British Pound (GBP) Latest – GBP/USD Steered By Renewed Dollar Strength

The US dollar comeback continues, aided by better-than-expected US economic data and higher US bond yields. Last Friday’s robust NFP number and this week’s strong US ISM data have fired up expectations that the US economy is stronger-than-expected and that the Fed can be more flexible and ramp up interest rate hikes if needed. The one-year US Treasury currently yields 4.77%, while the two-year UST trades at around 4.35%.

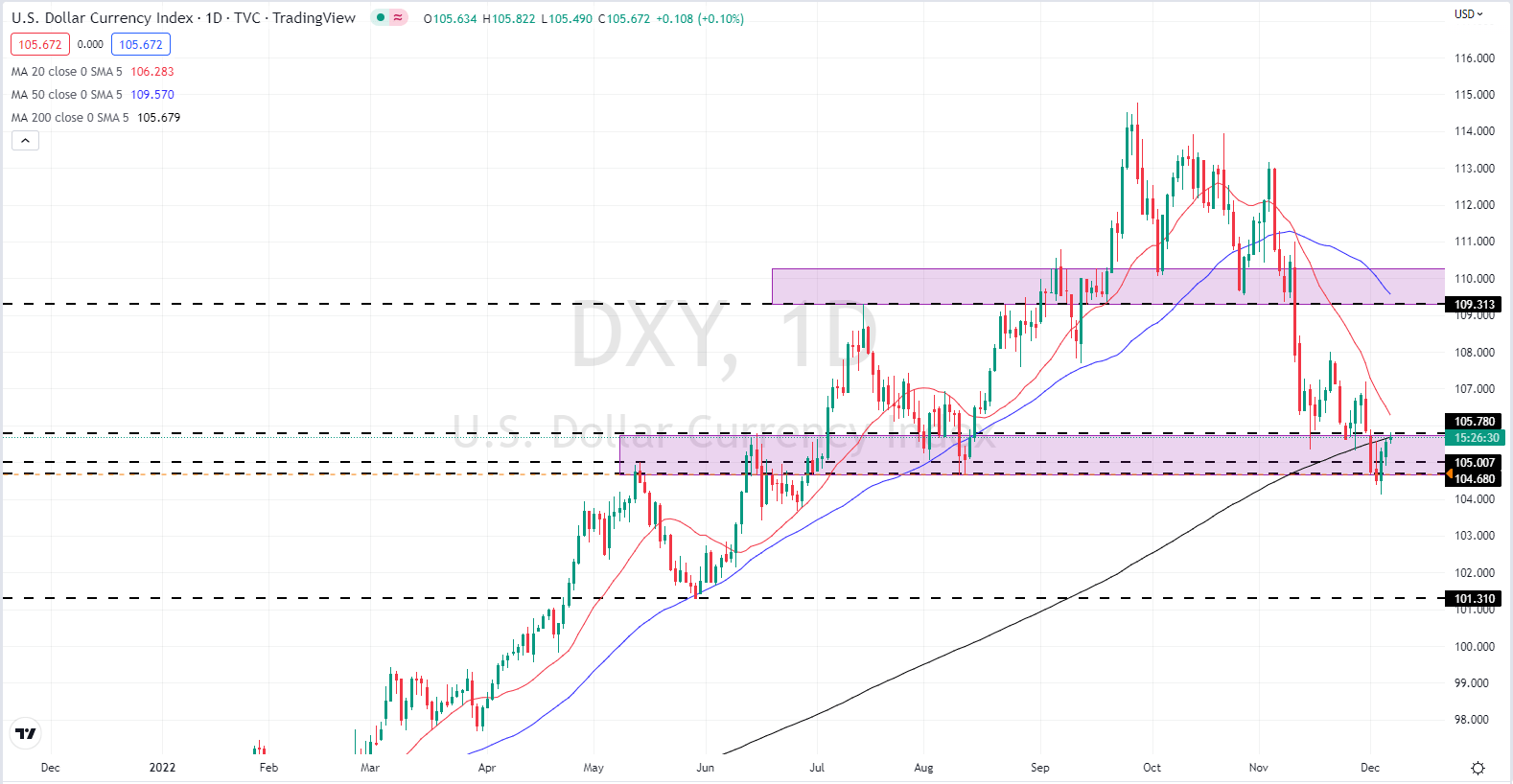

The supportive bond market backdrop is helping to push the US dollar higher after the greenback touched a fresh five-month low on Tuesday. The technical setup shows the DXY is trading on either side of the 200-day moving average and is pressing against resistance from a series of prior lows and highs.

US Dollar (DXY)

(Click on image to enlarge)

UK Chancellor of the Exchequer Jeremy Hunt is expected to unveil a host of reforms later this week to help boost the competitiveness of the City of London. According to various media reports, the new Chancellor is looking to pare back ring-fencing rules on the UK’s largest banks and adjust Solvency II rules to boost the insurance sector's competitiveness.

Next week sees a host of major central banks announce their latest monetary policy decisions ahead of the Christmas break. The Fed is expected to increase rates by 50 basis points next Wednesday, while the Bank of England is also expected to hike rates by the half-a-percentage point the next day. As always, the post-decision press conferences will need to be followed closely.

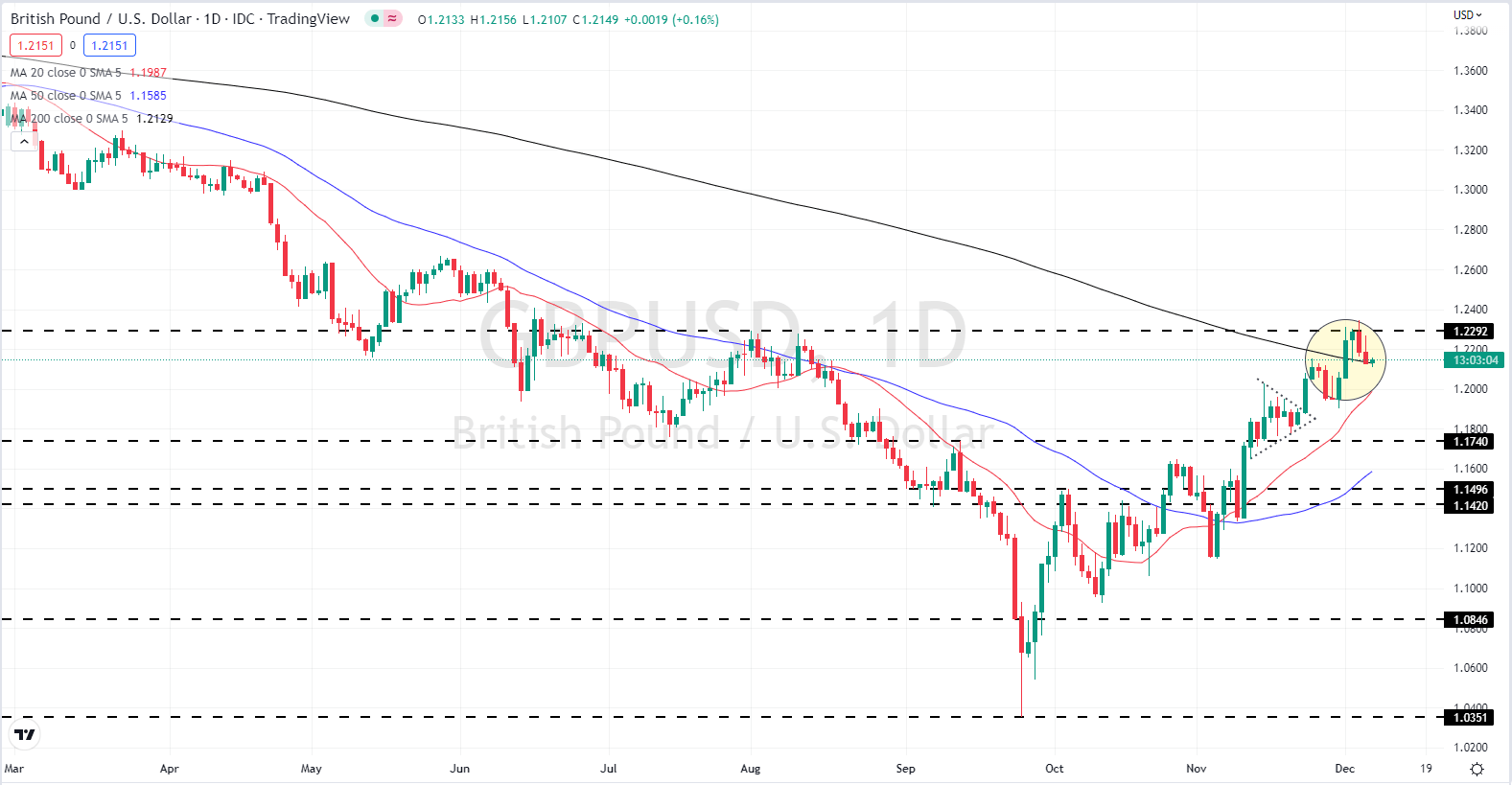

Cable is trading on either side of 1.2150 this morning, nearly two big figures lower than Monday’s multi-month high. The 200-day moving average is currently propping up cable, while the short- and medium-term moving averages are pointing higher, adding to the positive sentiment seen in the pair over the last few weeks. A break lower would bring the 1.2050 area into play.

GBP/USD Daily Price Chart

(Click on image to enlarge)

Charts via TradingView

Retail Traders Remain Net-Short

Retail trader data show 45.39% of traders are net-long with the ratio of traders short to long at 1.20 to 1. The number of traders net-long is 3.12% higher than yesterday and 7.90% lower from last week, while the number of traders net-short is 1.48% lower than yesterday and 2.68% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

What is your view on the British Pound – bullish or bearish?

More By This Author:

Euro (EUR/USD) Outlook Muted Ahead Of ECB And Fed Policy Decisions

Gold Price Outlook - Looking To Build The Next Leg Higher?

British Pound Outlook – GBP/USD Driven Higher by the US Dollar, Where Next?

Disclosure: See the full disclosure for DailyFX here.