Daily Market Outlook - Tuesday, Aug. 15

Image Source: Pixabay

Asian equity markets traded with mixed outcomes as market participants processed key releases, including disappointing Chinese activity data and the People's Bank of China's (PBoC) unexpected reductions in its 7-day Reverse Repo and 1-year Medium-term Lending Facility (MLF) rates. The Nikkei 225 index in Japan experienced an upswing following a robust Gross Domestic Product (GDP) report. The report indicated a 6.0% expansion in Japan's economy, surpassing the projected 3.1% growth. This growth rate marked the fastest annualized pace since the fourth quarter of 2020. The expansion was primarily driven by exports, while private consumption contracted for the first time in three quarters. Conversely, the Hang Seng index and the Shanghai Composite index displayed subdued performance. The underwhelming Chinese Industrial Production and Retail Sales figures overshadowed the surprise rate cuts made by the central bank. The People's Bank of China made a surprising reduction of 10 basis points in its 7-day Reverse Repo rate and a 15bps cut in its 1-year MLF rate. These rates now stand at 1.80% and 2.50%, respectively.

The latest UK labor market data, released earlier today, offers further indications that domestic inflationary pressures are likely to remain a concern for the Bank of England. Particularly noteworthy is the acceleration in headline wage growth, which reached a new high of 8.2% in June, up from a revised 7.2% in May. This increase was partly driven by one-off bonus payments within the National Health Service (NHS). When excluding bonuses, regular wage growth also rose to 7.8% from 7.5%. The report also revealed unexpected developments, including a rise in the unemployment rate from 4.0% to 4.2%, and a decrease of 66,000 in employment over the past three months. Despite the decline in job vacancies, their numbers still remain relatively high compared to pre-pandemic levels.

In the Eurozone investors will focus on the August German ZEW survey, released this morning, which holds significance, particularly considering the bulk of data for the third quarter so far indicating a slowdown in growth.

Stateside, retail sales data will take center stage later today. An expected monthly increase of 0.4% for July would signal ongoing economic growth in the third quarter.

FX Positioning & Sentiment

On Monday, the MSCI Emerging Markets (EM) Foreign Exchange (FX) index declined to a level of 1667, and it maintained a trading range of 1667 to 1670 on Tuesday. The index has fluctuated between 1659 and 1717 in 2023. A significant retracement level of the major rise that occurred from October to February is at 1661. If the index drops below 1659, it might signal the conclusion of this year's consolidation phase. Bearish signals emerged from the fact that the index closed below the 200-day moving average (DMA) and both the 55-DMA and 100-DMA dropped below the 100-DMA. Despite modest bets against Asian currencies, there appears to be limited restraint preventing a potential drop. Traders have taken long positions on Mexican peso (MXN), Brazilian real (BRL), and many investors have allocated significant amounts of capital to other carry trades.If the index experiences a decline, it could lead to a notable shift in market positioning and investment strategies.

CFTC Data As Of 11-08-23

- USD net spec short cut significantly in Aug 2-8 period; $IDX +0.52%

- EUR$ -0.31% in period; specs -22,251 contracts now +149,811

- $JPY +0.1% in period; specs -3,964 contracts as pair rises to key 145 lvl

- GBP$ -0.22% in period; specs -2,542 contracts, long cut to +47,020

- AUD$ -1.13% in period; specs +8,600 contracts, specs bottom-fish

- $CAD +1.05%; specs -6,988, position flips to -623

- BTC +2.64% specs -610 contracts into strength, now short 1,149 (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0800-05 (1.5B), 1.0810 (685M), 1.0850 (1.2B), 1.0900 (1.3B)

- EUR/USD: 1.0930-35 (1.1B), 1.0940 (2.3B), 1.0990 (2.1B), 1.1000 (2.1B)

- USD/JPY: 143.50 (1.0B), 145.00 (1.3B), 145.25 (595M), 146.00 (900M)

- GBP/USD: 1.2650 (570M), 1.2700 (585M). USD/CAD: 1.3100 (830M), 1.3400 (620M)

Overnight Newswire Updates of Note

- China’s Central Bank Unexpectedly Cuts Two Key Policy Rates

- China Industrial Output, Retail Sales Growth Miss Forecasts

- Japan’s Huge GDP Beat Driven By Exports As Domestic Demand Falls

- RBA Sees 'Credible Path' To Inflation Target At 4.1% Cash Rate

- Australia Q2 Wage Growth Softer Than Expected, Adds To Rate Pause Case

- Yellen Says China’s Slowdown Is A ‘Risk Factor’ For US Economy

- US Regulators Try To Consign Emergency Bank Fire Sales To History

- Yen Weakens Toward Level That Prompted September Intervention

- Chinese State Banks Sold Dollars To Support Yuan, Traders Say

- US Real Yield Climbs To 14-Year High, Stoking Demand For Dollar

- Oil’s Push Toward $90 Gets Lift From Physical Markets Everywhere

- Saudi Arabia And UAE Race To Buy Nvidia Chips To Power AI Ambitions

- Tesla Adds Lower Spec Model S, X EVs That Are $10,000 Cheaper

- US FDA Approves Pfizer’s Blood Cancer Therapy

- Esmark Becomes Second US Steel Suitor With $10Bln Offer

- NAB Flags Higher Loan Losses, Unveils A$1.5Bln Buyback

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

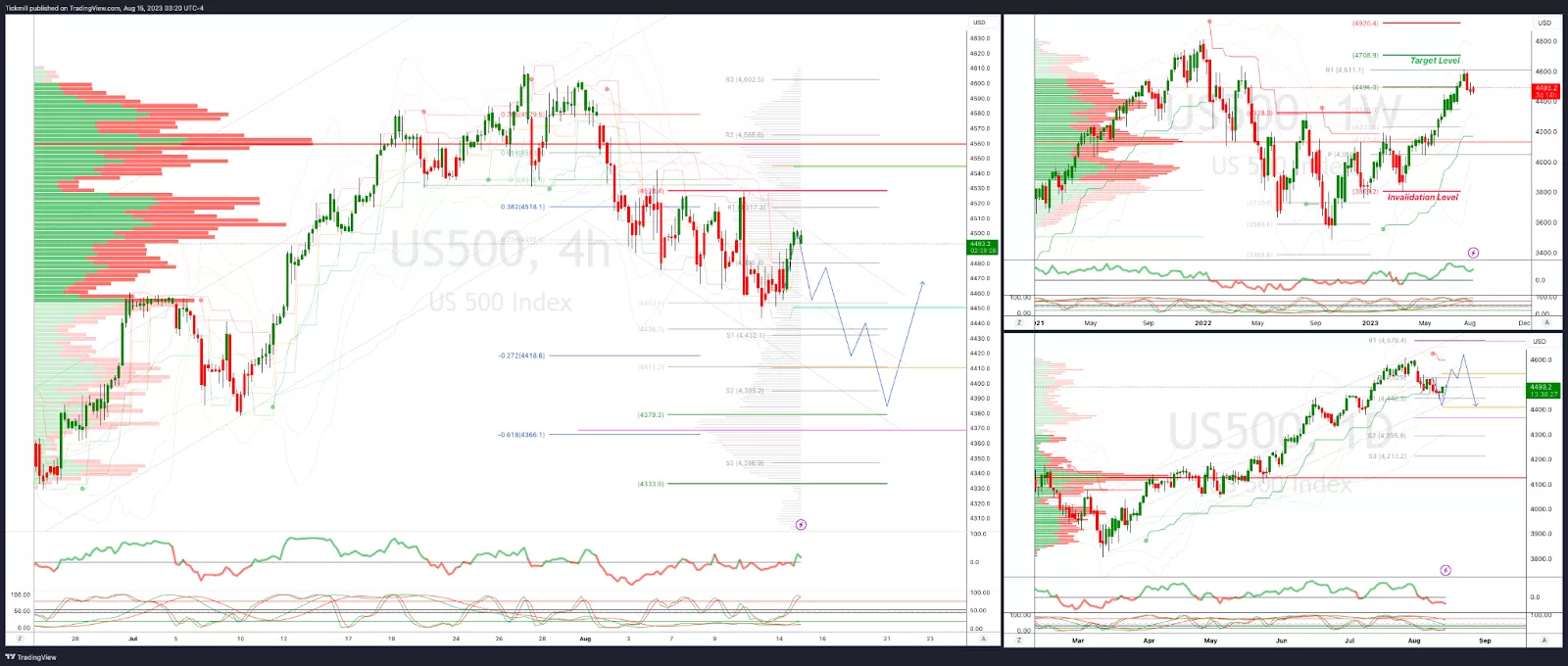

SP500 Intraday Bullish Above Bearish Below 4500

- Above 4530 opens 4560

- Primary resistance is 4560

- Primary objective is 4380

- 20 Day VWAP bearish, 5 Day VWAP bearish

(Click on image to enlarge)

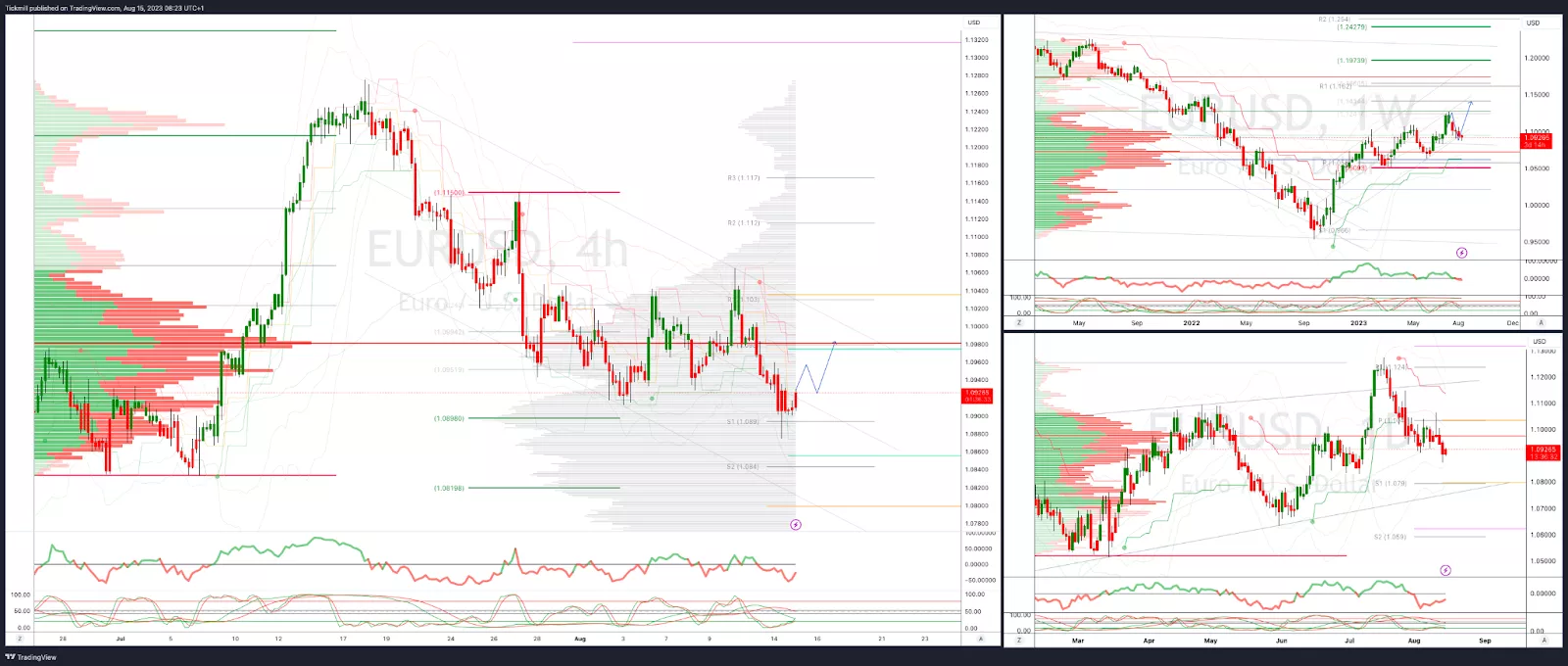

EURUSD Intraday Bullish Above Bearsih Below 1.1020

- Below 1.890 opens 1.0830

- Primary support is 1.830

- Primary objective is 1.13

- 20 Day VWAP bearish, 5 Day VWAP bearish

(Click on image to enlarge)

GBPUSD: Intraday Bullish Above Bearish Below 1.28

- Below 1.2750 opens 1.2650

- Primary support is 1.2590

- Primary objective 1.3850

- 20 Day VWAP bearish, 5 Day VWAP bearish

(Click on image to enlarge)

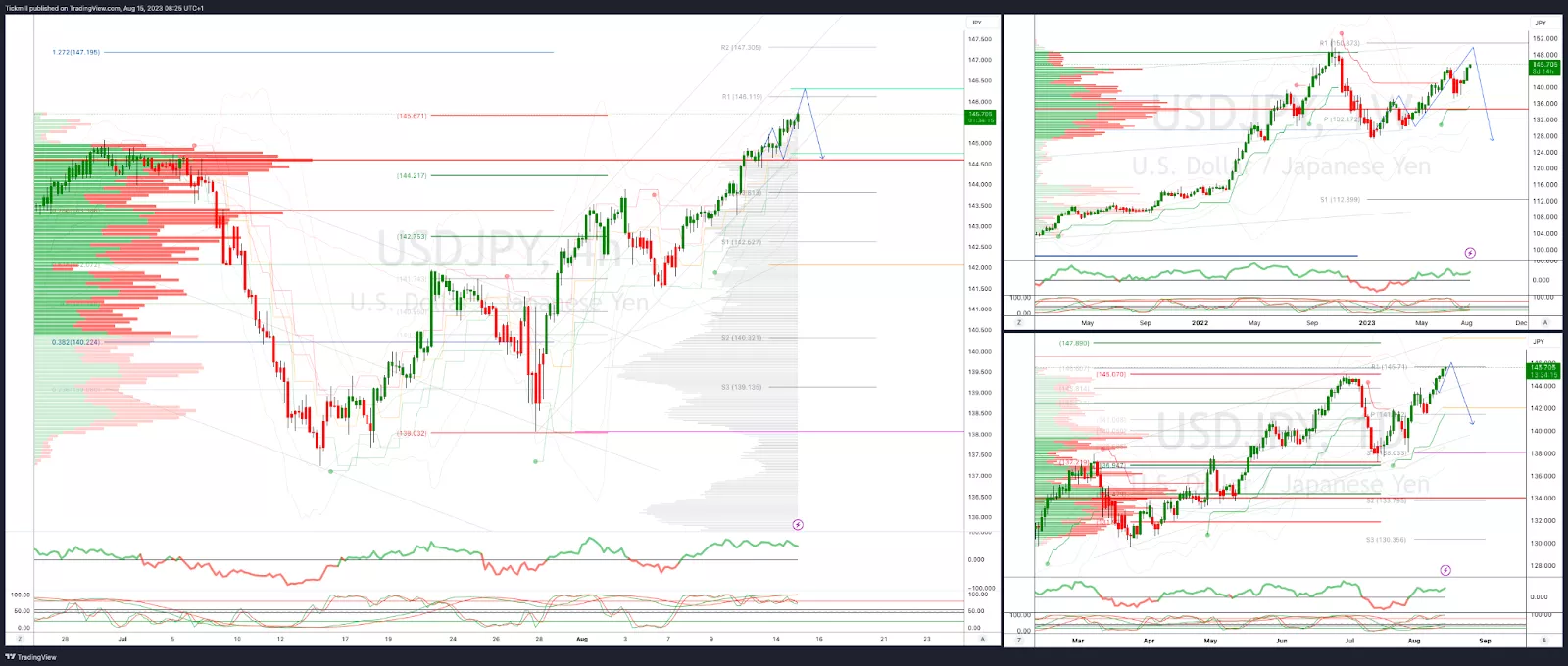

USDJPY Bullish Above Bearish Below 144.50

- Below 143 opens 142

- Primary support 140.50

- Primary objective is 147.20

- 20 Day VWAP bullish, 5 Day VWAP bullish

(Click on image to enlarge)

AUDUSD Intraday Bullish Above Bearish Below .6660

- Above .6750 opens .6820

- Primary resistance is .6730

- Primary objective is .6466

- 20 Day VWAP bearish, 5 Day VWAP bearsih

(Click on image to enlarge)

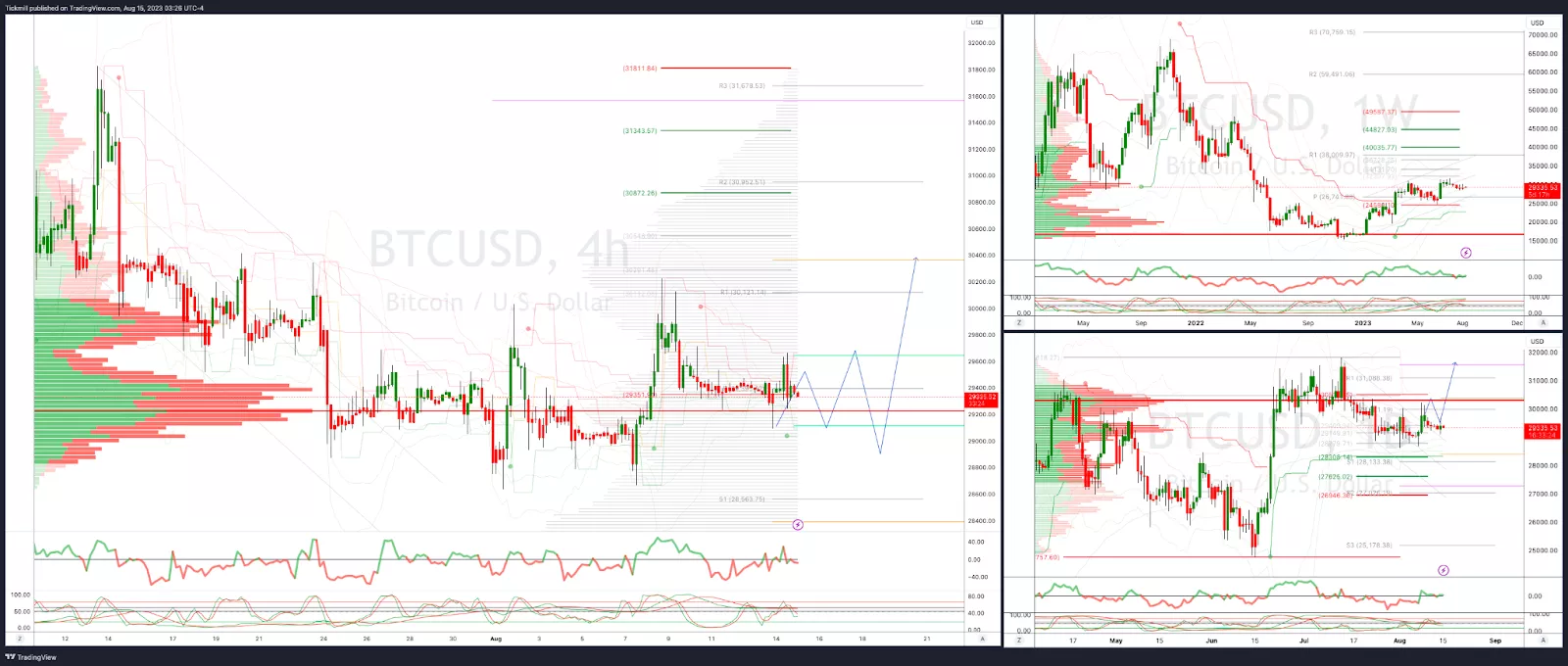

BTCUSD Intraday Bullish Above Bearish below 30000

- Below 29400 opens 28300

- Primary support is 28300

- Primary objective is 32750

- 20 Day VWAP bearish, 5 Day VWAP bearish

(Click on image to enlarge)

More By This Author:

The FTSE Finish LineDaily Market Outlook - Monday, Aug. 14

FTSE Rolling Over Into The Close, Potential BoE Action Weighs

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to ...

more