Daily Market Outlook - Friday, Jan. 10

Image Source: Unsplash

Asian stocks fell ahead of the U.S. employment data, which is anticipated to influence interest rate forecasts. The MSCI Asia index declined for the third consecutive day, with most market equities experiencing losses. S&P 500 futures showed slight fluctuations after U.S. stock markets paused on Thursday to observe a national day of mourning for former President Jimmy Carter. Treasuries remained steady during Asian trading, following a selloff earlier this week that pushed 30-year rates to their highest levels since 2023. Chinese yields rose after the PBOC announced a temporary halt to its government bond purchases, a surprising move given that the benchmark yield had just hit a new low. The offshore Yuan saw a slight appreciation against the Dollar. The Dollar index recorded a modest increase, continuing its three-day upward trend. The Yen depreciated by 0.1% against the Dollar. Traders are closely monitoring signs that Japan may intervene to support the Yen, with the upcoming U.S. employment report potentially acting as a catalyst for significant currency volatility.

Yesterday was relatively calm for UK gilts, likely due to subdued US activity (President Carter’s funeral), despite a jittery start to the session. With the US employment report, a quiet day today seems less probable, and FX volatility is anticipated to persist. The key issue is whether the BoE will intervene to support the gilt market or at least halt QT. It is not the BoE’s responsibility to ensure gilt yields remain low enough for the government to borrow as much as it desires. Such action would contradict the BoE’s operational independence. The BoE's monetary policy aims to achieve the 2% CPI target, not to absolve the government of the consequences of maintaining a narrow buffer against the fiscal rule. However, this does not imply that the BoE would never intervene, as past experiences suggest otherwise. Any motivation for intervention would relate to its financial stability policy objectives rather than monetary policy considerations. In essence, the potential for intervention would arise from signs of disorderly markets. Market participants believing that yields should rise to reflect weakened fiscal fundamentals does not constitute disorderly behaviour by itself. Therefore, the response to the intervention question hinges not on a specific yield threshold but rather on observing excessive volatility without any news, which has not occurred this week.

The US employment report due today is anticipated to reflect another month of growth, with the Bloomberg survey median standing at 138,000. The unemployment rate is forecasted to hold steady at 4.2%, although there is a risk that it could improve in the household survey after two months of weaker performance, potentially lowering that figure. As indicated in the December minutes, the Fed is now less worried about negative risks to the labour market. Other employment data supports this perspective, showing a recent drop in jobless claims, a general increase in hiring intentions across various surveys, along with a rise in JOLTS job openings and sustained strength in broader demand indicators and surveys following the election. This situation raises the threshold for the Fed to revert to a more dovish stance. Currently, there is little urgency to prolong the rate cut cycle. Given the persistence of underlying inflation (core PCE) and the risks posed by tariffs to the overall disinflation narrative, this caution is likely to persist as we progress through the early part of the year.

eliteOvernight Newswire Updates of Note

- Investors Shrug Off Economists’ Gloom Over Trump’s ‘Maganomics’

- Fed Officials Signal Interest Rates Likely on Hold for a While

- Dec Jobs Report Key To Fed’s Early 2025 Monetary Policy

- Yen Intervention Risk Creeps Higher As US Jobs Report Approaches

- Japan’s Household Spending Falls for Fourth Month

- ANZs Huge RBA Interest Rate Cut Projection Backflip

- Aussie Household Spending Rises With Black Friday Sales

- Hong Kong Housing Analysts Predict A Market Bottom This Year

- Falling Chinese Bond Yields Signal Concern With Deflation

- UK Debt Market Sell-off Threatens Mortgage Pain For Households

- BoE's Breeden Backs Rate Cuts, Says Hard To Know How Quickly

- EU Fears Donald Trump Rolling Back Biden-Era Measures

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0200 (1.2BLN), 1.0225-30 (1.3BLN), 1.0240-50 (642M)

- 1.0275 (1BLN), 1.0300 (2.6BLN), 1.0315-25 (3BLN), 1.0350 (1.8BLN)

- 1.0400 (2.3BLN). Related...

- USD/CHF: 0.8975 (350M), 0.9000 (446M), 0.9050 (201M)

- GBP/USD: 1.2300 (291M)

- AUD/USD: 0.6185 (1.6BLN)

- USD/CAD: 1.4300 (758M), 1.4325 (909M), 1.4400 (760M), 1.4500 (372M)

- USD/JPY: 157.00 (730M), 157.75 (552M) , 158.00 (520M), 159.00 (335M)

CFTC Data As Of 3/1/25

- Swiss franc has a net short position of -28,382 contracts.

- The British pound shows a net long position of 19,323 contracts.

- The euro has a net short position of -68,507 contracts.

- The Japanese yen reflects a net long position of 2,311 contracts.

- Bitcoin is in a net short position of -129 contracts.

- Speculators have reduced the net short position in CBOT US Treasury bonds futures by 19,961 contracts, bringing it to 26,342.

- The net short position in CBOT US ultrabond Treasury futures has been trimmed by 15,012 contracts to 204,292.

- The net short position in CBOT US 2-year Treasury futures has decreased by 6,298 contracts to 1,252,975.

- The net short position in CBOT US 10-year Treasury futures has been cut by 141,543 contracts to 591,374.

- The net short position in CBOT US 5-year Treasury futures has been reduced by 1,895 contracts to 1,760,422.

- Equity fund managers have increased the S&P 500 CME net long position by 2,531 contracts to 1,042,431.

- Meanwhile, equity fund speculators have raised the S&P 500 CME net short position by 78,396 contracts to 347,102.

Technical & Trade Views

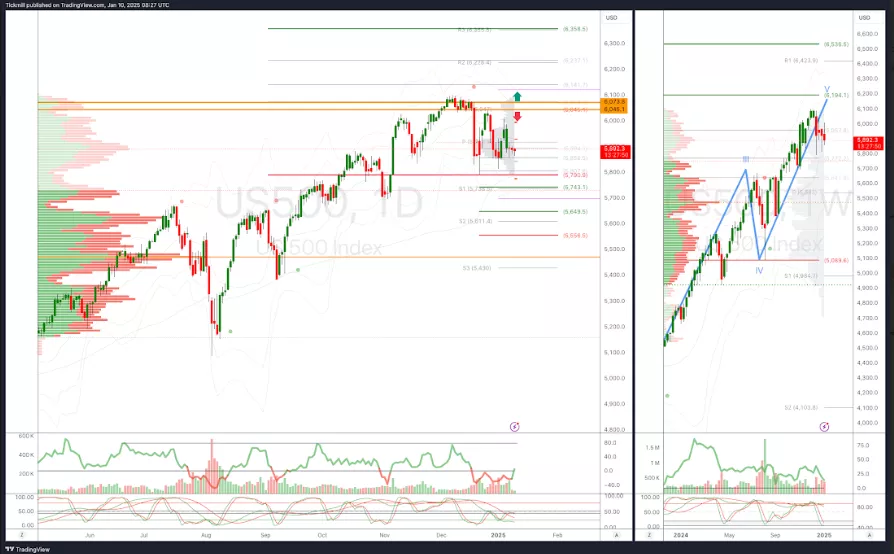

SP500 Short Against 6045

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness Into Jan 20th

- Long above 6075 target 6165

- Short Below 6045 target 5743

(Click on image to enlarge)

EURUSD Short Against 1.0435

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

GBPUSD Short Against 1.2614

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

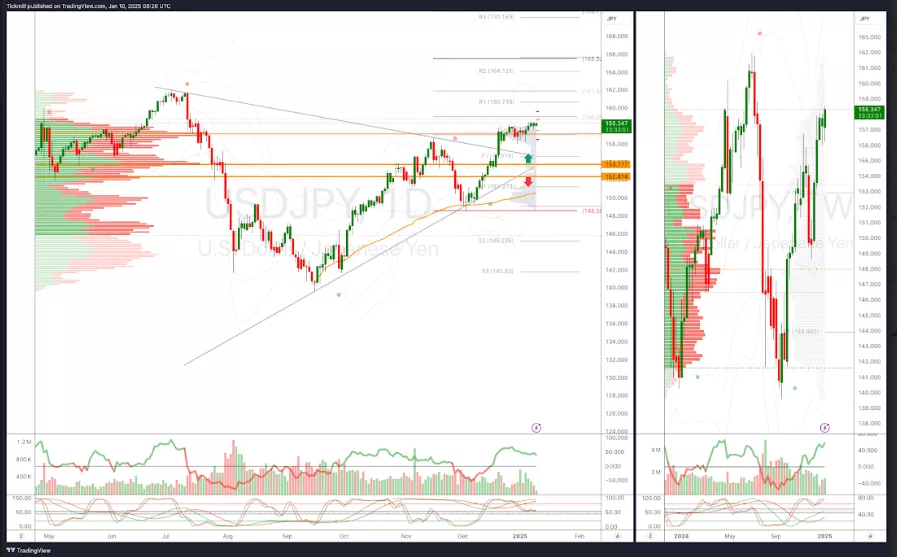

USDJPY Long Against 153.77

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into jan 23rd

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

XAUUSD Short Against 2692

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into Jan 15th

- Above 2725 target 2762

- Below 2692 target 2475

(Click on image to enlarge)

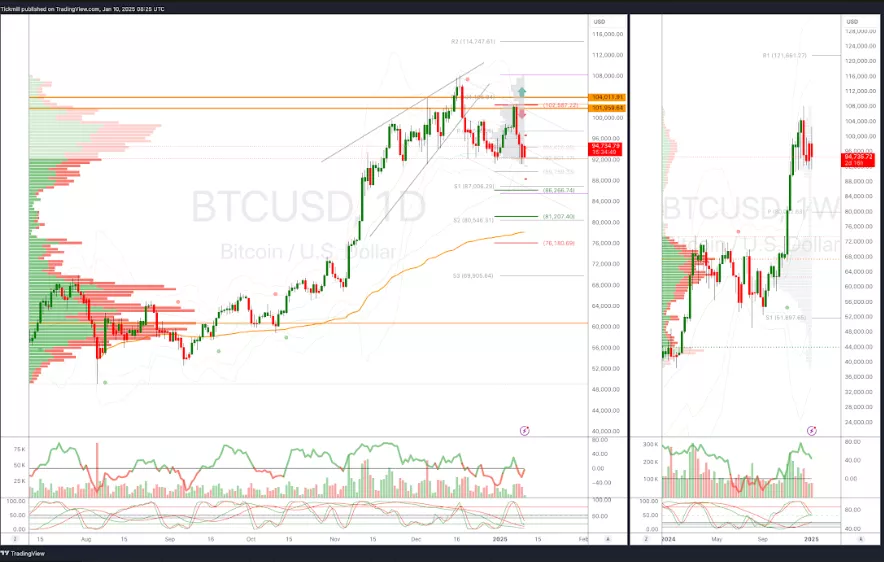

BTCUSD Short Against 101,960

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into Jan 15th

- Above 104,020 target 110,000

- Below 101,942 target 86,266

(Click on image to enlarge)

More By This Author:

FTSE UK Yields Surge AS MidCaps Slump To Eight Month Lows

Daily Market Outlook - Thursday, Jan. 9

FTSE Banks Bid As UK Yields Continue To Rise