WTI Holds 'Venezuela Blockade' Gains After Small Crude Draw, Record US Production

Image Source: Unsplash

Oil prices surged overnight, jumping off multi-year lows after President Trump ordered a "total and complete blockade" of oil tankers into and out of Venezuela.

That was amid hopes of a peace deal between Ukraine and Russia, among other factors including record domestic production and weakening demand in China.

But as one geopolitical risk looks set to ease, another one is ramping up. Trump said Venezuela was "completely surrounded by the largest Armada ever assembled in the History of South America," in a post on Truth Social late Tuesday.

However, the rally in oil prices may end up being short-lived unless other catalysts start to emerge.

"Ultimately, the trend is lower for oil, with it likely to persist unless there's a pick-up in global industrial activity, a bigger supply shock, or -- most likely -- intervention from OPEC to support prices," Capital.com analyst Kyle Rodda said in a note Wednesday.

But if the official data confirms API's big crude draw, we could see prices extend gains given how increasingly short crude positioning has become.

API

-

Crude -9.3mm

-

Cushing -510k

-

Gasoline +4.8mm

-

Distillates +2.5mm

DOE

-

Crude -1.27mm (-3.1mm exp)

-

Cushing -742k

-

Gasoline +4.81mm

-

Distillates +1.71mm

US crude inventories drew down modestly last week (dramatically less than API reported) while products saw stocks build for the fifth straight week...

Source: Bloomberg

US Crude production remains near record highs as rig counts continue to trend lower...

Source: Bloomberg

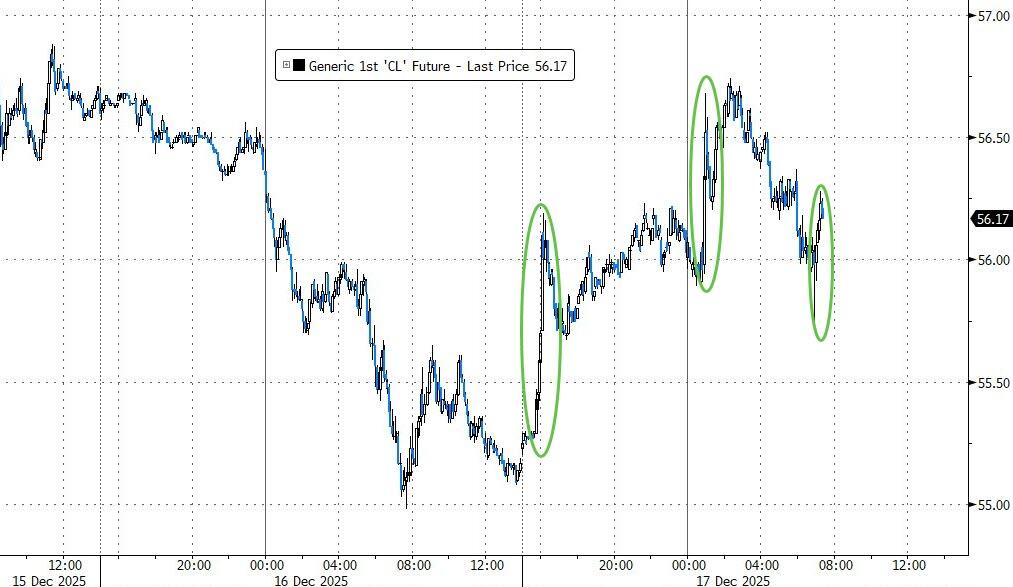

WTI is holding gains for now after the data...

Source: Bloomberg

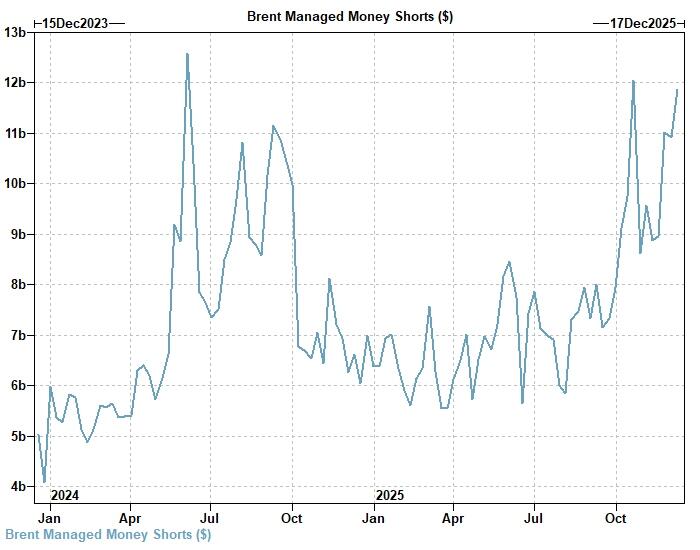

Over the past few weeks, Brent crude positioning grew increasingly short. The last Commitment of Traders report, covering through December 9th, exhibited Managed Money shorts at a 98% 2-year rank.

However for the moment, Goldman Sachs traders say that a larger recovery appears warranted to cause a significant short unwind.

After incorporating the drop on December 16th, price needs to recoup ~6% before momentum signals become positive, per GS Futures Strategists' framework.

Moreover, curve tightening is modest thus far, posing a limited threat to term structure shorts.

More By This Author:

Pump-Prices Plummet As Ukraine Peace Deal Progress Sparks Oil PlungeWall Street Eyes Lithium As Battery Storage Demand Poised To Spark New Upcycle

OPEC Maintains Bullish Oil Demand Outlook, IEA Trims Oil Glut Forecast

Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time you ...

more