A Tale Of Ever-Deeper Deficit Spending

Image Source: Pexels

MARKETS

Stocks kicked off November with a rally on Friday, led by Amazon (AMZN) and the usual big-tech heavyweights, once again proving that they’re the tail wagging the market dog—even amid some formidable background noise. Chief among the market’s worries is the Nov. 5 U.S. presidential election, ramping up volatility as investors brace for policy shifts. Adding to the tension is the Fed’s upcoming policy meeting on Nov. 6-7, where a pause signal for December could be on the table. However, let’s be clear: no one at the Fed will take Friday’s hurricane-distorted jobs data at face value for policy decisions.

Stripping away the noisy data, the U.S. economy remains resilient, with potential pro-growth tax cuts in the cards if Trump returns to the Oval Office—a scenario likely bullish for stocks but bearish for bonds, hence a barbell setup. With demands for higher term premiums, a possibly higher terminal rate than the market’s current pricing, and stock valuations at sky-high levels, the market’s ceiling may be lower than it appears. What is the real driving force behind this rally? The AI hyperscalers. Without their sustained momentum, the market could struggle to keep pace.

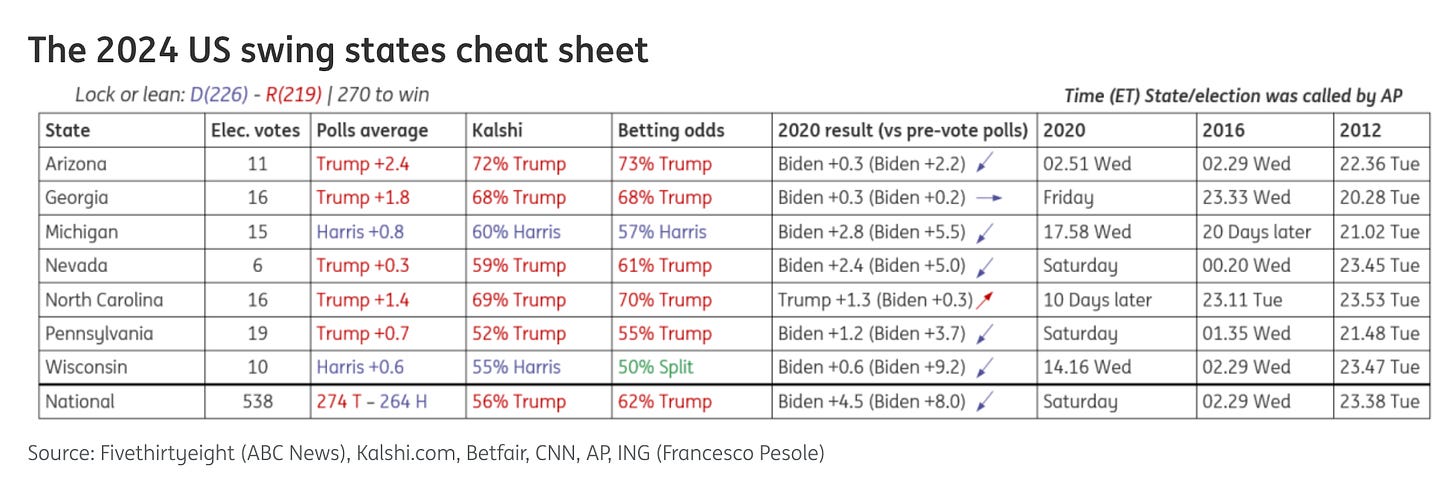

Friday’s jobs report was heavy on noise and light on signal. While two hurricanes left a trail of disruption across the U.S., bond traders barely blinked, driven by a mission to offload bonds in the lead-up to the election. The setup in rates leans decisively toward higher yields if Trump wins, and that was the story guiding action more than any weather anomalies in the data. Despite Harris taking the lead in key swing states like Wisconsin and Michigan, the betting markets remain firmly in Trump’s corner, with bond yields wrapping up at 4.38%.

Currency markets, however, stayed relatively subdued with a slight dollar bid. Rates are the cleanest, sharpest tool for betting on a Trump win via the “Polymarket” trade. So, while FX might be catching its breath, bond traders seem fully energized, pricing in a future that could come with a fiscal twist and more rate volatility, especially if Trump lands back in the Oval Office.

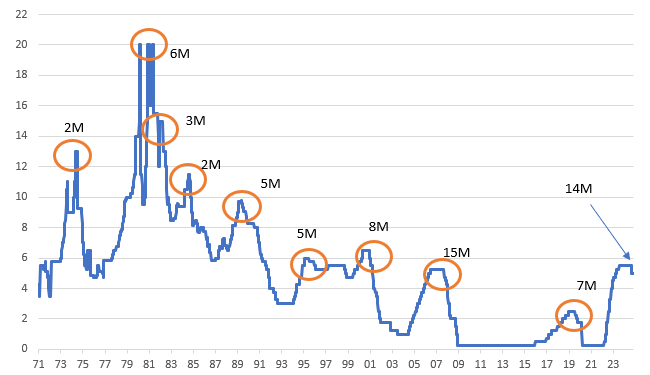

Today’s dominant macro narrative centers on a cycle of ever-deeper deficit spending, leading to persistent fiscal dominance across developed economies and feeding into a backdrop of high, sticky inflation. With nominal GDP expected to stay structurally elevated, especially in the U.S., it’s looking like the “neutral rate”—that policy sweet spot where growth neither accelerates nor slows—is higher than the Fed’s estimates currently acknowledge. This, in turn, hints at a shallower rate-cut trajectory than many in the market might wish for.

Unsurprisingly, these expectations have a direct link to the upcoming U.S. election. Markets, taking cues from betting odds, see a “red sweep” as more likely, suggesting a Trump-led aggressive fiscal expansion, tariffs, and tighter immigration controls—all of which are bound to push bond yields higher as the term premium rises. Put simply, with the odds favouring policies that ramp up spending while limiting rate cuts; the market is pricing in longer-lasting yield elevation.

But stepping beyond immediate election jitters, this fiscal expansion narrative isn’t new; it’s been building for some time. Governments, particularly those issuing dollar-denominated debt, benefit from central banks’ role as backstop buyers, creating a near-constant safety net. This doesn’t eliminate risks like currency devaluation or inflation. Still, it does reduce the likelihood of a “fiscal cliff,” allowing them to issue debt with relative confidence that their central banks have their back. Traders are betting on this fiscal momentum to keep inflationary pressures alive, tempering rate cut hopes and hinting at a more selective approach as yields will likely stay elevated for the foreseeable future.

Wall Street hopes the U.S. economy can skirt recession, even with an expected job market cooldown, helped along by government spending and an easing Fed—albeit in slow motion. So far, the overall economy has shown more resilience than many feared.

On the flip side, Friday’s data cast a shadow with a worse-than-expected contraction in U.S. manufacturing. The ISM manufacturing index posted a rough 46.5 reading—missing the consensus estimate of 47.6. That’s the lowest we’ve seen since July 2023, marking a tough start to Q4. S&P Global’s Chris Williamson called it “disappointing,” noting a “worryingly steep” decline in order books and a stockpile of unsold goods that could lead to production cuts unless demand picks up soon.

On his end, ISM’s Tim Fiore pointed to policy uncertainties on both the fiscal and monetary fronts, adding that companies are showing “an unwillingness to invest in capital and inventory” amid unclear policy directions. It’s a picture that smacks of stagflation on the manufacturing side—demand dragging while inflation hangs around.

Equity markets took a step back this week, digesting a full plate of economic data, earnings reports, and the ever-nearing U.S. election. The S&P 500 shed 1.4%, led by a 3% pullback in tech, as attention shifted squarely to next Tuesday’s showdown. Since late September—when betting odds began to swing Trump’s way—markets have lifted long-term Treasury yields, strengthened the U.S. dollar, and supported equities. Current odds suggest around a 60% chance of a Trump win, up from 50% at September’s close. The market’s “Trump trade” seems to be aligning with expectations for a pro-growth agenda despite potential tariffs and a steeper deficit path.

It’s also worth noting that stronger-than-expected U.S. economic data recently have dimmed prospects for aggressive Fed easing, giving markets one more reason to brace for a tighter fiscal stance. Unlike 2016, a Trump win may not catch the market off guard this time around, with key moves already in play.

Looking at elections from a broader lens, they typically deliver a fairly neutral punch to equities. Immediate post-election market responses don’t show any clear trend, and S&P 500 performance under a unified government (with a 10.3% average annual return since 1951) versus a divided government (8.5%) doesn’t offer a statistically decisive edge. More likely, those returns reflect the timing of some powerful recoveries in early economic cycles, as seen in 2003 and 2009, rather than election outcomes themselves.

All said, as the election jitters settle, major market implications will likely take shape soon. And while the results could shape some near-term moves, history suggests any longer-term election impact on stocks may be subtle.

NUTS & BOLTS

We knew it would be an ugly jobs report—October’s was almost a given, with hurricanes Helene and Milton, the East Coast ports disruption, and Boeing’s ongoing strike leaving their marks on the economy. Manufacturing employment took a hit, shedding 46k jobs, while private payrolls dropped by 28k The Bureau of Labor Statistics, in a special note, highlighted that while they couldn’t precisely quantify the impact, it’s clear that these shocks weighed heavily on payroll estimates. Lower-than-average initial survey collection rates only added to the noise. That said, the sharp drop in weekly jobless claims over the last two weeks, following a brief spike, suggests the labor market’s underlying health remains intact heading into Q4

Unfortunately, this report may be the opening act in a string of disappointing October data. We’ll likely see weather and strike effects crop up in industrial production, retail sales, building activity, and home sales. These numbers will probably paint a gloomier-than-warranted picture of economic health—a temporary stain, not a permanent one. Meanwhile, investors and the Federal Reserve will keep their eyes on the U.S. election and potential shifts in fiscal policies on taxation and spending, which will have a far more significant and lasting impact on GDP, deficits, inflation, and interest rates.

Thankfully, the timing isn’t all bad: these weaker October reports are coming on the heels of a strong third quarter. With two more quarter-point Fed rate cuts expected by year’s end, the foundation for steady growth remains intact. So, despite the hurricane setbacks, the U.S. labour market and broader economic outlook still look relatively bright as we approach the year’s end.

ELECTION NIGHT

I’m at that classic pre-election crossroad: do I hold on to my speculative long USDJPY positions, or just settle in with some Ooha (sugar-free, sea salt lemon for the occasion) and a big tub of popcorn to watch the fireworks from a safe distance?

After all, what better drink for the “oohs” and “aahs” of this week’s election—and the fiscal fireworks sure to follow—than a chilled Ooha?

Here’s the kicker: a decisive win could mean we know the outcome by Election Day itself or, at most, a few hours later. In that scenario, I’d get a quick answer—either it’s a jackpot moment or a swift write-off.

But, if this turns into a messy, nail-biting count, my popcorn might have to last a while. Swing states aren’t even starting to tally mail-in ballots until Election Day, and with mail-in voting at record levels, the waiting game could stretch on. Recounts, legal challenges... it’s easy to see this dragging out. Remember 2020? Took four days for networks to call it for Biden. This time, with even more at stake, we could be in for an extended round of suspense.

So, here’s the real question: Do I hold and hope for a clear-cut victory to drive a big move in USDJPY, or do I sit back, sip the Ooha, and let the dust settle? Because if it’s anything less than a decisive win, it’s going to be a drawn-out process—and I might be better off as a front-row spectator.

Financial markets have already started to price in a Trump win, betting on extended or expanded tax cuts and tariff policies likely to push the dollar higher and bond yields along with it. But here’s the catch: if the results aren’t clear-cut, markets might start hedging for a Harris upset, which would see traders unwinding those “Trump trades.” Personally, I think the clues will be in the early state-by-state breakdowns and the initial voting splits—but that’s not even factoring in potential delays from tight Senate races, which could also spell trouble for market stability. If we end up with a split Congress, expect the market’s reaction to take on a whole different tone.

Meanwhile, let’s spare a thought for the Fed officials—probably wishing they could duck out of the election crossfire but instead are gearing up for a rate decision on Thursday, right in the middle of the post-election whirlwind. A rate cut seems firmly on the docket, and if it wasn’t going to happen, we’d have likely heard a hint from the usual Fed “whisperers” like Nick over at the WSJ or Colby at the FT by now. Yet here we are, with no hints, no leaks—just the quiet before a potentially decisive move.

CHART OF THE WEEK

The Fed will be treading carefully, acutely aware that its actions and commentary could further stir financial markets already in a heightened state of volatility. In recent weeks, markets have shown a growing confidence in a Trump victory, with equities, the dollar, and Treasury yields all moving higher. If Trump does clinch the win, these trends could gain even more momentum.

However, a Kamala Harris victory could trigger a sharp reversal as markets adjust to the potential for higher taxes and a less business-friendly environment, albeit balanced by likely increased predictability in trade policy and global relations. The stakes are high on both sides, and the Fed’s next steps must navigate these competing market expectations carefully.

Fed funds ceiling with duration between last interest rate hike in a cycle and the first rate cut (%)

Source: Macrobond, ING

More By This Author:

U.S. Election Jitters Suck The Air Out Of The Room

Blockbuster Hiring And American Spending Sprees Set To Complicate The Fed's December Move

Amid Election Day Tremors Rocking Treasuries, Investors Finally Caught A Break