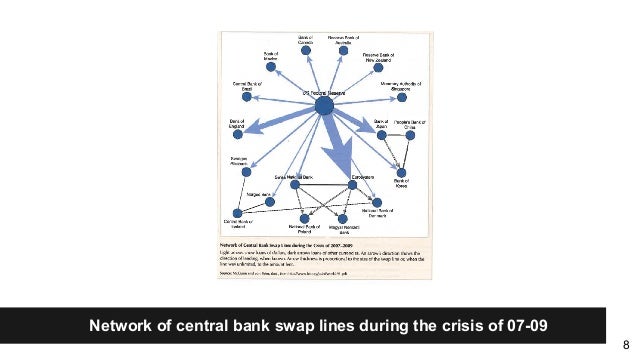

Central Banks Use Of Credit Swaps To Stabilize Markets

Image Source: Pixabay

Central Banks have resorted to credit swaps as a major part of their effort to prop up the global financial system. This is a major reason we are now seeing currencies trading in a narrow band. In short, even as the dollar is under attack, it is the primary tool being used to prop up other fiat currencies. Credit swaps are masking just how weak some of the other fiat currencies and the banking systems issuing and supporting them have become.

The dollar has been swept into the debate of failing fiat currencies. At some point, these clowns will realize all this doom porn about the dollar crashing is not helping them. Talk of killing the dollar, often referred to as the "cleanest dirty shirt in the closet," is not a panacea for other currencies. Remember the whole system is based on faith and the idea it is all downhill for the dollar creates a doom loop for all fiat currencies.

(Click on image to enlarge)

It is important to point out that the ECB President, Lagarde, is one of "them." By this, I mean, her background solidly plants her in the "globalist camp." Her time as head of the IMF may enhance her credibility with some people but it also stains her as a liar with an agenda that cannot be trusted. There is little doubt that Lagarde is committed to propping up the current system while pushing to be a key player in its replacement. All this feeds into why the ECB views completing the European capital markets union as pivotal in determining whether the euro retains its place as the second global currency.

Information collected before April 10, indicates we are seeing a tightened of lending standards. This is worsening a credit crunch that is likely to spark a hard economic landing in the coming months. This was confirmed in the latest Federal Reserve's Beige Book. The reality is that without these credit swaps, the global financial system might spin out of control. Major shifts in the value of currencies could easily set off a crisis in the massive highly leveraged derivatives market.

The ICE U.S. Dollar Index which measures the dollar's strength against a basket of rivals recently logged its fifth straight weekly decline according to data from FactSet. This puts the U.S. dollar on the path to its longest losing streak in nearly three years. That may soon end. Recently the weekly data released by the Commodity Futures Trading Commission indicated for the first time since January 2022 that speculators are now using futures and options to bet that the dollar will appreciate against a broad group of currencies. These include the British pound, the euro, the yen, the Canadian dollar, and more.

In the past, independent central banks could focus on stabilizing inflation by steering demand without having to pay too much attention to supply-side disruptions. That period of relative stability is over. We have entered a more multipolar world. Lower growth, higher costs, and trade tensions all signal the possibility of repeated supply shocks. This is bad news for both the economy and financial markets.

It has been over a month since signs of banking stress first appeared in America's regional banks. What many Americans fail to see is the stress growing across the globe. Now everyone is busy looking for the next "credit event" to surface or waiting for the next shoe to drop. Michael Every of Rabobank has pointed out that Fed-speak underlined the US economy is ‘doing just fine’ with rates at 5% is the usual "small picture" stuff of most market commentary rather than something of substance.

The positive market commentary does not offset the reality that credit availability in certain sectors of the economy is contracting at a highly alarming pace. As conditions in the broad finance sector deteriorate lending volumes and loan demand is declining. This is a problem, especially for Main Street considering small to medium-sized banks with less than $250bn in assets account for roughly 50% of US commercial and industrial lending. They also are responsible for around 60% of residential real estate lending, 80% of commercial real estate lending, and 45% of consumer lending.

Keynes noted that central banks have been allowed to act like the conductor of an international orchestra. This is because after the USD became the global reserve currency, and the euro rose to second place their power was enhanced. Some of this has now waned due to China's growing influence. The People's Bank of China has gone about setting up over 30 bilateral swap lines with other central banks to compensate for the lack of liquid financial markets in the renminbi.

To be clear, as the world drifts farther into competing geopolitical blocs, governments increase their spending, and deficits grow, it is difficult to envision any fiat currency as a safe store of wealth. Inflation is structurally built into the system. The FX architecture of swap lines may temporarily ease pressure giving the system time to adjust but will not hold back the tide of reality for long. Even some major fiat currencies will lose value faster than others. The yen is proof of this.

More By This Author:

Japan, A Record Trade Deficit In 2022 Added To Its Woes

Credit Suisse, A Canary In A Special Type Of Coal Mine

As We Sell Off Our Strategic Oil Reserves, Ponder This

Disclaimer: Please do your own due diligence before buying or selling any securities mentioned in this article. We do not warrant the completeness or accuracy of the content or data provided in ...

more