Yes, That Was A Gold/Silver Bubble That Burst

Image Source: Unsplash

Last Friday, the gold/silver bubble exploded in spectacular fashion. Many traders and investors lost money, but options traders who used a “free trade” made out nicely.

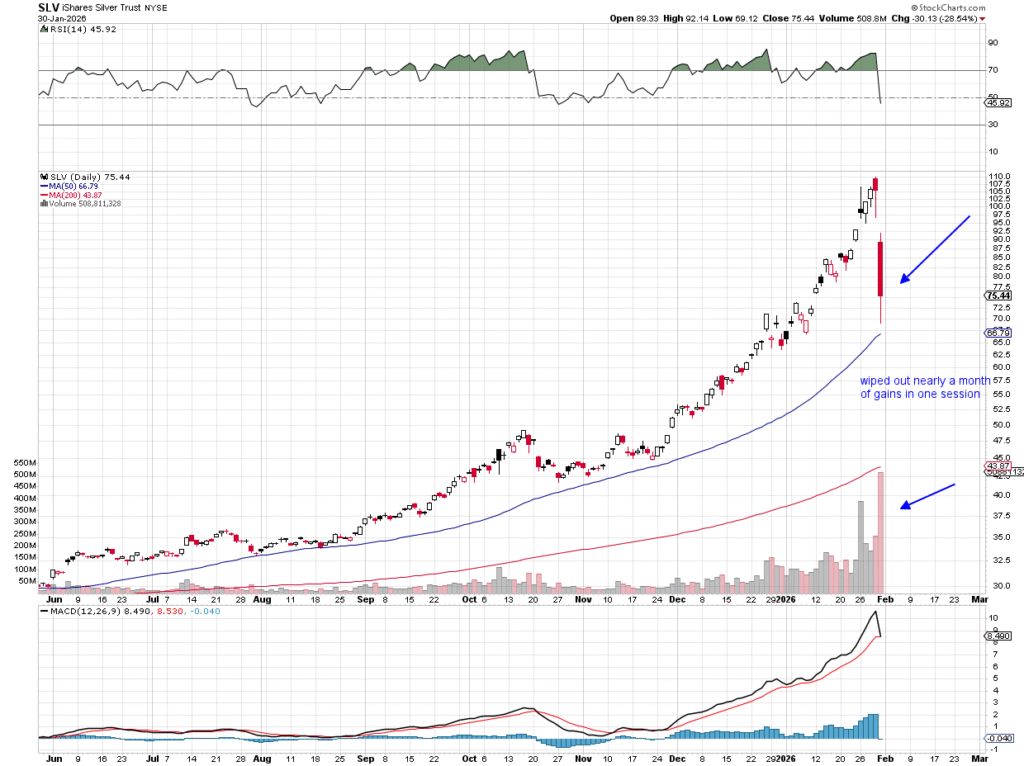

Nearly a month of gains in both precious metals were wiped out in a single trading session. Plenty of traders and investors made profited from their rise. And many were dumbfounded on Friday watching them nosedive.

Yep, that was a gold/silver bubble – here’s why

Now, I may be met with some resistance for saying gold and silver were in a bubble. But take a look at the silver chart below. It was rising in parabolic fashion for weeks. At some point, people were going to hit the sell button and cash in their gains.

(Click on image to enlarge)

Why won’t some people call this a bubble? Well, bubbles are typically associated with wild valuations that are not supported by fundamentals, excess momentum, or just a feeding frenzy fueled by greed.

Those situations have one belief in common: Someone out there is always willing to pay more. That belief really expands the bubble, and the longer the bubble expands, the bigger the fall in the end.

Silver was down 32% in one session. Gold was down 11%. Those drops are devastating for anyone who just bought in the last few weeks.

Even if we call these sharp moves to the downsides a burst bubble, the party is definitely not over. I can’t predict the future, but I feel confident saying that there are some really good opportunities to trade these metals again.

Why? Volatility is extremely high. (Remember, high volatility simply means an expansion of the price range in which an asset is trading). Silver’s range had been very tight for years – until this past year.

How can you avoid losing money in a bubble?

Stay out of the way when the media/public start talking about it incessantly. When this happens, you are already late to the party. It’s the wrong time to buy shares.

If you got in early, keep in mind the uptrend won’t last forever. Take your profits when you have them. If you’d like, you can buy new options at higher prices.

We talk about this strategy often in our chat room. We call it the “free trade”. You can take your original investment off the table when you sell. The new trade doesn’t risk the original investment, and it allows you to potentially book more gains.

When an asset accelerates quickly in value, take advantage of the momentum to make money. As long as you continue to sell options when you have a profit and roll into a new trade, you will come out ahead.

More By This Author:

Natera Inc Chart Analysis

Eldorado Gold Corp Chart Analysis

Do You Have The Right Options Trading Mindset?

Disclaimer: Explosives Options disclaims any responsibility for the accuracy of the content of this article. Visitors assume the all risk of viewing, reading, using, or relying upon this ...

more