WTI Rebounds From Two-Week Lows Amid Venezuela Turmoil, Upside Capped Below $60

Image Source: Pixabay

West Texas Intermediate (WTI) Crude Oil rebounds sharply on Monday, reversing earlier losses as traders assess the implications of the United States’ dramatic move against Venezuela following weekend military strikes that led to the ousting of President Nicolas Maduro.

At the time of writing, WTI trades around $58.00 per barrel, recovering after slipping to over two-week lows near $56.19 earlier in the European session.

Venezuela holds the world’s largest proven Crude Oil reserves, estimated at around 303 billion barrels, according to the US Energy Information Administration (EIA). Despite the massive reserves, the country exports far less Oil than other major reserve holders such as Saudi Arabia, Russia, Iran, or Canada.

Following the attacks, US President Donald Trump said on Saturday that Venezuela’s oil sector had been “a total bust for a long period of time,” adding: “The oil business in Venezuela has been a total bust for a long period of time… we are going to have our very large US oil companies — spend billions of dollars — and start making money for the country.” However, Trump also stressed that sanctions on Venezuelan crude would remain in place.

The remarks added to concerns about an already oversupplied market. That said, US intervention in Venezuela is unlikely to translate into an immediate boost in crude Oil supply as the country’s Oil infrastructure remains far below optimal levels, making any meaningful production recovery a costly and long-term effort.

(Click on image to enlarge)

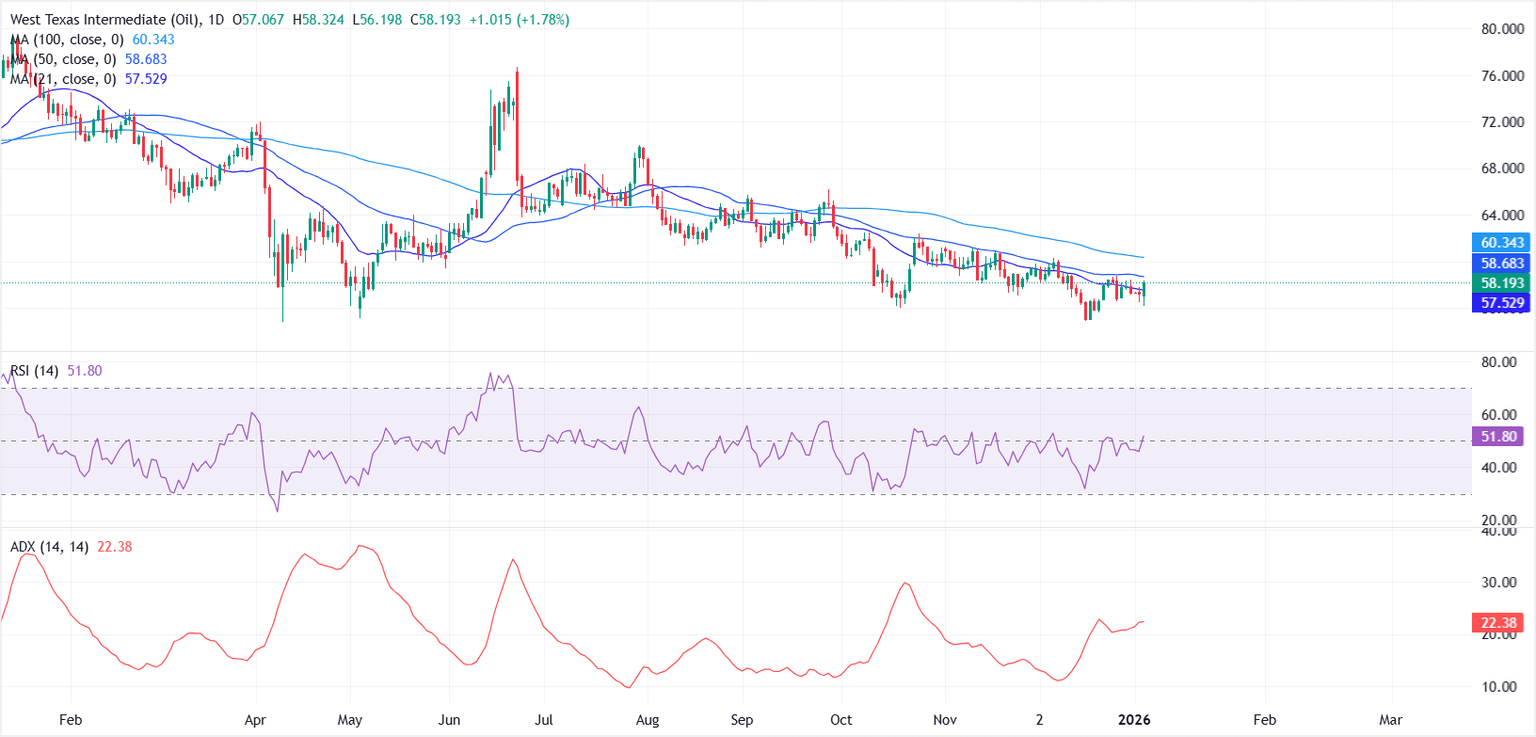

From a technical standpoint, the daily chart suggests a modest rebound in WTI, with prices moving back above the 21-day Simple Moving Average (SMA) near $57.52. On the upside, gains may remain limited, as the 50-day SMA around $58.68 stands as immediate resistance.

A stronger barrier is seen near the $60 psychological level, where the 100-day SMA sits around $60.34. Without a clear break above $60, the broader downside risk is likely to remain in place.

Momentum indicators paint a cautious but stabilising picture. The Relative Strength Index (RSI) is hovering near the 50 level, suggesting neutral momentum after sliding towards oversold territory. Meanwhile, the Average Directional Index (ADX) remains subdued, sitting around the low-20s, indicating that the broader trend lacks strength.

More By This Author:

EUR/USD Holds Losses As Markets Await US ISM Manufacturing PMI FiguresForecasting The Upcoming Week: Markets Enter The New Year Calmly, U.S. Dollar Stable Ahead Of Key Data

EUR/USD Hits Fresh One-Week Lows Following Weak Eurozone Data

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more