Daily Market Outlook - Thursday, April 23

Image Source: Unsplash

Wednesday's rally in risk assets has lost momentum as uncertainty resurfaces. While yesterday saw a stronger tone in equities due to market relief over Powell's job security and more conciliatory signals regarding China tariffs, this optimism has waned in the Asian session. The S&P 500 closed up by 1.67%, but futures are slightly down, and Asian markets present a mixed picture, with Chinese indices declining. Although the outlook appeared somewhat brighter following partial concessions from Trump, significant uncertainty remains, as highlighted in the Fed's latest Beige Book release. Overnight, Trump mentioned that a new tariff rate for China could be announced in the next two to three weeks. However, Bessent's remarks tempered enthusiasm, suggesting a two to three-year timeframe for a comprehensive review of US-China trade issues. Additionally, there was some confusion regarding potential tariff reductions or exemptions for certain auto parts. The $70 billion 5-year US Treasury auction was more successful than the previous day's 2-year sale, clearing 1 basis point below the current market level at just under 4%. Overall, yields across the curve remain largely unchanged since late in the London session, and in the FX market, the Yen has strengthened slightly, falling back below 143 against the USD. Bank of England Governor Bailey highlighted the need to seriously consider the risk to growth due to the shock to global trade. On the same day, the UK flash Composite PMI indicated contraction, and Bailey's focus on the impact of tariffs on growth, rather than inflation risks, suggests a potential shift towards a more dovish outlook in the May Monetary Policy Report.

The PMIs from S&P Global flash releases for April, announced yesterday, were eyed for indications of the impact from the US tariff announcements at the beginning of the month. From a European standpoint, the positive aspect was that the Composite euro area index remained in expansion territory, albeit barely, at 50.1. Germany slipped into the contraction zone below 50, and France remained there. Comparatively, the UK survey results appeared worse, with the composite flash PMI dropping to 48.2, falling below 50 for the first time since October 2023. The unfavorable indicators weren't limited to activity alone; notably, there was a significant 7.4 point decline in future expectations for the service sector. The real concern is the simultaneous increase in price pressures alongside a dip in activity. The UK stands out among its peers in terms of both starting levels and monthly changes in the price components of the PMIs (top right quadrant in the chart) and weakness in activity (pink triangles in the bottom left quadrant). Tax increases on employers taking effect this month, coupled with the US tariff shock, have been detrimental to both economic activity and inflation. The prospect of GDP falling below potential while inflation remains stubbornly above target poses a challenge for the MPC. However, recent exchange rate strength may alleviate medium-term inflation concerns to some extent.

The macro slate for the day ahead sees: German IFO, UK CBI surveys, US durable goods orders, Initial Jobless Claims, existing home sales, and Fed surveys. Central Bank Speakers: BoE’s Lombardelli, ECB’s Nagel, Lane, Simkus, and Rehn, Fed’s Kashkari.

Overnight Newswire Updates of Note

- German Ifo Business Morale Expected To Fall Amid Tariff Tantrums

- Europeans Fear Growing Rift With US Over Ukraine Talks

- UK And EU To Finalise Plans For Defence Pact

- Australia's Albanese Pledges To Set Up Critical Minerals Strategic Reserve

- IMF Urges BoJ Flexibility On Rates As Tariffs Dent Outlook

- Yen Strengthens Ahead of Japan FinMin Kato - US Trsy Bessent Meeting

- Foreign Bidders For Treasury Auctions Unswayed By Tariffs Tumult

- Trump Ramps Up Pressure On Zelenskiy To Accept Peace Deal

- Trump Says He Might Call Powell To Press For Interest Rate Cuts

- Donald Trump To Exempt Carmakers From Some US Tariffs

- China Factories Slow Production, Sent Workers Home As Tariffs Bite

- China To Kick Off Special Bond Sale As Tariffs Threaten Economy

- AT&T, Verizon Will Pass Cell Phone Tariff Costs On To Customers

- SK Hynix Qtrly Profit Soars 158% As Chip Demand Surges On AI Boom

- IBM Says 15 Contracts Impacted By DOGE Cost Cuts, Shares Drop

- Texas Instruments Gives Rosy Forecast After Demand Rebounds

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1250 (1.1BLN), 1.1300-05 (843M), 1.1370 (1BLN), 1.1430 (800M)

- 1.1450 (1.1BLN), 1.1500 (1.3BLN), 1.1575 (609M)

- USD/CHF: 0.8350 (530M). EUR/CHF: 0.9500 (486M), 0.9550 (452M)

- GBP/USD: 1.3180 (311M), 1.3290-1.3300 (258M). EUR/GBP: 0.8490-0.8500 (460M)

- USD/CAD: 1.3650 (275M), 1.3680 (400M), 1.3950 (562M)

- USD/JPY: 140.00 (2BLN), 140.50-55 (1BLN), 141.00 (624M), 141.55 (1BLN)

- 142.00 (555M), 143.00 (905M), 143.65-70 (384M), 144.00-10 (565M)

- 145.00 (1.5BLN)

- EUR/JPY: 158.95 (300M), 164.95 (235M). AUD/JPY: 89.75 (350M)

CFTC Data As Of 18/4/25

- The Euro's net long position is at 69,280 contracts, while Bitcoin holds a net long position of 586 contracts. The Japanese yen shows a strong net long position of 171,855 contracts, in contrast to the Swiss franc's net short position of 28,584 contracts. The British pound has a net long position of 6,509 contracts.

- Equity fund speculators have decreased their S&P 500 CME net short position by 47,956 contracts, lowering it to 239,649. In contrast, equity fund managers have increased their S&P 500 CME net long position by 1,812 contracts, bringing it to 805,062.

- Speculators have expanded the net short position in CBOT US 5-Year Treasury futures by 40,000 contracts to 2,061,575, while reducing the CBOT US 10-Year Treasury futures net short position by 140,715 contracts to 937,755. Additionally, the net short position for CBOT US 2-Year Treasury futures has risen by 56,664 contracts to 1,254,773. Speculators have also increased the net short position for CBOT US Ultrabond Treasury futures by 19,747 contracts to 220,057, and for CBOT US Treasury bonds futures by 82,631 contracts to 100,785.

Technical & Trade Views

SP500 Pivot 5610

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 5665 target 5792

- Below 5000 target 4755

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into the end of April

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

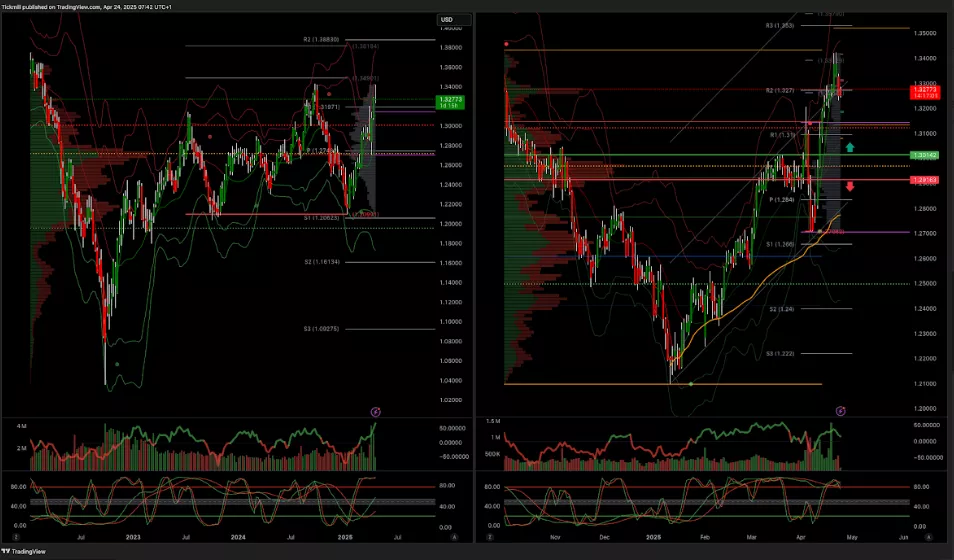

GBPUSD Pivot 1.28

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

USDJPY Pivot 147.70

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into early May

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

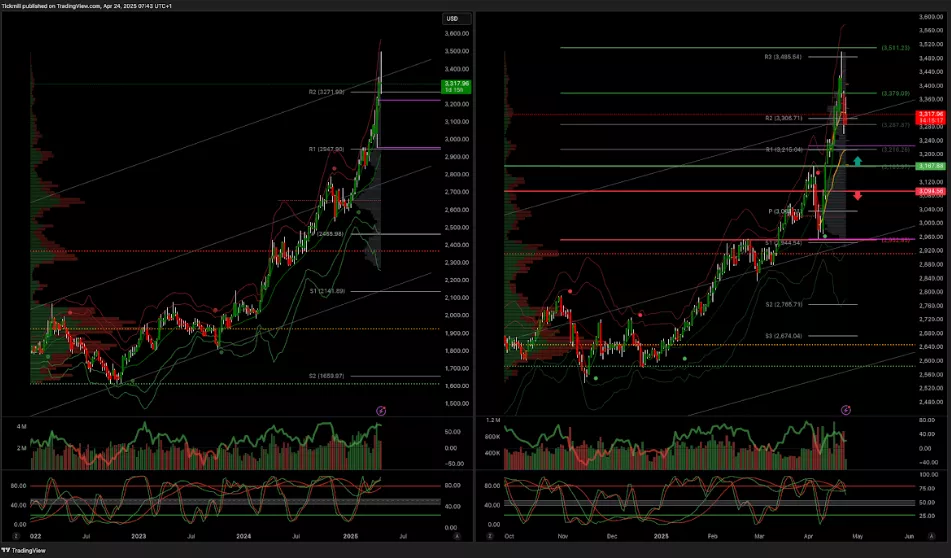

XAUUSD Pivot 3100

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into mid/late April

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

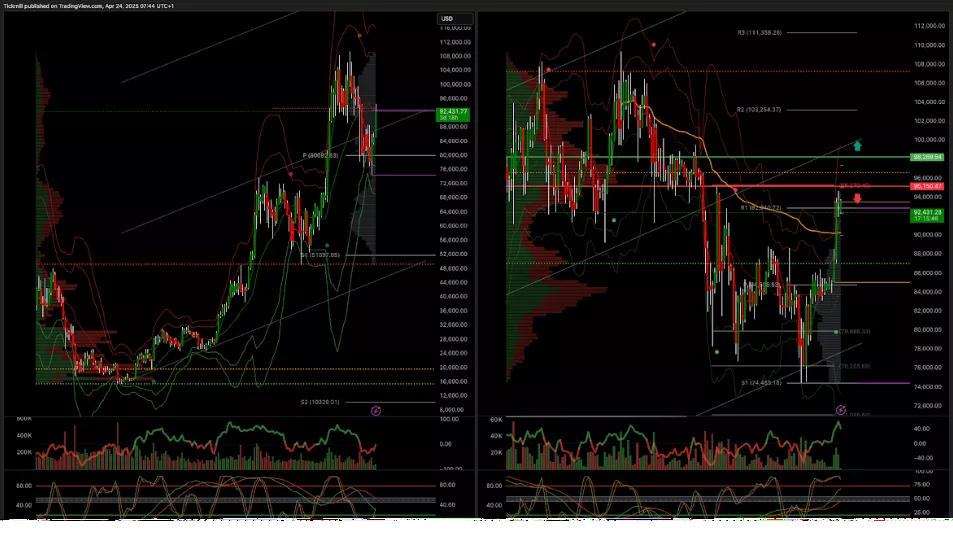

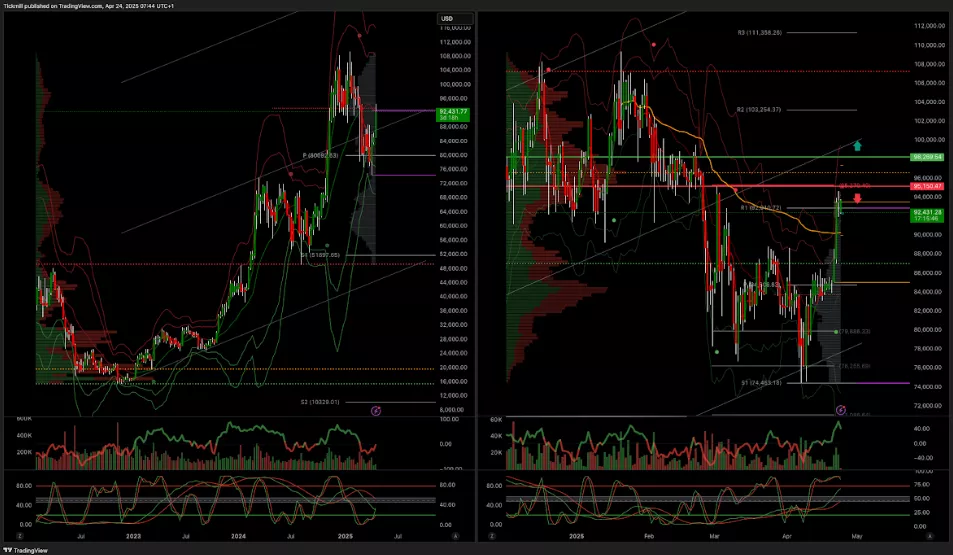

BTCUSD Pivot 90k

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into mid/late April

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Wednesday, April 23Daily Market Outlook - Wednesday, April 23

The FTSE Finish Line - Tuesday, April 22