WTI Price Analysis: WTI Drops Amid Chinese Real Estate Sector Fears

At the start of the week, the West Texas Intermediate (WTI) barrel lost traction, fell to a daily low of $81.30, and settled near $82.00. A stronger USD on the back of higher US yields and Chinese real estate sector concerns are mainly responsible for the Oil’s downward trajectory.

China's major real estate firm, Country Garden Holdings, revealed a projected loss of $7.6 billion for H1 2023 and announced that it would halt trading 11 onshore bonds starting Monday. This caused a nearly 20% drop in their shares, bringing down the Shangai Composite Index. In addition, Moody’s warned of a potential crisis spillover to the country's property and financial markets, possibly delaying the sector's recovery. It's worth mentioning that China is the largest Oil importer in the world, so the weakness of the real estate industry, an important gauge of an economy’s health, weighs on the WTI’s price.

On the other hand, the USD, measured by the DXY index, rose above 103.00, and the Greenback gained interest in higher US yields. In that sense, the bond markets are flashing signals that investors are confident that the Federal Reserve (Fed) won’t hike in September but that the odds of a 25 basis point increase in November have risen to nearly 40%, according to the CME FedWatch tool. In that sense, higher rates which tend to cool down economic activity, present another challenge to Oil prices.

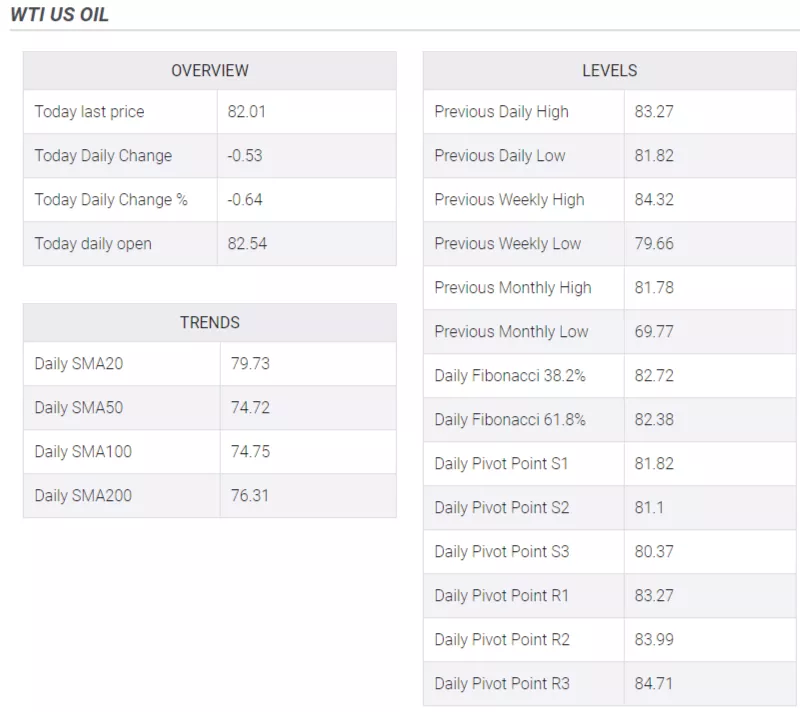

WTI Levels to watch

The technical analysis of the daily chart suggests a shift towards a neutral to a bearish outlook for WTI, with indications of bullish exhaustion. The Relative Strength Index (RSI) exhibits a negative slope above its midline, while the Moving Average Convergence Divergence (MACD) displays fading green bars. That being said, the pair is above the 20,100,200-day Simple Moving Averages (SMAs), indicating a favourable position for the bulls in the bigger picture.

Support levels: $81.30, $81.00, $79.50.

Resistance levels: $83.70, $84.00, $85.00

WTI Daily chart

(Click on image to enlarge)

-638276433502947504.png)

More By This Author:

US Dollar Steady As Markets Bounce Back

Nasdaq 100 Looks Set For Correction, But S&P 500 Is Holding On For Now

Pound Sterling Weakens Ahead Of Employment Data

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more