WTI Hovers Near 11-Week Lows After Surprise Crude Build, Production Pop

Image Source: Pixabay

Oil prices fell to a ten-week low early on Wednesday as another major forecasting agency warned global inventories are on the rise amid higher supply, while a report showed an unexpected hike in U.S. inventories.

In its monthly Oil Market Report, the International Energy Agency again trimmed its 2025 demand-growth forecast to 0.7-million barrels per day (bpd), down by 20,000 bpd from July and by 350,000 bpd since the start of the year, on weaker-than-expected demand from developing economies.

"While oil market balances look ever more bloated as forecast supply far eclipses demand towards year-end and in 2026, additional sanctions on Russia and Iran may curb supplies from the world's third and fifth largest producers ... While it is still too early to determine the outcome of these latest policy changes moving in different directions, it is clear that something will have to give for the market to balance," the report noted.

The report follows on Tuesday's Short-Term Energy Outlook from the Energy Information Administration (EIA) that slashed its Brent crude price forecast to US$58.00 per barrel in the fourth quarter, down from its July forecast of US$71.00, as it sees supply up 2.0-million bpd in the second half of 2025 from the year's first six months, while demand is up by only 1.6-million b/d, pushing inventories higher and lowering prices.

Overnight, saw prices drift lower after API reported a surprise crude build, adding to concerns that demand may not be there.

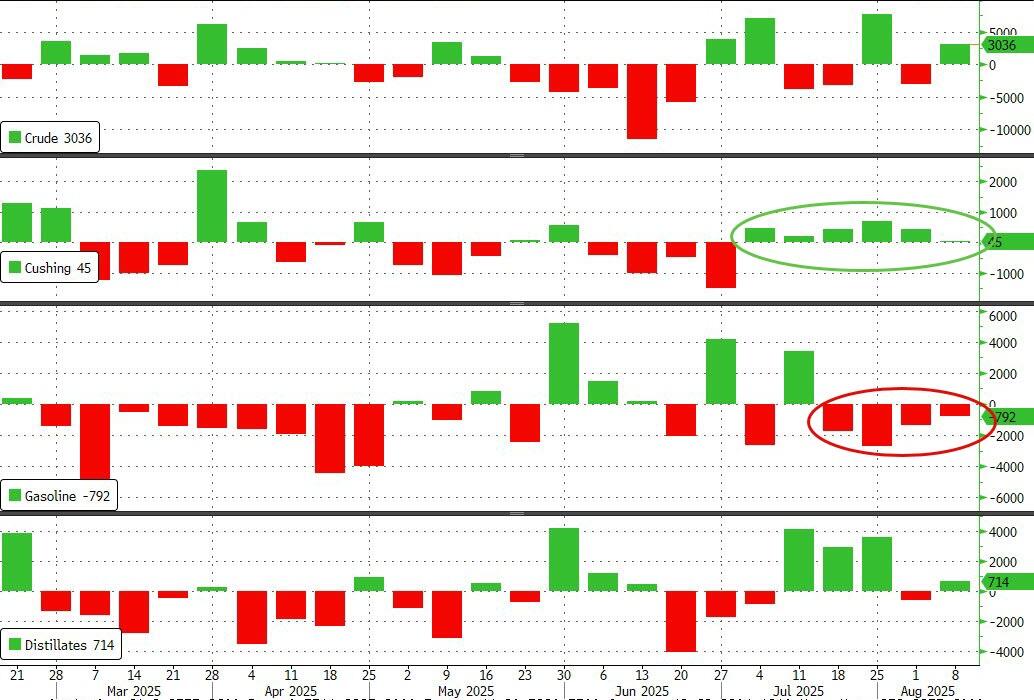

API

-

Crude +1.52mm (-1.0mm exp)

-

Cushing

-

Gasoline -1.78mm

-

Distillates +295k

DOE

-

Crude +3.036mm (-1.0mm exp)

-

Cushing +45k

-

Gasoline -792k

-

Distillates +714k

The official data confirmed API's surprise build for crude stocks as the Cushing hub saw stocks rise for the 6th straight week (though only modestly last week)...

Source: Bloomberg

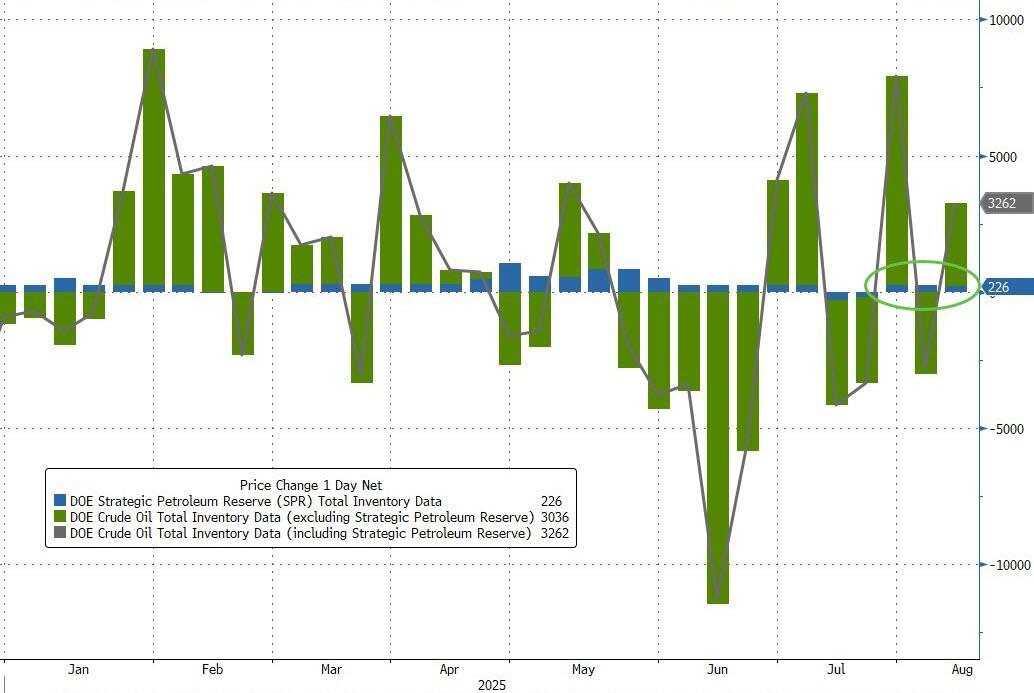

Another weekly addition to the SPR helped drive total US commercial crude stocks higher...

Source: Bloomberg

US Crude production inched higher last week (amid an ongoing trend lower in rig counts)...

Source: Bloomberg

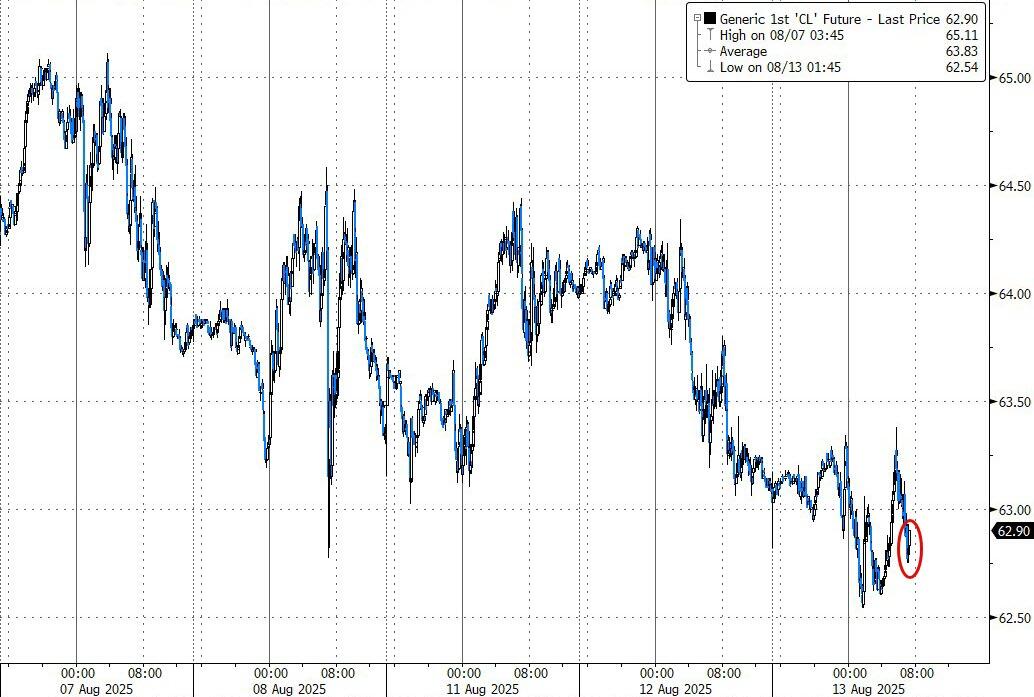

Crude prices hovered near the lows of the day...

Source: Bloomberg

.., near 11-week lows...

Oil traders are tracking preparations for the talks, given that they may result in an easing of US sanctions on OPEC+ member Russia. Prices have fallen this year as the producer group accelerated output hikes, though moves have been more muted in recent days amid thin summer trading.

“Markets continue to remain in a wait-and-see approach as we await the big Trump-Putin meeting in Alaska,” said Keshav Lohiya, founder of consultant Oilytics.

More By This Author:

Cava Crashes After Outlook Slashed, Cautious On DinersRate-Cut Odds Soar As US Consumer Prices Once Again Reject Trump Tariff Terror

Key Events This Week: CPI, PPI Retail Sales, Trump-Putin Summit

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more