WTI Shrugs Off Large Inventory Builds, Gasoline Demand Tumbles

Oil prices are flat this morning, after bouncing back from some ugliness overnight, hovering around unchanged from last night's surprise API-reported inventory builds across the board. This morning's US CPI report prompted some volatility but that was quickly rejected.

Recent weakness in oil prices has reflected Chinese cities imposing more lockdowns and curbs on movement to try to contain the spread of the latest highly contagious Omicron variant and has also been hindered by a strong dollar.

"A worsening macroeconomic outlook and fears of recession are weighing on market sentiment, while there are ongoing risks on the supply side. For now, weaker-than-expected oil demand growth in advanced economies and resilient Russian supply has loosened headline balances," the IEA said in its influential Monthly Oil Market Report.

For now, the machines are watching for demand destruction, targeting that 200DMA technical level for WTI ($93.32)...

API

- Crude +4.762mm (+1.4mm exp)

- Cushing +298k

- Gasoline +2.927mm (-200k exp)

- Distillates +3.262mm (+900k exp)

DOE

- Crude +3.254mm (+1.4mm exp)

- Cushing +316k

- Gasoline +5.825mm (-200k exp)

- Distillates +2.668mm (+900k exp)

After API reported across-the-board inventory builds (and sizable ones too), the official DOE data confirmed even larger product builds...

Source: Bloomberg

The one big caveat to this seemingly big build is that crude stockpiles including the release from the strategic reserve actually contracted by 3.63 million barrels. The big question in the market is what happens when the government is no longer releasing about a million barrels a day in few months.

There were builds across every sub-component in the energy complex... except the SPR, which saw a 6.8mm drain last week to its lowest level since 1985...

Source: Bloomberg

US Crude production dipped modestly last week from two-year highs...

Source: Bloomberg

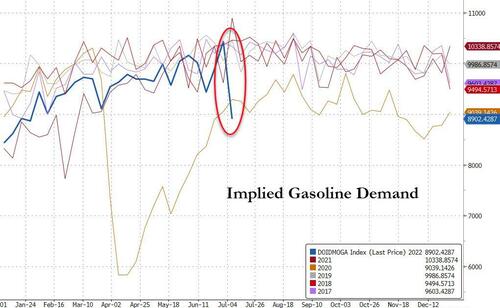

Gasoline demand plunged last week. The four-week rolling average of gasoline demand is now at its lowest seasonally since 2000. The level is so low for this time of year that it is not even 1% higher than 2020, the first pandemic summer in the US.

Source: Bloomberg

WTI hovered around $95.50 ahead of the official data, having bounced perfectly off its 200DMA overnight...

WTI extended losses modestly after the big builds...

Finally, despite recession fears, several energy agencies agree that supply tightness is set to worsen. IEA’s Executive Director Fatih Birol said nations “might not have seen the worst” of a global energy crunch.

Additionally, hope that Biden will persuade the Saudis to pump more are unlikelyas "International spare capacity estimates have been steadily falling in recent months as OPEC+ has badly undershot their own output targets, despite calls from the Biden administration to increase supply in order to combat high prices at the [gasoline] pump," Tyler Richey, co-editor at Sevens Report Research, told MarketWatch.

The drop in crude prices comes as President Biden prepares to visit Saudi Arabia this week in an attempt to persuade the Kingdom to increase its oil output, although analysts think that the American leader is unlikely to succeed.

Torbjorn Soltvedt, an analyst at Verisk Maplecroft, a risk intelligence company, said:

“US calls on Saudi Arabia to increase the rate of oil production have fallen on deaf ears. This is unlikely to change. Aside from uncertainty over Saudi spare capacity, it is now too late for a shift in Saudi oil production to impact petrol prices in the US ahead of November’s midterm elections. Opec+ supply restraint is also set to end in September in any case, paving the way for a steady increase in Saudi supply over the coming months.”

Finally, we note that Bloomberg Intelligence Senior Oil & Gas Analyst Fernando Valle warns: “Growing recessionary fears are depressing oil prices, supported by the steep selloff in copper and other commodities. Increased volatility has been driven by a surge in oil-derivative sales. Russia’s threat to cut off the natural gas supply to Europe this winter is another overhang. The move would force utilities to switch to fuel oil from natural gas, supporting demand for oil, but might be offset by lower industrial activity in Germany and France.”

More By This Author:

US Consumer Prices Soared In June, Americans' Real Wages Fall For 15th Straight MonthWTI Holds Big Losses After API Reports Across-The-Board Inventory Builds

U.S. Small Business Optimism Outlook Crashes To Record Low, Yield Curve Inverts Most Since 2007

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more