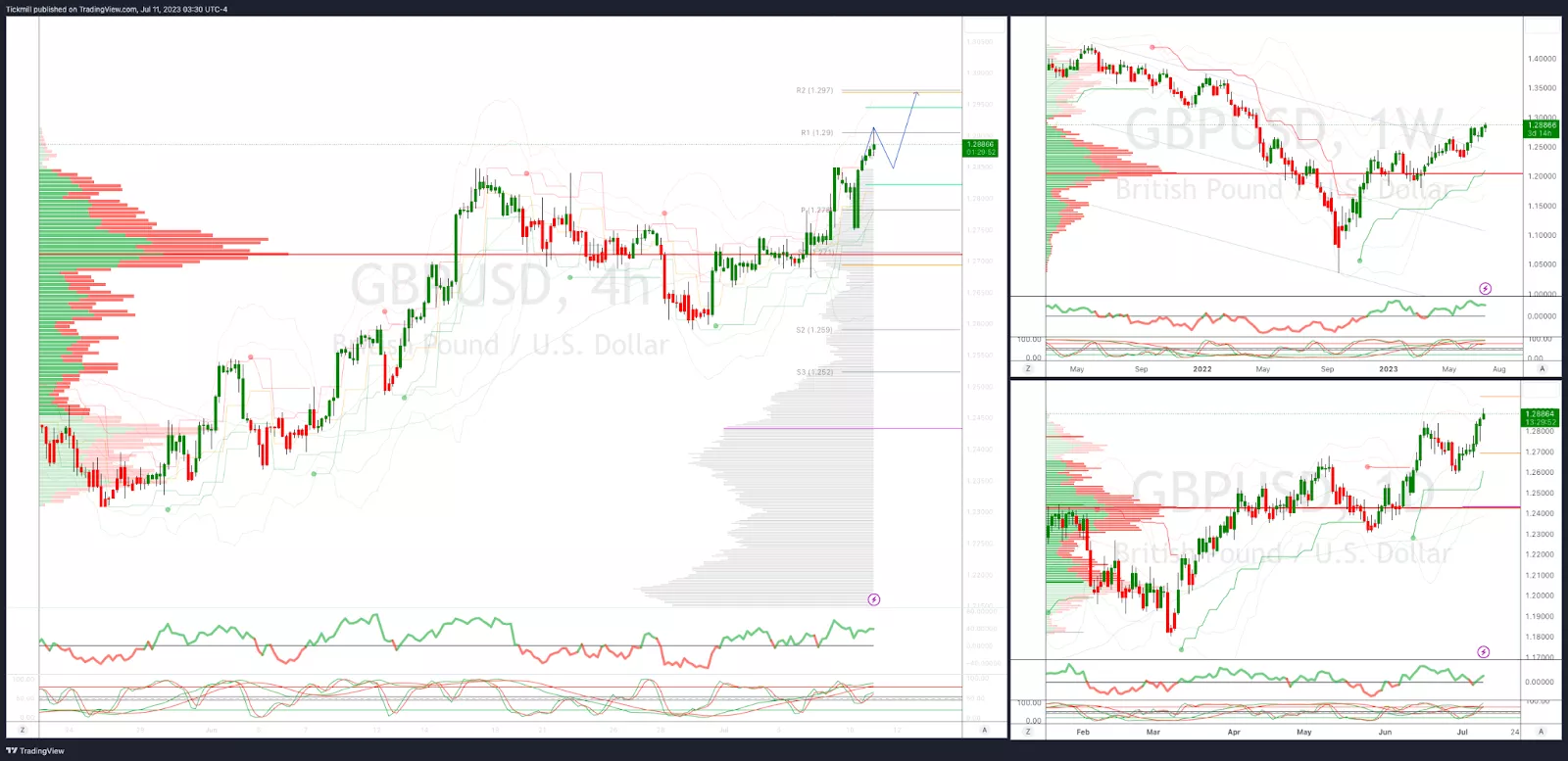

GBPUSD: Intraday Bullish Above Bearish Below 1.2750 Target Hit, New Pattern Emerging

- Below 1.2730 opens 1.268

- Primary support is 1.26

- Primary objective 1.2970

- 20 Day VWAP bullish, 5 Day VWAP bullish

(Click on image to enlarge)

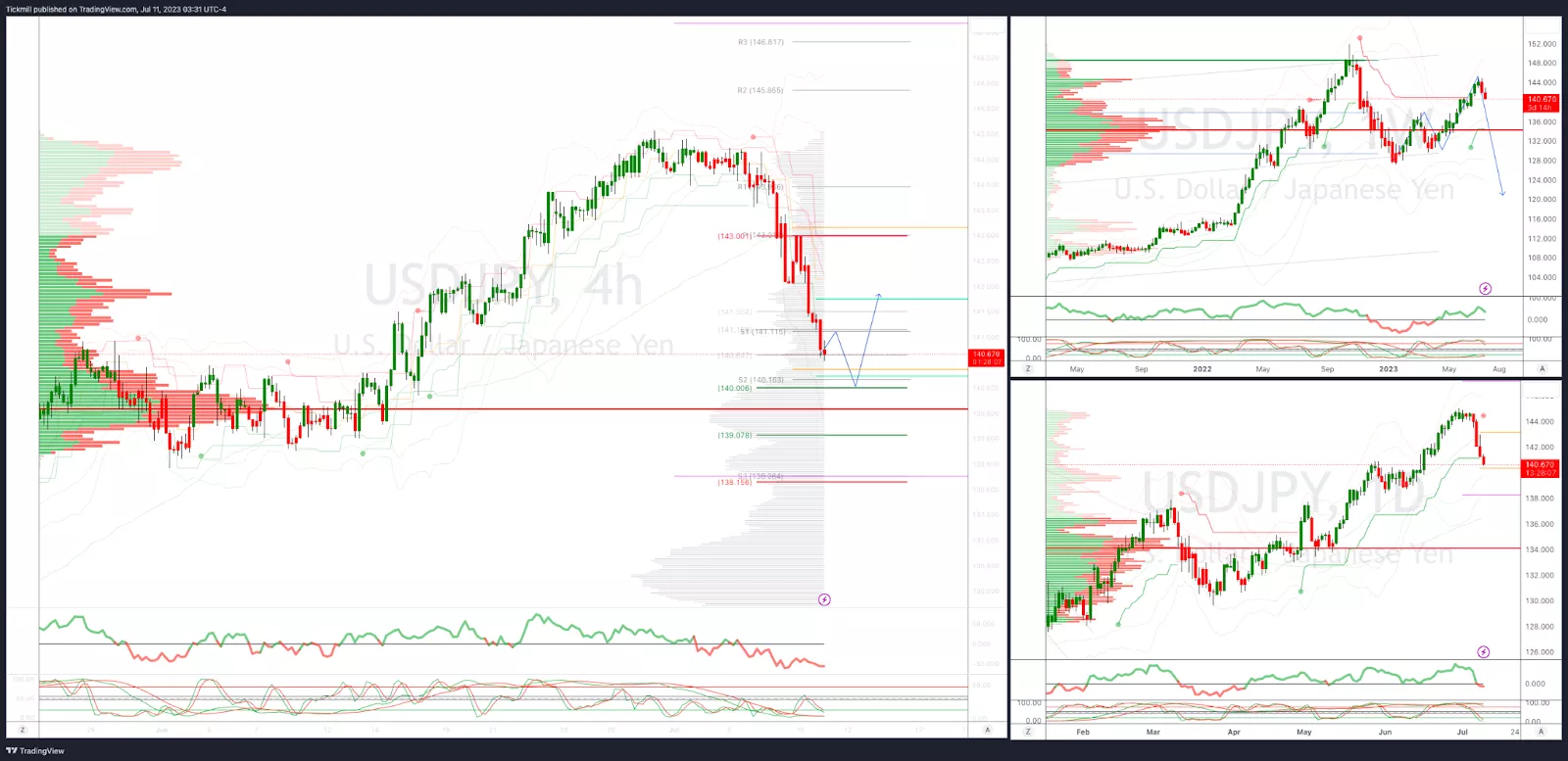

USDJPY Bullish Above Bearish Below 143

- Above 143 opens 144

- Primary support is 140

- Primary objective is 140

- 20 Day VWAP bullish, 5 Day VWAP bearish

(Click on image to enlarge)

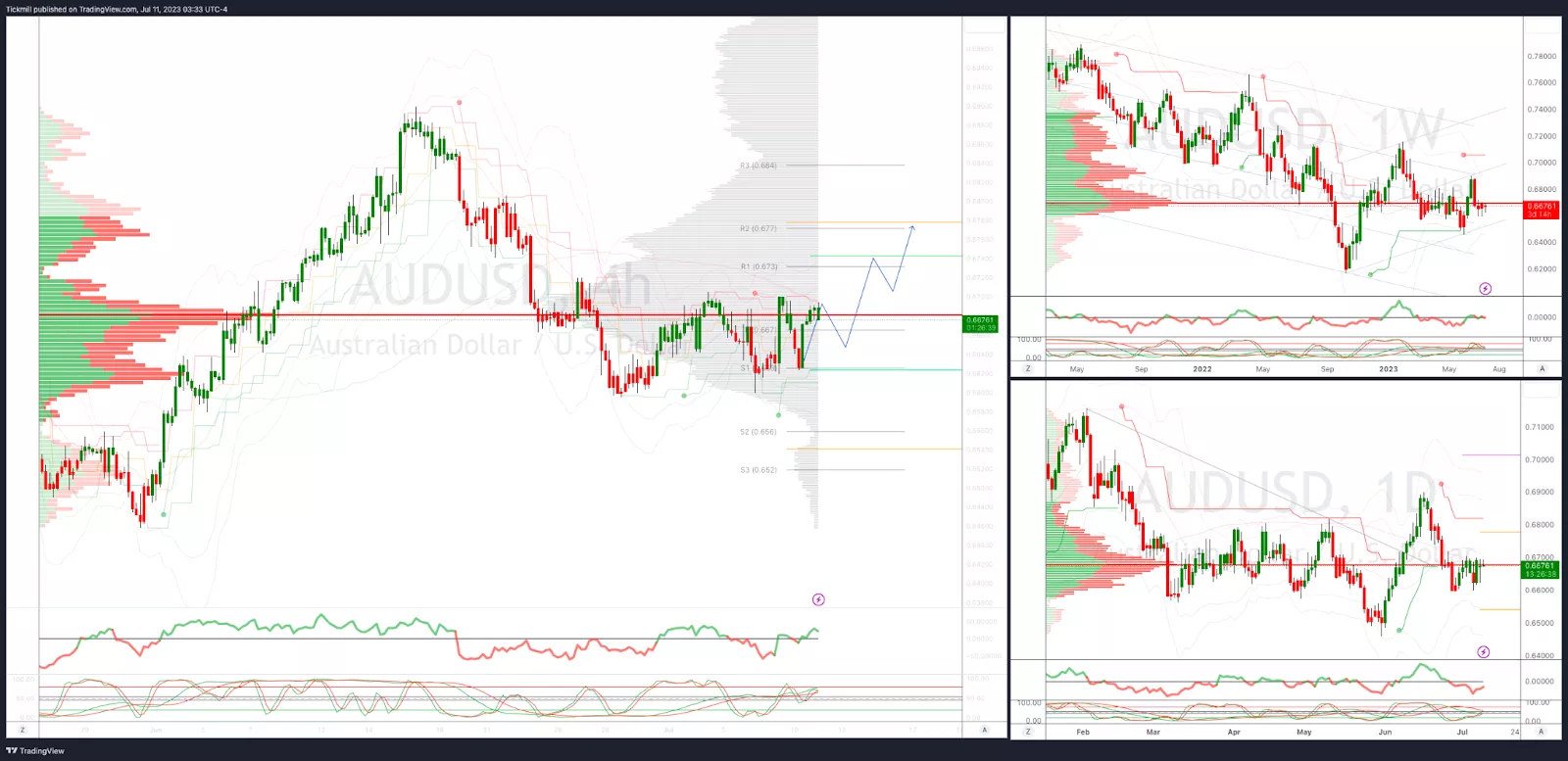

AUDUSD Bias:Intraday Bullish Above Bearish Below .6660

- Below .6600 opens .6550

- Primary support is .6448

- Primary objective is .6917

- 20 Day VWAP bearish, 5 Day VWAP bullish

(Click on image to enlarge)

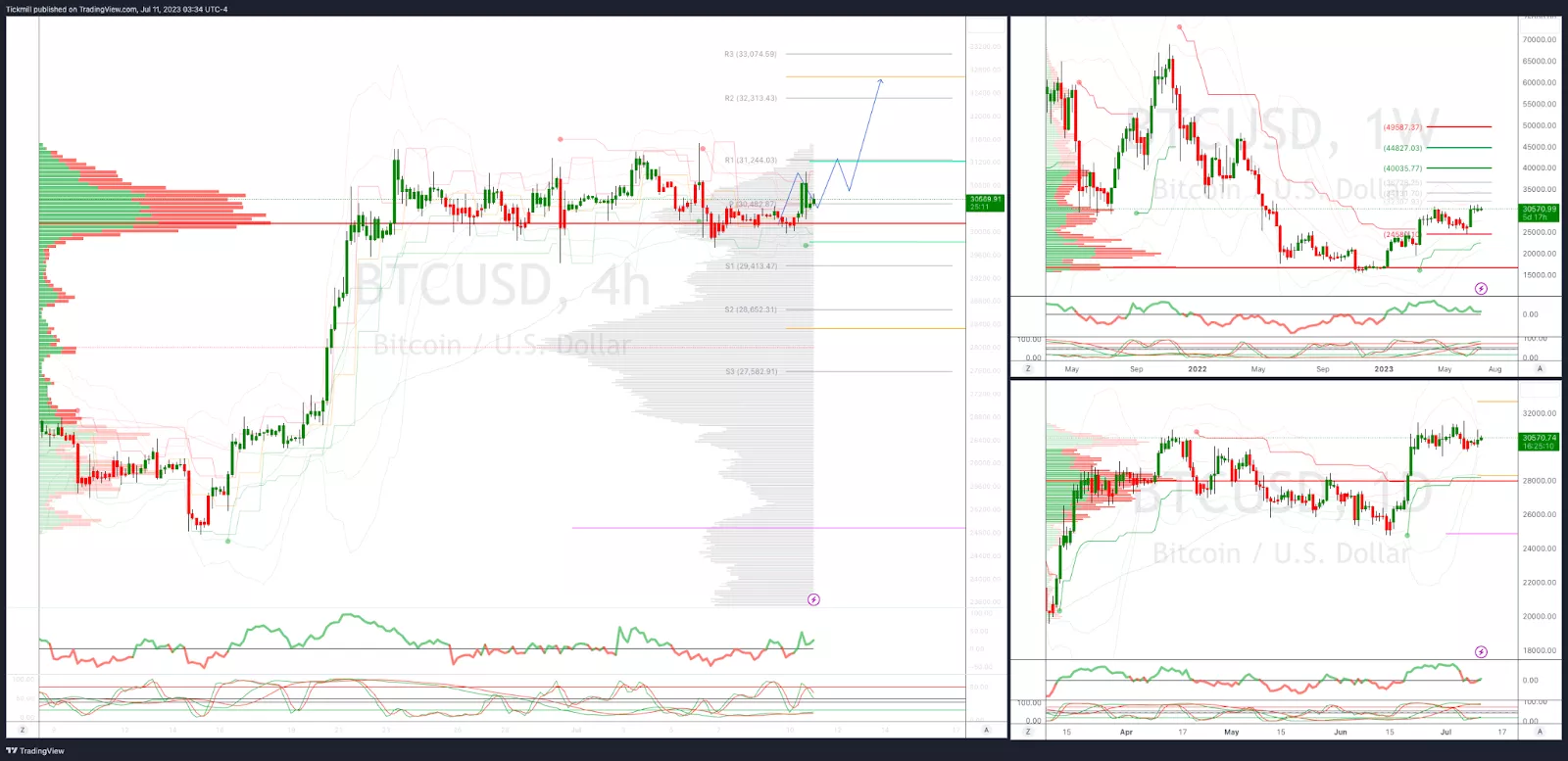

BTCUSD Intraday Bullish Above Bearish below 30000

- Below 29400 opens 28600

- Primary support is 28400

- Primary objective is 32750

- 20 Day VWAP bullish, 5 Day VWAP bullish

(Click on image to enlarge)

More By This Author:

FTSE 100: Starting The Week In The Green As Morgan Stanley Eyes UK EquitiesDaily Market Outlook - Monday, July 10

FTSE A New Three Month Low In A Challenging Week For UK Investors

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to ...

more