WTI Rallies Towards $76.50 As The USD Remains Offered Due To Powell’s Speech

Image Source: Unsplash

The US crude oil benchmark, also known as Western Texas Intermediate (WTI), advances sharply as the US Dollar (USD) weakens, as the US Federal Reserve (Fed) Chair Jerome Powell speaks at the Economic Club of Washington. At the time of writing, WTI is trading at $76.50 PB.

Wall Street turned green as Fed Chair Jerome Powell failed to pushback against the last week’s astonishing employment report in the United States (US), which spurred a market’s reaction, sending the US Dollar soaring and US Treasury bond yields jumping more than 20 bps, namely the 10-year benchmark note rate.

However, the US Dollar Index (DXY) is falling 0.35%, down at 103.264, sparking an upward reaction in WTI, hovering around the 20-day Exponential Moving Average (EMA) at $77.61.

Additional factors influencing oil prices are optimism about China’s reopening, and worries about supply shortages as a major export terminal in Turkey was shut down following an earthquake in the country.

China’s reopening following the relaxation of the Covid-19 zero-tolerance policy augmented speculations that oil demand would increase during 2023. Even the International Energy Agency (IEA) estimates that half of 2023 global oil demand will come from China.

Meanwhile, operations at Ceyhan, Turkey’s main oil export terminal, were shut after an earthquake hit the region. The terminal will remain closed until February 8.

WTI technical analysis

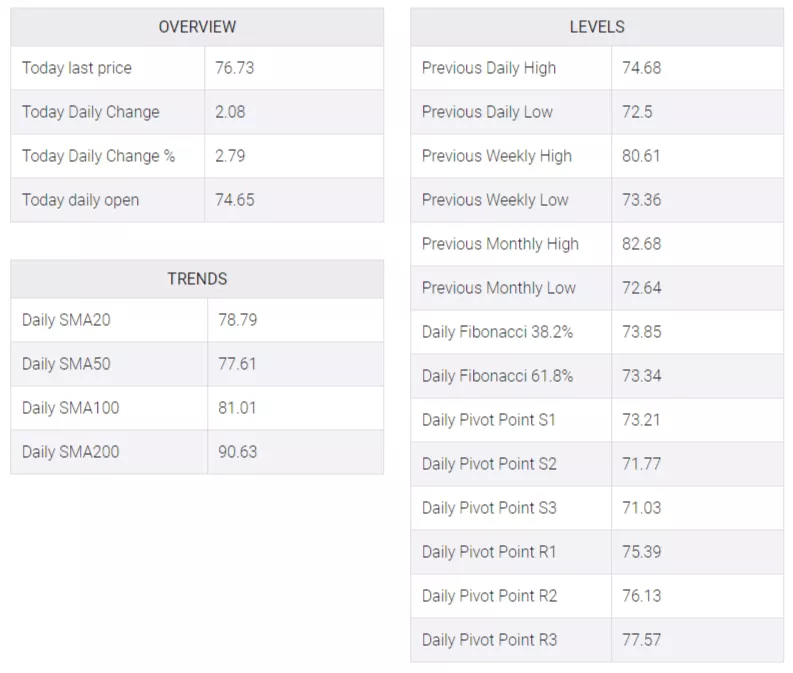

WTI is trading sideways after the US Federal Reserve Chair Jerome Powell finished its speech. It should be said that WTI broke to new daily highs of $77.11 on dovish remarks by Powell, weakening the US Dollar. Nevertheless, oil failed to gain traction and clear the 20-day EMA at $77.58, which could’ve exposed last Friday’s high at $77.96. Break above and the $78.00 figure is up for grabs.

On the flip side, WTI's first support would be $74.40, which, once cleared could pave the way for further downside.

WTI US OIL

More By This Author:

USD/JPY Price Analysis: Bulls Move In And Target 133.00 Ahead Of The 200-DMA

USD/JPY Jumps To Fresh Daily High, Eyes 130.00 Mark On Mostly Upbeat NFP Report

USD/CAD Climbs To Mid-1.3300s Amid Sliding Oil Prices, Modest USD Uptick Ahead Of NFP

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more