Daily Market Outlook - Thursday, Oct. 17

Image Source: Unsplash

Asian stock markets are trading mostly higher on Thursday, buoyed by the positive sentiment from Wall Street's performance overnight, as markets remain optimistic about the interest rate outlook following the release of the latest US inflation data. Based on the recent economic data, CME Group's FedWatch tool is indicating a 94.2% chance the US Fed will lower interest rates by a quarter point next month. On the earnings front, TSMC's net income for the third quarter surpassed the average analyst forecast. The report alleviated concerns over the semiconductor industry after ASML's underwhelming order figures and reduced revenue projection for 2025 earlier this week, leading to support for the flagship chip sector.

The Japanese market is experiencing further losses on Thursday, despite the positive signals from Wall Street. The Nikkei 225 is dropping below the 39,000 handle with declines in exporters and technology stocks partially offset by gains in automakers and financial stocks. Traders have also responded to domestic data showing Japan recording a trade deficit in September, as exports unexpectedly declined while import growth slowed.

China's CSI300 real estate index declined by 5%, erasing two days of gains. China's housing minister pledged to improve builders' access to funding to complete thousands of projects, and the central bank's deputy governor stated that cuts to down payments had already boosted confidence and sales. However, there was no new initiative to excite markets about a meaningful revival in a sector where a crackdown on developers' borrowing has triggered a wave of defaults, while declining prices have shaken households' faith in the asset class. Property developer Sunac China, taking the recent rally as a cue to raise capital, contributed to dampening the mood. Hong Kong-listed mainland developers fell by 3%. Some investors took the opportunity to cash in on the good news, leading to a pullback.

Even though President Lagarde has taken a balanced stance, market pricing now assigns a likelihood of over 90% for Thursday's policy rate decrease of another quarter point. Data on Eurozone business has been dismal, especially in manufacturing, with indications that the slowdown is affecting services as well. This increases the dangers associated with the employment market's tightness. Inflation statistics have also improved, with HICP in Germany, France, Italy, and Spain falling below 2%. Although disinflation in services is still obstinate, weak demand, softening wage pressures, and the headline rate's ongoing slowdown will all continue to push down underlying prices. In the'medium-term' timeframe, inflation should return to goal in a sustainable manner, according to the Council. Risks of negative growth should be more worrisome than any lingering consequences of the earlier inflation shock since the policy operates with a lag. Since the policy is excessively restricted, it is difficult to argue for more "wait and see."

Overnight Newswire Updates of Note

- ECB Set For Second Rate Cut; Inflation, Growth Abate

- BoE PRA Signals Regulatory Easing To Spur Growth

- China’s Economy Likely Expanded, Weakly Paced

- China Plans $562B Support For Unfinished Properties

- Taiwan: China Tested Missiles During Military Drills

- RBA Rates To Stay High As Employment Surges 64k

- Polls: Japan’s Ruling LDP May Lose Majority

- Japan Exports Slip For First Time In 10 Months

- ASX 200 Soars Past Record; Jobs Data Beats Estimates

- DFS Q3 Profit Jumps On Robust Interest Income

- BHP Q1 Iron Ore Output Rises 3%, Tops Estimates

- US Biden Envoy Waves Arm Suspension: Israel An Ally

- US Forces Launch Major Strikes On Houthi Sites

(Sourced from reliable financial news outlets)

As the US elections draw near, the financial markets are bracing for potential volatility, presenting both opportunities and challenges for traders. To help navigate this crucial period, we have launched the US Elections - Traders Hub, a comprehensive resource tailored to meet the needs of traders at every level.

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0800 (707M), 1.0845-50 (475M), 1.0875 (205M), 1.0900 (210M)

- 1.0950 (362M), 1.0975 (914M), 1.0990-1.1000 (2.7BLN), 1.1005-10 (1.4BLN)

- USD/CHF: 0.8675 (493M). EUR/SEK: 11.4500 (628M)

- GBP/USD: 1.2950 (600M), 1.3050 (476M), 1.3100-10 (744M)

- AUD/USD: 0.6650 (488M), 0.6700 (1.6BLN)

- NZD/USD: 0.6000 (461M), 0.6150 (250M)

- AUD/NZD: 1.0950 (1.2BLN), 1.1050 (548M), 1.1100 (660M)

- USD/JPY: 148.90-149.00 (423M), 149.20-25 (463M)

- 149.50 (525M), 150.00-05 (1.3BLN)

- EUR/JPY: 160.40 (564M), 162.00 (470M), 165.00 (808M)

- AUD/JPY: 100.50 (210M), 101.25 (484M)

CFTC Data As Of 11/10/24

- Japanese Yen net long position is 36,528 contracts

- British Pound net long position is 93,135 contracts

- Euro net long position is 39,098 contracts

- Bitcoin net short position is -1,282 contracts

- Swiss Franc posts net short position of -22,459 contracts

- Equity fund speculators increase S&P 500 CME net short position by 26,533 contracts to 328,810

- Equity fund managers cut S&P 500 CME net long position by 6,124 contracts to 1,041,583

- Speculators trim CBOT US 10-year Treasury futures net short position by 183,760 contracts to 960,129

Technical & Trade Views

SP500 Bullish Above Bearish Below 5750

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 5720 opens 5660

- Primary support 5575

- Primary objective 5820 - TARGET HIT NEW PATTERN EMERGING

(Click on image to enlarge)

EURUSD Bullish Above Bearish Below 1.11

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.1030 opens 1.1120

- Primary support 1.0850

- Primary objective 1.0850 - TARGET HIT NEW PATTERN EMRGING

(Click on image to enlarge)

GBPUSD Bullish Above Bearish Below 1.3230

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 1.31 opens 1.29

- Primary support is 1.29

- Primary objective 1.29

(Click on image to enlarge)

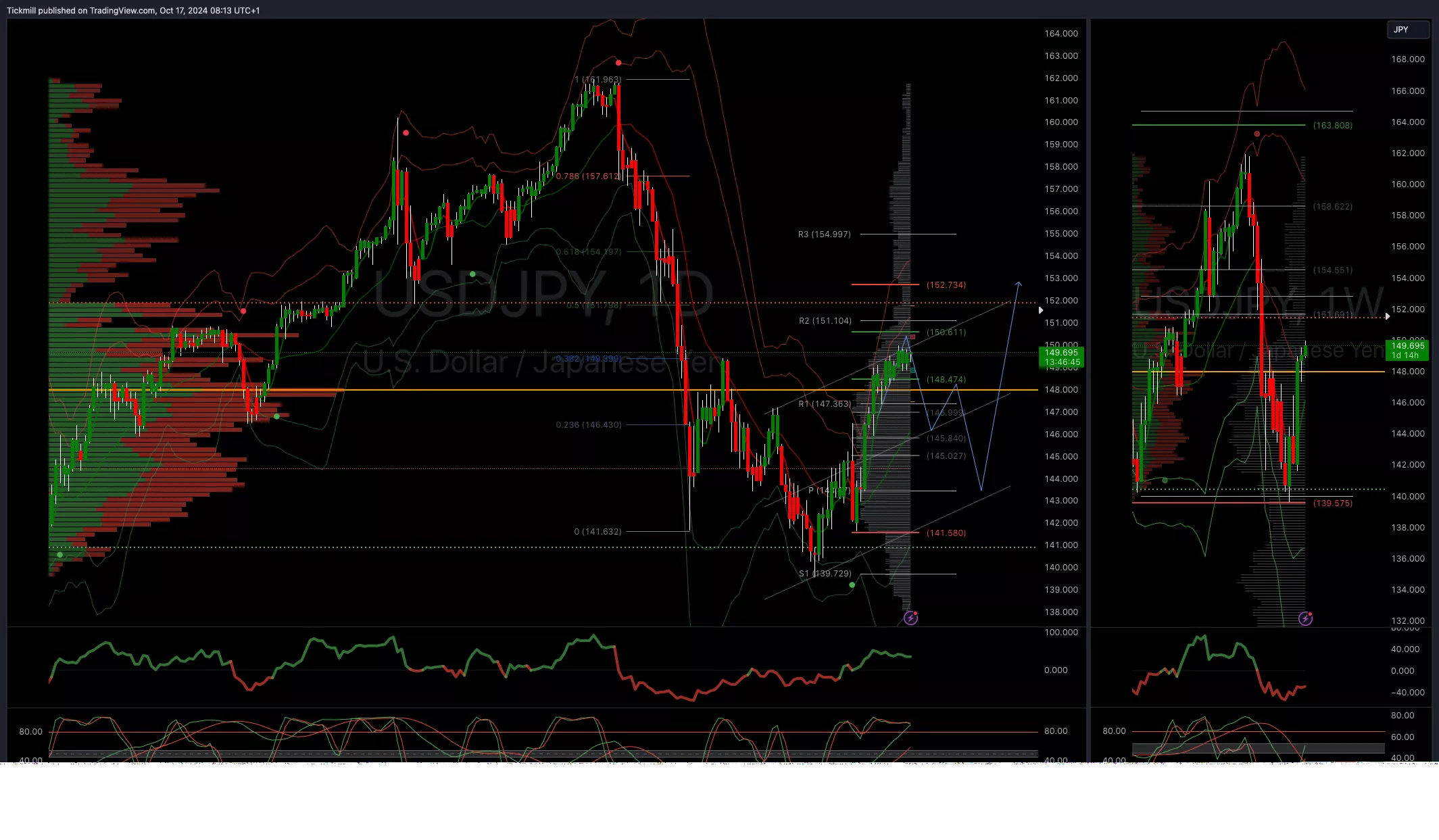

USDJPY Bullish Above Bearish Below 144

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 141.50 opens 138

- Primary resistance 152

- Primary objective is 152

(Click on image to enlarge)

XAUUSD Bullish Above Bearish Below 2645

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 2600 opens 2550

- Primary support 2550

- Primary objective is 2720

(Click on image to enlarge)

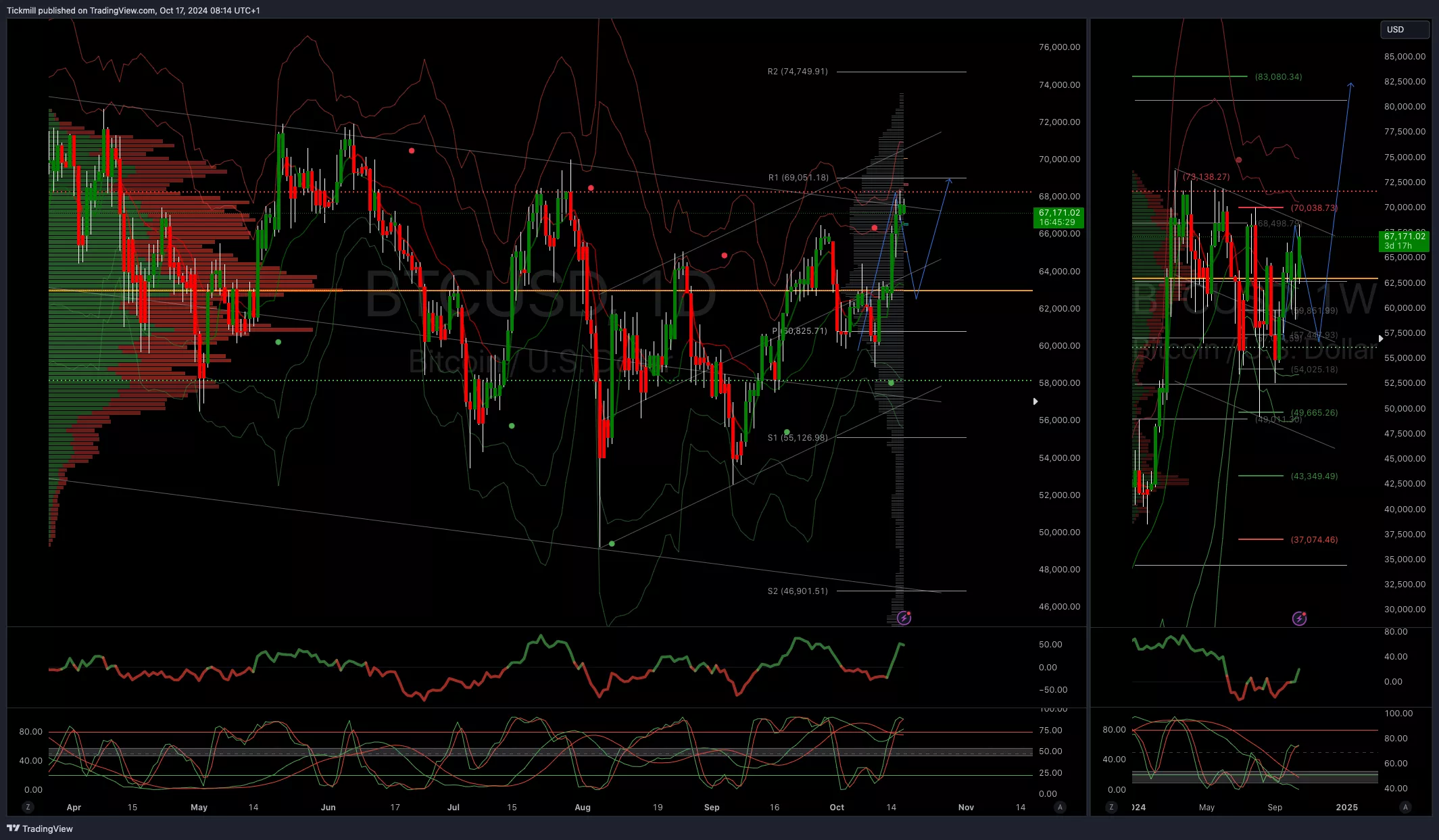

BTCUSD Bullish Above Bearish Below 57000

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 57000 opens 52000

- Primary support is 500000

- Primary objective is 700000

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, Oct. 16

FTSE Turns Green Into The Close AS US Risk Sentiment Surges

SP500 Weekly Action Areas & Price Objectives