WTI Rallies After Big Crude Draw; Biden Admin Drains SPR For 13th Week In A Row

Oil prices slipped to the lower end of their recent range yesterday - WTI back below $70 - shrugging off any 'war premium' from Russia's coup-gate and seemingly weakening on expectations of a more hawkish Fed after strong econ numbers today.

"The market appears to have quickly discounted any meaningful supply risk tied to the short-lived uprising by Russian paramilitary forces over the weekend. That comes amid a broader trend that has seen Russian crude exports frequently come in above expectations over the past year as the country continues to find buying interest from China and other developing markets to counter lost market share in the U.S. and EU," said Robbie Fraser, manager of global research and analytics at Schneider Electric, in a note.

For now, all eyes will be on crude stocks after last week's unexpected draw (and API's reported draw)...

API

- Crude -2.4mm (-1.47mm exp)

- Cushing +1.45mm

- Gasoline -2.85mm

- Distillates +777k

DOE

- Crude -9.6mm (-1.47mm exp)

- Cushing +1.2mm

- Gasoline +603k

- Distillates +123k

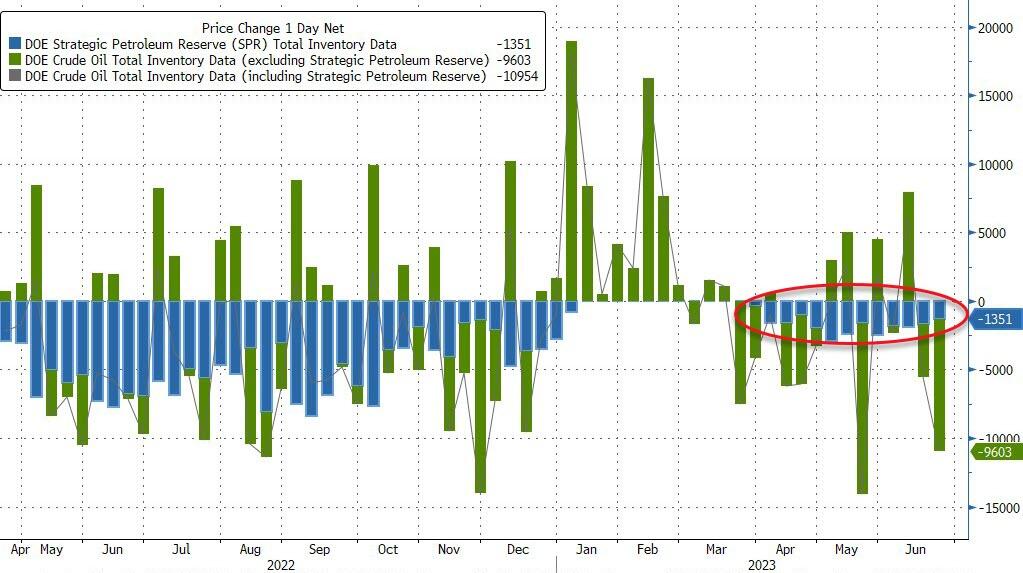

US crude stockpiles plunged 9.6mm barrels last week - far greater than expected. Products saw small builds...

(Click on image to enlarge)

Source: Bloomberg

Inventories at the Cushing Hub rose to their highest since June 2021

(Click on image to enlarge)

Source: Bloomberg

Despite the ongoing promise by the Biden admin to start refilling, the SPR was drained last week for the 13th straight week (-1.35mm bbl)

(Click on image to enlarge)

Source: Bloomberg

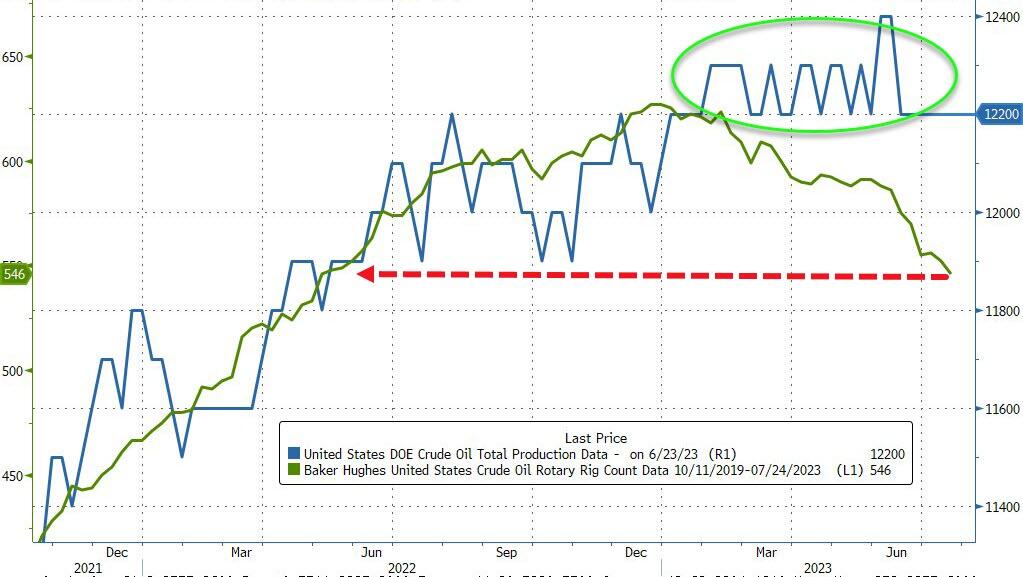

The US oil rig count has plunged in recent weeks - now at its lowest in over a year - but US crude production has not inflected yet...

(Click on image to enlarge)

Source: Bloomberg

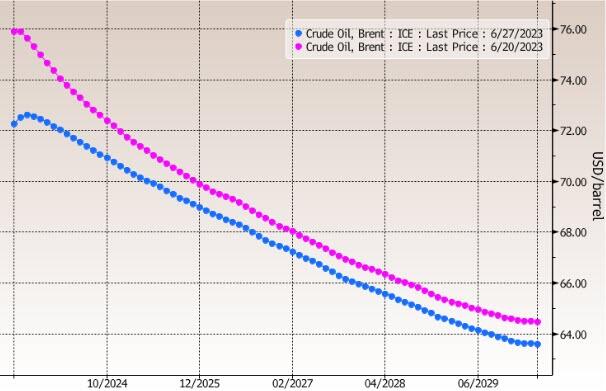

WTI was trading just below $68 ahead of the print - at the low end of its recent range - but rallied back above $68 after the big draw...

(Click on image to enlarge)

“Oil is well and truly stuck and rangebound, taking all the news on the chin,” said Ole Hansen, head of commodities strategy at Saxo Bank.

In fact, as Bloomberg's Grant Smith reports, oil price spreads are sending an ever-stronger signal of oversupply in global markets, and flashing a warning sign for the OPEC+ alliance.

Timespreads will continue to face headwinds due to pessimistic views on demand and high interest rates, Goldman analysts wrote in a note to clients.

More By This Author:

US New Home Sales Unexpectedly Explode Higher In May

Mediocre 5Y Auction Sees First Tail Since January

US Durable Goods Orders Unexpectedly Soar In May