Daily Market Outlook - Monday, Nov. 25

Image Source: Pixabay

The market's response to fund manager Scott Bessent's selection as the next U.S. Treasury Secretary has dominated Asian trade. Asian markets are trading mostly higher on Monday, buoyed by the positive performance on Wall Street on Friday, with significant gains in Japan, Indonesia, and South Korea. The general investor sentiment is satisfaction that Bessant is a well-known candidate rather than an unknown one. Bessent's fiscally conservative rhetoric has pushed 10-year Treasury yields lower, but it is unclear if he will be able to reduce deficits while extending tax cuts that are about to expire. He has mentioned reducing spending and boosting economic growth in order to address the massive amount of U.S. debt and bring the budget deficit down to 3% of GDP. Critics would point out that the United States has seen robust growth for a long time and that the deficit has only become bigger, and that the amount of discretionary spending that may be reduced is insignificant when compared to necessities like Medicare and defence. Though the tariff levels stated, like 60% on Chinese goods, were "maximalist" stances that might be softened, Bessent has advocated for tariffs and suggested that they be "layered in gradually." In an apparent attempt to counter President-elect Donald Trump's prior experiment with devaluation as a means of reducing trade deficits, he has also expressed support for a strong dollar. With markets fully priced for a quarter-point cut from the ECB next month and implying a nearly 58% possibility that it will loosen by a full 50 basis points on December 12, the dollar has been supported by the difference in economic performance between the U.S. and Europe. The likelihood of a rate cut in December has decreased from 70% a month ago to 52%, indicating that bets on the Fed have shifted in the opposite direction. By the end of 2025, the market has only factored in 65 basis points of Fed easing, whereas the ECB has factored in 154 basis points.

This week's key events include U.S. inflation data that will further shape Federal Reserve rate expectations and China's official PMIs. While trading may slow ahead of the Thanksgiving holiday, there is a busy U.S. data calendar, including consumer confidence, new home sales, and the FOMC minutes. Significant releases also include GDP, personal income, and the Fed's preferred inflation gauge, the core PCE price index. Reactions to President-elect Trump's Treasury secretary nomination will be monitored. The RBNZ is widely expected to cut rates, and China's central bank is likely to hold its medium-term lending facility rate. Japanese data will provide a broad snapshot of the economy, while the euro zone and UK have a relatively light schedule. Australia's CPI and Canada's GDP are also due.

Overnight Newswire Updates of Note

- German Ifo Morale Set For Slight Dip After Trump Win

- China Keeps MLF Rate Unchanged For Second Month

- Shadow Board Favours 50bps RBNZ Rate Cut This Week

- NZ Retail Spending Slows Again, Pointing To Recession

- Fed Survey Finds Inflation Risk Fading; Debt, Trade Wars Rise

- Ken Griffin: Wary Of Trump’s Tax-Cut And Tariff Agenda

- Trump Picks Scott Bessent As Treasury Secretary

- Trump Wants Deals On Ukraine And Israel

- Axios: Israel, Lebanon On Cusp Of Ceasefire Deal

- Gold Prices Ease From A Three-Week Peak On Profit-Taking

- Bitcoin’s Rally Stalls After Nearing The Historic $100K Level

- Amazon’s Chip Making Plan To Rival Nvidia In AI Chips

- UniCredit Makes Offer For Italian Rival Banco BPM

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0425 (2.2BLN), 1.0435-40 (2.2BLN), 1.0470 (808M),

- 1.0485 (1.4BLN), 1.0490-1.0500 (820M), 1.0550-55 (408M), 1.0600 (1.2BLN)

- EUR/CHF: 0.9395-0.9400 (314M). EUR/GBP: 0.8300 (543M)

- GBP/USD: 1.2645-50 (434M), 1.2700 (444M)

- AUD/USD: 0.6530-40 (441M)

- NZD/USD: 0.6000 (1.8BLN)

- USD/CAD: 1.3925 (550M)1.4015 (485M)

- USD/JPY: 156.50 (762M)

CFTC Data As Of 22/11/24

- Equity fund managers raise S&P 500 CME net long position by 60 contracts to 1,079,539

- Equity fund speculators trim S&P 500 CME net short position by 29,885 contracts to 258,924

- Euro net short position is -42,557 contracts

- Japanese yen net short position is -46,868 contracts

- Swiss franc posts net short position of -37,071

- British pound net long position is 40,315

- Bitcoin net short position is -2,084 contracts

- Speculators trim CBOT US Treasury bonds futures net short position by 6,123 contracts to 35,645

- Speculators increase CBOT US 10-year Treasury futures net short position by 91,701 contracts to 907,502

- Speculators increase CBOT US 5-year Treasury futures net short position by 113,816 contracts to 1,983,026

- Speculators increase CBOT US 2-year Treasury futures net short position by 23,473 contracts to 1,447,344

Technical & Trade Views

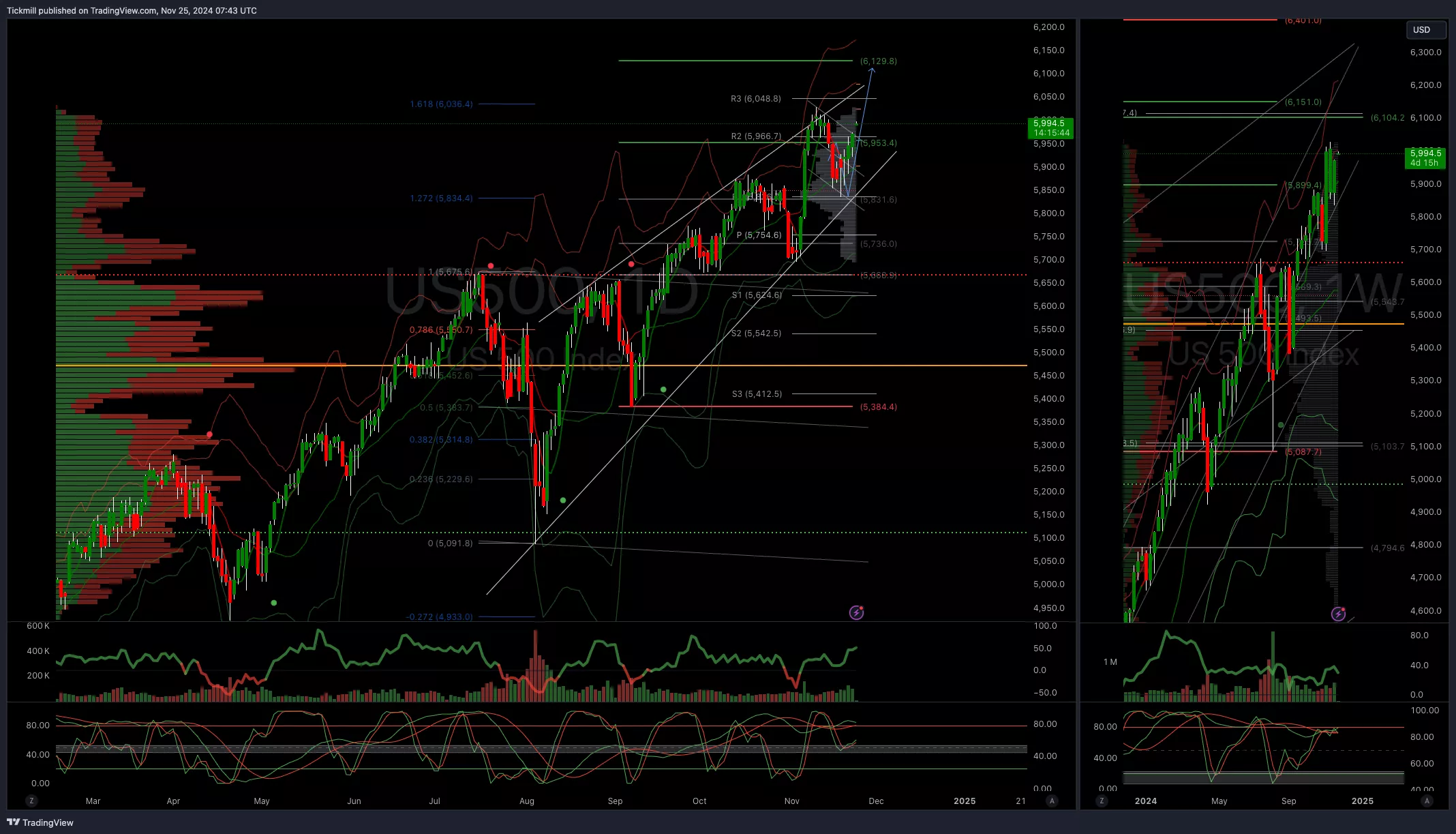

SP500 Bullish Above Bearish Below 5960

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 5790 opens 5700

- Primary support 5795

- Primary objective 6100

(Click on image to enlarge)

EURUSD Bullish Above Bearish Below 1.05

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.05 opens 1.07

- Primary resistance 1.0950

- Primary objective 1.0380 - TARGET HIT NEW PATTERN EMERGING

(Click on image to enlarge)

GBPUSD Bullish Above Bearish Below 1.2750

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.26 opens 1.2750

- Primary resistance 1.3050

- Primary objective 1.25 - TARGET HIT NEW PATTERN EMERGING

(Click on image to enlarge)

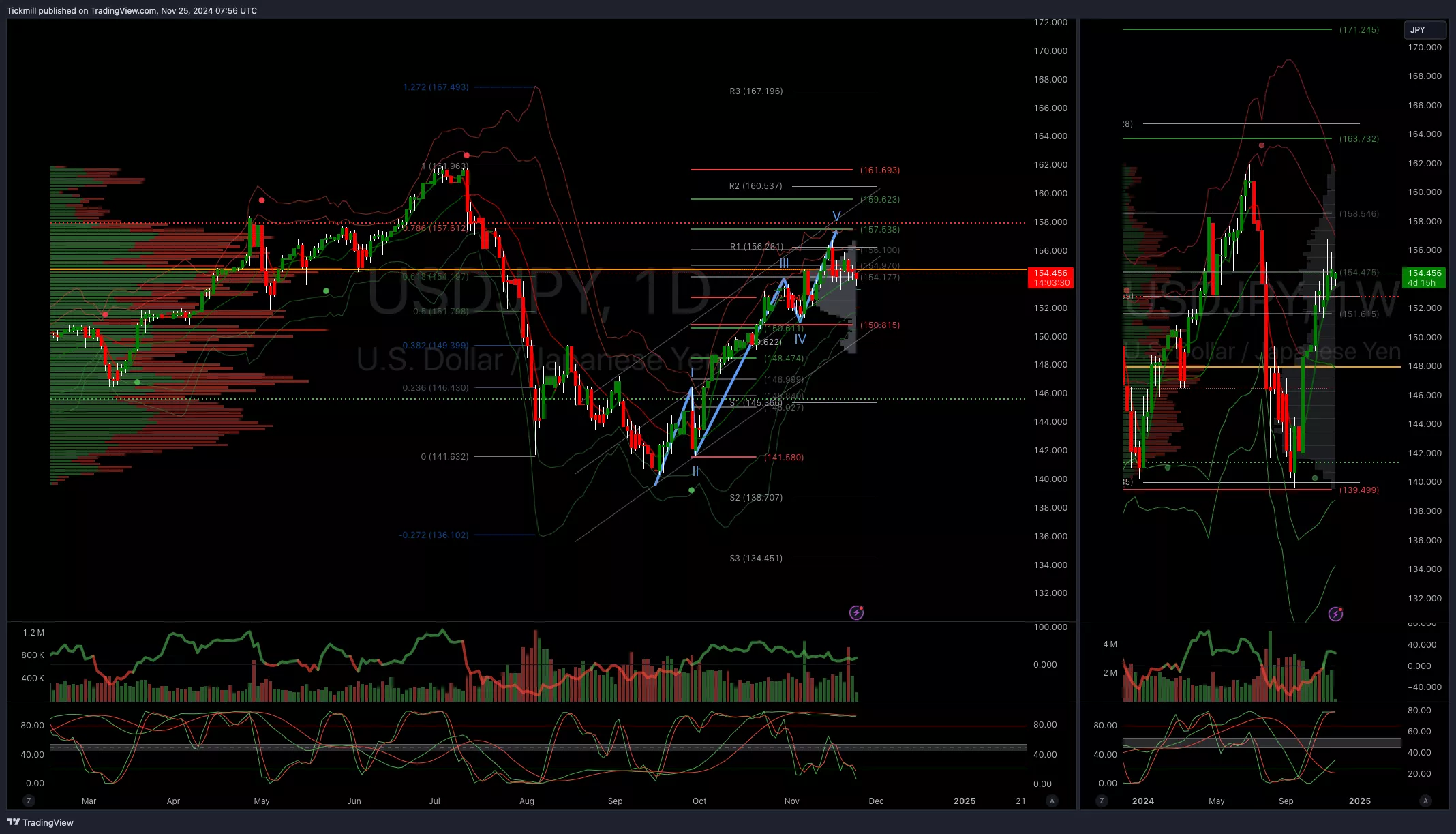

USDJPY Bullish Above Bearish Below 154

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 154 opens 152

- Primary support 148

- Primary objective is 157.50

(Click on image to enlarge)

XAUUSD Bullish Above Bearish Below 2600

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 2590 opens 2530

- Primary support 2530

- Primary objective is 2800

(Click on image to enlarge)

BTCUSD Bullish Above Bearish Below 93000

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 92000 opens 87500

- Primary support is 85000

- Primary objective is 100,000

(Click on image to enlarge)

More By This Author:

FTSE Bid On Downbeat Data As Traders Bet On BoE Rate CutsDaily Market Outlook - Friday, Nov. 22

FTSE Posts Gains As Manufacturer Outlook Points To Green Shoots