Could Nio's Stock Surge 30% Following Spike In EV Deliveries? A Technical Look

Nio, Inc (NIO) was spiking up over 6% Friday morning after declining over 5% on Thursday amid a pullback in the general markets that saw the S&P 500 decline 1.57%, with 1.08% of the decrease taking within the last 45 minutes of the trading session.

The Shanghai, China-based electric vehicle manufacturer reported an improvement in March deliveries on Friday. Nio delivered a total of 9,985 vehicles during the month, representing a 61.4% increase over its February deliveries and a 37.6% improvement from March 2021.

The stock, which has been heavily beaten down amid poor U.S.-China relations and the Chinese government’s crackdown on companies headquartered there, plunged 80% between the Jan. 11, 2021 all-time high of $66.99 and the 52-week low of $13.01 printed on March 15, but has recently reversed course.

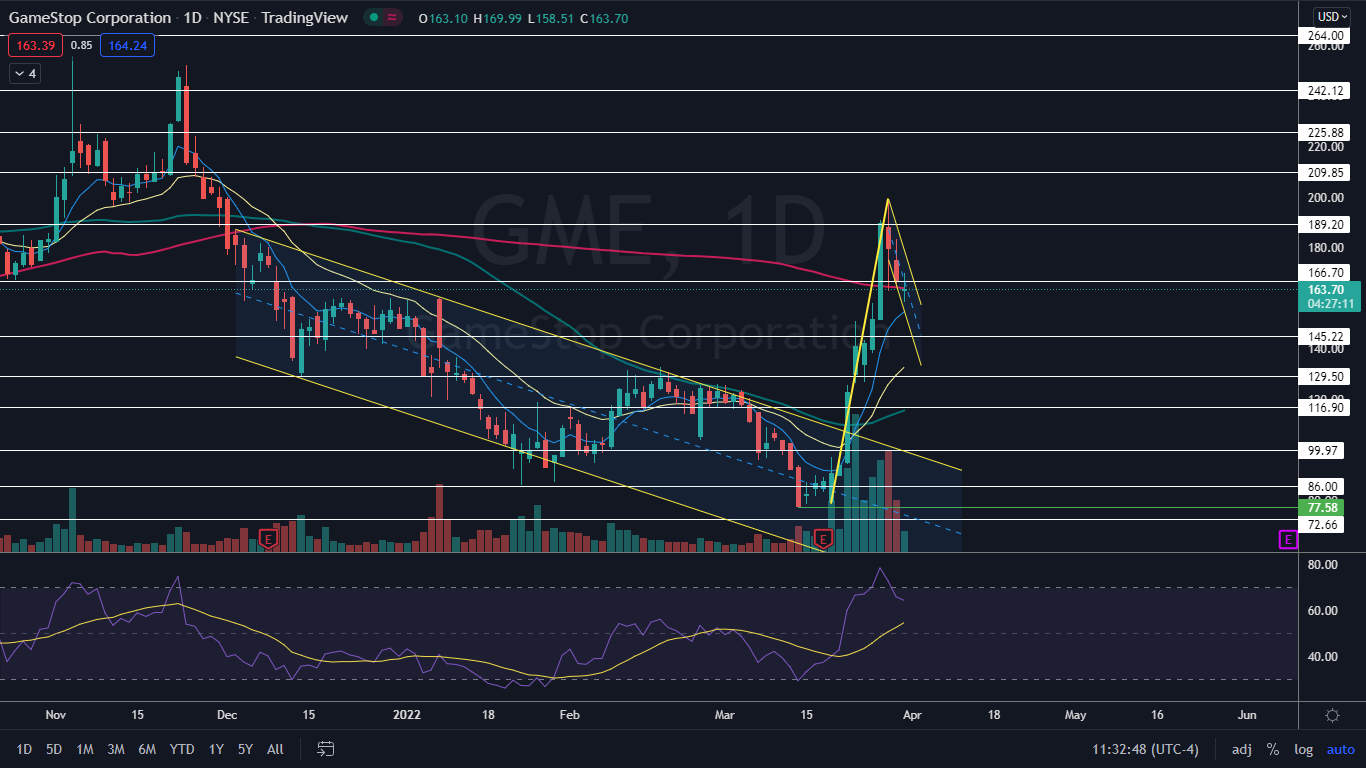

The Nio Chart

Nio reversed course into an uptrend on March 15 and has printed a series of higher highs and higher lows, with the most recent higher high formed on Wednesday at the $23.86 level and the most recent confirmed higher low created at the $19.35 level on March 25. Thursday’s price action, which caused the stock to drop to the $20.76 mark, may serve as the next higher low in the pattern.

The drop in Nio’s price on Thursday was on lower-than-average volume, which indicated a period of consolidation rather than a mass exodus from the stock. Only 77.64 million Nio shares exchanged hands compared to the 10-day average of 92.29 million.

Nio has a gap above on the chart between $26.41 and $27.22. Gaps on charts fill about 90% of the time, making it likely the stock will trade up to fill the empty range in the future. If Nio were to rise up to fill the gap, it would represent a 30% increase in the share price.

Nio is trading above the eight-day and 21-day exponential moving averages (EMAs), with the eight-day EMA trending above the 21-day, both of which are bullish indicators. On Thursday, Nio tested support at both moving averages and closed the day in line with the eight-day EMA.

- Bulls want to see big bullish volume come in and push Nio up to print a higher high in the uptrend, which will allow the stock to regain support at the 50-day simple moving average. Nio has resistance above at $21.77 and $23.98.

- Bears want to see big bearish volume come in and drop Nio down below the eight-day and 21-day EMAs, which could cause the stock to print a lower low and negate the uptrend. Nio has support below at $20.25 and $16.75.

(Click on image to enlarge)

Photo courtesy of Nio.

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.