Daily Market Outlook - Thursday, March 30

Image Source: Pexels

Nasdaq On The Cusp Of A New Bull Market

Month and quarter-end flows have seen Asian equity markets trade with a subdued tone, the upbeat finish on Wall Street failed to follow into the Asian session in any meaningful fashion as investors closed out positions, without any data catalyst to take advantage of Asian markets remained relatively range bound. Stateside, however, the Nasdaq is poised to close out the quarter with record returns pointing to the potential for a technical new bull market set to be confirmed, as the tech-heavy index is set to post 20%+ returns from its December lows.

Another quiet European data session this morning with the only prints of interest coming from Eurozone March inflation indications delivered via German and Spanish numbers ahead of the Eurozone flash estimate on Friday. Investors will be alert to signs of a retreat in headline inflation due mainly to energy prices. Germany’s harmonized inflation is expected to drop to 7.5% from 9.3%. Core inflation, however, is expected to remain stubbornly high.

The latest print for US Q4 GDP is expected to remain at 2.7% year over year. US weekly jobless claims are expected to remain at record lows, suggesting little in the way of loosening the US labor market. US investors will likely be sitting on the sidelines ahead of Friday’s PCE deflator, the much-touted preferred inflation gauge for the Federal Reserve. Fed's Barkin (non-voter), Collins (non-voter) and Kashkari (voter) will speak, while US Treasury Secretary Yellen will also be making some comments these come after her recent ambiguity around deposit insurance and the governments' inclination or lack thereof to support depositors at all costs.

FX Options For 10am New York Cut

- EUR/USD: 1.0700 (EU2.84b), 1.1000 (EU1.89b), 1.1300 (EU1.63b)

- USD/JPY: 131.00 ($1.55b), 132.00 ($1.39b), 131.50 ($1.29b)

- USD/CNY: 6.8600 ($398m), 6.8785 ($373.3m), 6.9000 ($334.6m)

- USD/CAD: 1.1300 ($600m), 1.2450 ($540m), 1.3513 ($500m)

- USD/MXN: 18.00 ($650m), 18.70 ($499.8m), 18.90 ($483.9m)

- GBP/USD: 1.1200 (GBP619.5m), 1.2000 (GBP513.7m), 1.2200 (GBP426.3m)

- AUD/USD: 0.6650 (AUD850m), 0.6600 (AUD833.6m), 0.6745 (AUD589.7m)

- USD/KRW: 1280.00 ($350m)

- EUR/GBP: 0.8725 (EU384.6m)

- CitiFX preliminary estimate of month-end FX hedge rebalancing flows points to moderate U.S. dollar selling against all major currencies except the euro. Although fixed income performed strongly across the board, our model suggests that both international equity and fixed income investors will likely be USD sellers this month-end,Japanese investors' needs to increase hedges on well-performing foreign fixed income strengthen the need to buy the yen and sell the dollar, although strong performance of European and UK fixed income weakens the buy signal for euro and sterling.

Overnight News of Note

- Bank Relief And Alibaba Policies Nudge Asian Stocks Higher

- US Futures Little Changed As Investors Come Off Winning Day

- Powell Points GOPs To Estimates Showing One More Rate Hike

- White House To Prepare New Bank Rule Proposals After Failures

- FDIC To Consider Bank Size In Applying Special Assessment Fee

- Li Calls China ‘Anchor For World Peace,’ Optimistic On Economy

- Investors Bet Australia To Manage Soft Landing With High Rates

- RBA Review Set To Propose Specialised Board, Fewer Meetings

- Australian Job Vacancies Fall Over Quarter, Still High Historically

- Bank Of Canada Ready To Act In Case Of Extreme Market Stress

- ECB's Schnabel: Underlying Inflation In Eurozone Proving Sticky

- BoE's Mann: Low Headline CPI, High Core, Make Policy Difficult

- Green Shoot For UK Economy, Firms Forecast Return Of Growth

- Alibaba Says May Cede Control Of Some Businesses Over Time

- Barclays Strategist: ‘Second Wave’ Of Deposit Outflows Coming

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

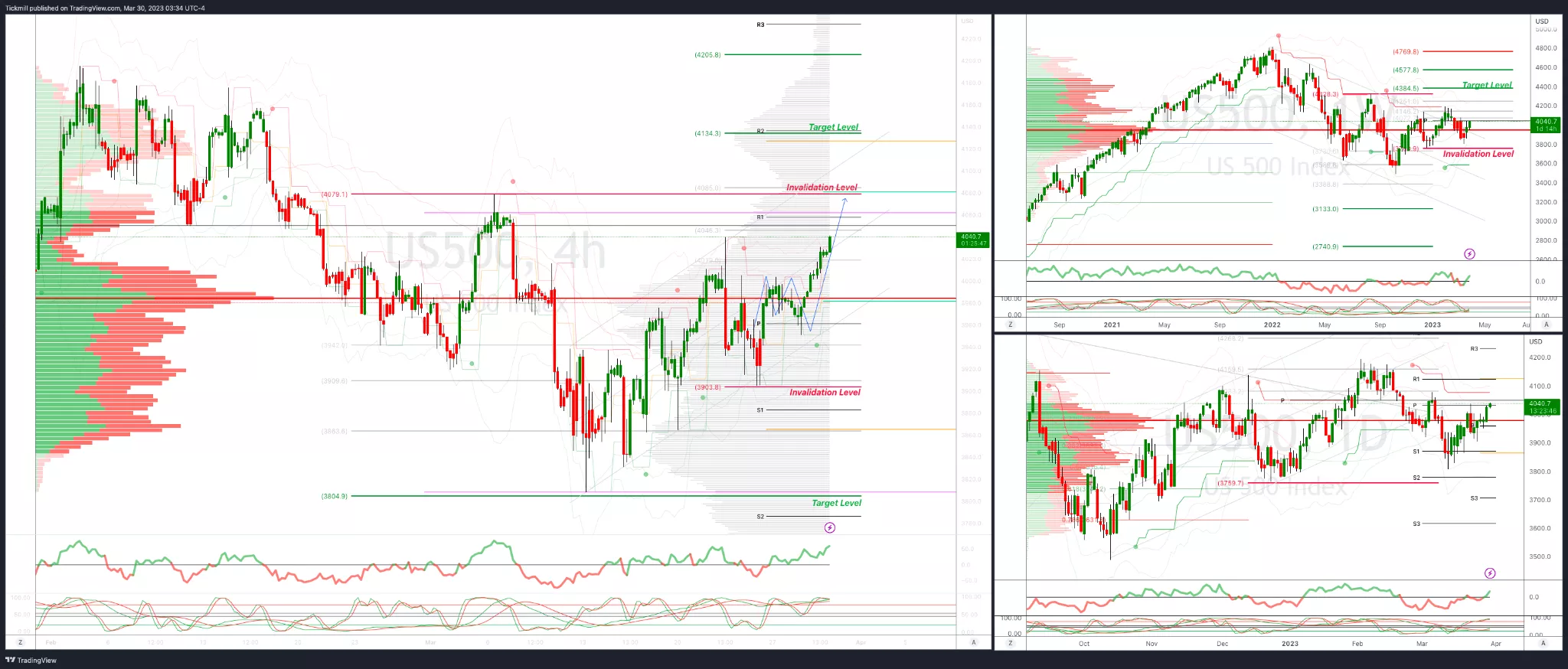

SP500 Bias: Intraday Bullish Above Bearish Below 4000

- Primary resistance is 4078

- Primary objective is 3804

- Above 4040 opens 4078

- 20 Day VWAP bullish, 5 Day VWAP bullish

(Click on image to enlarge)

EURUSD Bias: Intraday Bullish Above Bearish below 1.0830

- Primary support is 1.07

- Primary objective is 1.1128

- Below 1.0700 opens 1.0660

- 20 Day VWAP bullish, 5 Day VWAP bearish

(Click on image to enlarge)

_638157610979687282.webp)

GBPUSD Bias: Intraday Bullish Above Bearish below 1.2280

- Primary support is 1.2200

- Primary objective 1.2411

- Below 1.2170 opens 1.2100

- 20 Day VWAP bullish, 5 Day VWAP bullish

(Click on image to enlarge)

_638157611283905327.webp)

USDJPY Bias: Intraday Bullish above Bearish Below 133.00

- Primary resistance is 135.15

- Primary objective is 129.15

- Above 136 opens 137.90

- 20 Day VWAP bearish, 5 Day VWAP bearish

(Click on image to enlarge)

_638157611571869141.webp)

AUDUSD Bias: Intraday Bullish Above Bearish below .6696

- Primary resistance is .6740

- Primary objective is .6950

- Below .6560 opens .6450

- 20 Day VWAP bearish, 5 Day VWAP bullish

(Click on image to enlarge)

_638157611871712007.webp)

BTCUSD Intraday Bias: Bullish Above Bearish below 26500

- Primary support 23000

- Primary objective is 30000

- Below 23000 opens 22400

- 20 Day VWAP bullish, 5 Day VWAP bullish

(Click on image to enlarge)

_638157612184356014.webp)

More By This Author:

Daily Market Outlook - Wednesday, March 29Daily Market Outlook - Friday, March 24

Daily Market Outlook - Thursday, March 23

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to ...

more