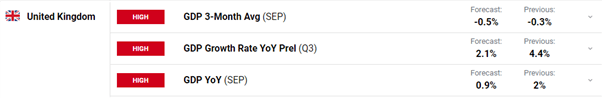

British Pound Latest: GBP/USD Still Vulnerable To Swings In Sentiment

The souring of risk sentiment over the last two days hit the Sterling and other high-beta assets hard with the British Pound losing around 1.5% against the US dollar at one stage yesterday. The change in risk sentiment, likely caused by ongoing covid lockdowns in China, the FTX crypto-exchange implosion, and uncertainty over the midterm results in the US pushed equity markets including the FTSE 100 lower, dragging the Sterling along in its wake. Sterling will remain volatile until this risk backdrop settles.

Later today, the latest US inflation report (13:30GMT) will be released to an eager market. The core rate y/y is expected to have nudged 0.1% lower to 6.5% in October, while the headline rate is seen two-tenths of a percent lower at 8%. Today’s report will be closely parsed in light of recent commentary from some Fed voting members who have been hinting that the central bank may not go for another oversized (75bps) rate hike in December. The latest CME Fed Watch Tool shows a 54.5% chance of a 50bp hike and a 45.5% chance of a 75bp increase.

For all market-moving data releases and economic events see the DailyFX Calendar.

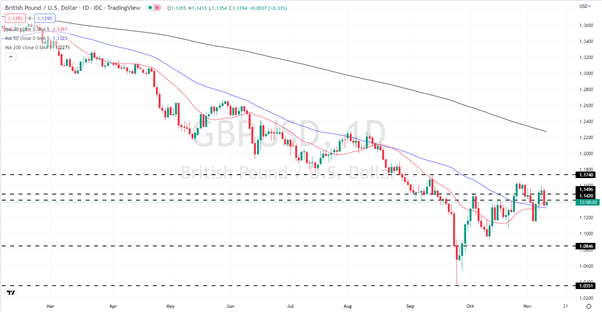

Cable’s reaction to yesterday’s sell-off and the easing of risk sentiment today is negligible so far. The pair continue to reject 1.1400 and with a cluster of recent high prints all the way up to the 1.1650 area, any upside is going to be limited and hard fought for. One positive for cable is the recent break of a series of lower highs that had defined the move lower. The sterling needs a fundamental boost and tomorrow’s latest UK GDP figures may, or may not, provide this. The UK economy is expected to have contracted in September, it just remains to be seen by how much.

GBP/USD Daily Price Chart

(Click on image to enlarge)

Chart via TradingView

A Big Swing in GBP/USD Positioning

Retail trader data show 61.82% of traders are net-long with the ratio of traders long to short at 1.62 to 1. The number of traders net-long is 13.95% higher than yesterday and 2.45% lower than last week, while the number of traders net-short is 19.54% lower than yesterday and 6.17% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

What is your view on the British Pound – bullish or bearish?

More By This Author:

Gold (XAU/USD) Rally Stalls For Now As The US Dollar Looks To RecoverBitcoin (BTC) Slumps As FTX And Binance Spat Hits Market Sentiment

Euro (EUR) Latest: Hawkish ECB Talk Boosts The Euro, EUR/USD Parity Being Tested

Disclosure: See the full disclosure for DailyFX here.