Consumer Delinquencies Rising

Image source: Pixabay

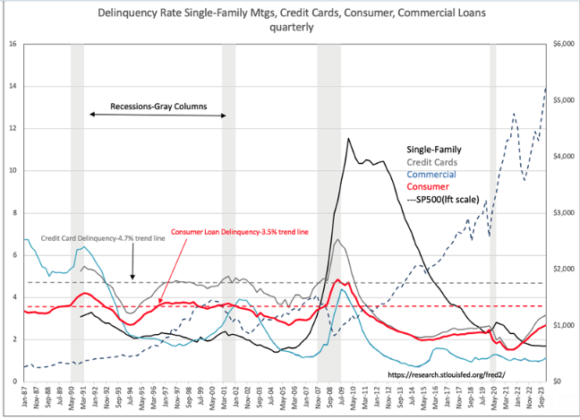

This data is not recessionary now, but as I said previously, it is rising relatively steadily, which is not ideal. This bears close watching as it tends to be the consumer who rolls over first, driving the economy into recessionary environments.

Both the consumer and credit cards are at levels not seen since 2012 when the economy was still recovering from the financial crisis of ’08-’09. We need those lines to start to flatten, or recession calls will only get louder

Davidson” submits:

The benchmarks identifying financial fragility in the US credit system are delinquency rates for Consumer Credit Cards above 4.7% and for Consumer Loans above 3.5%.. Today’s report places these at 3.16% and 2.68% respectively. Recessions have begun shortly after consumer delinquency rates exceeded these levels in the aftermath of what many now call a “Black Swan Event”. A Black Swan event is one that startles lenders and causes them to withdraw credit extension from borrowers temporarily. When delinquencies are already at benchmark levels, credit withdrawal has historically pushed a fragile system into recession. Such events can occur multiple times during a market cycle without effect if investors have cash reserves and are below these benchmark levels.

It is not the absolute level of debt that is the issue but the ability to service that debt that creates a fragile condition. Like a set of dominos lined up in a row, a single event can push the first one down, the rest following till the financial weakness has been rectified. The US financial system appears stable from the consumer debt side despite the looming issues in commercial real estate. The recession forecast the last 2yrs and by some even today is without merit considering today’s reports. With US GDP roughly 70% consumerism, a recession remains some distance, 2yrs-3yrs, into the future.

More By This Author:

Sentiment And Data Not MatchingFlush Money Market Funds Typically Mean Rally

Real Personal Income Rises

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more