Daily Market Outlook - Thursday, Oct. 19

Image Source: Pixabay

Asia - Asian stocks experienced widespread declines, largely influenced by a spillover of selling pressure from Wall Street. This was driven by the latest earnings reports and persisting geopolitical uncertainties. In addition, the upward trend in bond yields posed further challenges. The Nikkei 225 in Japan suffered significant losses, even though Japanese trade figures were generally better than expected. The surge in U.S. Treasury yields had a ripple effect on regional bond markets in Asia. In particular, Japanese government bond yields climbed to levels not seen in a decade, reflecting the broader trend of increasing interest rates and bond yields in the region. Both the Hang Seng in Hong Kong and the Shanghai Composite in mainland China conformed to the negative sentiment. Hong Kong's market was hit hardest, primarily due to weakness in Chinese tech stocks and the troubled property sector. The latter was weighed down by ongoing debt issues and the continued contraction of Chinese property prices.

Europe - The European data docket for today is relatively light, with no notable releases in the UK and only "second-tier" data in the Eurozone. However, it's worth noting that important releases are scheduled in the UK for early tomorrow, which could have a significant impact on the market. Additionally, two UK parliamentary by-elections taking place today will offer insights into the government's level of support. Observers will be looking for clues regarding the potential timing of a general election, which must be held no later than January 2025.

US - Stateside economic data continue to outperform expectations. September's retail sales and industrial production figures, both exceeding expectations, point to a robust third-quarter GDP release next week and indicate strong momentum heading into the fourth quarter. However, existing home sales for September are anticipated to show a sharp decline, potentially signaling that high mortgage rates are affecting demand. Yet, it's worth noting that a lack of housing supply may also be constraining the market. The weekly initial jobless claims data, which have indicated a healthy labor market, will also be released.

The highlight of the day will be a speech by Fed Chair Jerome Powell he will speak on inflation and the labor market. He is expected to discuss the challenges and opportunities for monetary policy in the aftermath of the COVID-19 crisis, as well as the implications of the Fed's new inflation target and its flexible average inflation targeting framework. He will also address the recent inflation developments and the Fed's policy stance. Recent comments from Fed officials have suggested that an interest rate hike at their policy update on November 1st is now unlikely due to the recent increase in bond yields, which has acted as a form of monetary tightening. As a result, markets are assigning a very low probability to a November rate hike. Fed policymakers will enter their pre-announcement silent period after this weekend, making today's speeches one of the last opportunities to signal whether a November rate hike remains a genuine possibility.

FX Positioning & Sentiment

The USD/JPY currency pair is facing resistance as it approaches the 150.00 level, limiting its upside potential. However, the downside is also constrained. Yesterday, the trading range for USD/JPY was between 149.49 and 149.94, while overnight in Asia, it fluctuated between 149.77 and 149.91. There are ongoing offers in the market, particularly from exporters and option players, just before the 150.00 mark, which is acting as a strong barrier. Market participants note that some USD/JPY long positions are being closed as investors seek the safety of the Japanese yen due to global uncertainties. Furthermore, the pair is being influenced by higher U.S. yields and the broader interest rate differentials between Japan and the United States, which are supportive for the USD. U.S. Treasury 10-year yields are at cycle highs, hovering around 4.939%, and 2-year yields are at approximately 5.244%. Despite these factors, there is a sense of caution in the market, primarily due to developments in the Middle East. Additionally, investors are closely watching for any hints from the Federal Reserve, particularly regarding their stance on higher interest rates and inflation. Chairman Jerome Powell's upcoming speech is a key focus for market participants.

CFTC Data As Of 4-10-23

- The US Dollar Index ($IDX) declined by 1.2% in this period.

- The Euro (EUR/$) appreciated by 1.36% during the same period, leading to a reduction of -3,411 contracts in speculative positions. The total net long positions now amount to +75,532.

- The Japanese Yen (JPY/$) saw a minor decrease of -0.22%, resulting in an increase of +14,512 contracts in speculative positions. The total net short positions now stand at -99,476, and the pair is close to the key 150 level.

- The British Pound (GBP/$) strengthened by 1.75%, but speculative positions reduced by -3,368 contracts, mainly due to a dovish Bank of England.

- The Australian Dollar (AUD/$) gained 2% in the same period, with speculative positions increasing by +5,410 contracts, totaling -76,577. The AUD has been lower since Tuesday.

- Bitcoin (BTC) saw a modest increase of 0.04%, and speculative positions grew by +95 contracts, reaching +1,151. The expectation of ETF approval supports BTC.

- It's worth noting that the USD has rallied on a more hawkish Federal Reserve outlook since the period ended, and SOFR red contracts suggest an expectation of higher rates for a longer duration. (Source Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0450 (887M), 1.0560 (917M), 1.0600 (587M), 1.0620-25 (785M)

- 1.0650-55 (614M), 1.0690-1.0700 (2.21BLN), 1.0705-15 (471M)

- 1.0720-30 (528M), 1.0750-55 (1.16BLN)

- USD/JPY: 148.50 (351M), 148.70-75 (438M), 149.00 (379M), 149.30 (281M)

- 149.45-50 (1.02BLN), 149.75-80 (378M), 150.00 (1.1BLN)

- 150.50 (775M), 151.00 (822M)

- USD/CHF: 0.8795-05 (876M), 0.8880 (353M), 0.9100 (250M)

- GBP/USD: 1.2140 (5710M), 1.2160 (1.03BLN), 1.2200 (1.9BLN)

- 1.2210-15 (1.12BLN)

- EUR/GBP: 0.8600 (305M), 0.8610-15 (805M). EUR/AUD: 1.6600 (467M)

- AUD/USD: 0.6350 (608M), 0.6400 (426M), 0.6415-25 (1.1BLN), 0.6465 (1.1BLN)

- 0.6480 (395M)

- NZD/USD: 0.5920-25 (771M), 0.5940 (262M)

- AUD/NZD: 1.0700 (280M), 1.0800 (350M), 1.0900 (234M)

- USD/CAD: 1.3640-50 (1.23BLN), 1.3680-85 (542M), 1.3700 (346M)

- AUD/JPY: 94.50 (400M)

Overnight Newswire Updates of Note

- Australian Jobs Grow Less Than Expected In September As Labour Market Cools

- Japan's Exports Return To Growth, Rising 4.3% In September

- US Gives Israel ‘Private Backing’ For Ground Invasion Of Gaza

- BoK Stands Pat Again As Economy Shows Signs Of Cooling

- US Suspends Some Sanctions On Venezuelan Oil, Gas, Gold Sectors

- Fed's Waller Says 'Too Soon To Tell' If More Interest Rate Hikes Needed

- Fed’s Williams Says Interest Rates Need To Be Restrictive ‘For Some Time’

- Jim Jordan Loses Supporters On Second Failed House Speaker Vote

- UK Government Debt Will Rise To 140% Of GDP, Think Tank Forecasts

- Dollar Holds Near 150 Yen Ahead Of Fed Chair Remarks

- 10-Year US Treasury Yield Tops 4.9%

- Key JGB Yield Rises To 0.825%, Highest In 10 Years-2 Months

- Russia Has No Plans Yet To Further Ease Diesel Export Rules

- Netflix Subscribers Surge As Company Announces Price Hikes In Some Regions

- Tesla Revenues Disappoint On Price Cuts And Plant Shutdowns

- Amazon Plans To Deploy Delivery Drones In The UK And Italy Next Year

- OpenAI Is In Talks To Sell Shares At An $86 Bln Valuation

- Disney To Break Out Sports Revenue In Financial Reports

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

SP500 Bias: Bullish Above Bearish Below 4280

- Below 4280 opens 4250

- Primary resistance is 4450

- Primary objective is 4446

- 20 Day VWAP bullish, 5 Day VWAP bearish

(Click on image to enlarge)

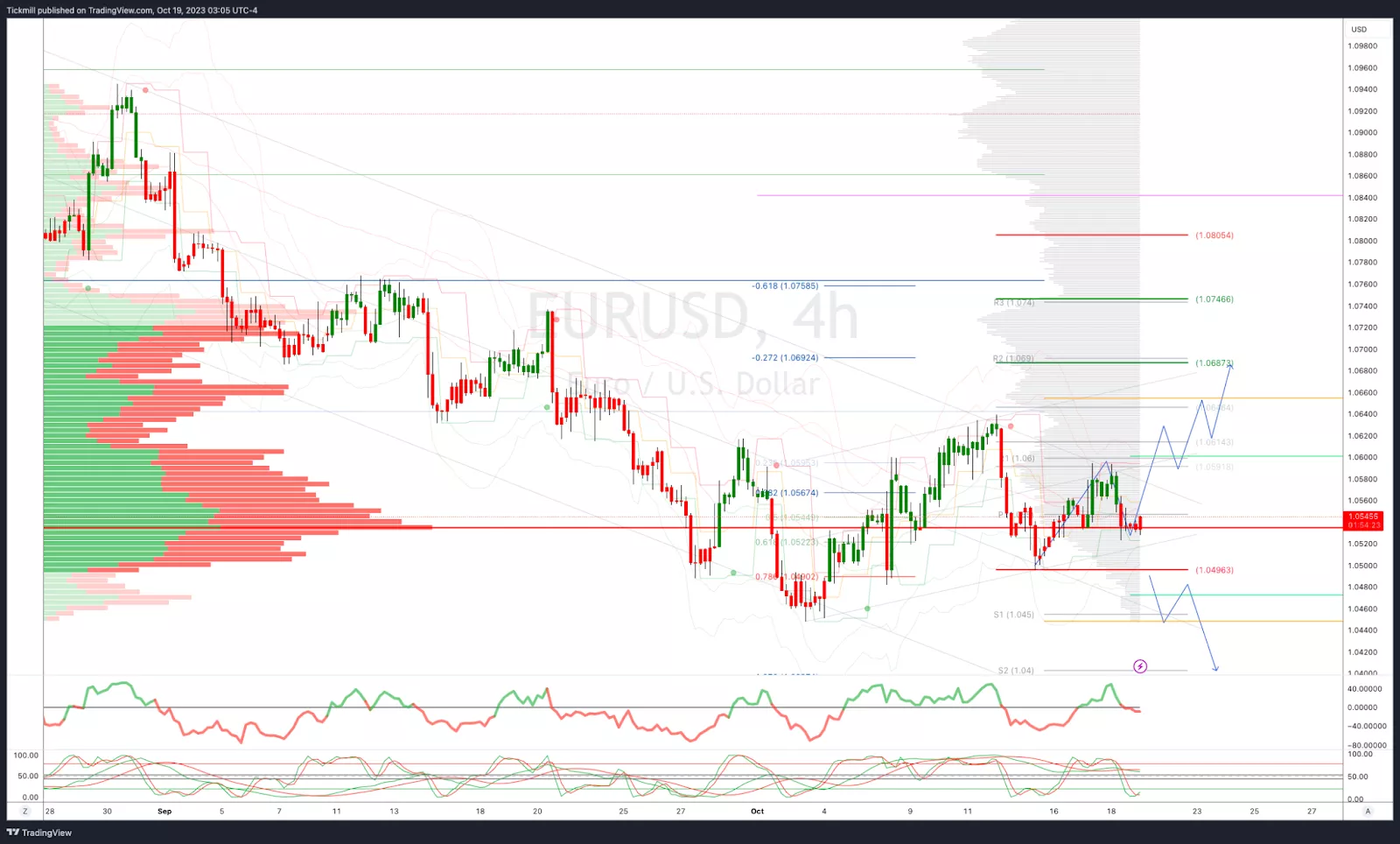

EURUSD Bias: Bullish Above Bearish Below 1.06

- Below 1.0520 opens 1.0480

- Primary support is 1.05

- Primary objective is 1.0680

- 20 Day VWAP bearish, 5 Day VWAP bullish

(Click on image to enlarge)

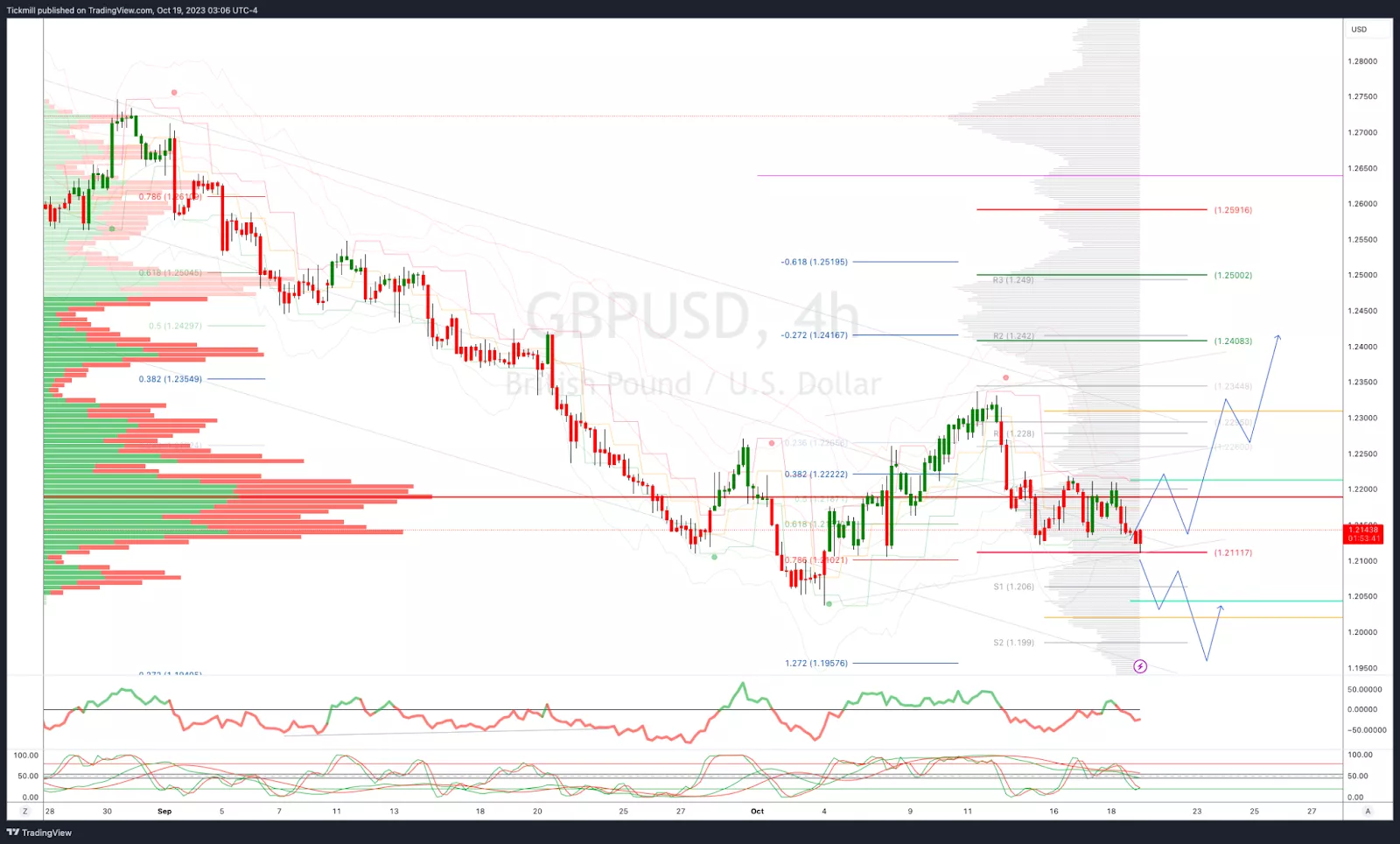

GBPUSD Bias: Bullish Above Bearish Below 1.21

- Below 1.21 opens 1.1950

- Primary support is 1.21

- Primary objective 1.24

- 20 Day VWAP bearish, 5 Day VWAP bearish

(Click on image to enlarge)

USDJPY Bias: Bullish Above Bearish Below 149.25

- Below 149 opens 148.50

- Primary support 144.50

- Primary objective is 150.20

- 20 Day VWAP bullish, 5 Day VWAP bullish

(Click on image to enlarge)

AUDUSD Bias: Bullish Above Bearish Below .6400

- Above .6475 opens .6525

- Primary resistance is .6620

- Primary objective is .6270

- 20 Day VWAP bearish, 5 Day VWAP bullish

(Click on image to enlarge)

BTCUSD Bias: Bullish Above Bearish below 27500

- Below 27100 opens 26500

- Primary support is 26500

- Primary objective is 31200

- 20 Day VWAP bullish, 5 Day VWAP bullish

(Click on image to enlarge)

More By This Author:

FTSE Slides On Hot Consumer Inflation DataDaily Market Outlook - Wednesday, Oct. 18

FTSE Early Dip Recovered Heading For A Positive Close