WTI Holds Ugly Losses Despite 3rd Weekly Crude Draw In A Row

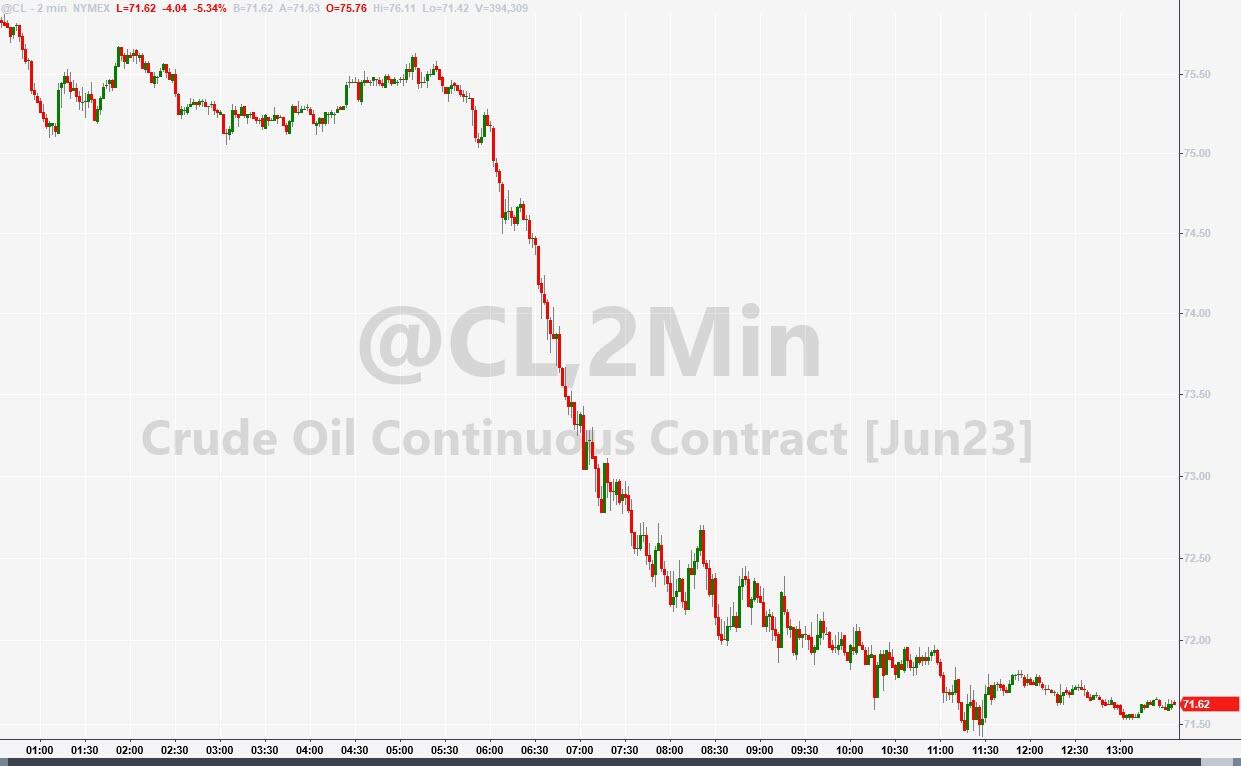

Oil prices cratered today - their biggest drop since the start of January - amid low liquidity and dismal macro data.

“The market is an investor desert,” said Scott Shelton, an energy specialist at ICAP.

“The fundamental information that generates predictable price action doesn’t exist.”

Separately, Bloomberg reported Tuesday that OPEC's oil production fell last month by 310,000 barrels a day to an average of 28.8 million, the lowest in nearly a year, as a pipeline suspension reduced exports from Iraq.

Tonight's API data may hint at just how big a downturn we are seeing.

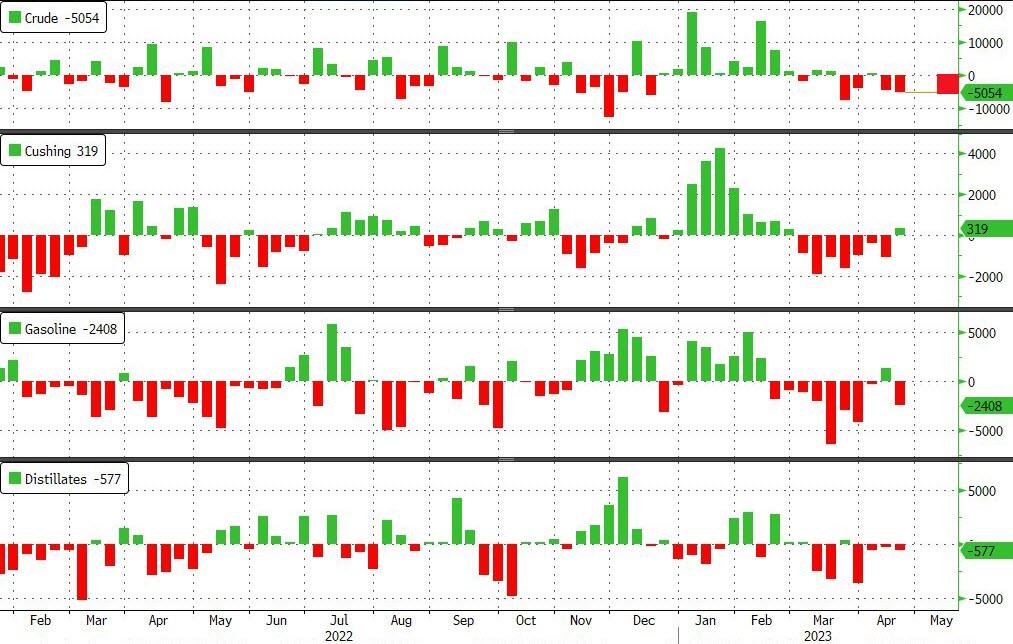

API

- Crude -3.939mm (-3.30mm exp)

- Cushing

- Gasoline (-300k exp)

- Distillates (-1.5mm exp)

For the 3rd week in a row, crude stocks saw a draw-down (slightly bigger than expected)...

(Click on image to enlarge)

Source: Bloomberg

The OPEC+ output cuts announced in early April "have only gone into effect this week," so inventory declines may not start until July, he said.

"Recession fear is like a hurricane that destroys everything along its path -- oil included," said Manish Raj, managing director at Velandera Energy Partners.

"It does not matter that fundamentals for oil are now stronger than ever, with rising demand and falling supply in the foreseeable future."

WTI was hovering just above $71.50 ahead of the API print with little to no reaction after...

(Click on image to enlarge)

“It’s going to take some evidence in the physical market on the tightening we see in our balances before we see any more positive or committed trading activity,” Emily Ashford, an energy analyst at Standard Chartered Bank, said by phone.

Finally, we note that Morgan Stanley slashed its forecast for Brent crude prices in the third quarter by $12.50 to $77.50 a barrel, saying Russian supplies remain high enough and that much of the demand boost from China’s reopening has likely already played out.

More By This Author:

Tesla Bumps Prices Of Model 3 And Model Y Higher In U.S. And China

Blackstone's BREIT Suffers Sixth Consecutive Month Of Withdraws As CRE Deteriorates

General Motors Shares Pop 3% After Morgan Stanley Upgrade To Overweight, Raised Price Target

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more