WTI Price Forecast: Oil Struggles Below $60 As Bullish Momentum Fades

Image Source: Unsplash

West Texas Intermediate (WTI) edges lower on Thursday, giving back this week’s gains as geopolitical risk premiums fade after US President Donald Trump softened his rhetoric on Iran, easing fears of imminent military action. At the time of writing, WTI trades around $59.26 per barrel, down nearly 1.40% on the day.

However, prices are finding some support after reports that US forces in the Caribbean Sea intercepted and seized a sixth Oil tanker under sanctions, which the Trump administration says is connected to Venezuela.

The US benchmark had surged to $62.19, its highest level since October, on Wednesday as investors priced in a growing risk of supply disruptions amid fears that the United States could take military action against Iran. With those concerns now easing, broader oversupply worries are resurfacing and weighing on sentiment.

Meanwhile, a resilient US Dollar (USD) is adding to the pressure, making dollar-denominated Crude more expensive for overseas buyers.

(Click on image to enlarge)

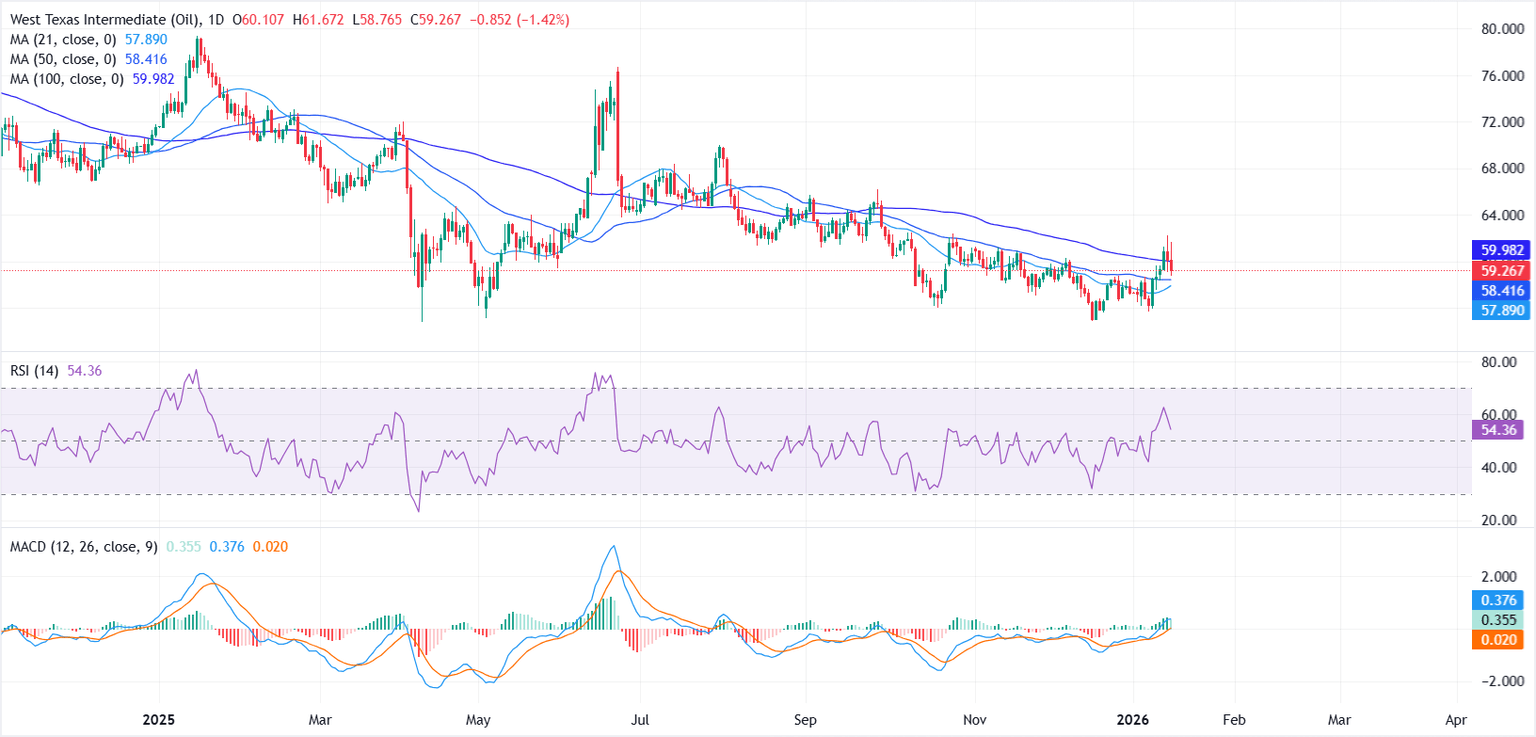

From a technical perspective, sellers remain in control after WTI failed to sustain a move above the $60.00 psychological mark. While the near-term structure appears mildly constructive, with prices holding above the 21-day and 50-day Simple Moving Averages (SMAs), the broader trend remains capped below the 100-day SMA, which continues to limit upside attempts.

The Moving Average Convergence Divergence (MACD) line remains above the Signal line in positive territory, while the histogram flattens. Meanwhile, the Relative Strength Index (RSI) hovers near 52 and is turning lower, signaling that bullish momentum is fading.

On the downside, immediate support is located in the $59.00–$58.00 zone, where short- and medium-term moving averages converge. A sustained break below this region would reinforce bearish pressure and could expose the next support area near $56.00-$55.00.

On the upside, the $60.00 handle remains the first key hurdle. A decisive close above this psychological level, alongside a clear break of the 100-day SMA, would be needed to ease downside pressure and open the door for a broader recovery.

More By This Author:

Silver Price Pulls Back From Record High As Safe-Haven Demand WanesEUR/USD Trims Losses Amid Strong Eurozone Industrial Production

Silver Price Forecast: XAG/USD Jumps To Record High Past $89.00 As Bullish Momentum Fades

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more