WTI Rebounds Despite Big Crude Draw & Production Increase; Gasoline Demand Jumped

Oil prices extended losses this morning - amid some notable volatility around US CPI - after a bigger than expected crude build reported by API, the imminent reopening of crude flows to Europe from Russia through Ukraine, and continued weakness in real wages.

"Crude oil prices rose on Tuesday on news pipeline flows of crude oil from Russia via Ukraine to Europe had been halted over a payment dispute of transit fees. The line, however, is expected to reopen within days but it nevertheless highlights and supports the current price divergence between WTI futures stuck around $90, amid rising US stockpiles and slowing gasoline demand, and Brent," Saxo Bank said in a note on its website.

For now, all eyes are the official data to confirm (or deny) the API report...

API

- Crude +2.156mm (-400k exp)

- Cushing -627k

- Gasoline +910k

- Distillates 1.376mm

DOE

- Crude +5.457mm (-400k exp)

- Cushing +723k

- Gasoline -4.978mm

- Distillates +2.166mm

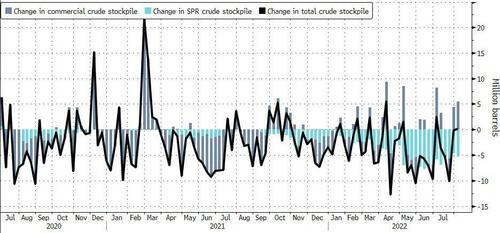

After the prior week's surprise build, analysts expected a small draw this week (while API reported another sizable build). However, analysts were seriously wrong with crude inventories rising by 5.457mm. Cushing stocks are also up for the 6th straight week...

Source: Bloomberg

Total crude stockpiles were virtually unchanged for a second week, with a 5.5 million barrel build in the commercial crude inventory almost entirely offset by a draw of 5.3 million barrels from the Strategic Petroleum Reserve.

Source: Bloomberg

US Crude production rose to a new cycle high while the rig count dipped last week...

Source: Bloomberg

Gasoline demand picked up notably last week - back to normal...

Source: Bloomberg

WTI traded below $88.00 ahead of the official data but rallied back to $88.50 right as the data hit and extended those gains...

Not everyone is so bearish: “The market is going to tighten up very, very quickly” this winter, said Amrita Sen, chief oil analyst at consultant Energy Aspects.

More By This Author:

US Consumer Price Inflation Slows In July, Real Wages Continue To Tumble

Oil Slides As Ukraine Readies Resumption Of Russian Crude Flow To Europe

Retail Investors Pile Into Meme Stocks Despite Violent Selloff

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more