Daily Market Outlook - Friday, May 16

Image Source: Pexels

The week kicked off strongly, but by Friday, the risk-on rally, boosted by a trade truce between China and the U.S., was losing momentum as traders became concerned that the recovery had exceeded expectations and that more developments in the trade situation were forthcoming. Wall Street and European stock futures remain steady, while Asian markets show a mixed performance. The Hang Seng index in Hong Kong dropped by 0.8%, weighed down by a more than 5% decline in Alibaba's shares following disappointing earnings that failed to satisfy investors. The dollar declined for the second consecutive session while stock prices fell, following significant market fluctuations earlier in the week due to the US-China tariff agreement easing. The dollar depreciated against major currencies, notably benefiting the yen and Swiss franc. The yield on the 10-year Treasury dipped slightly after a 10 basis point drop on Thursday, as investors factored in the likelihood of two Federal Reserve interest rate cuts this year. This subdued trading indicated a more cautious approach after a strong week for risk assets stemming from US-China trade discussions. As Friday approached, a measure of global stocks had risen for seven straight days, reaching a level not observed since February when it hit a record high. US equity futures remained steady following a 0.4% increase in the S&P 500 on Thursday, supported by defensive dividend-paying stocks that had underperformed recently. Meta led the losses among major tech companies on Thursday after it was reported that the rollout of a key AI model would be delayed.

Today's macro highlights include: Italy's CPI, US housing starts, import/export prices, Michigan sentiment, and speeches from ECB’s Cipollone and Lane.The key events on the macro slate for the coming week is the S&P Global flash PMIs for May, scheduled for Thursday. Following the impact on confidence in April due to US trade policy, these surveys will offer crucial insights into how firms are reacting. The focus will be particularly on the UK, as last month's reading pushed the composite index below 50, indicating contraction. The Bank of England (BoE) downplayed the growth impact from US tariffs at the May Monetary Policy Report press conference, but if indicators suggest GDP is declining, it will challenge the hawkish members of the Monetary Policy Committee (MPC).

The week is busy in the UK, with April's Consumer Price Index (CPI) expected on Wednesday to show the headline rate rising above 3% due to the OFGEM price cap reset, among other factors. Additionally, retail sales data is due on Friday, and public finances data for the first month of the new fiscal year will be released on Thursday. Following a disappointing outcome in March for the 2024-25 period, another poor deficit figure could draw attention to the fragility of government finances ahead of the Spending Review on June 11. There will also be several MPC speakers, including two appearances by Pill.

Elsewhere, the Reserve Bank of Australia (RBA) will decide on interest rates, with markets anticipating a 25 basis point cut. The European Central Bank (ECB) will release the meeting record from the April Governing Council on Thursday. Most US and euro area data are considered second-tier, although the schedule for speakers is becoming more crowded.

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1130-35 (1.2BLN), 1.1150 (1.6BLN), 1.1200 (5.1BLN)

- 1.1225-30 (2BLN), 1.1300 (912M)

- USD/CHF: 0.8420 (390M)

- GBP/USD: 1.3305 (462M), 1.3330 (330M)

- AUD/USD: 0.6420 (900M), 0.6475 (603M)

- NZD/USD: 0.5875 (445M), 0.5935 (211M)

- USD/CAD: 1.3850 (1.2BLN), 1.3945-50 (926M), 1.3975-85 (1.8BLN)

- 1.4000 (2.5BLN)

- USD/JPY: 144.24 (400M), 145.00 (903M), 145.20 (460M), 145.40 (440M)

- 146.00 (400M)

CFTC Data As Of 9/5/25

- Speculators raised their net short position in CBOT US Treasury bonds futures by 10,233 contracts to a total of 95,789. They also increased their net short position in CBOT US Ultrabond Treasury futures by 13,381 contracts, bringing it to 264,775.

- In addition, speculators elevated their net short position in CBOT US 2-year Treasury futures by 14,416 contracts, resulting in a total of 1,220,793. The net short position for CBOT US 5-year Treasury futures went up by 3,952 contracts to 2,296,496. The net short position for CBOT US 10-year Treasury futures increased by 81,631 contracts, reaching 953,168.

- Equity fund managers reduced their net long position in the S&P 500 CME by 13,088 contracts, bringing it to 813,162. Meanwhile, equity fund speculators raised their net short position in the S&P 500 CME by 6,469 contracts, totaling 255,931.

- The net long position for the Japanese yen stands at 176,859 contracts, the euro at 75,719 contracts, and the British pound at 29,235 contracts. The Swiss franc has a net short position of -23,574 contracts, and Bitcoin's net short position is -1,781 contracts..

Technical & Trade Views

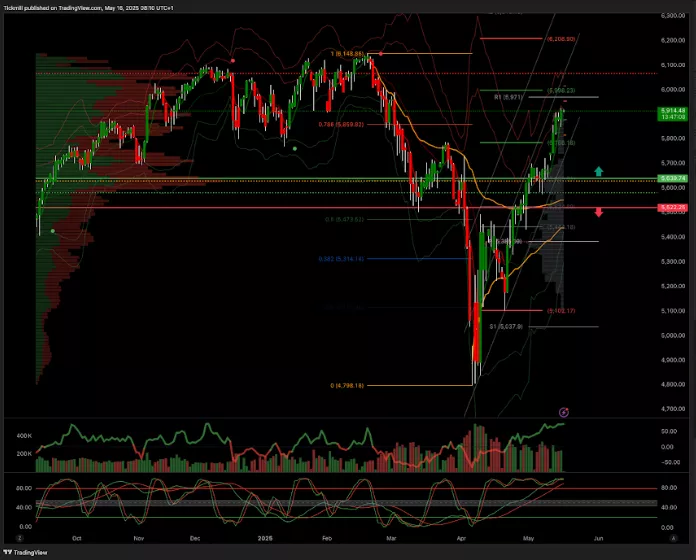

SP500 Pivot 5750

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5790 target 5998

- Below 5500 target 5385

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

USDJPY Pivot 147.70

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

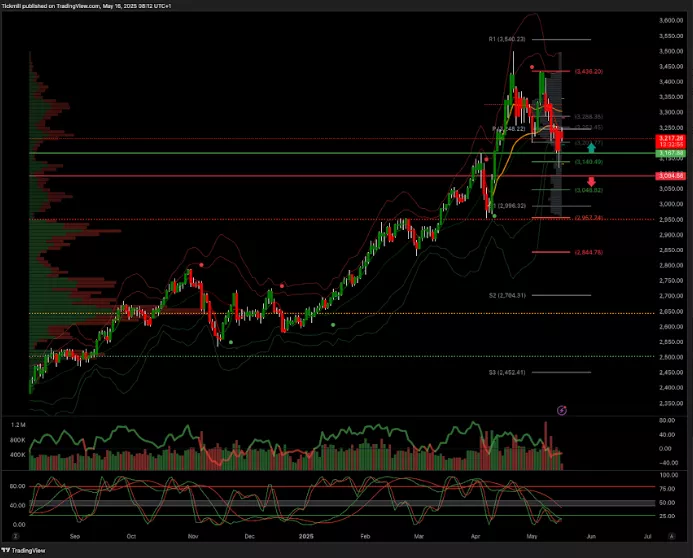

XAUUSD Pivot 3100

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

BTCUSD Pivot 96.7k

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Thursday, May 15

Daily Market Outlook - Thursday, May 15

The FTSE Finish Line - Wednesday, May 14