Bitcoin Price Outlook As Macro Conditions Set To Drive Rally Despite Latest Pullback

Image Source: Unsplash

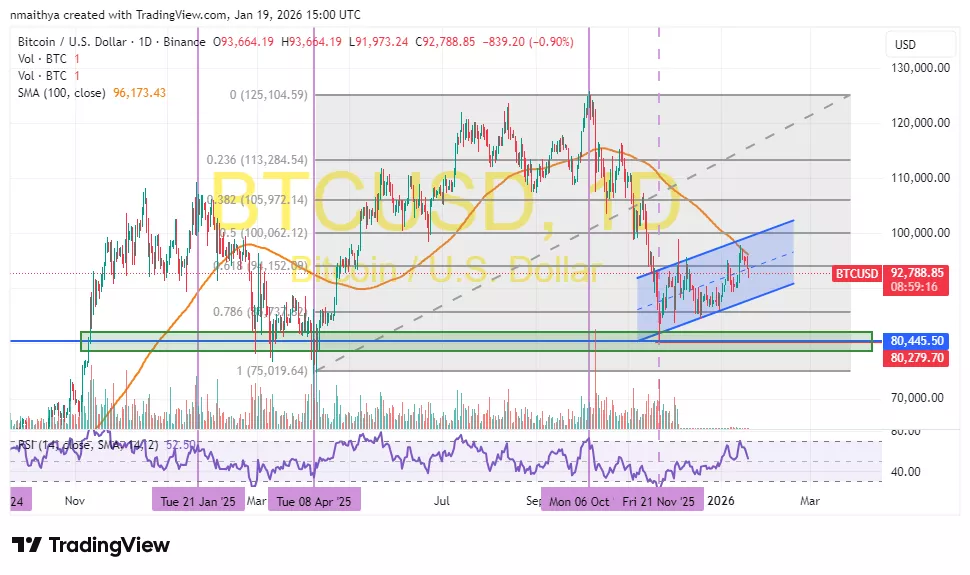

The Bitcoin price (BTC/USD) has dropped more than 5% since setting a new six-week high of $97,900 last Wednesday, resulting in a loss of over $100 billion in market capitalization. However, the upward trajectory continues to hold after establishing a strong support around the $80,000 level.

The 100-day moving average line is now acting as a key resistance to the upward momentum, after triggering the latest pullback. However, the long-term outlook remains positive with continued institutional buying and US macro conditions looking promising, an argument also supported by Capital.com researchers.

(Click on image to enlarge)

Bitcoin continues to trade within an ascending channel formation in the daily chart, despite last week’s pullback.

In an exclusive discussion with Capital.com senior market analyst Kyle Rodda about the BTC/USD price outlook, he said the market sentiment on Bitcoin flipped in the last few days, as it did in the technology sector, illustrating Bitcoin’s positive correlation with the industry.

“Firstly, risk appetite was strong for the first couple of weeks of the year. Equities were back at record highs and tech stocks were looking more constructive, a correlation with which Bitcoin hasn't yet shed,” said Rodda.

“The opposite prevailed over the weekend, and Bitcoin proved to be something of a canary in the coal mine.”

All eyes are on the US Macro and Trump

The US macroeconomic decisions continue to play a significant part in the movement of the Bitcoin price. However, it is geopolitical calls that have had the biggest impact in recent times, with the latest renaissance coinciding with the US air strike on Venezuela and the capture of President Maduro.

According to Capital.com’s Rodda, the shock of new tariffs by the Trump administration on Europe “has watered down risk appetite, with Bitcoin dropping as a result.” He now expects trade uncertainty to persist over the next two days. “If that can be bypassed, the outlook for Bitcoin is constructive,” he said.

Looking further into the year, the Bitcoin price will likely be supported by the US government spending, which continues to rise after topping $4 trillion in the third quarter of 2025. The bitcoin price will also likely receive a boost from more interest rate cuts, after the Federal Reserve lowered the funds rate to 3.75% in December.

“US rates are expected to keep coming down, and the US Government is spending like a drunken sailor,” said Rodda, who also expected increased geopolitical risks to have a positive impact on Bitcoin.

More By This Author:

Nvidia: Latest Pullback Is An Opportunity To Buy

XRP News: 24-Hour Volume Tops $4.5B, Amid U.S.-China Trade Deal Hope, Bitrue Rewards Offer, ETF Delays

The Stock Market Is Coming To The Blockchain And These Are The Early Winners

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more