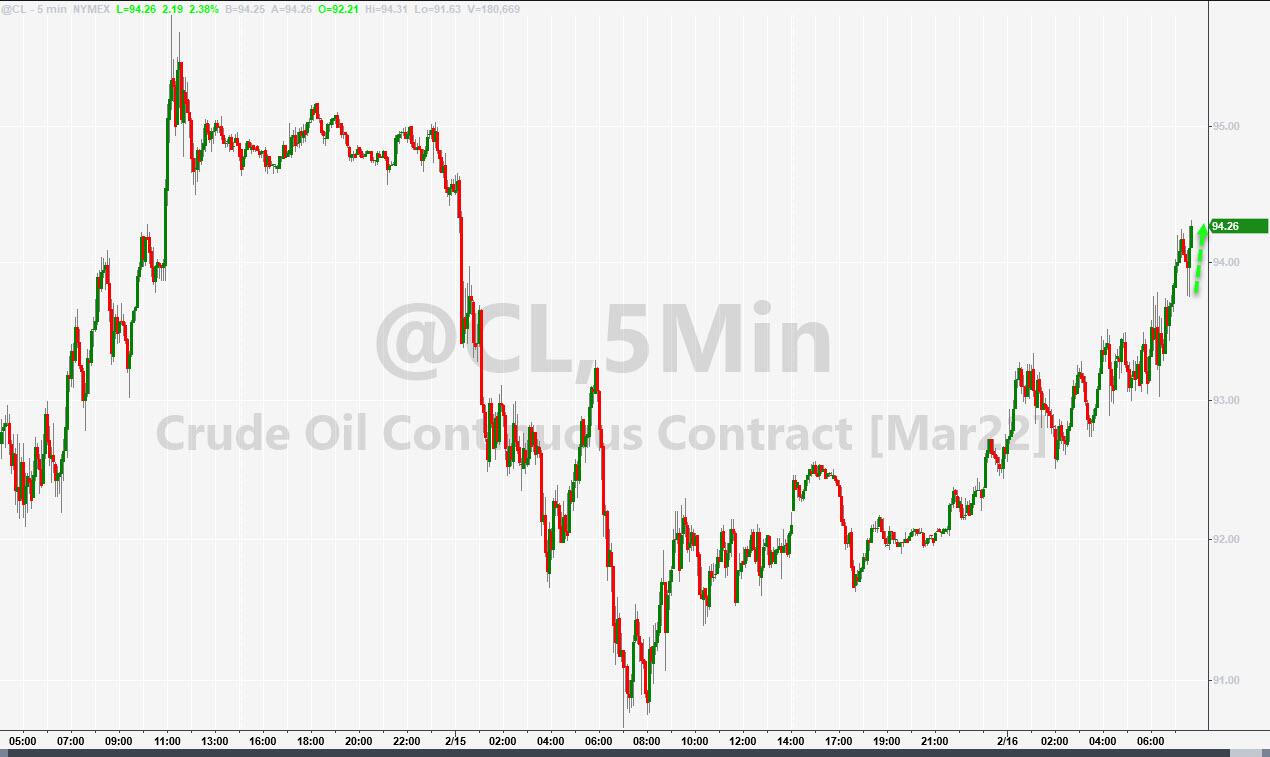

WTI Soars Back Above $95 As "Tank Bottoms" Are Close At Cushing

A combination of US and NATO comments that Russia is not retreating (providing no evidence of said statement) and the continued plunge in stocks at Cushing, has sent oil prices soaring.

With debates about "tank bottoms" being close at America's largest storage hub...

...WTI has now erased all of yesterday's losses and more and is trading back above $95...

That is going to crush Biden's plan to bring down retail gas prices.

***

Oil prices are rebounding dramatically this morning, accelerating gains from last night across the board inventory draw reported by API, after US SecState Blinken (and NATO's Stoltenberg) claimed that there are no signs that Russia is withdrawing (and remember today was 'invasion day' according to the mainstream media).

“Market participants are still willing to pay a sizable premium for oil that is deliverable at short notice,” said Carsten Fritsch, an analyst at Commerzbank AG.

Will an unexpected crude build spook oil traders or a big draw lift prices back to Biden-crushing highs?

API

- Crude -1.076mm (-220k exp)

- Cushing -2.382mm

- Gasoline -923k (-900k exp)

- Distillates -546k (-1mm exp)

DOE

- Crude +1.12mm (-220k exp)

- Cushing -1.90mm

- Gasoline -1.33mm (-900k exp)

- Distillates -1.552mm (-1mm exp)

Flipping the script from API, the official data showed that Crude inventories unexpectedly built last week. Cushing stocks fell for the 6th straight week...

(Click on image to enlarge)

Source: Bloomberg

U.S. Gulf refiners cut runs to 83.5%, the lowest since October after a cold spell cut off power to four major refiners.

Cushing stocks extend their plunge back towards operational low levels, dropping to the lowest level since Sept 2018 (adding to global inventory tightness fears). Notably, this low level of inventories at the biggest storage hub in the country is one reason why prompt timespreads are soaring.

Source: Bloomberg

Gasoline demand unexpectedly slowed once again last week, after rebounding from Omicron...

(Click on image to enlarge)

Source: Bloomberg

US crude production was flat week over week, despite a big jump in the rig count...

(Click on image to enlarge)

After yesterday's biggest daily drop this year, WTI was trading back above $94 ahead of the official inventory data, and extending gains despite the crude build...

(Click on image to enlarge)

This is not good news for President Biden's gas price reduction plans.

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more