Buckle Up For A Busy Week

Image Source: Unsplash

For a short week, last week was a wild one. Tariff threats, then a hasty reversal, caused stocks to drop significantly on Tuesday, rebound Wednesday, and further claw back over the subsequent two sessions.Shares continue to rebound this morning ahead of a highly consequential slew of financial news in the days ahead.We have an FOMC meeting on Wednesday followed in mere hours by three earnings reports from Mag 7 stocks.That’s not to mention earnings reports from nearly one quarter of the S&P 500 (SPX) and possible interventions in the Japanese yen.At least for today, traders don’t seem too perturbed by the potential for volatility.

Although SPX closed a mere -0.35% lower and the Nasdaq 100 (NDX) managed a 0.3% gain, the Cboe Volatility Index (VIX) reflected the changing mood, jumping from 15.86 last Friday to a high of 20.99 on Tuesday, before closing the week at 16.09.It is notable, however, that while the moves in VIX reflected relatively unchanged expectations for volatility over the coming 30 days, its 9-day counterpart VIX9D rose meaningfully last week, from 12.09 to 15.00.Part of that rise can be explained by the fact that the reading ahead of the long weekend included a non-trading day, but most of the nearly 25% jump is the result of anticipating the events of the week ahead.

8-Days, VIX (red/green 15-Minute Candles), VIX9D (blue line)

(Click on image to enlarge)

Source: Interactive Brokers

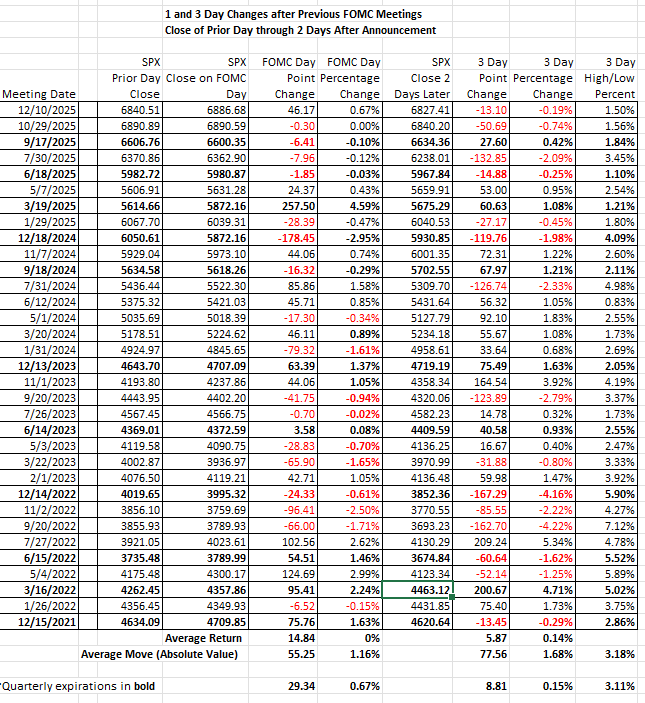

It is probably correct for traders to be relatively calm ahead of the upcoming FOMC meeting. There is virtually no expectation for a cut this week – both ForecastEx and CME FedWatch show no more than a 2% chance – and the last meeting resulted in only a 1.5% high-low range over the ensuing three-day period.While Chair Powell’s comments at the press conference are typically lapped up by traders hanging on his every word, it is important to remember that he is a lame duck in that position.Many of the questions are likely to relate to the political turmoil that surrounds the Federal Reserve right now, whether they reference his recent video responding to reports of investigations about the cost of the Fed’s renovation, his appearance in support of Governor Lisa Cook at the Supreme Court, or whether he intends to stay on as a Fed Governor after his term as Chair ends.It presents a bit of a conundrum for reporters who need to weigh the potential probative value of a response to one of those questions against the likelihood that Powell will demur.

Meanwhile, stock traders seem quite OK with the dollar plunging against the yen, which has risen about 3% since hints of concerted intervention swept the currency markets, and dips against other major currencies.In the short term, a weaker dollar is positive for stocks because they boost the non-dollar earnings of the multinationals that dominate major equity indices.In the longer term, it could prove problematic if there appears to be a flight out of US assets.So far, there is some relative affection for global stocks (bear in mind that IBKR offers access to thousands of non-US stocks), but not necessarily a flight.The flight is into metals, with gold up over 2% and silver up a staggering 14% (!) as I type this.I am curious to hear what the Chair might have to say about those goings-on.

Source: Interactive Brokers

More By This Author:

Burrito ThursdayI Missed A Big Day

One Comment Changes The Odds (Bigly!)

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx ...

more