Crypto Craters But Bonds And Stocks Bid On 'Bad' Macro/Trade News

Clearly unacceptable China pre-conditions for a trade-deal and ugly consumption and housing data was just what the doctor ordered for a buying spree in stocks today (presumably because the worse things get fundamentally or geopolitically, the closer The Fed gets to delivering its 50bps "insurance" cut in July)... what a bloody joke!

So before we start, there's this... "Soft" data has collapsed (Kansas Fed joins a long list today) catching down to "hard" data's dismal levels...

(Click on image to enlarge)

And that bad news sparked a dovish push in market expectations for The Fed...

(Click on image to enlarge)

Which was all that was needed to bid bonds and stocks higher on the day...

(Click on image to enlarge)

Small Caps and Trannies surged on the day (which means it was all a short-squeeze) with Dow underperforming (weighed down by Boeing)...Total meltup short-squeeze at the close in small caps...

(Click on image to enlarge)

And indeed, it was the biggest short squeeze in June as "Most Shorted" spiked...

(Click on image to enlarge)

The Dow dipped late on as Boeing admitted the Max737 delays will continue...

(Click on image to enlarge)

Chinese stocks pumped back up to unchanged on the week overnight...

(Click on image to enlarge)

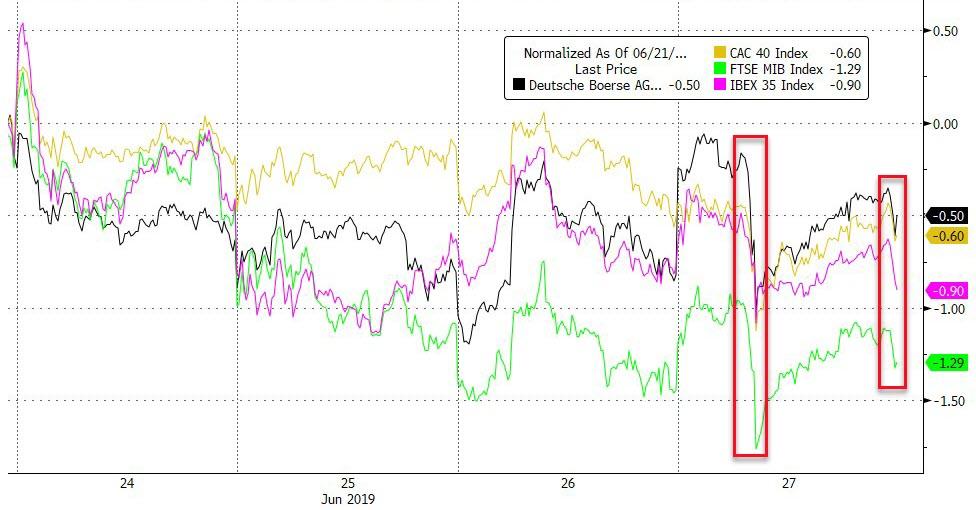

European markets were small down on the day with an ugly close...

(Click on image to enlarge)

Gold remains the big winner since The Fed went Full Dovetard...

(Click on image to enlarge)

Treasury yields tumbled on the day with the long-end outperforming...

(Click on image to enlarge)

With 10Y Yields stalling at last week's post-Fed highs and tumbling back to 2.00%...

(Click on image to enlarge)

The Dollar was unchanged, remaining in the very narrow range since the post-FOMC plunge...

(Click on image to enlarge)

The Brazilian Real spiked on chatter about pension reform being voted on before recess...

(Click on image to enlarge)

Yuan strengthened on the day, despite the headlines...

(Click on image to enlarge)

Some serious carnage in cryptos today (but we note that Bitcoin is up 10% on the week and is still up 200% YTD)...

(Click on image to enlarge)

With Bitcoin back below $11k...

(Click on image to enlarge)

Commodities were generally unchanged on the day...

(Click on image to enlarge)

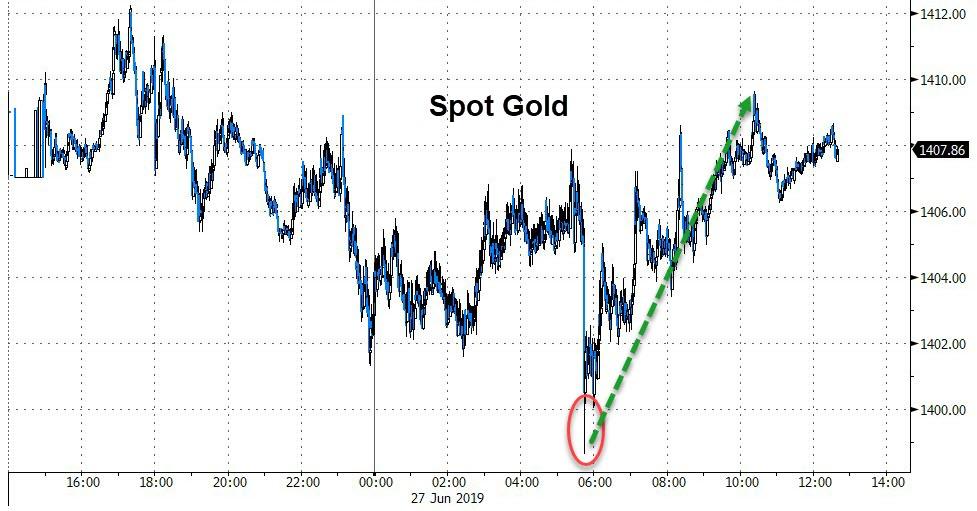

Spot Gold briefly dipped below $1400 but was bid at that level...

(Click on image to enlarge)

Commodities and Bonds seem convinced all is not well (as stocks near record highs)...

(Click on image to enlarge)

Finally, as Bloomberg's Ye Xie notes, the collapse in regional Fed surveys leaves the stock market vulnerable. With the Kansas City Manufacturing Activity Index posting a reading of zero, all five regional Fed surveys of business activity deteriorated this month. That points to the risk that the ISM manufacturing index next week may fall below 50, the dividing line between growth and contraction. Take a look at this chart tracking the ISM PMI and the excess year-on-year return of the S&P 500 over three-month Libor.

(Click on image to enlarge)

Have trades given up on giving a shit?

(Click on image to enlarge)

Besides... when did fun-durr-mentals matter?

(Click on image to enlarge)

"It's not the economy... or trade... it's The Fed, stupid!"

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more