Cash Rush In Europe, Stock Rush In The US And Gold Rush In China

New week, new highs for US markets!

Nasdaq sets new monthly closing records:

(Click on image to enlarge)

Since the low point of 2020, the bullish ABCD extension pattern is now aiming for a target beyond the 20,000-point threshold, a level that bearish investors will find very hard to defend.

The spectacular rise of technology stocks is spreading a noticeable wealth effect in the United States.

Even if this market rally depends on a few stocks, the importance of passive funds and household exposure to ETFs tracking market performance are contributing to the propagation of this wealth effect.

Nvidia's share price is concentrating most of the rise. The figures are impressive.

Since April 19, 2024, NVDA has risen by $1.9 trillion. The stock has been adding around $150 billion every 24 hours for the past month!

We're witnessing the biggest gamma short squeeze in history, resulting in a massive wealth effect for many Americans exposed to this rising market via passive investments!

In Europe, where households have limited exposure to market performance, it is difficult to fully understand this phenomenon.

One in three American households is benefiting from the vertiginous rise in stock markets, driven by Nvidia!

In Europe, the situation is completely different. Only one in ten households in France or the UK is invested in equities:

The Germans and the French tend to prefer to keep their savings in bank accounts, even if they earn less than the rate of inflation:

In Germany, retail bank deposits reached record levels:

The increase in bank deposits coincides with an accumulation of negative economic news.

Recent figures for factory orders confirm that the country remains mired in declining activity. German factory orders for April showed a monthly variation of -0.2%, whereas a recovery to +0.6% was expected. This disappointing figure follows a decline of -0.4% in March.

The downturn in the German economy is further encouraging savers to build up their cash reserves.

Equity rush in the USA, cash rush in Europe, and gold rush in China!

Three regions of the world, three different investment strategies...

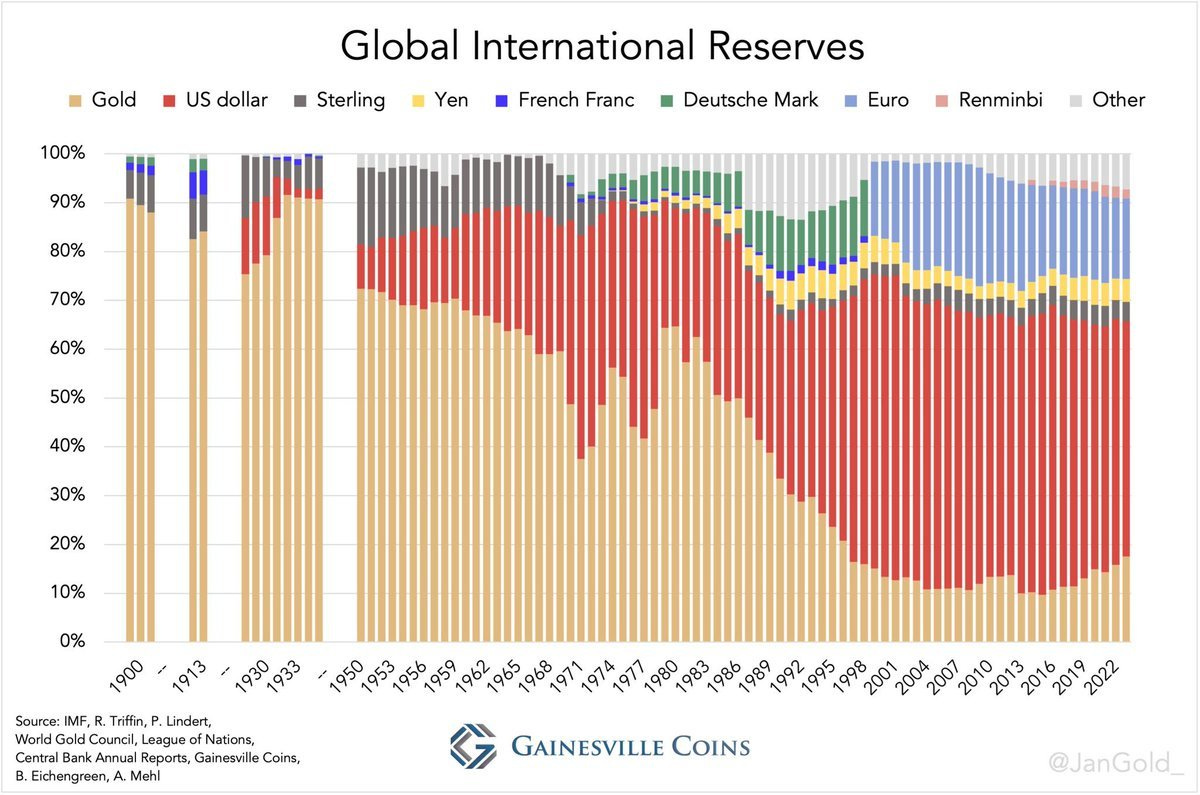

As reported in previous bulletins, China is progressively moving away from the dollar, preferring gold in its reserves, a strategy increasingly adopted by other BRICS countries.

India has just announced, for the first time since 1991, the repatriation of its gold reserves held in the UK.

India's central bank has moved around a 100 tonnes from the United Kingdom back to its vaults in India. The move is part of a wider strategy to repatriate part of the country's gold reserves, with the intention of transferring more bullion in the coming months.

Such an initiative is part of a global context in which several countries are seeking to increase their direct control over their gold reserves, reflecting a worldwide trend towards a revaluation of physical assets in the face of economic and geopolitical uncertainties. Moving these reserves also represents a precautionary measure against possible restrictions or risks associated with holding gold abroad. This repatriation strategy reflects India's desire to strengthen its financial sovereignty and better secure its national assets.

The BRICS now prefer gold as the basis of their foreign exchange reserves, and the trend towards selling dollar reserves in these countries could accelerate.

Sales of dollar-denominated assets are being offset by increasing purchases by Washington's allies.

In March, Japan added $199 billion to its foreign exchange reserves, while Great Britain increased its reserves by $268 billion. The British now hold $728.1 billion in US Treasuries, making them the world's third largest sovereign holder of USTs, and soon the second, ahead of China.

America's traditional allies are currently offsetting Chinese sales, but for how long will this last?

This shift towards gold is clearly visible on the monthly chart published in the investment letter published for clients of GoldBroker:

The DXY index, which measures the dollar's performance, has just broken an uptrend that began at the start of the year:

(Click on image to enlarge)

The weakness of the U.S. dollar obviously provides considerable support for the price of gold, in this historically difficult period for the yellow metal. June is traditionally one of the least favorable months for precious metals, but gold could benefit from a weak dollar to avoid the sharp correction that is customary at this time of year.

More By This Author:

Gold Measures Lack Of Fiscal DisciplineSilver And Gold Vs. CPI At Historic Inflection Points

Historic Tensions On The Silver Market

Disclosure: GoldBroker.com, all rights reserved.