Housing Speculation Has Led To Excess And Downside Risk

Zillow plans to sell roughly 18,000 homes through its home-flipping algorithm, called Zillow Offers, and expects to lose about 5% to 7% on the failed venture, the company told investors last week. Zillow (Z) says it underestimated the risks inherent in buying homes en masse to sell them for a quick profit.

The discussion below offers some lucid big picture on the mess that low rates and misguided policy incentives have made in America, and the economic and financial risks inherent.

The percentage of homes in the US purchased by investors is rising sharply. It’s now nearly 1 in 4. The average homebuyer is having a harder & harder time competing, especially as this influx of institutional capital continues to drive up prices.

Is America in danger of becoming a nation of renters, leasing their homes from hedge fund landlords? Here is a direct video link to part one.

Here is a direct video link to part two.

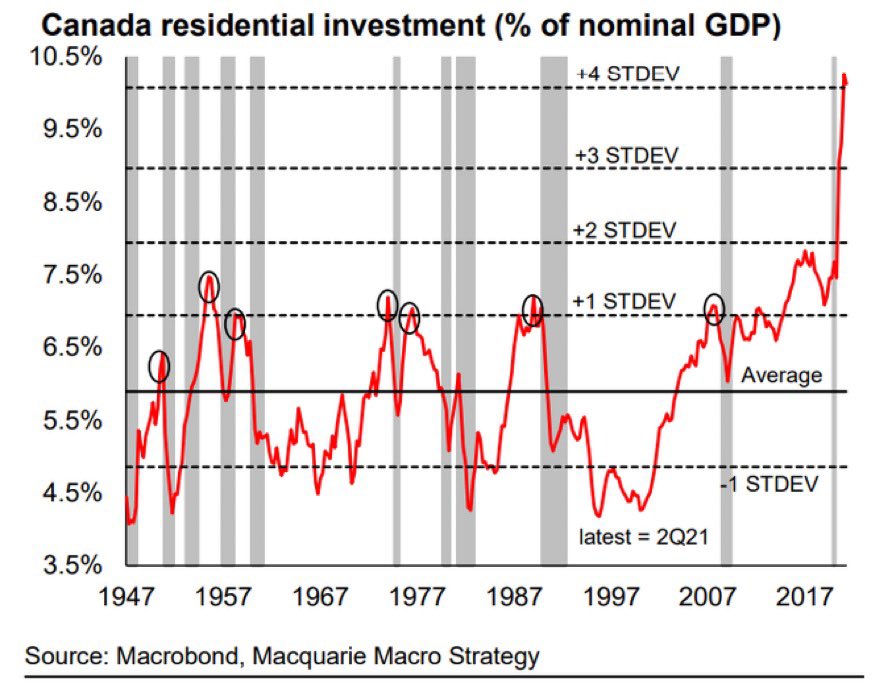

Similar conditions have led to similar behaviour in Canadian property markets. As shown below, the downside is even more significant in Canada thanks to the obscene residential over-investment–more than 10% of Canada’s nominal GDP in 2021. As charted below, since 1947, this is a ludicrous four standard deviations above the historical mean. This suggests that the mean-reversion this cycle is likely to be gruesome for highly levered participants and Canada’s under-diversified economy.

Disclosure: None.