Daily Market Outlook - Thursday, July 25

Image Source: Pixabay

On Thursday, most Asian stock markets are experiencing a decline, influenced by the overall negative signals from global markets. The drop is primarily driven by significant decreases in technology stocks, following the trend of the tech-heavy Nasdaq, after several major U.S. tech companies reported unsatisfactory quarterly results. Additionally, investors remain apprehensive due to ongoing worries about the decelerating growth in China, the world's second largest economy. Continuing from the significant declines in the last session, the Japanese market is experiencing a sharp decrease on Thursday, in line with the overall negative trends in global markets. The Nikkei 225 is dropping by almost 3 percent, approaching the 38,000 level, with substantial losses in most sectors driven by leading index companies and technology stocks.

Thursday will see the release of business confidence from Germany and monetary aggregates from the euro area, making it a relatively quiet day for European economic news. Stateside the only release of note will be jobless claims which have started to tick up of late.

Overnight Newswire Updates of Note

- China Cuts One-year Policy Rate By Most Since 2020

- BoJ To Weigh Rate Hike, Detail Plan To Halve Bond Buying

- Democrats To Nominate Harris Running Mate By Aug. 7

- US Warns Of Investments From ‘Foreign Threat Actors’

- Biden Says Time For ‘Younger Voices’ In Oval Office Speech

- Bond Market Is Now More About Recession Than Election

- Japanese Officials Quiet On Forex As Yen Sharply Rebounds

- Japan Leads Record $989B Year Of Asian Investment In US

- Extended USDJPY Sells to 152.00, Awaits US GDP Data

- Aussie Declines Admist Falling Commodity Prices

- Israel's Netanyahu, Seek Support In Face Of War Protests

- The Commodities Feed: Oil Supply Risks Linger

- Blackrock Leads Ether ETFs Rack Up $100 Mln

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0830 (865M), 1.0850-55 (1.2BLN), 1.0870 (651M), 1.0915 (554M)

- EUR/CHF: 0.9580-90 (373M). EUR/GBP: 0.8355 (1BLN)

- AUD/USD: 0.6520 (200M), 0.6615-20 (333M), 0.6640 (647M)

- USD/CAD: 1.3750 (526M), 1.3800-10 (1BLN)

- USD/JPY: 152.07 (250M), 152.50 (660M), 153.00-10 (930M)

- AUD/JPY: 100.00 (670M)

CFTC Data As Of 16/7/24

- Equity fund managers raise S&P 500 CME net long position by 19,908 contracts to 997,340

- Equity fund speculators increase S&P 500 CME net short position by 28,517 contracts to 370,142

- Japanese yen net short position is 151,072 contracts

- British pound net long position is 132,902 contracts

- Euro net long position is 24,749 contracts

- Swiss franc posts net short position of -49,793 contracts

- Bitcoin net short position is -579 contracts

Technical & Trade Views

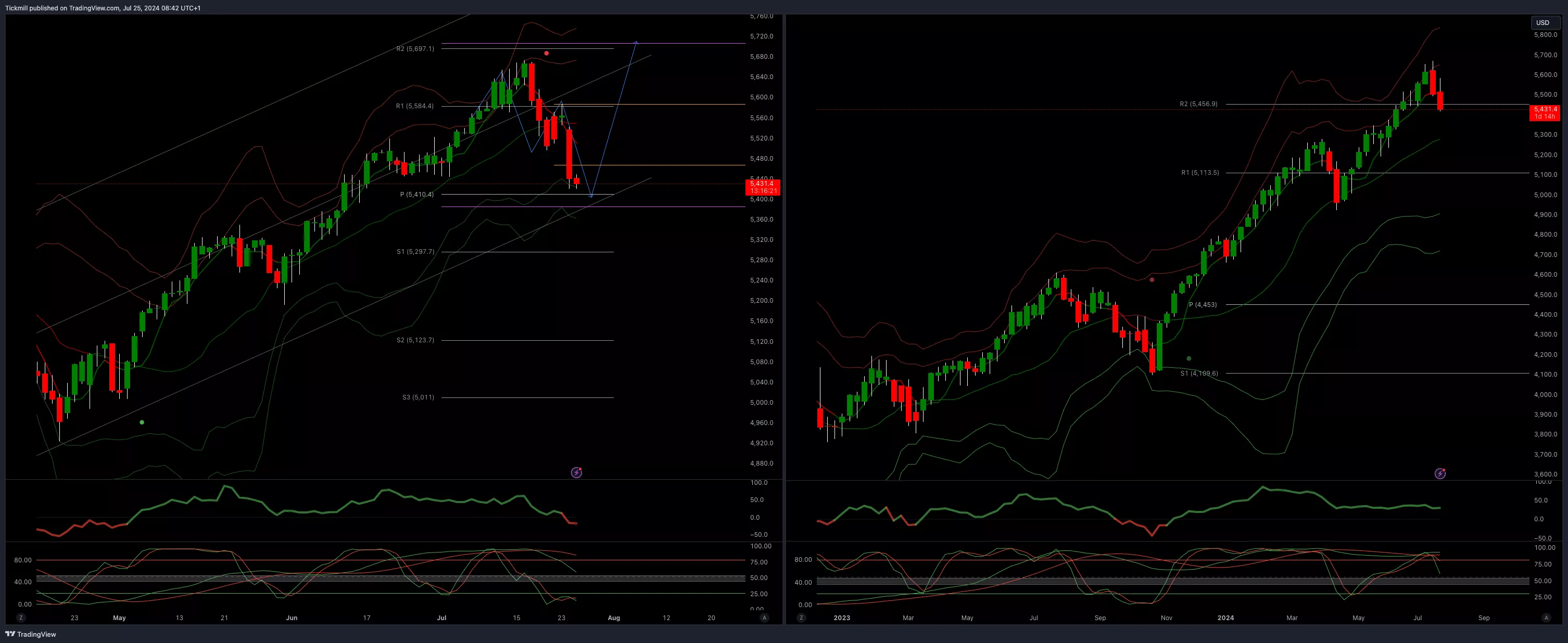

SP500 Bullish Above Bearish Below 5480

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 5475 opens 5450

- Primary support 5400

- Primary objective is 5700

(Click on image to enlarge)

EURUSD Bullish Above Bearish Below 1.09

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.880 opens 1.0940

- Primary resistance 1.0981

- Primary objective is 1.07

(Click on image to enlarge)

GBPUSD Bullish Above Bearish Below 1.29

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 1.2670 opens 1.2450

- Primary support is 1.2690

- Primary objective 1.3137/60

(Click on image to enlarge)

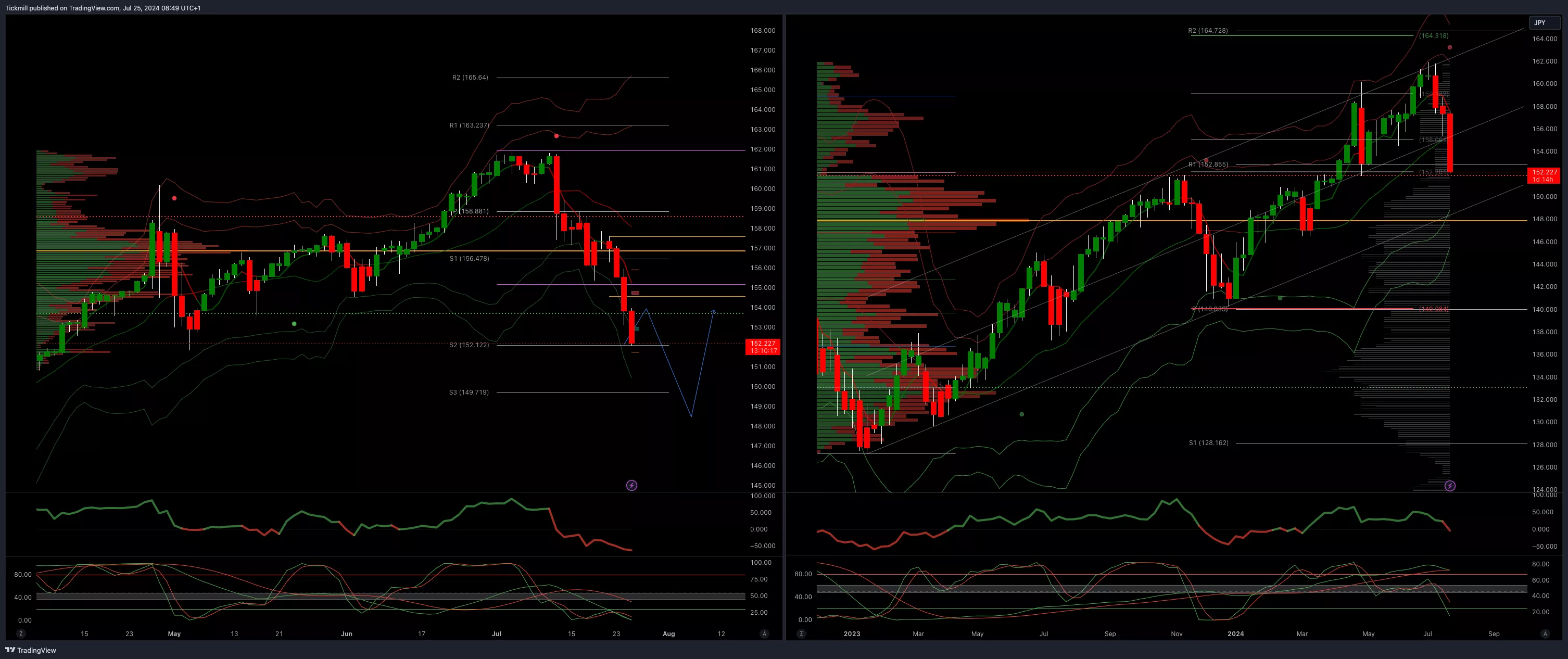

USDJPY Bullish Above Bearish Below 156

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 152 opens 148.80

- Primary support 152

- Primary objective is 148.80

(Click on image to enlarge)

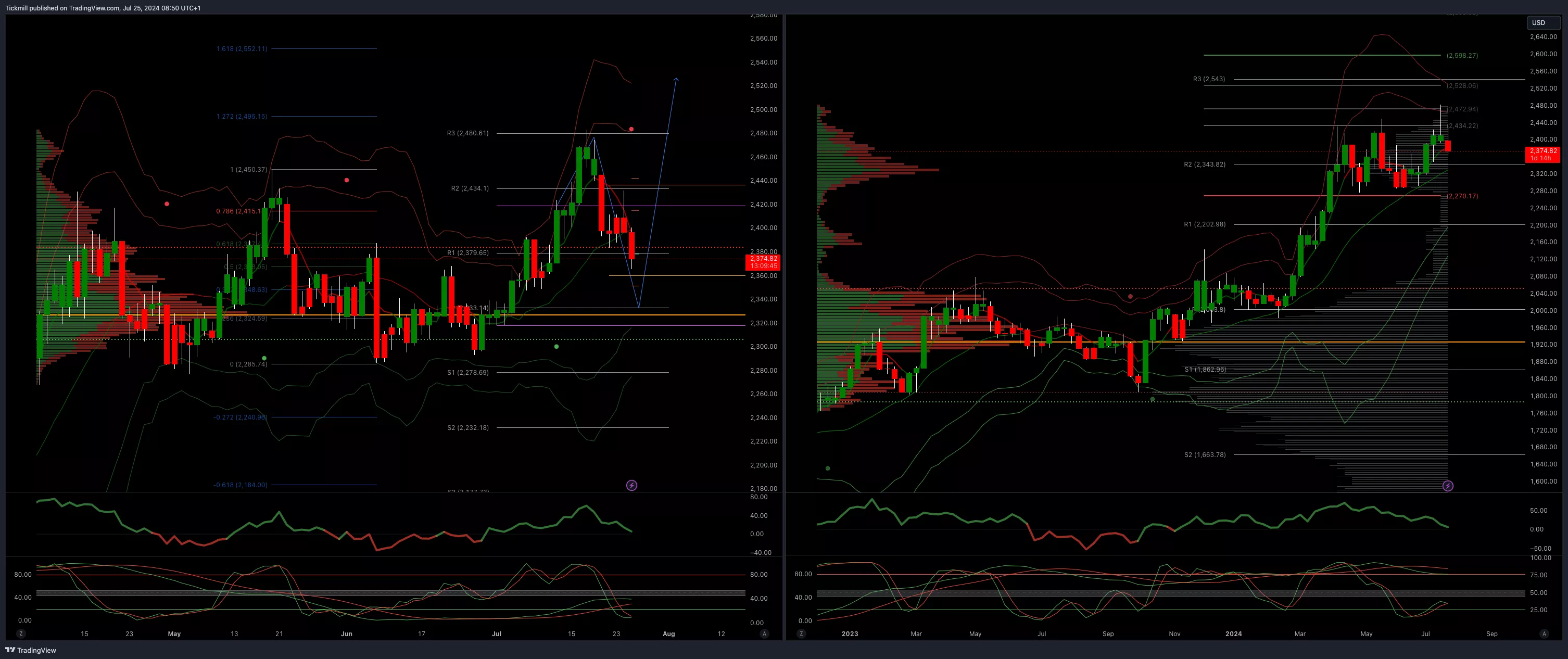

XAUUSD Bullish Above Bearish Below 2345

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 2400 opens 2330

- Primary support 2300

- Primary objective is 2598

(Click on image to enlarge)

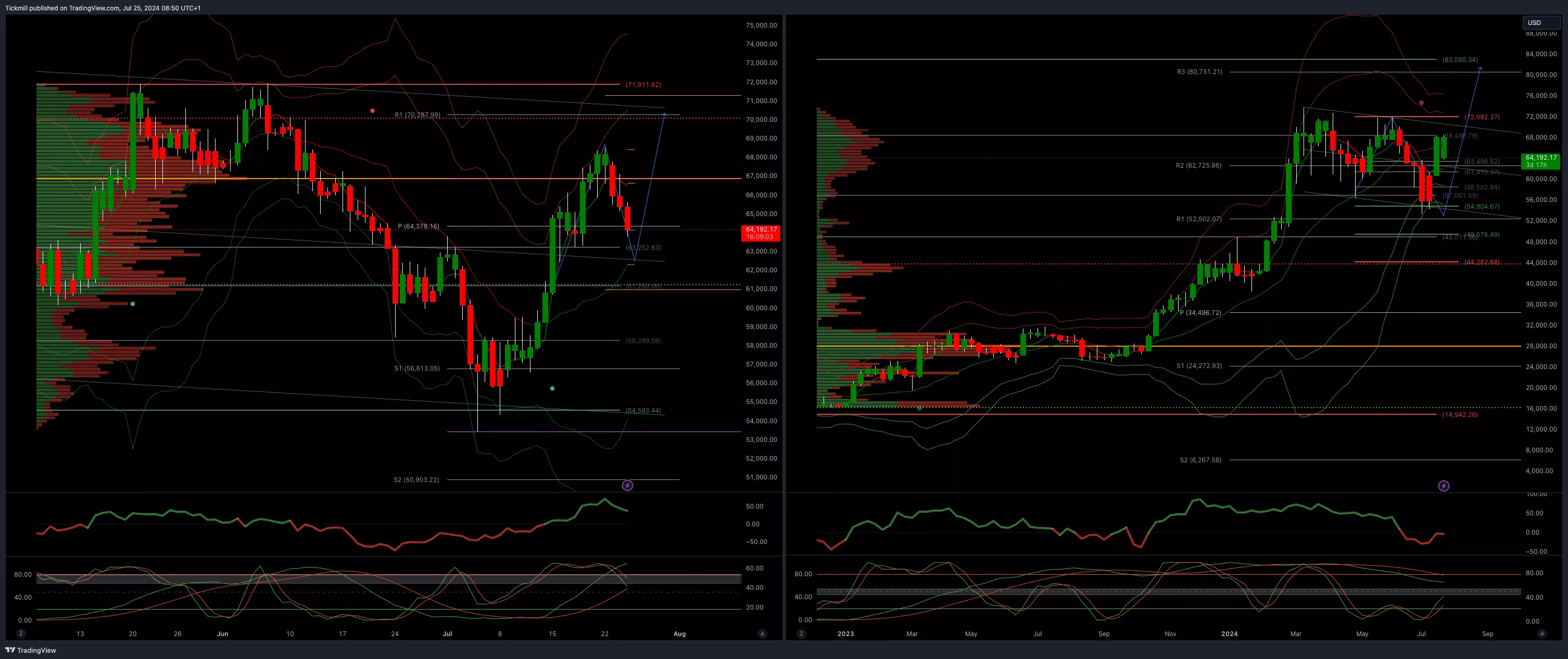

BTCUSD Bullish Above Bearish below 62000

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 67000 opens 70000

- Primary support is 50000

- Primary objective is 70000

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Wednesday, July 24Daily Market Outlook - Wednesday, July 24

SP500 Daily Trade Plan - Wednesday, July 24