AUD/USD Forecast: Australian Dollar Rallies In Holiday Trading

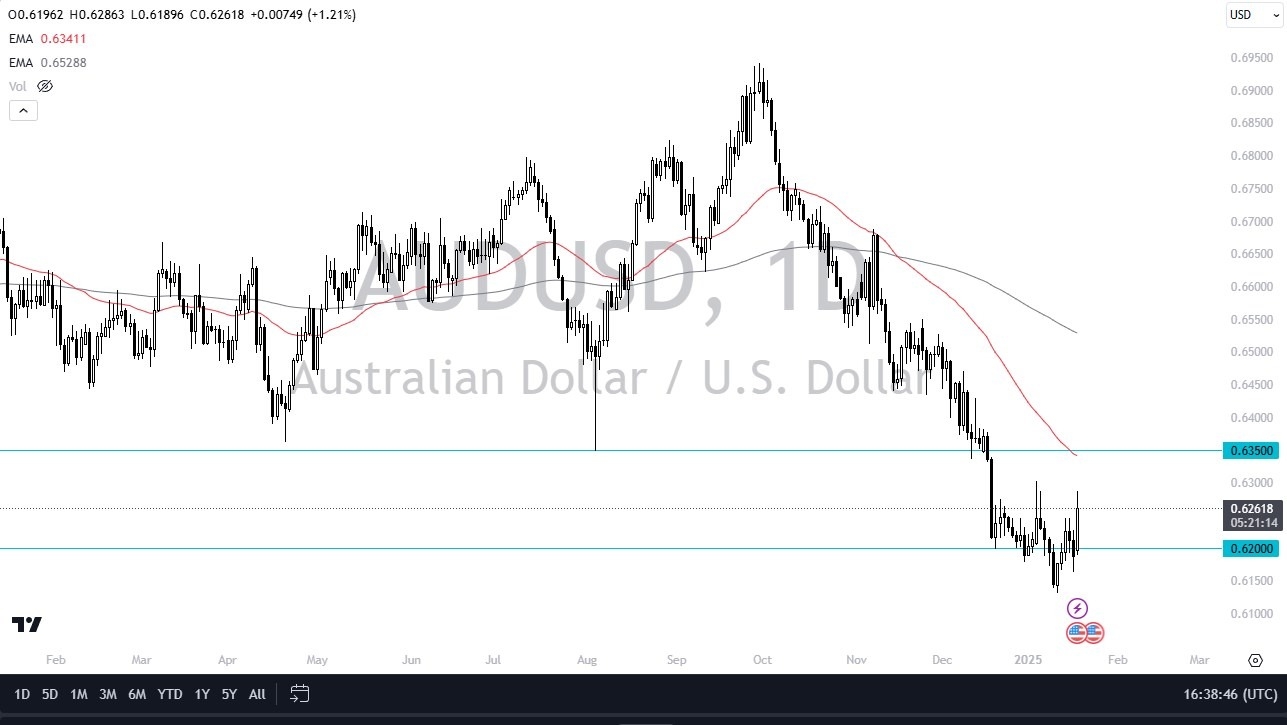

- In my daily analysis of the major currency pairs around the world, the Australian dollar has captured my attention by shooting straight up in the air, but it looks like it is struggling in the same general vicinity that we have seen for a while.

- As a result, I think you have a scenario where traders can take advantage of a bit of exhaustion and perhaps try to pick up “cheap US dollars.”

China and Australia

The Chinese economy is of course struggling a bit, and so long as that is going to be the case, the Australians will be in serious trouble. Australia is far too reliant on the Chinese economy, and I think that, going forward, this will continue to be a major issue. Looking at the size of the candlestick, the market is likely to continue to see an attempt to follow through, but I think ultimately this is a market that continues to be looked at through the prism of whether or not it is offering value, mainly in the form of US dollars. Remember, the US dollar of course is going to continue to be favored as the Federal Reserve is likely to continue to see reasons to stay relatively tight.

Technical Analysis

Looking at the technical analysis, the air has been very negative for quite some time, but even if we were to take off to the upside the 50 Day EMA sits near the 0.6350 level, which also happens to be a major area of market memory. All things being equal, if the market were to look to that region, I think that traders would be watching very closely to see if there’s any type of exhaustion. If there is, I think there would be an even more aggressive move to the downside. As far as buying the Australian dollar is concerned, it would be for a short-term move at best, as money continues to flow into the United States overall.

More By This Author:

WTI Crude Oil Forecast: WTI Crude Oil Is Looking For ValueUSD/JPY Forecast: US Dollar Bounces Against Japanese Yen

Pairs In Focus - Sunday, Jan. 19

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more