Hedge Funds Are Getting The Hell Out Of New York In Favor Of Florida

Hedge funds are taking their business to Florida, a new Bloomberg report notes. We have recently been documenting the ongoing exodus to Florida as names like Goldman Sachs Group Inc. (GS), Apollo Global Management Inc. (APO), and Point72 Asset Management are all taking steps to move operations out of the state (or at least diversify operations).

Timothy Noonan, a law partner at Hodgson Russ who specializes in tax residency issues, recently told Bloomberg: “There definitely is an unprecedented migration of high-net-worth taxpayers from New York City, and some of them are taking their businesses with them. With rates set to go up, they are ready to get out.”

While there is optimism about tourism and leisure providing a much-needed cash infusion back into New York, it's going to be tough to not take into account the hole that many wealthy defectors will leave in the city's budget. Florida, on the other hand, doesn't have a state income tax.

Elliott Management Corp. "has seen several of its highest-paid executives leave Manhattan" in favor of Palm Beach, while Scott Shleifer, co-founder of the private equity unit at the $40 billion Tiger Global Management, also just bought a $132 million home in Palm Beach. Dan Sundheim, who runs $20 billion D1 Capital Partners, is also relocating toward Miami.

In some instances, hedge fund partners will move to Florida but keep staff and operations in New York. They will owe some New York taxes, but likely not as much as they would have otherwise. Bloomberg points out exactly how important the discussion of taxes are to smaller firms:

"Take the example of a manager who makes $10 million per year. In New York City, they would have paid more than $1.1 million in state and local taxes last year, and more like $1.2 million this year after the tax hike. By moving to Florida, the manager avoids that charge every year, as well as about $400,000 annually that their firm owes to the city’s 4% unincorporated business tax.

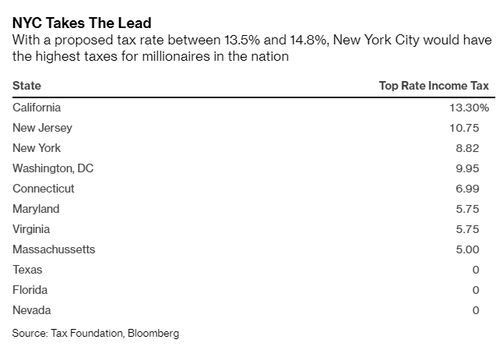

"The savings are even bigger for the most successful managers. In addition to hiking the top rate on single filers earning more than $1.1 million — from 8.82% to 9.65% — the state added two new brackets: income above $5 million will be taxed at 10.3% and $25 million at 10.9%. Adding these to the city’s top rate of 3.88%, rich New York City residents now face marginal rates of 13.5% to 14.8%, surpassing the 13.3% top rate in California, previously the U.S.’s highest."

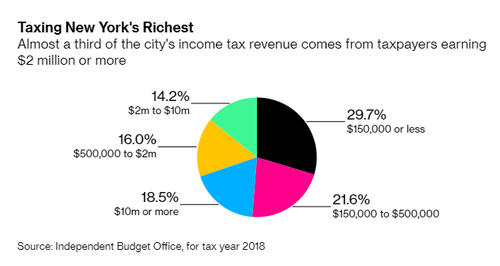

Taxpayers in New York earning $10 million or more paid 17% of income taxes in 2018, the report says. In New York City alone, about 1,800 people earned at least $10 million in 2018 and were responsible for 18.5% of the city's tax revenue, equating to roughly $2.1 billion.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more