WTI Price Analysis: Oil Prices Escalate To Highs Since April Amid Tighter Supply

On Thursday, the West Texas Intermediate (WTI) rose more than 1% to its highest level since mid-April, above $80.00. Investors seem to be weighing the fact that the Chinese economic stimulus would bolster local economic activity and drive Oil prices up on higher demand. In addition, expectations ofOrganization of the Petroleum Exporting Countries (OPEC) production cuts give further traction to the black gold.

On the negative side, the USD strength following the Federal Reserve (Fed) hike on Wednesday and the release of robust economic activity data on Thursday may limit the WTI’s advance. In that sense, as Jerome Powell opened a hike in September as the decision will be based on data, strong US data fuel hawkish bets on the Fed favouring the USD.

In that sense, it was reported that the Q2 Gross Domestic Product (GDP) increased at an annualised rate of 2.4%, exceeding the 1.8% expected and the previous 2%. Durable goods saw a notable increase in June. The headline number increased by 4.7% MoM, exceeding the market expectation of 1%, while orders excluding Defense and Transportation increased by 6.2% and 0.6%, respectively, despite expectations for them to remain unchanged.

In addition, Jobless Claims for the week ending on July 21 decreased further, coming in at 221,000 rather than the predicted 235,000 and the previous 228,000. According to the CME FedWatch tool, markets are discounting low odds of a hike in September (24%).

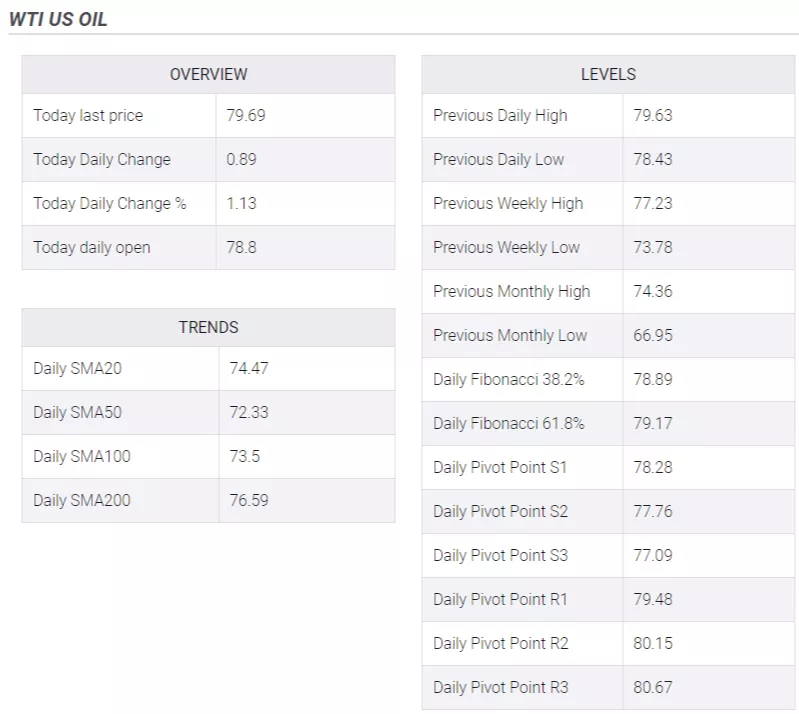

WTI Levels to watch

From a technical standpoint and according to the daily chart, the WTI holds a short-term bullish perspective. The price remains trading above its main moving averages, while its indicators edge higher but stand near overbought conditions to a downward correction shouldn’t be taken off the table.

Resistance levels: $82.00,$82.30,$82.50.

Support levels: $76.66 (200-day SMA), $74.96 (20-day SMA),$73.52 (100-day SMA).

WTI Daily chart

(Click on image to enlarge)

-638260698103410065.png)

More By This Author:

AUD/USD Price Analysis: Clings To Strong Gains Near Weekly Top, Above 0.6800 Mark

Gold Price Forecast: XAU/USD Whipsawed But Leans Towards Trendline Support On Fed Hike

WTI Price Analysis: WTI Retreats Towards $79.00 Ahead Of Fed Decision

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more