Bubble Or Not: The Smart Way To Make Money With Bitcoin

Summary: Bitcoin works more like a digital store of value than a digital currency or a financial asset. This means that trying to estimate an intrinsic value for Bitcoin is pointless, and prices fluctuate according to demand trends as opposed to fundamental value. When making buy or sell decisions in Bitcoin, a quantitative trend following system could be a smart way to maximize the risk and return equation. This idea was discussed in more depth with members of my private investing community, The Data Driven Investor.

What Is Bitcoin?

There are multiple possible ways to describe what Bitcoin (GBTC, BITCOMP) really is. Leaving the technological and sociological considerations aside, this article is focused on what Bitcoin means for investors and traders.

Bitcoin was originally intended as a payment method or a digital currency. From the original paper called Bitcoin: A Peer-to-Peer Electronic Cash System:

“Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model. Completely non-reversible transactions are not really possible, since financial institutions cannot avoid mediating disputes. The cost of mediation increases transaction costs, limiting the minimum practical transaction size and cutting off the possibility for small casual transactions, and there is a broader cost in the loss of ability to make non-reversible payments for non reversible services. With the possibility of reversal, the need for trust spreads. Merchants must be wary of their customers, hassling them for more information than they would otherwise need. A certain percentage of fraud is accepted as unavoidable. These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party.

What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.”

The original intended use for Bitcoin was as a digital currency, or a medium of exchange. However, most users are not exchanging their Bitcoin for products and services, but rather making buy or sell decisions on Bitcoin according to their expectations about price fluctuations. Most people are investing or trading Bitcoin, not using it as payment method.

A simple anecdote illustrates how volatility means that Bitcoin doesn't really work well as digital currency in practical terms. On May of 2010 a developer bought two pizzas for 10,000 units of a then-little-known digital currency called Bitcoin. At a current price of over 11,700 for Bitcoin, this means that those two pizzas would cost nearly $117.5 million.

Nobody wants to be the guy who lost over $117 million for buying two pizzas with Bitcoin, so people tend to hold on to the digital asset. The main idea is that scarcity generates value, which makes Bitcoin much more similar to digital gold than a digital currency. Like gold, Bitcoin can be seen as a refuge for those who do not trust central banks, governments, and fiat currencies.

Unlike stocks or bonds, Bitcoin doesn't generate any cash flows. This makes it impossible to calculate the asset’s intrinsic value. The main drivers behind Bitcoin and gold are quite similar: Supply is limited, so price fluctuations depend on demand. Such demand is mostly as a “store of value” as opposed to transactional or industrial uses, so trust and overall investor sentiment towards Bitcoin are the main drivers behind price fluctuations.

This means that buy and sell decisions need to be made by observing demand, not calculating a so called “intrinsic value” for the digital asset. You shouldn't try to figure out if Bitcoin is undervalued or overvalued, but rather try to determine if net demand for Bitcoin is increasing or declining.

Bitcoin Bubble? Who Cares?

There is a lot of discussion among investors regarding whether Bitcoin is a bubble or not. When you look at the tremendous price increases over time, it’s easy to make the case that investors’ behaviour in the Bitcoin market is even more extreme than the behaviour observed in many of the most extraordinary bubbles in history.

Nevertheless, the key definition of a market bubble is that prices rise materially above the fundamental value of the asset. Since there is no such a thing as a fundamental value for Bitcoin, the discussion is pointless.

From a practical perspective, we could say that market participants shouldn't really care much about the bubble discussion. Bitcoin is for trading based on demand trends, not for investing based on intrinsic value.

If and when you are on the right side of the price trend, you will probably make good money on Bitcoin, no matter if the crypto asset is in a bubble or not.

Trend Following And Asset Bubbles

The way is see it, the best way to approach Bitcoin is with a quantitative trend following strategy. This means developing and implementing a quantitative system to measure the overall trend in asset prices and position your money accordingly. No speculation or prediction about future price movements is involved in the process.

Just to use a particularly popular trend measure, an uptrend can be defined as an environment in which prices are above their 200-day (or 10 months) moving average. Similarly, the markets can be considered in a downtrend trend when prices are below such moving average.

In Mebane Faber’s excellent paper entitled Learning to Love Investment Bubbles: What if Sir Isaac Newton Had Been a Trend follower? the author applies this trend following strategy on 12 different historical bubbles across the stocks, currencies, and commodities markets.

The trend following strategy made a great job at increasing returns, reducing volatility, and protecting investor capital from the massive drawdowns when those bubbles exploded. From the paper:

“Across twelve market bubbles we find that a trend following system would have improved return while reducing volatility. Most importantly, it would have reduced drawdowns significantly leading to the most important rule in all of investing – surviving to invest another day.”

Based on these concepts I have developed a similar trend following strategy for members in my research service: The Data Driven Investor. The service uses different quantitative algorithms to pick stocks based time-proven return drivers. For example, the Power Factors System focuses on companies with superior financial quality, attractive valuations, and strong momentum

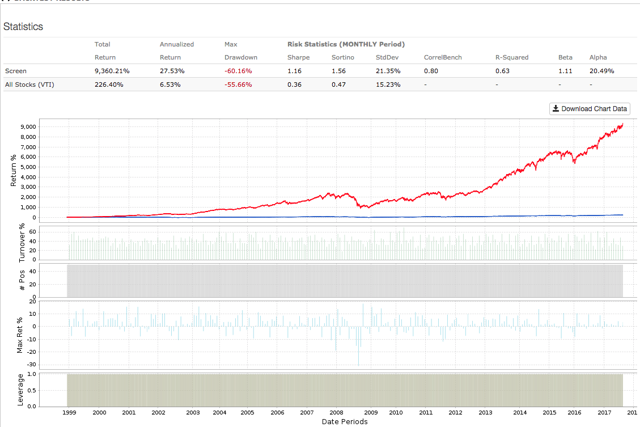

The system has produced impressive back-tested performance over time. Since January of 1999 the 50 best-ranking stocks in the Power Factors System produced an average annual return of 27.53% per year, far surpassing the 6.53% annual return delivered by the Vanguard Total Stock Market ETF (VTI) in the same period.

While the Power Factors portfolio has produced extraordinary gains in the long term, the system also suffered big drawdowns of more than 60% during the credit bubble and the ensuing crisis in 2008-2009.

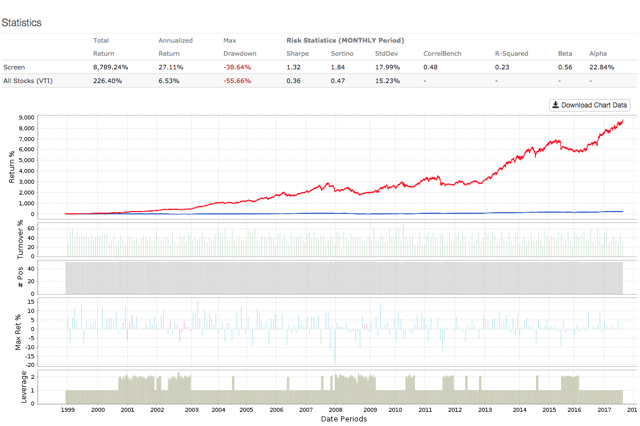

In order to reduce volatility, we can implement a trend following system for the Power Factors portfolio. In this case, the system protects the portfolio by taking a short position in the Vanguard Total Stock Market ETF when such ETF is below its 200-day moving average.

The system works quite well in terms of providing downside protection and reducing volatility. Annual return is almost the same, at 27.11% versus 27.53% for the version without the trend following protection. On the other hand, the hedging system reduces maximum drawdown from 60.16% to 38.64%. The sharpe ratio - which measures risk adjusted returns - increases from to 1.16 to 1.32.

Data and charts are from Portfolio123, and the Power Factors System is exclusively available to subscribers in The Data Driven Investor. Free trials available now.

The Bottom Line

When it comes to Bitcoin, following demand trends is a much sounder approach than trying to estimate a fair valuation for the crypto asset. Quantitative trend following systems such as the ones described above work remarkably well across different asset classes, even when those markets go through massive bubbles. For this reason, implementing a quantitative trend following method to Bitcoin could be a smart way to play such an explosive market.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.