Daily Market Outlook - Thursday, Oct. 31

Image Source: Pexels

Asian stocks declined on Thursday as semiconductor stocks mirrored overnight drops on Wall Street, while Meta Platforms and Microsoft warned of accelerating costs for artificial intelligence, investors continue to become cautious about mounting capex without requisite revenue expansion. This raised concerns about similar issues for Amazon, which reports earnings along with Apple after the close in New York today. The yen rose from near a three-month low against the dollar, with the Bank of Japan's statement containing some hawkish undertones, leading some analysts to suggest the possibility of a December interest rate hike. More broadly, the dollar took a pause, having retreated from a near three-month peak against major peers on Wednesday. Investors were also cautious ahead of the U.S. non-farm payrolls data on Friday, the presidential election next Tuesday, and a Federal Reserve policy decision on Thursday. Japan's Nikkei share average closed the day down 0.5%. After surveys on Chinese manufacturing and services did indicate some uptick in activity, mainland Chinese blue chips fell 0.7% and Hong Kong's Hang Seng fell 0.3%, reversing earlier gains. Officials hold a week-long conference next week, investors are expecting Beijing to provide more clarity on stimulus; however, markets are cautious regarding another round of detail light disappointment.

Away from the UK, the data calendar is still very busy. In the Eurozone October flash inflation will be released, there might be some upside risk to the widely held belief that the euro area will grow by 1.9% year over year, given the positive news from yesterday's German numbers. However, the ECB is probably going to examine the September hike in the annual rate because energy price base effects are a feature this month.

Stateside, the September personal income and spending deflator data is released today, after yesterday's close-to-expected 2.8% q/q SAAR US GDP for Q3. the headline inflation rate on this metric is expected to be 0.2% m/m, while the core inflation rate is expected to be 0.3% m/m. Although yesterday's ADP employment report's record-breaking 233k was more than twice as high as anticipated, the median wage drop for those changing jobs somewhat eased, falling 0.5 percentage points to 6.2% year over year. In addition to the data from JOLTS and Consumer Confidence earlier in the week showing that overall momentum in the US employment market is continuing slowing, the pay growth difference for those who are not changing jobs is narrowing.

Overnight Newswire Updates of Note

- EU Inflation Set To Rise; To Remain Below ECB Target

- BoJ Keeps Policy Interest Rate On Hold At 0.25%

- Japan’s Factory Output Picks Up As Economy Sputter

- Japan Retail Sales Gain 0.5% On Year In September

- Yen Under Pressure As BoJ Keeps Rates Steady

- China’s Factory Activity Expands, First Time Since April

- Aussie Retail Hold Firm, Augur Well For Consumption

- NZ Housing Market Bogged Down By Flood Of Listings

- MicroStrategy Plans To Raise $42B To Buy More BTC

- Samsung’s Profit Rises After Business Offsets AI Gloom

- Microsoft Sails As AI Frenzy To Double-Digit Cloud Growth

- Meta Rides AI Boom To Stellar Less Than Exp Earnings

- VW Proposes 10% Pay Cut To Tackle Crisis

- FMR PM Sunak: UK Budget Contains Broken Promises

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0775-80 (1.3B), 1.0800 (2.3B),1.0825 (744M),1.0840 (508M),

- EUR/USD: 1.0850 (1.2B), 1.0900 (3.4B), 1.0925 (2.3B), 1.0950 (757M)

- EUR/USD: 1.0970 (507M), 1.0980 (977M), 1.1000 (1.2B)

- USD/JPY: 151.50 (656M), 152.00 (1.4B), 153.00 (743M), 153.50 (1.7B)

- USD/JPY: 154.00 (620M), 154.50 (530M), 155.00 (666M)

- GBP/USD: 1.2900 (429M), 1.2950 (480M), 1.2995-1.3000 (805M), 1.3260 (537M)

- EUR/GBP: 0.8300 (1.0B), 0.8325 (634M), 0.8350 (1.7B), 0.8400 (700M)

- EUR/GBP: 0.8450 (501M). EUR/CHF: 0.9365 (550M)

- AUD/USD: 0.6610 (621M), 0.6750 (928M). NZD/USD: 0.6020 (712M)

- AUD/NZD: 1.0950 (934M), 1.1100 (924M), 1.1150 (751M)

- USD/CAD: 1.3700 (1.4B), 1.3725-35 (870M), 1.3765 (687M), 1.3950 (423M)

- USD/CAD: 1.4000 (642M)

CFTC Data As Of 25/10/24

- EUR net speculative long position disappears, now short 28,524 contracts, down from long 17,150 the previous week.

- JPY long position drops to 12,771 contracts from 34,110.

- GBP long position cut to 74,576 contracts from 85,802.

- AUD long position increases to 27,679 contracts from 19,269.

- CAD short position grows to 140,631 contracts from 122,393.

- Speculators trim CBOT US 10-year Treasury futures net short position by 16,874 contracts to 848,191

- Equity fund managers raise S&P 500 CME net long position by 15470 contracts to 1,065,824

- Equity fund speculators trim S&P 500 CME net short position by 19,439 contracts to 304,612

Technical & Trade Views

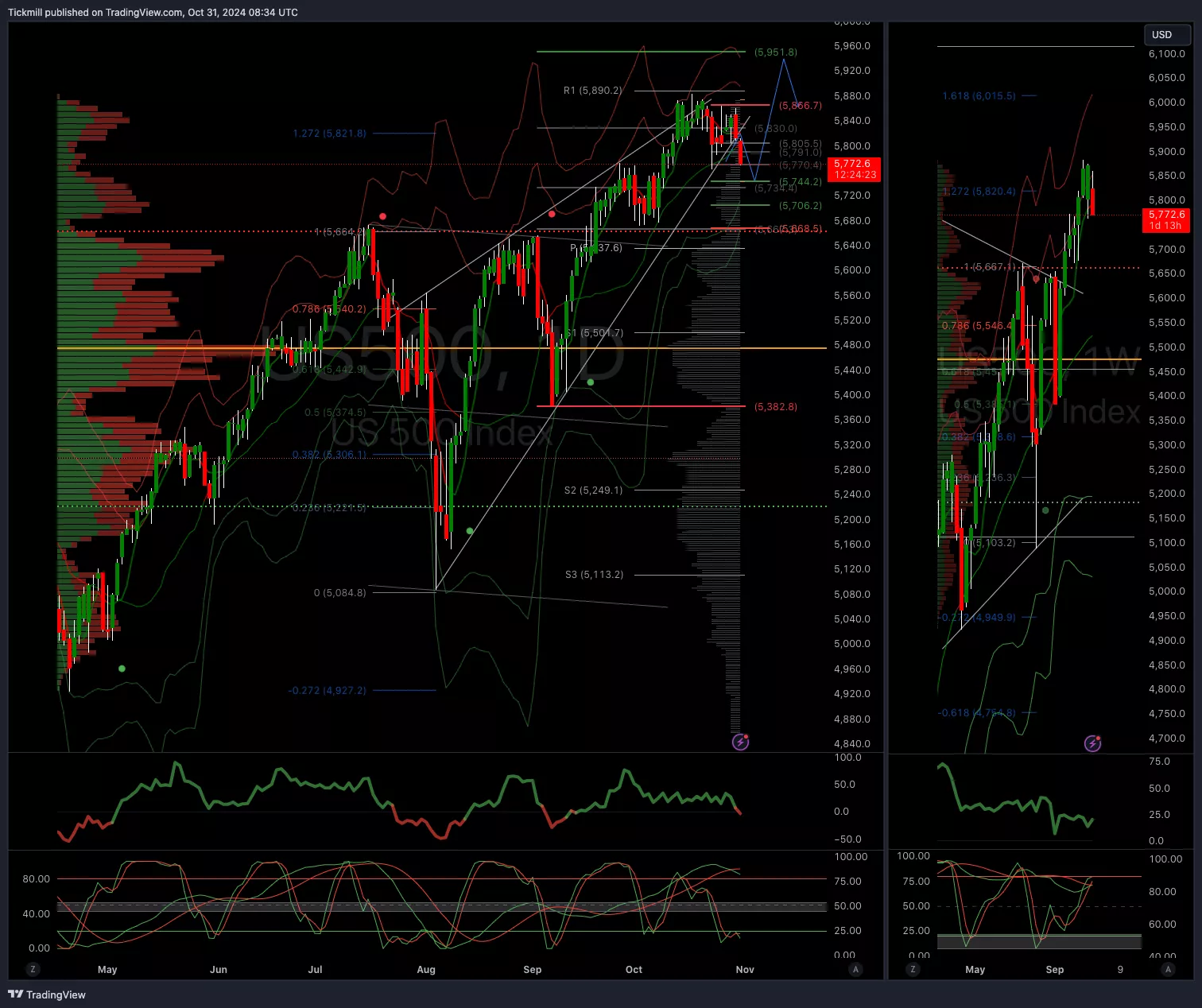

SP500 Bullish Above Bearish Below 5775

- Daily VWAP bearish

- Weekly VWAP bearsih

- Below 5720 opens 5660

- Primary support 5660

- Primary objective 5950

(Click on image to enlarge)

EURUSD Bullish Above Bearish Below 1.09

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 1.09 opens 1.0980

- Primary support 1.0750

- Primary objective 1.0750

(Click on image to enlarge)

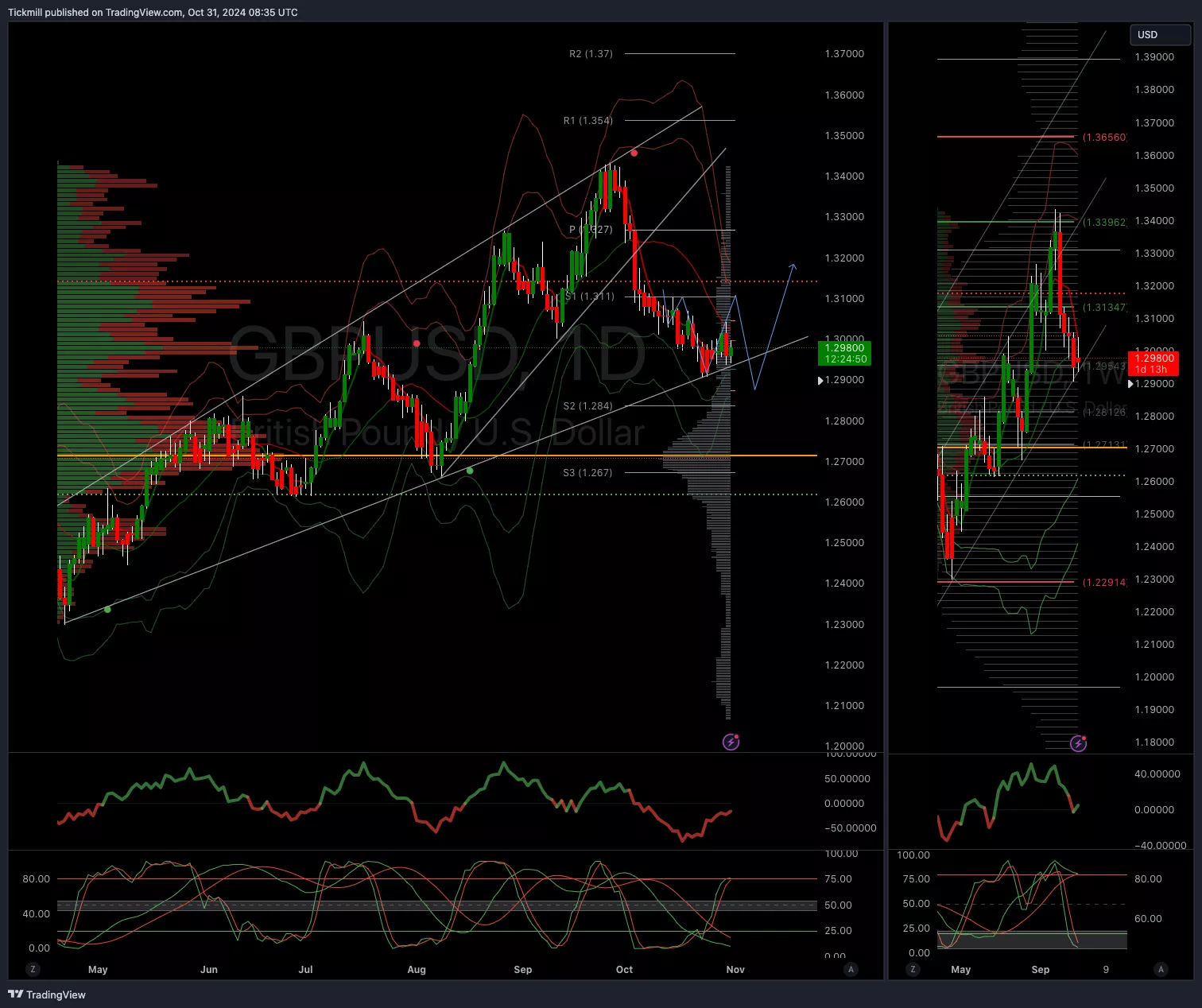

GBPUSD Bullish Above Bearish Below 1.3050

- Daily VWAP bullish

- Weekly VWAP bearish

- Below 1.29 opens 1.27

- Primary support is 1.29

- Primary objective 1.31

(Click on image to enlarge)

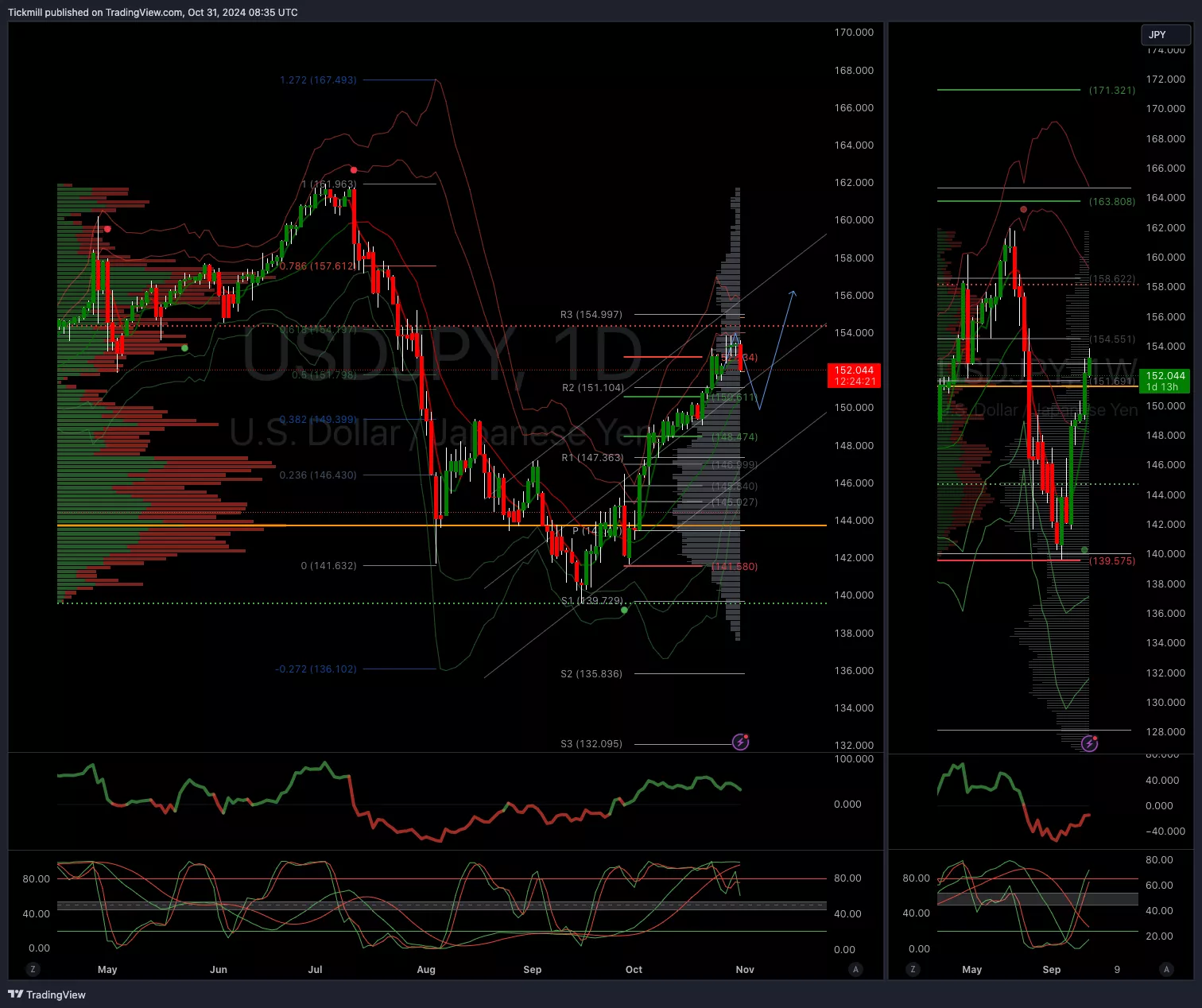

USDJPY Bullish Above Bearish Below 148

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 148 opens 144

- Primary support 148

- Primary objective is 156

(Click on image to enlarge)

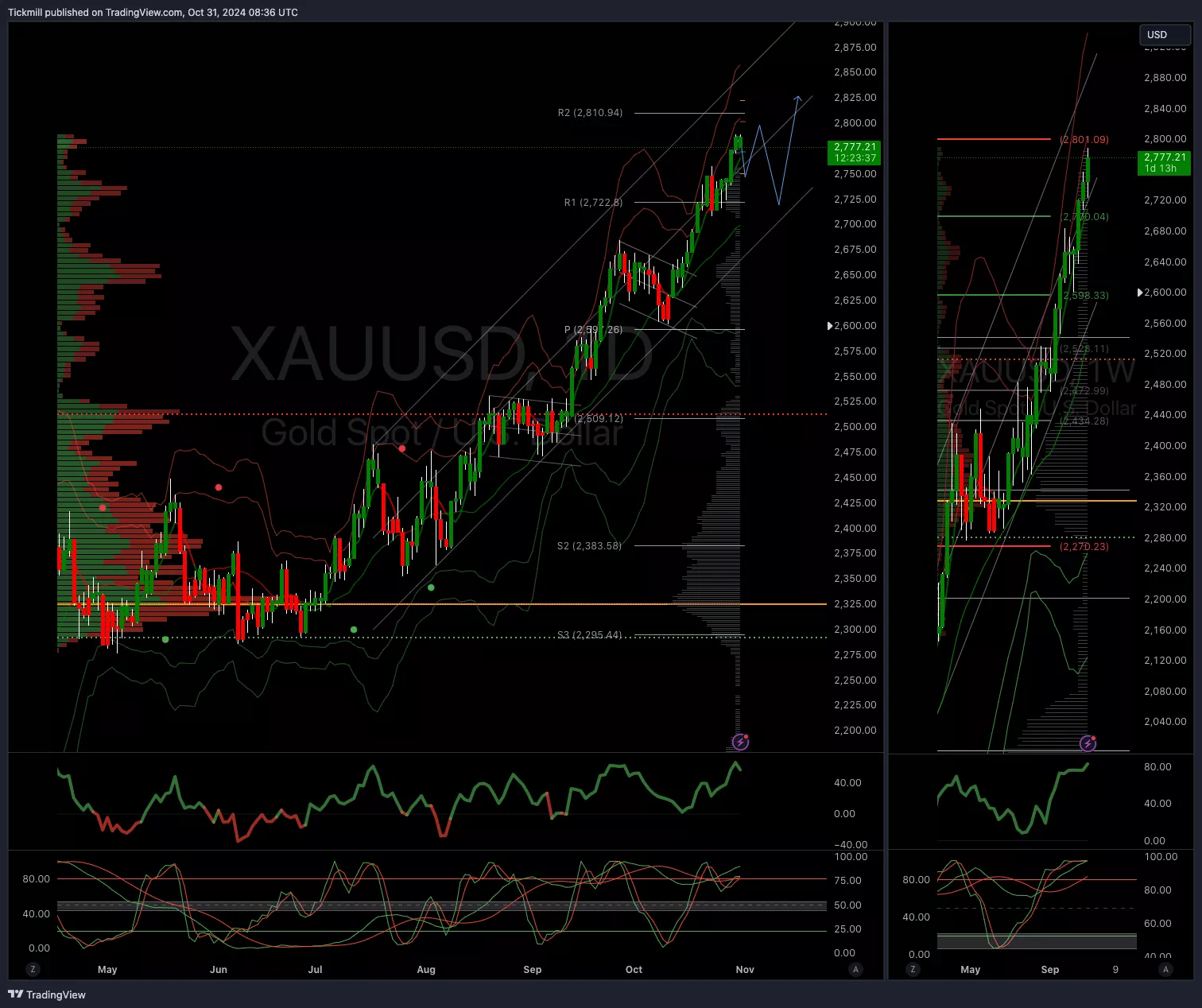

XAUUSD Bullish Above Bearish Below 2680

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 2670 opens 2600

- Primary support 2550

- Primary objective is 2800

(Click on image to enlarge)

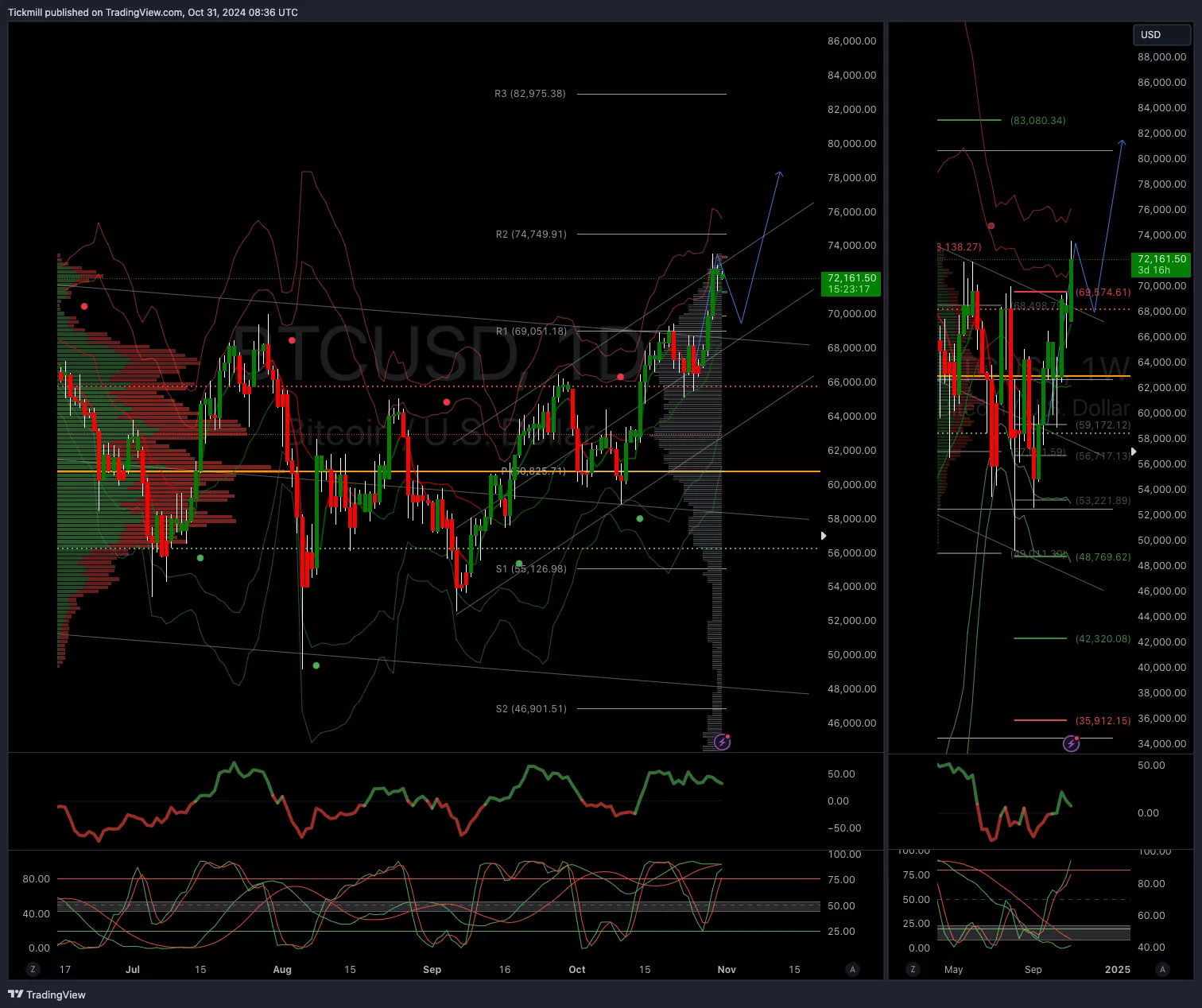

BTCUSD Bullish Above Bearish Below 69500

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 69000 opens 64000

- Primary support is 58000

- Primary objective is 80000

(Click on image to enlarge)

More By This Author:

FTSE Under Pressure As UK Budget Deals A Blow To Investor Sentiment

Daily Market Outlook - Wednesday, Oct. 30

FTSE Falls Hard Into The Close, As Investors Turn Cautious Ahead Of The Budget

As the US elections draw near, the financial markets are bracing for potential volatility, presenting both opportunities and challenges for traders. To help navigate this crucial period, we have ...

more