Core CPI Hotter Than Expected As Used-Car Price Rise Offsets Energy Drop

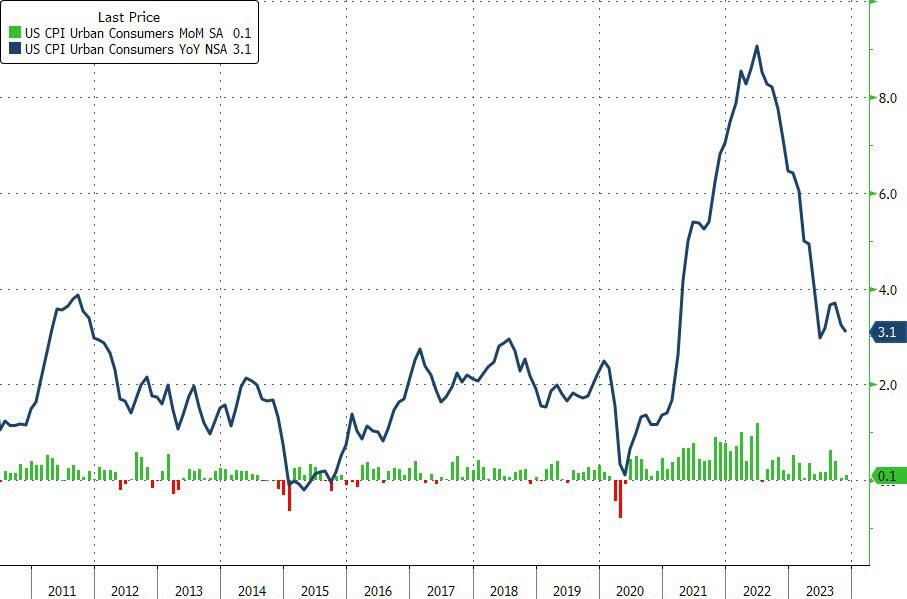

Having slowed to unch MoM in October, November's headline CPI was also expected to be flat MoM, but it printed modestly hotter than expected +0.1% MoM, which dragged the YoY CPI change down to 3.1% (as expected) from 3.2% in October. That is still above June's 3.1% YoY low print...

Source: Bloomberg

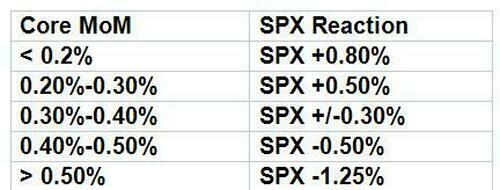

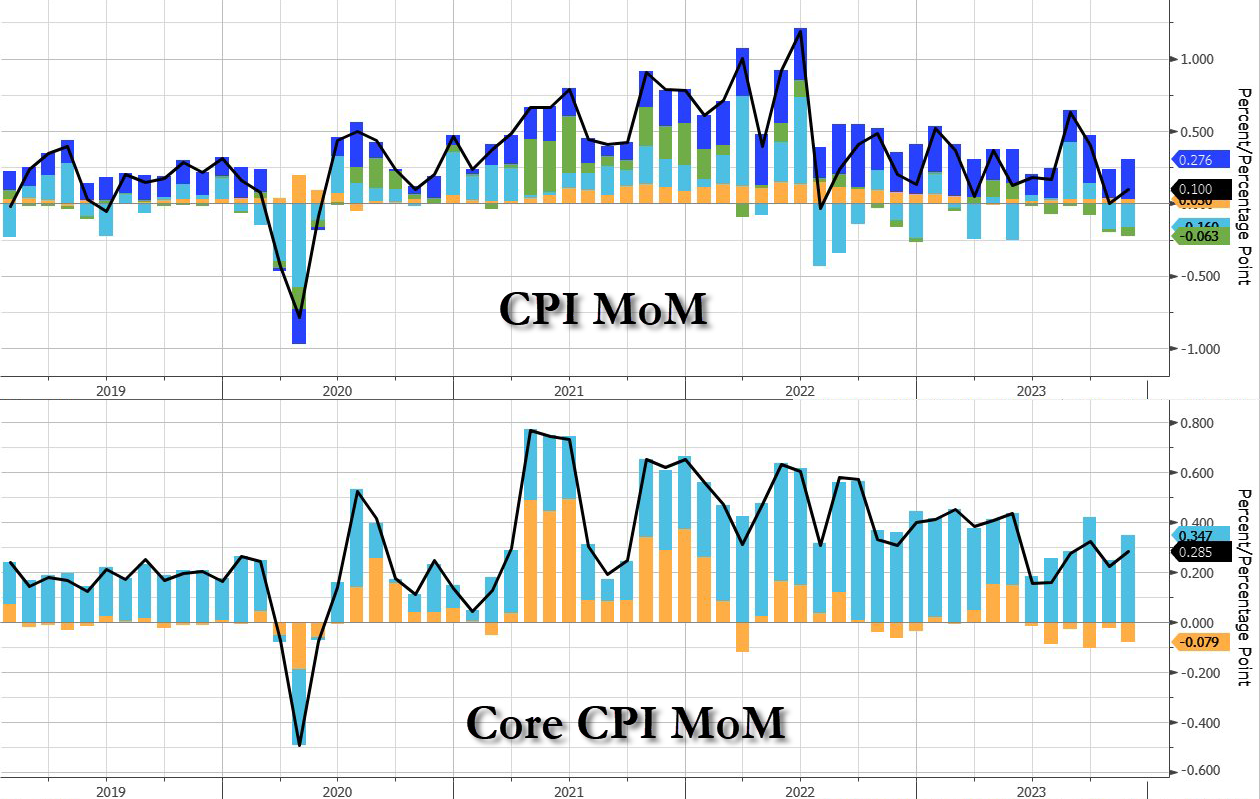

Core CPI accelerated modestly MoM (as expected), rising 0.3% (from +0.2%) with Core CPI YoY flat at 4.0% from October...

Source: Bloomberg

Most problematically for The Fed (and the 'rate-cut-hypers') is the fact that Core CPI Services Ex-Shelter (SuperCore) rose 0.5% MoM (hot) and 4.08% YoY (back above the Maginot Line of 4%)...

Source: Bloomberg

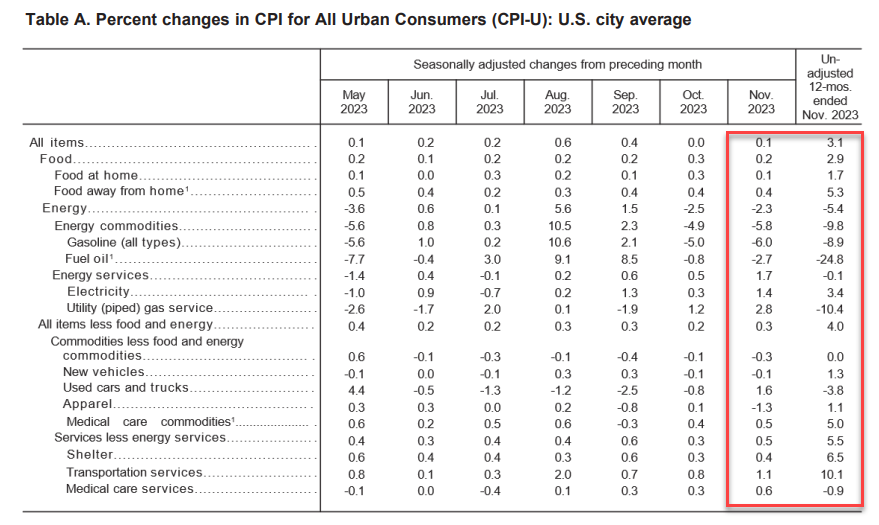

Under the hood, Energy declined considerably but Used Car prices rose...

3m and 6m annualized rates are down one-tenth and three-tenths respectively to 3.3% and 2.8%. This is the first time that the 6m measure has been below 3% for since March 2021

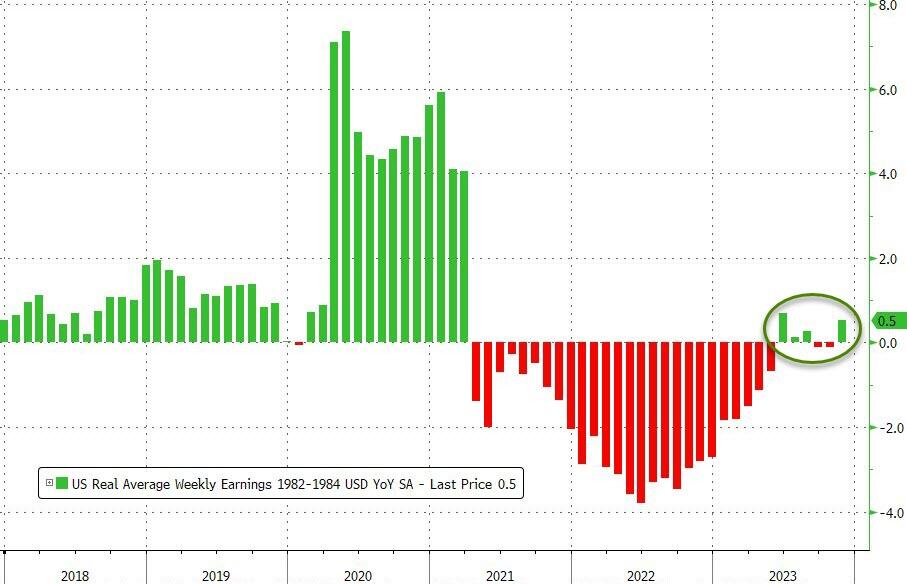

On the bright side, real average hourly earnings rose 0.5% YoY in November...

Source: Bloomberg

What happens next?

Goldilocks? Or does this mean Powell will have to push back harder against the exuberance in the market for rate-cuts?

More By This Author:

1-In-5 Young Americans Say Holocaust Was A Myth, Twice As Many Democrats As RepublicansYear-Ahead Inflation Expectations Tumble To Lowest Since April 2021 In Latest NY Fed Survey

Ugly, Tailing 3Y Auction Sees Lowest Foreign Demand Since June 2022

Disclosure: None