Daily Market Outlook - Monday, Aug. 12

Image Source: Unsplash

Following Friday's mostly positive signs from US markets, Asian stock markets are relatively higher on Monday as they continue to rebound from a recent sell-off that was prompted by worries that the largest economy in the world will enter a recession. Additionally, before important US inflation data later this week, traders might be hesitant to make more large moves. Friday's Asian market close was largely positive.

Markets will be driven this week by speeches by Fed officials, China's monthly activity data, monetary policy meetings of the Reserve Bank of New Zealand and Norges Bank, U.S. inflation data that is crucial to Federal Reserve interest rate forecasts, and U.S. earnings releases.

The U.S. July PPI on Tuesday and the July CPI on Wednesday could shed light on whether the markets have priced in the likelihood of a 50 basis point reduction in the Federal Reserve rate in September at 51%, in response to the weak July employment report. The core CPI is predicted to decrease from 3.3% to 3.2% year over year. The New York Empire State Manufacturing Index, the Philadelphia Fed Manufacturing Index, retail sales, industrial production, capacity utilization, business inventories, business conditions at the Philadelphia Fed, housing starts, University of Michigan consumer sentiment, and inflation expectations are all included in the packed data schedule. More rate hints could be revealed in speeches by Fed policy makers Austan Goolsbee, Patrick Harker, Alberto Musalem, and Raphael Bostic as they play down concerns about a recession.

On Thursday, China's monthly activity figures for July will be closely examined for indications of a revival in the country's struggling economy. Retail sales are predicted to increase to 2.6% from 2.0% and industrial output will decline to 5.2% from 5.3% in June. Urban investment, unemployment, and home prices are also due in January–July. This week sees the release of July credit data, which is expected to show a steep decline in new yuan loans.

In a Reuters survey, the majority of economists predict that the Reserve Bank of New Zealand will keep interest rates at 5.5% during its meeting on Wednesday. However, if unemployment increases and inflation expectations decline, there may be clues of an easing in October. Markets predict a 25 basis point drop with an 81% chance. It is time for food inflation data.

The data highlights in Europe include the expectations from the eurozone ZEW survey, employment, the second estimate of the quarter-on-quarter GDP, industrial production, trade balance, and German ZEW economic sentiment.

This is a low-key week for Japan, with Monday off and only the PPI, Q2 GDP, and industrial production reports due.

Expectations for Bank of England rates will be influenced by the UK's hectic data schedule. Retail sales, industrial production, trade balance, jobs and average wages, inflation, and preliminary Q2 GDP are among the releases.

Australia will make statistics on wages and employment available. Deputy Governor Andrew Hauser of the Reserve Bank of Australia will speak on Monday, and on Friday, Governor Michele Bullock and other central bank representatives will testify before a parliamentary economics committee.

Overnight Newswire Updates of Note

- RBA Deputy Governor Andrew Hauser’s Speech

- VP Harris: Fed Is Independent Of The Oval Office

- NZIER Shadow Board’s Split On RBNZ’s OCR Decision

- Ex-BoJ Board Member Rules Out Another Rate Hike This Year

- Israeli Forces Intercept Projectiles From Lebanon

- Global Market Vulnerability Exposed By Carry-Trade Unwind

- US Pressure On Israel Over Middle East Escalations

- Russian Energy Exports Surpass $5 Billion Amid Tensions

- Central Banks Dump Dollars And Yuan In Favor Of Gold

- Oil Holds On To Last Week’s Gains

- Moscow Vows ‘Tough Response’ To Kyiv’s Encroachment

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0830 (EU1.33b), 1.0950 (EU895.9m), 1.0900 (EU741.5m)

- USD/JPY: 153.25 ($300m)

- AUD/USD: 0.6635 (AUD505.9m)USD/CNY: 7.3000 ($1.12b), 7.7900 ($469.2m)

- USD/CNY: 7.3000 ($1.12b), 7.7900 ($469.2m)

- USD/CAD: 1.3910 ($358m)

- GBP/USD: 1.2545 (GBP553.2m), 1.2255 (GBP519.2m), 1.2750 (GBP363.3m)

- USD/BRL: 5.5000 ($450m), 5.0500 ($400.5m)

CFTC Data As Of 09/8/24

- Equity fund speculators trim S&P 500 CME net short position by 25,312 contracts to 222,856

- Equity fund managers cut S&P 500 CME net long position by 57,309 contracts to 881,533

- Swiss franc posts net short position of -22,073 contracts

- British pound net long position is 74,399 contracts

- Euro net long position is 33,580 contracts

- Japanese yen net short position is -11,354 contracts

- Bitcoin net long position is 538 contracts

Technical & Trade Views

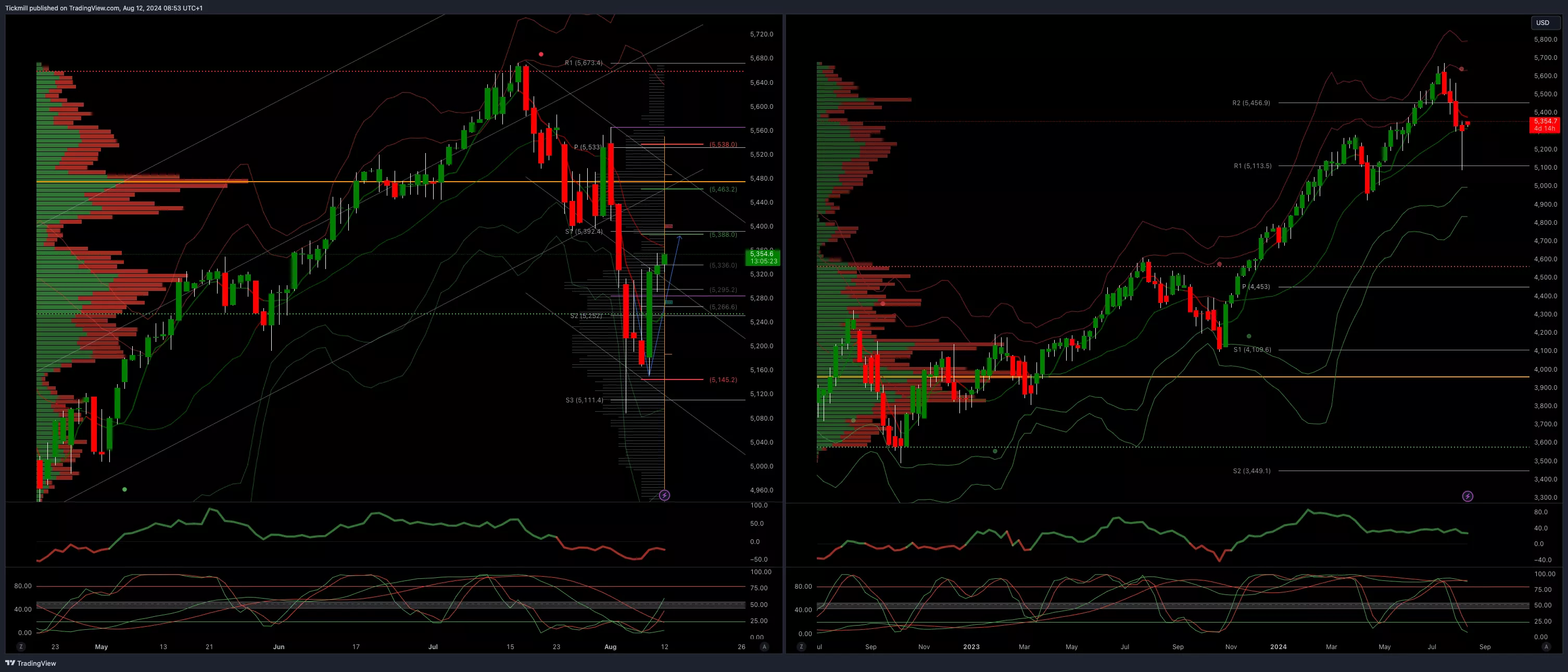

SP500 Bullish Above Bearish Below 5150

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 5388 opens 5470

- Primary resistance 5470

- Primary objective is 5000

(Click on image to enlarge)

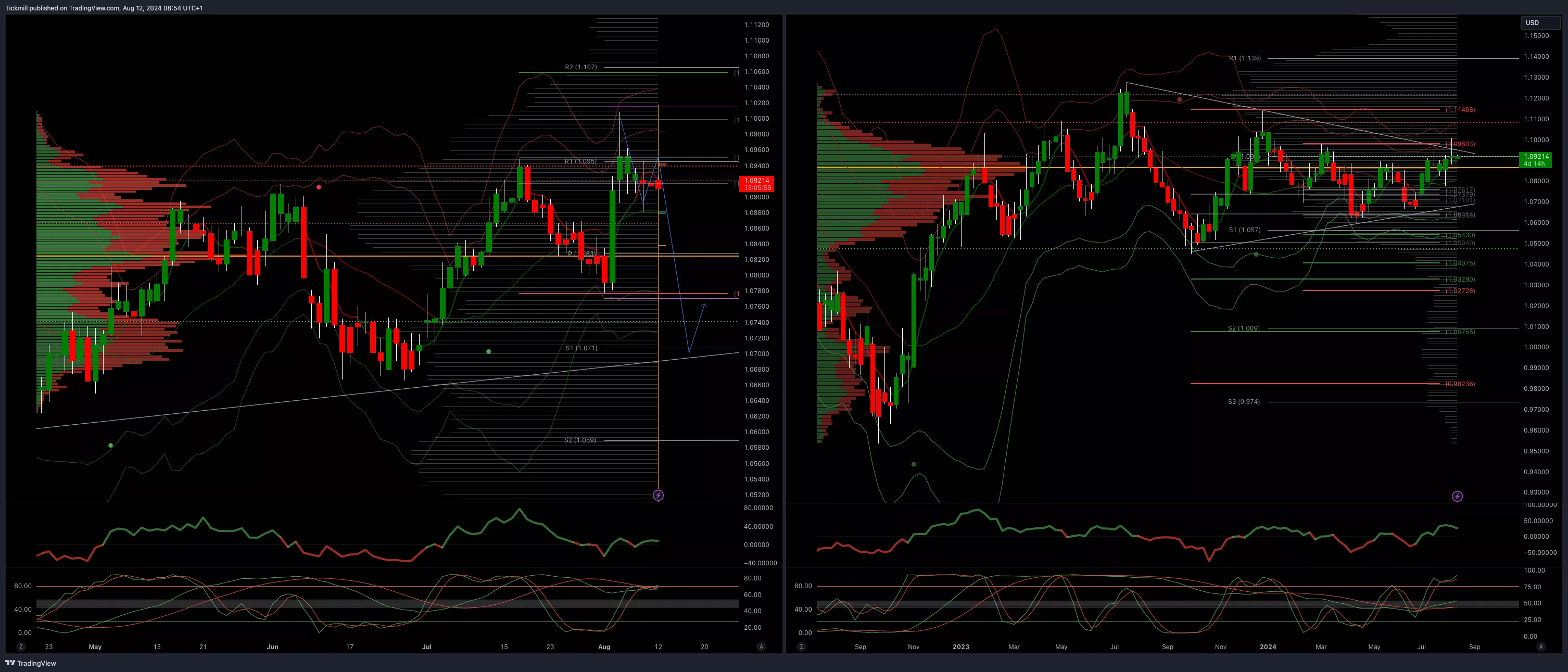

EURUSD Bullish Above Bearish Below 1.09

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.0975 opens 1.1075

- Primary resistance 1.0981

- Primary objective is 1.07

(Click on image to enlarge)

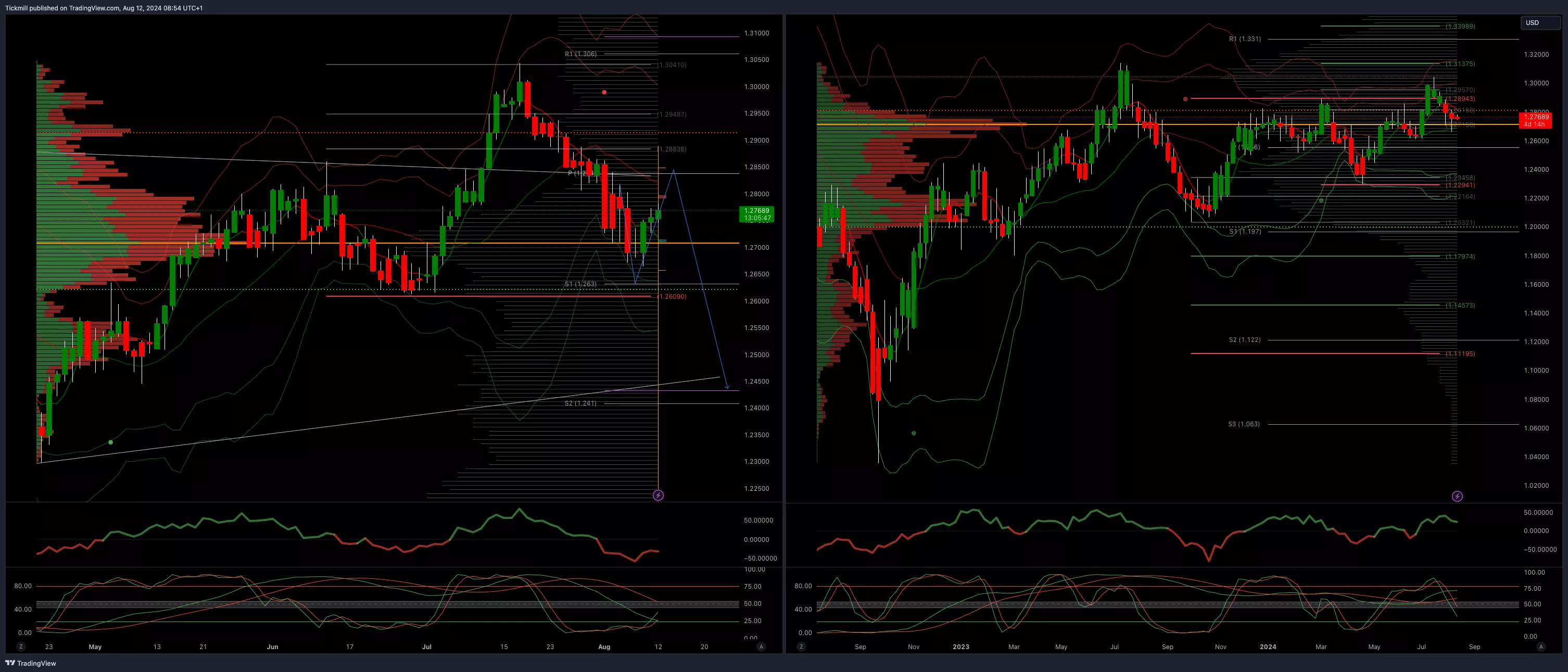

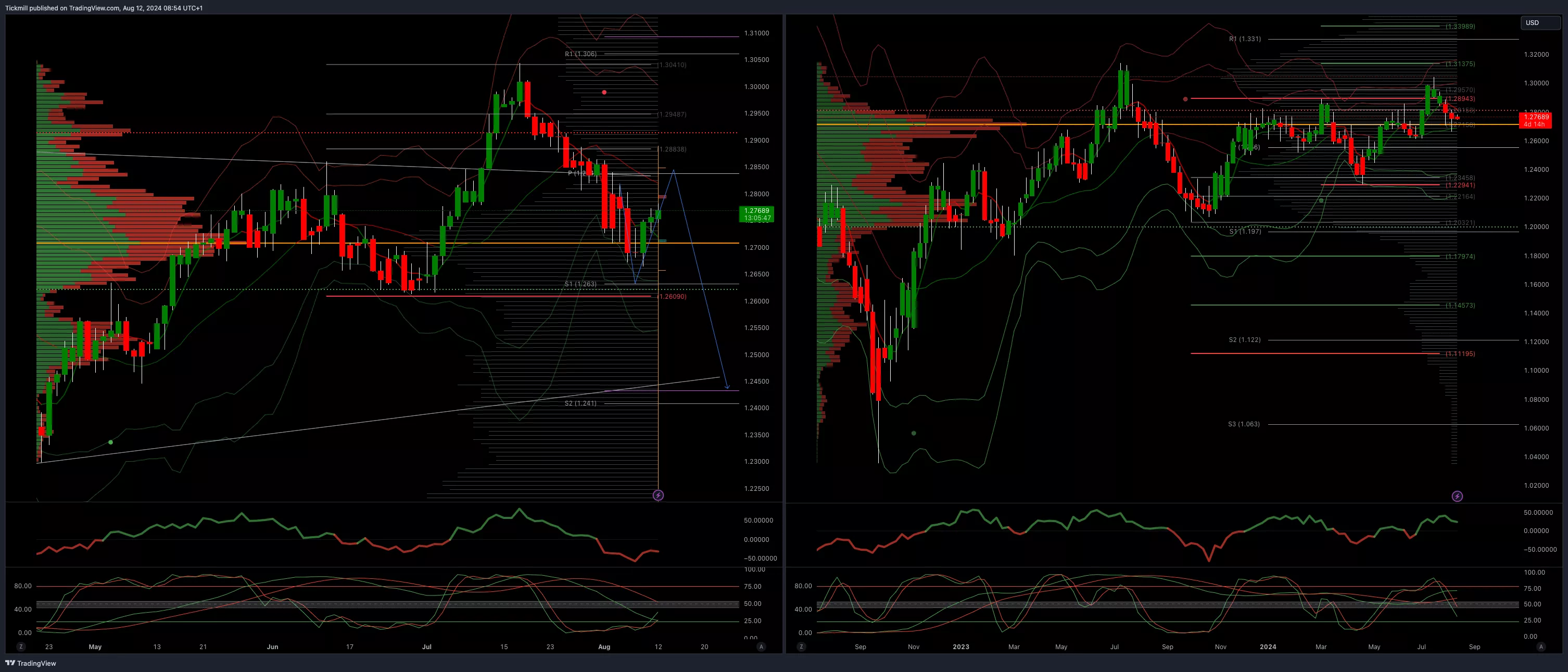

GBPUSD Bullish Above Bearish Below 1.29

- Daily VWAP bullish

- Weekly VWAP bearish

- Below 1.2670 opens 1.2450

- Primary support is 1.2690

- Primary objective 1.2450

(Click on image to enlarge)

USDJPY Bullish Above Bearish Below 149

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 150 opens 153

- Primary support 140

- Primary objective is 153

(Click on image to enlarge)

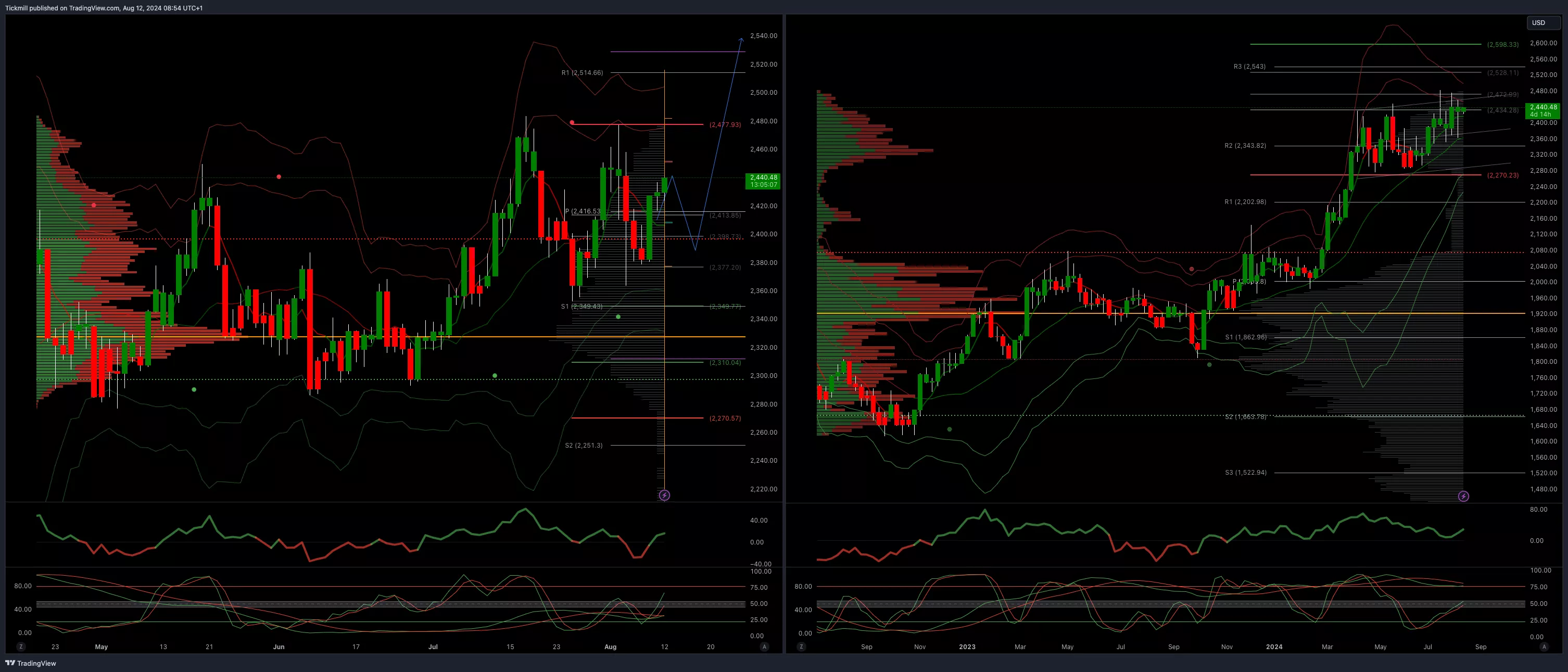

XAUUSD Bullish Above Bearish Below 2345

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 2400 opens 2330

- Primary support 2300

- Primary objective is 2598

(Click on image to enlarge)

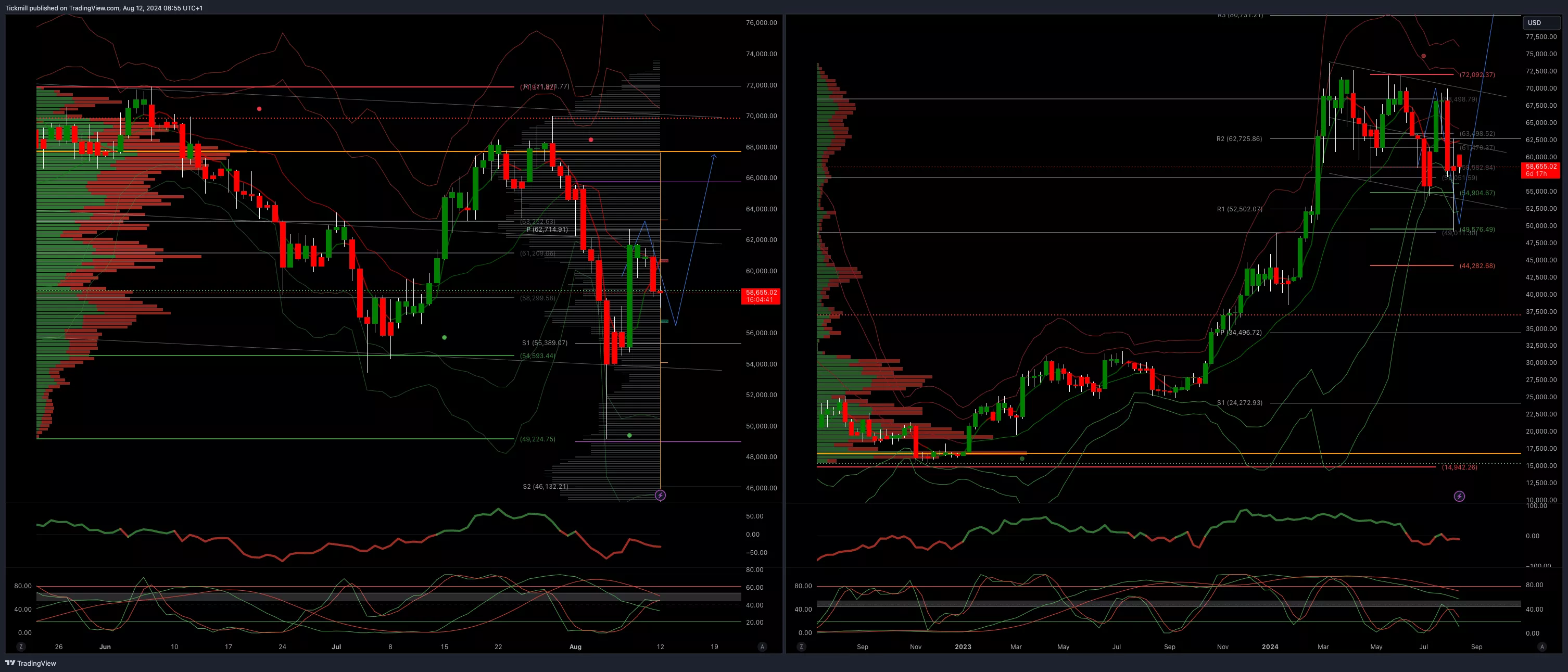

BTCUSD Bullish Above Bearish below 58000

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 61000 opens 68000

- Primary support is 50000

- Primary objective is 70000

(Click on image to enlarge)

More By This Author:

SP500 Weekly Wrap & Daily Trade Plan - Friday, August 9FTSE Bid As Markets Continue To Rebound From Monday’s Rout

SP500 Daily Trade Plan - Thursday, August 8