WTI Price Forecast: Sees Immediate Support Near $55 Amid US-Venezuela Clash

Image Source: Unsplash

West Texas Intermediate (WTI), futures on NYMEX, trade 1.15% lower to near $56.00 during the late Asian trading session on Wednesday. The Oil price is under pressure as THE pledge from United States (US) President Donald Trump to restructure Venezuela’s Oil industry after Washington’s military action in the economy has raised hopes of increased global crude production.

Technically, higher Oil production in a steady demand environment weighs on the price.

On Monday, US President Trump announced that he will ask domestic Oil companies to support rebuilding Venezuela’s Oil infrastructure and will sell IT in global markets. Amid the US military action in Venezuela, they also captured President Nicolas Maduro over drug-trafficking charges.

Going forward, the major trigger for the Oil price will be the US Nonfarm Payrolls (NFP) for December, which will be released on Friday. The US official employment data will influence market expectations for the Federal Reserve’s (Fed) monetary policy outlook. Lower interest rates by the Fed bode well for the Oil price.

WTI technical analysis

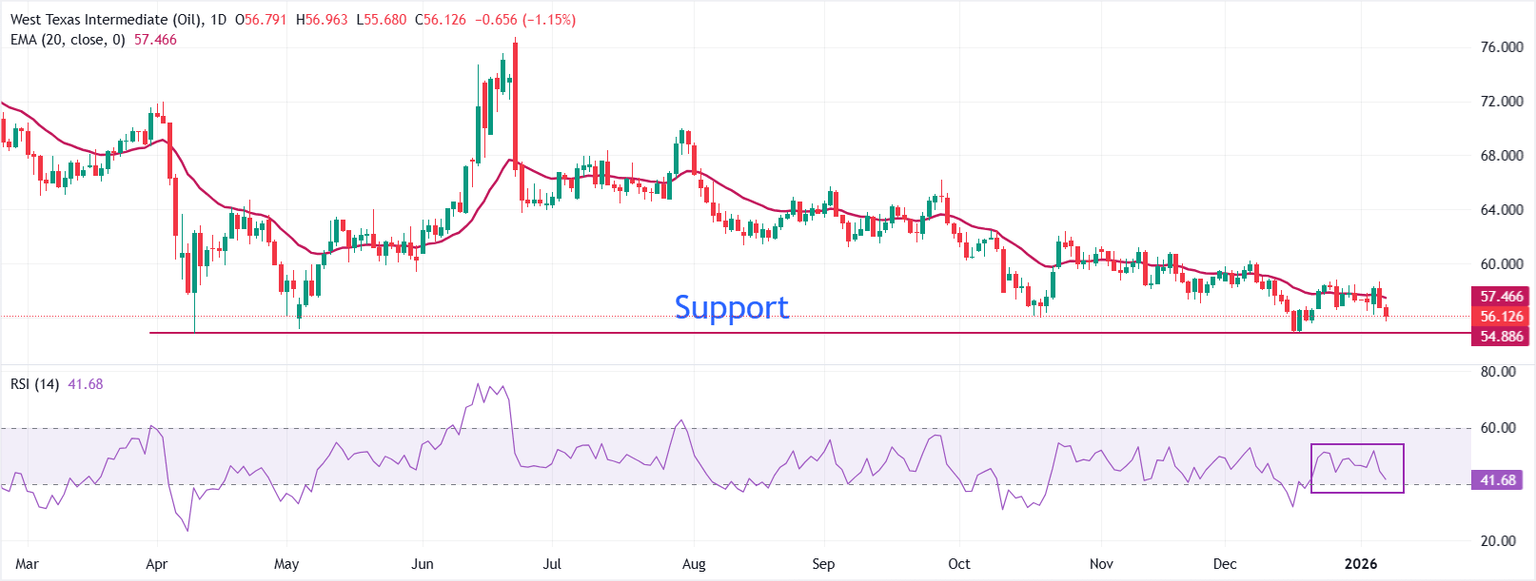

WTI US Oil trades lower at around $56.10 on Wednesday. The 14-day Relative Strength Index (RSI) at 41.68 points to weak momentum without an oversold signal.

The 20-day Exponential Moving Average (EMA) at $57.47 slopes lower and caps rebounds, keeping the bias bearish. With price holding beneath the falling average, rallies would remain corrective, and could go for a deeper retracement towards the psychological level of $50.00 after breaking below the immediate support of $55.00.

On the contrary, a daily close of the price above this 20-day EMA would shift the tone toward balance, and pave the way for an adavncement towards the December high around $60.00.

More By This Author:

Pound Sterling Turns Upside Down Against Its PeersPound Sterling Gains As Market Sentiment Improves

USD/CHF Ticks Down To Near 0.7910 As US Dollar Falls Back

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more