Cooling US Inflation Keeps The Fed On Track For Rate Cuts

July inflation data suggests the Federal Reserve remains on track to hit its 2% target, which should allow the Fed to increasingly focus on its other target of maximizing US employment. A September interest rate cut is broadly expected, but the question of magnitude remains and puts the focus on the August jobs report, due 6 September.

US inflation a touch softer than predicted

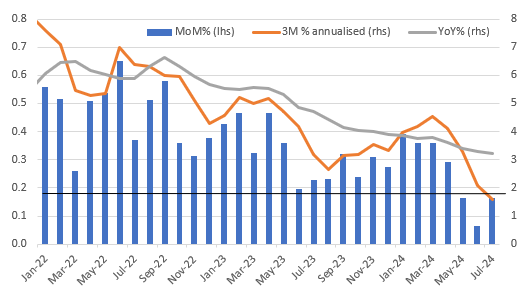

US consumer price inflation has risen 0.2% month-on-month for both headline and core, in line with expectations. However, it is slightly better than that as to 3 decimal places headline rose 0.155% and core rose 0.165%, both of which are below the 0.17% rate that over time brings us to 2% year-on-year. The chart below shows that we have had three consecutive readings below 0.17% MoM for core inflation and that the 3M annualized rate is now just 1.6%. The Fed has told us they won't wait for the YoY rate to hit 2% (currently 3.2%) before cutting interest rates, because if they do that the risk is they have left rates too high for too long. This would mean a greater chance of an undershoot in late 2025 / early 2026.

US core CPI metrics

Source: Macrobond, ING

Housing cost pressures linger

The details show apparel prices fell 0.4% MoM while transportation fell 0.1% thanks to falling new and used vehicle prices and a 1.6% drop in airline fares. Medical care costs also fell. Supercore (services ex food, energy and housing) rose 0.21% after two consecutive negative prints, but remember we had averaged above 0.5% MoM in the first four months of the year, so there is still a clear moderation, with this component effectively averaging 0% over the past 3M. In general the numbers can be choppy, but we don't believe we are on the cusp of a renewed pick up in prices – unit labor costs suggests the "costs" side of things looks well behaved while surveys of corporate pricing behavior, such as the NFIB price intentions series and regional Fed surveys of prices received, continue to moderate.

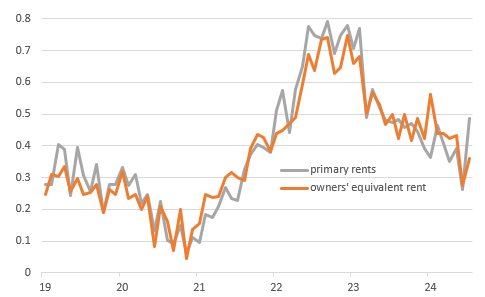

The one area of real disappointment was housing with primary rents up 0.5% MoM and owners’ equivalent rent up 0.4%. Recent numbers had been tracking more in line with private surveys on housing costs, so the re-acceleration today is a surprise. The market has seemingly moved to reduce the pricing of a 50bp cut in September on the back of this.

Housing costs MoM% re-accelerate

Source: Macrobond, ING

The question of rate cut magnitude remains

Nonetheless, this report should help to cement expectations for another 0.2% MoM and quite possibly 0.1% print for the Fed's favored inflation measure – the core PCE deflator – in a couple of weeks’ time. That would ensure a Fed rate cut in September in light of the cooling jobs market and softening business surveys with it only being a question of magnitude. For now we favour a 50bp to start off as the Fed plays catch-up to the data before reverting to 25bp moves thereafter. However, the jobs report, published on 6 September is critical for this view. A soft payrolls and another move higher in the unemployment rate and then a 50bp move looks assured. A strong jobs number and perhaps a dip in the unemployment rate back to 4.2% and it will be a 25bp cut.

More By This Author:

Polish GDP Growth Beats Expectations As Core Inflation Rises

The Commodities Feed: Oil Rises Amid Declining US Inventories

Eurozone Industry Continues To Struggle

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more