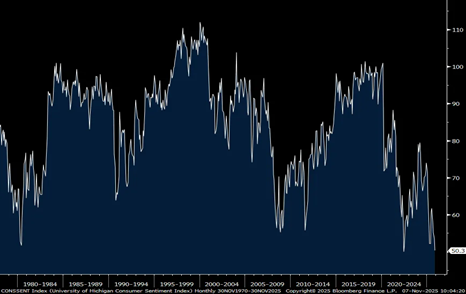

Confidence: Near A Record Low As Job, Inflation Concerns Spike

The November University of Michigan consumer confidence index fell to 50.3 – just above a record low. The survey dates back to the 1970s. Most of the decline was in the current conditions component, which was down 6.3 points. The expectations side was lower by 1.3 points month-over-month

The answers to the labor market questions really weakened. Those that see “more” unemployment in the coming 12 months rose seven points to 71, the most since May 1980. The income component was down by 14 points to -16.

Spending intentions weakened across the board. Those saying it’s a good time to buy a vehicle fell nine points to the lowest since June 2022. The “buying a home” reading declined by five points (after rebounding by eight points last month with lower mortgage rates).

Politics filters in of course. But we saw a drop for both Democrats and Republicans, as well as for Independents. Specifically for Independents (to separate the two parties and their partisan feelings), confidence fell 4.5 points to 45 – the lowest since the question was first asked in 1984.

The UoM said this: “With the federal government shutdown dragging on for over a month, consumers are now expressing worries about potential negative consequences for the economy. This month’s decline in sentiment was widespread throughout the population, seen across age, income, and political affiliation.”

The biggest issue remains the high cost of living – at the same time wage growth slows. Said UoM: “The share of consumers spontaneously mentioning the negative effects of high prices on their personal finances rose for the fifth consecutive month to 48%, up from 34% in January 2025. In addition, 29% of consumers spontaneously referenced weak incomes, surging from 20% last month and the highest seen since 2020.”

Bottom line: We have a lower-case “i” economy (though I can’t take credit for that as I heard it somewhere else). It means that the upper income/stock-holding consumer is the “dot”...and the lower part is the rest of the consumers, who have a pretty downbeat view of their financial situation.

More By This Author:

ARTY: An AI-Focused Fund For This AI-Driven EconomyPLTR: Burry's Big Downside Bet Smacks Palantir Shares

SYK: A Medical Equipment Maker Benefiting From M&A, New Products