Daily Market Outlook - Friday, Jan. 31

Image Source: Pixabay

Asian markets declined on Friday, burdened by worries regarding DeepSeek’s influence on the AI sector. US futures increased following positive reports from Apple. Regional equities represented by the MCSI index reversed a two-day gain, with SK Hynix and Samsung experiencing significant drops in response to AI stock sell-offs as the nation’s markets reopened after the Lunar New Year holidays. SK Hynix is a key supplier to Nvidia, while Samsung’s main semiconductor division reported a profit that fell short of expectations. Markets in mainland China, Hong Kong, and Taiwan remain closed. The Dollar strengthened against most of its G10 10 peers as Trump is set to implement his first round of tariffs on Saturday. Treasuries declined, and the yen lost early gains ahead of BoJ’s Ueda’s address to parliament. Gold remained steady after hitting a new peak of $2,795 per ounce on Friday, on track to achieve its best month since March. Oil prices also rose, with WTI trading around $73 per barrel.

The ECB decreased the deposit rate by 25 basis points to 2.75%, a move that was anticipated and resulted in a subdued market reaction. Concerns about the impact of Trump's policies were highlighted, with Lagarde noting that trade tensions are undesirable, although no definitive conclusions were reached. The assertion that recovery conditions remain favourable seems overly optimistic, especially after weaker-than-expected Q4 GDP results for the Eurozone. Confidence is growing that inflation will return to target this year, supported by ongoing restrictive policies and refinancing of debts at higher rates. ECB economists are expected to release a lower estimate of R Star soon, which could inform policy-making. The final decisions will be data-dependent, but there is potential for rate cuts at upcoming meetings until mid-year.

Lloyds Business Barometer reports a slight dip in business confidence to 37% in January from 39% in December, marking five months of decline. Firms are more optimistic about their own trading prospects, with a net balance of 51%, compared to broader economic outlooks. Despite a partial rebound in the January PMI survey, the Business Barometer has outperformed other correlated indicators. All indices have shown a downward trend since autumn, suggesting a weaker GDP projection in the BoE’s February MPR. The hiring intentions balance decreased by one point to +32%, still stronger than similar surveys. Pushback against the idea that next week’s BoE meeting could signal a dovish tone focuses on forecasts of CPI inflation staying above target, around 3%, through 2025. While the MPC emphasises long-term inflation projections over current levels, past CPI overshoots and risks of rising inflation expectations complicate the narrative. Ignoring near-term inflation entirely isn’t viable, but neither is disregarding downside risks from weak demand and a potential output gap. Historical precedents exist, such as 2008-09 and 2011-12, where policy was loosened despite above-target CPI. If growth continues to weaken, ~3% CPI in the short term may not prevent more aggressive policy easing than markets currently expect.

Today's data slate Stateside includes the US Employment Cost Index, PCE inflation data, and the Fed's preferred inflation gauge. Barring any significant negative surprises, Fed officials are anticipated to uphold their cautious approach to rate cuts, as signalled earlier this week. The contrasting policy paths of global central banks have emerged as a key focus in recent weeks, suggesting that policymakers are set to follow their own distinct strategies heading into 2025.

The primary focus for markets heading into the weekend is the potential announcement of tariffs from Trump on Saturday. On Thursday, the president reiterated his threat of imposing a 100% tariff on BRICS nations to deter them from replacing the U.S. dollar as the global reserve currency. He is also "very much" considering new tariffs on China, which could cast a shadow over Lunar New Year celebrations in the world's second-largest economy.

Overnight Newswire Updates of Note

- Gloom Deepens Among UK Businesses, Lloyds Survey Shows

- Trump: Any Country Trying To Replace USD Will Face 100% Tariffs

- Trump To Hit Canada, Mexico With 25% Tariffs On Saturday

- Canada Warns Trump’s Tariffs To Leave US Reliant On Venezuela’s Oil

- Apple Forecast Cheers Investors After Mixed Holiday Results

- Intel Sales Slide As Chipmaker Pursues Turnaround Strategy

- Visa Profit Climbs On Cross-border Growth, Beating Estimates

- Hong Kong To Open Door To First Single-Stock Leveraged ETFs In Asia

- Nissan, Honda To Announce Decision On Integration Hopes By Mid-Feb

- Japan PM: Will Seek Stable Energy Supply From Trump

- Japan’s Economy Faces Fallout From Trump’s China Tariff Threats

- Tokyo Inflation Continues To Back More BoJ Rate Hikes

- RBA Seen Cutting Rates Next Month, In First Easing In Four Years

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0250 (837M), 1.0265 (643M), 1.0270-75 (392M)

- 1.0290-00 (2.7BLN),1.0305-10 (773M), 1.0325-35 (886M)

- 1.0350-60 (1.5BLN), 1.0375-80 (1.2BLN), 1.0395-05 (3.6BLN)

- 1.0415-25 (1.34BLN), 1.0440-50 (3.8BLN), 1.0465-75 (1.2BLN)

- 1.0500 (1.9BLN), 1.0520-25 (2.4BLN)

- USD/JPY: 153.70 (250M), 154.00 (795M), 154.50 (216M)

- 154.75 (850M), 155.00 (1.42BLN), 155.35-50 (1.3BLN)

- 156.00 (280M)

- USD/CHF: 0.9000-10 (930M). EUR/CHF: 0.9375 (200M)

- GBP/USD: 1.2400 (221M), 1.2420 (230M), 1.2475 (597M)

- 1.2620 (225M)

- EUR/GBP: 0.8305 (200M), 0.8400 (305M), 0.8420 (713M)

- AUD/USD: 0.6100 (265M), 0.6200-10 (947M), 0.6220-25 (515M)

- 0.6245-50 (640M), 0.6300 (586M), 0.6350-60 (700M)

- USD/CAD: 1.4300 (664M), 1.4350 (817M), 1.4400-10 (1.5BLN)

- 1.4420-25 (871M), 1.4450 (260M), 1.4500 (1.6BLN)

IB FX Month End Rebalancing Model

- Credit Agricole FX month-end rebalancing model suggests selling the USD against a basket of currencies. The model indicates that there will be mild USD selling across the board, with the strongest sell signal against the JPY.

- According to our corporate flow model, there is an indication of EUR selling at the end of the month. Thus, in our combined strategy, we will be utilizing the signals from the standalone month-end rebalancing model.

- Based on Deutsche Bank's model, rebalancing flows driven by relative equity performance indicate slight USD purchasing against the euro and Scandinavian currencies. However, seasonal trends suggest overall USD selling, particularly at the end of the month and on the first trading day of February.

CFTC Data As Of 24/1/25

This summary provides an overview of the trading positions held by equity fund managers and speculators in various futures markets as of the reporting period ending January 21:

1. Currencies (Net Short Positions):**

- **Euro**: **-62,486** contracts (significant bearish sentiment).

- **Japanese Yen**: **-14,673** contracts (moderate bearish stance).

- **Swiss Franc**: **-41,837** contracts (notable bearish sentiment).

- **British Pound**: **-8,257** contracts (marginal bearish positioning).

2. Bitcoin (Net Long Position):**

- **BTC**: **+739** contracts (mild bullish positioning in the futures market, reflecting growing optimism).

3. Equities (S&P 500 CME Futures):**

- **Equity Fund Managers (Long)**: Increased net long position by **+7,931 contracts** to a total of **+931,930 contracts**, signaling continued optimism.

- **Equity Fund Speculators (Short)**: Expanded net short position by **+88,671 contracts** to a total of **-399,756 contracts**, highlighting growing speculative bearish bets.

4. Treasuries (CBOT Futures):**

**Long Positions:**

- **US Treasury Bonds (30-year)**: Net long position grew by **+24,404 contracts** to **+24,456**, reflecting a more bullish outlook on long-term bonds.

**Short Positions:**

- **US Ultrabond (long-term Treasuries)**: Net short position decreased (trimmed) by **-12,434 contracts** to **-229,988**, indicating less bearish sentiment.

- **2-Year Treasury Futures**: Net short position trimmed by **-82,829 contracts** to **-1,174,377**, showing a reduction in bearish sentiment on short-dated bonds.

- **5-Year Treasury Futures**: Net short position increased by **+18,570 contracts** to **-1,796,191**, reflecting stronger bearish sentiment for mid-duration bonds.

- **10-Year Treasury Futures**: Net short position increased by **+12,310 contracts** to **-580,245**, indicating growing bearish sentiment for this maturity segment.

**Key Takeaways:**

1. **Currencies**: Persistent bearish sentiment dominates, particularly for the **euro** and **Swiss franc**, with speculative shorts significantly outweighing longs.

2. **Bitcoin**: A small but positive net long position reflects a bullish tilt.

3. **Equities**:

- Fund managers are steadfastly **bullish** on the S&P 500, while speculators maintain a growing **bearish stance**, signaling a potential divergence of sentiment.

4. **Treasuries**:

- **Long-duration bonds** (30-year) saw increased long positions, indicating optimism in long-term fixed income.

- **Shorter and mid-duration bonds** (e.g., 5-year, 2-year) retain heavy net short positions, reflecting expectations of rising interest rates or bearish bond sentiment.

Overall, bullish interest in long bonds and equity fund managers’ sustained optimism, while speculative shorts dominate in currencies and some Treasury maturities.

Technical & Trade Views

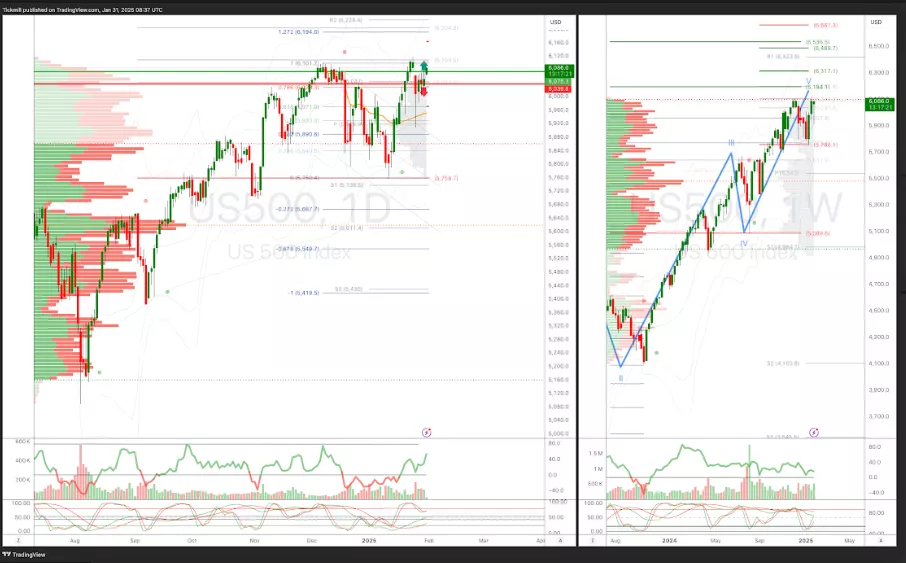

SP500 Pivot 6040

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness Into Feb 6th

- Long above 6075 target 6195

- Short Below 6045 target 5743

(Click on image to enlarge)

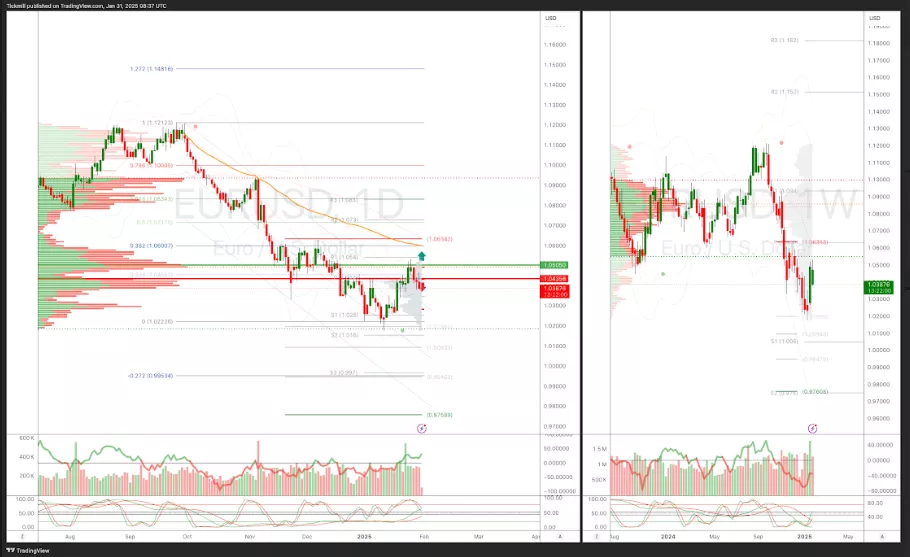

EURUSD Pivot 1.0435

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

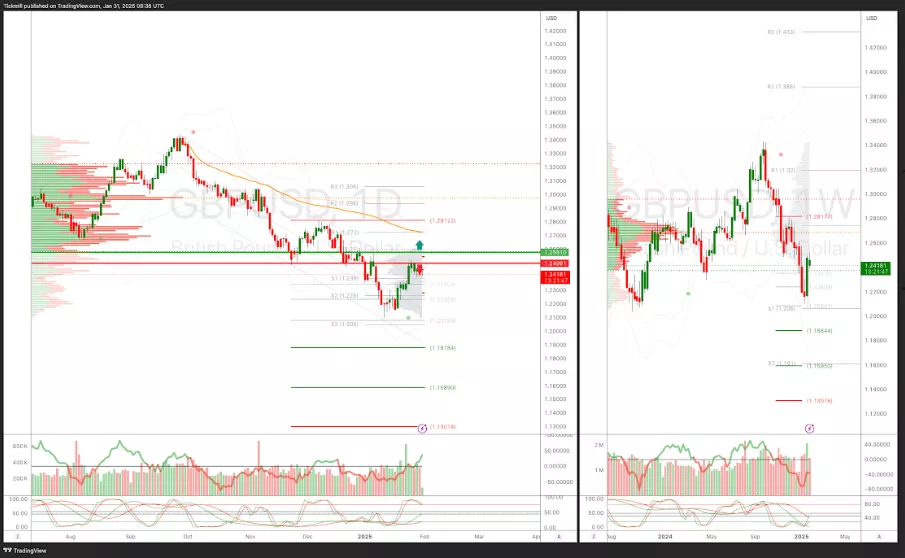

GBPUSD Pivot 1.2614

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

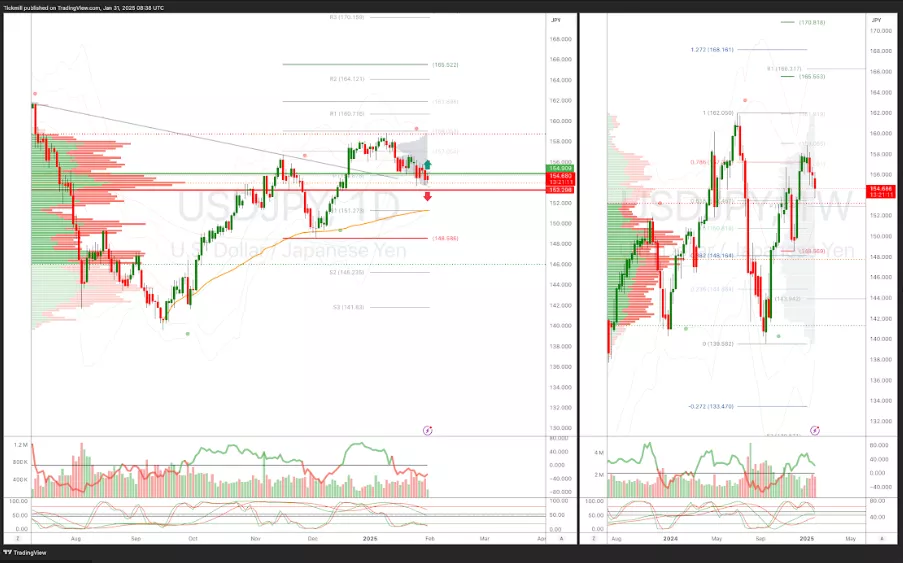

USDJPY Pivot 153.77

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into jan 23rd

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

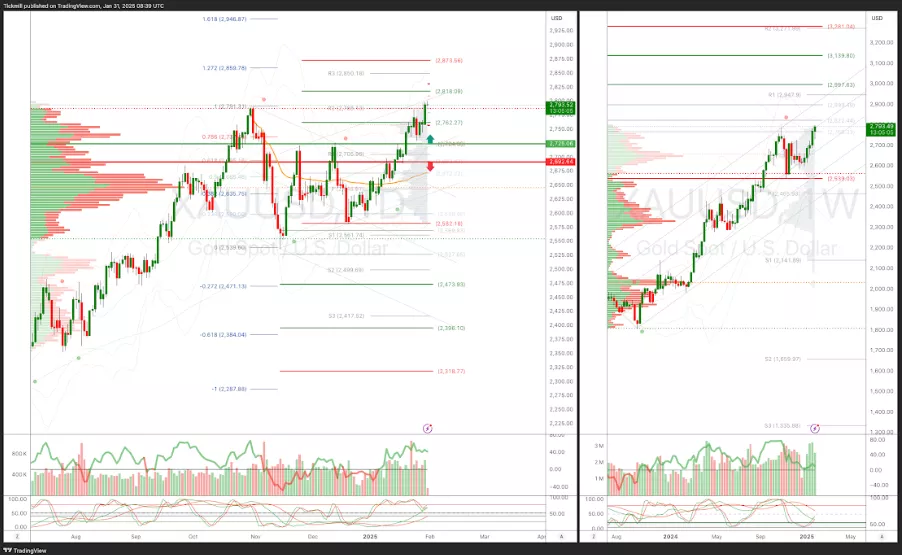

XAUUSD Pivot 2692

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2725 target 2873

- Below 2692 target 2475

(Click on image to enlarge)

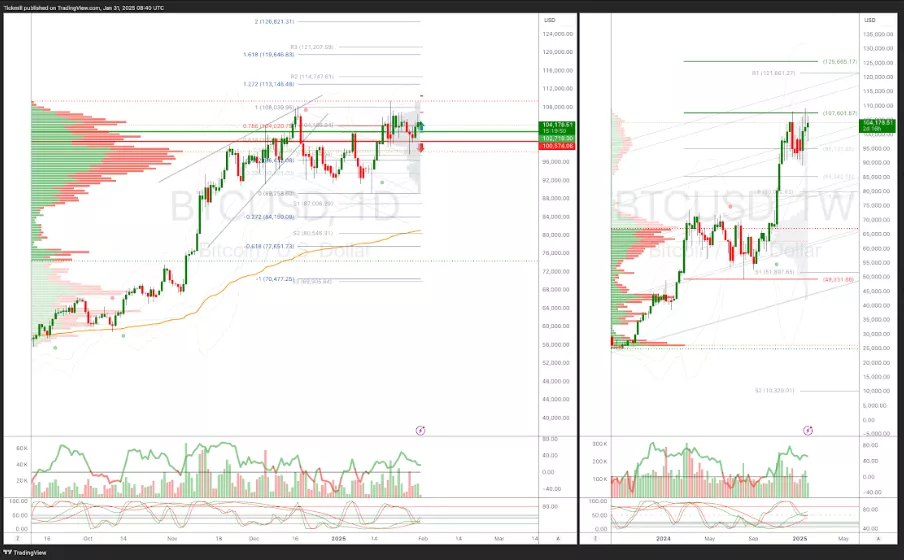

BTCUSD Pivot 101,960

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into Apr 9th

- Above 104,020 target 110,000

- Below 101,942 target 86,266

(Click on image to enlarge)

More By This Author:

FTSE At Record Highs

Daily Market Outlook - Thursday, Jan. 30

FTSE Rubber Hits The Road As Auto Parts Sector Soars On Takeover News