Daily Market Outlook - Thursday, Dec. 12

Image Source: Unsplash

Asian markets climbed on Thursday, spurred by a tech-driven rally on Wall Street, as an expected U.S. consumer inflation report strengthened predictions of a Federal Reserve interest rate cut next week. Japan's Nikkei index surpassed 40,000 for the first time since mid-October, supported by gains in the chip sector. The yen's decline also aided the exporter-heavy index, as traders lowered their expectations for a Bank of Japan rate hike next week. Meanwhile, the Australian dollar surged after employment figures far exceeded forecasts, bouncing back from Wednesday's drop following a Reuters report hinting that Beijing might allow further yuan devaluation next year. Given that China is Australia's largest trading partner, the Australian dollar is often viewed as a liquid stand-in for the yuan. The yuan held steady above a one-week low after the central bank set a slightly stronger official rate.

At today’s ECB meeting, expectations for a rate cut may clash with Lagarde's reluctance to make firm commitments. A 25 basis point reduction in the ECB’s deposit rate, bringing it down to 3%, is the most probable outcome from the Governing Council’s meeting today. Therefore, the market's attention will be on hints regarding future actions. If a 25 basis point cut occurs today, the market anticipates over 60 basis points of cumulative easing spread across the January and March meetings. In other words, market expectations suggest a significant likelihood that one of the first two meetings in 2025 will see a 50 basis point cut, alongside a 25 basis point reduction at the other meeting. Since October, expectations had initially leaned towards a larger cut in December before tapering off. The immediate concern is that the forecasts for January and March may need to be adjusted downwards at this point. Historical patterns indicate that Lagarde tends to use press conferences to avoid making firm commitments and emphasise a'meeting by meeting' decision-making process. A continued trend of poor PMI data, for instance, could further bolster expectations for rate cuts in early 2025, but that will be addressed next week. At this moment, it may be overly optimistic to expect Lagarde to completely endorse the market's dovish outlook.

Stateside, the US is set to release its Producer Price Index (PPI) figures later today. This announcement comes just a day after the market received a consumer inflation report that was in line with expectations and not excessively high. This particular reading of consumer inflation has significantly influenced market sentiment, leading many to believe that the Federal Reserve is likely to implement a rate cut during their upcoming meeting on December 18. The anticipation surrounding these economic indicators reflects the ongoing concerns about inflation and the overall health of the economy, as investors and analysts closely monitor the Federal Reserve's actions and decisions in response to these economic signals.

Overnight Newswire Updates of Note

- Swiss Central Bank Cuts by 50bps

- ECB Set To Cut Rates For Third Time In Four Months

- China To Expand Private Pension Program Nationwide In Reform

- China Must Innovate In Chip Design Or Risk Global Market Lag

- BoJ Leaning Toward Keeping Rates Steady Next Week, Sources Say

- New Zealand Primary Exports Tipped to Recover Despite Trade Risk

- Australia Jobless Rate Falls, Labour Market Stays Tight

- RBA Alert To Trump Tariffs Inflation Risk

- Trump Seen As Unlikely To Stall Pace Of Sustainable Debt Sales

- Brazil Central Bank Pledges To Hike Rates To 14.25% By March

- Gold Edges Higher As Fed Rate Cut Prospects Support

- Adobe Gives Tepid Sales Outlook, Stoking AI Disruption Fears

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0475 (1BLN), 1.0500 (1.7BLN), 1.0525 (566M), 1.0550 (2.1BLN),

- 1.0560 (476M), 1.0575-85 (1.2BLN), 1.0600 (1.6BLN)

- USD/CHF: 0.8790 (543M), 0.8850 (331M), 0.8900 (313M)

- EUR/CHF: 0.9300 (540M), 0.9325-35 (716M)

- EUR/GBP: 0.8190 (417M), 0.8280-90 (561M)

- GBP/USD: 1.2715 (300M), 1.2745-50 (530M), 1.2760 (217M), 1.2800 (451M)

- AUD/USD: 0.6390-0.6400 (730M), 0.6450 (1.4BLN), 0.6485-90 (591M)

- 0.6500-10 (1.3BLN)

- USD/CAD: 1.4100 (1.3BLN), 1.4230 (1.3BLN), 1.4250 (710M)

- USD/JPY: 152.00 (820M), 152.15-25 (1.1BLN), 152.70 (1.3BLN)

- 153.00 (320M), 153.25 (351M)

CFTC Data As Of 6/12/24

- Equity fund managers cut S&P 500 CME net long position by 7,148 contracts to 1,096,911

- Equity fund speculators increase S&P 500 CME net short position by 59,926 contracts to 370,331

- Speculators increase CBOT US Treasury Bonds futures net short position by 11,361 contracts to 58,775

- Speculators trim CBOT US 2-year Treasury futures net short position by 31,747 contracts to 1,202,899

- Speculators increase CBOT US 5-year Treasury futures net short position by 95,529 contracts to 1,861,100

- Speculators trim CBOT US 10-year Treasury futures net short position by 34,702 contracts to 891,901

- Euro net short position is -57,489 contracts

- Japanese yen net long position is 2,334 contracts

- Swiss franc posts net short position of -41,094 contracts

- British pound net long position is 19,326 contracts

- Bitcoin net short position is -1,595 contracts

Technical & Trade Views

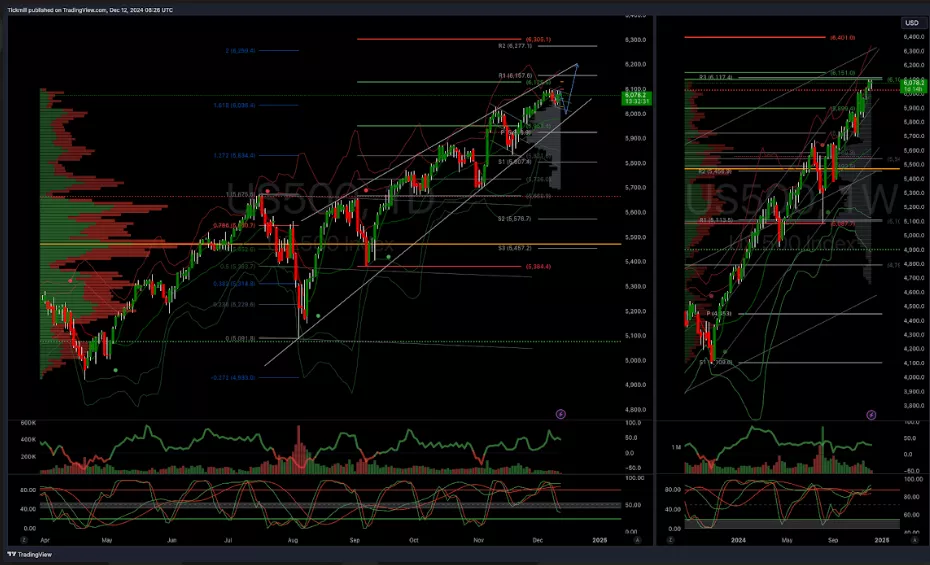

SP500 Bullish Above Bearish Below 6100

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 5990 opens 5930

- Primary support 5795

- Primary objective 6200

(Click on image to enlarge)

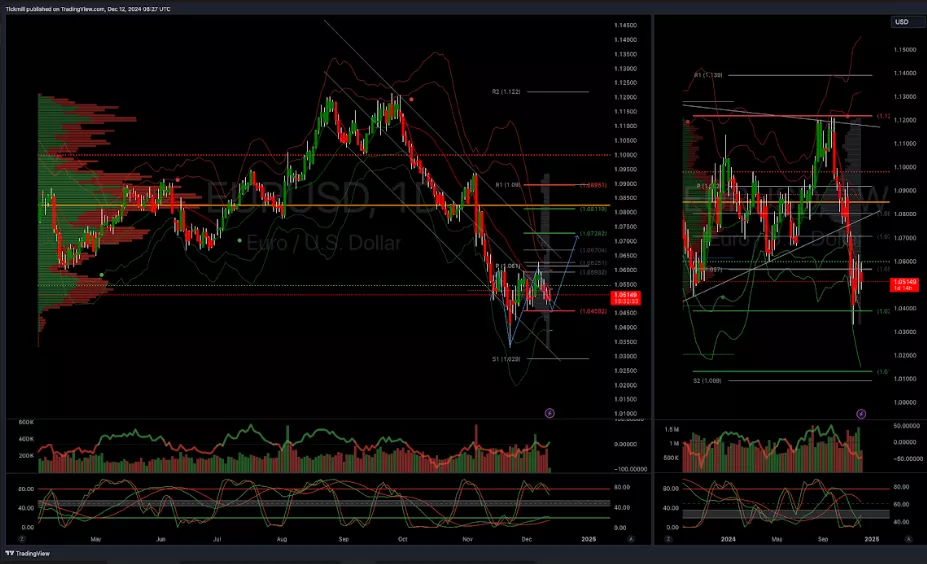

EURUSD Bullish Above Bearish Below 1.0450

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.0590 opens 1.0728

- Primary resistance 1.0950

- Primary objective 1.0728

(Click on image to enlarge)

GBPUSD Bullish Above Bearish Below 1.26

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 1.2760 opens 1.2859

- Primary resistance 1.3050

- Primary objective 1.2859

(Click on image to enlarge)

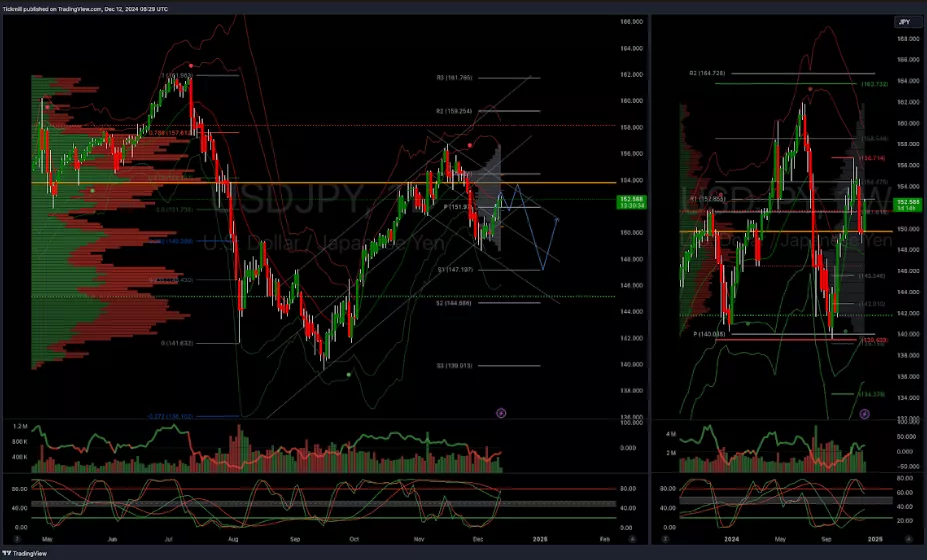

USDJPY Bullish Above Bearish Below 154

- Daily VWAP bullish

- Weekly VWAP bearish

- Below 150 opens 148

- Primary support 150

- Primary objective is 157.50

(Click on image to enlarge)

XAUUSD Bullish Above Bearish Below 2600

- Daily VWAP bullish

- Weekly VWAP bearish

- Below 2530 opens 2467

- Primary support 2530

- Primary objective is 2800

(Click on image to enlarge)

BTCUSD Bullish Above Bearish Below 92000

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 91000 opens 87500

- Primary support is 85000

Primary objective is 100,000 TARGET HIT NEW PATTERN EMERGING

(Click on image to enlarge)

More By This Author:

FTSE Reverses From Two-Week Low On U.S. Inflation As Fed Rate Move Locked

Daily Market Outlook - Wednesday, Dec. 11

FTSE In The Red As Copper Price Pressure Miners