WTI Holds Losses Despite Another Huge Crude Draw

Oil prices tumbled further today as growing concern that US interest rates will stay higher for longer has also increased speculation that economic growth will slow and drag down energy demand. Dollar strength also did not help.

“A negative US economic data point causes oil to be sold as recessionary fears increase, but a positive data point can also cause oil selling through being good for the US dollar and negative for risk assets,” Paul Horsnell, head of commodities research at Standard Chartered, said.

“There is always interplay between those effects, but in the past three weeks oil has tended to fall after both good and bad economic data.”

After last week's huge crude draw, all eyes are back on inventory/supply data for any signals that this drawdown in price is over.

API

- Crude -6.246mm (-3.884mm)

- Cushing +30k - first build in 5 weeks

- Gasoline +5.93mm

- Distillates +3.55mm

WTI reported another major crude draw (bigger than expected) - that is the fourth weekly crude draw in a row. On the other hand, Products saw significant builds for the fourth straight week...

(Click on image to enlarge)

Source: Bloomberg

WTI hovered just above $74 ahead of the API print, and inched higher on the crude draw...

(Click on image to enlarge)

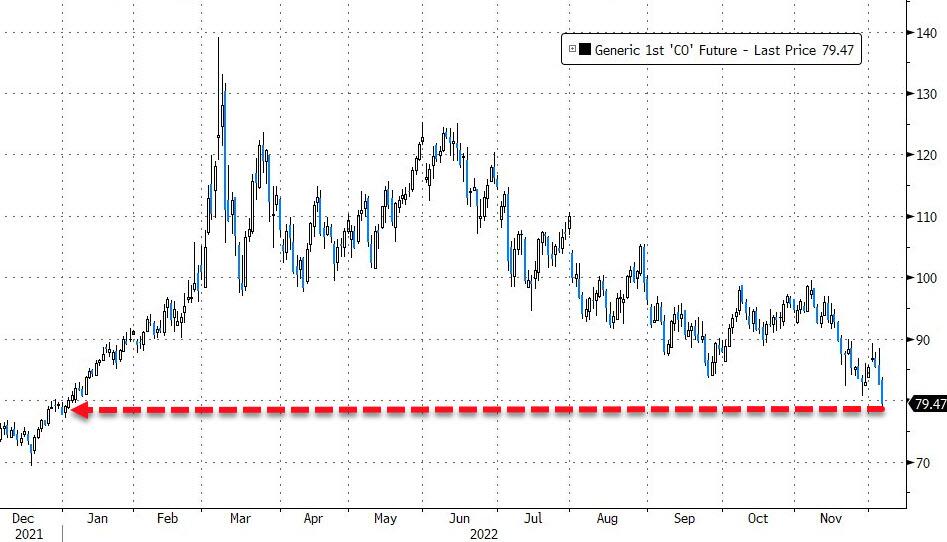

Brent broke down below $80 for the first time since January...

(Click on image to enlarge)

Traders are “fleeing the market” because of the “absurd” price actions oil has recently experienced, Ed Morse, global head of commodity research at Citigroup Inc., said in a Bloomberg Television interview.

“We are getting toward the end of the year, and those who made money this year did not want to lose any.”

The oil market’s structure has also been in freefall, with one gauge of US trading at its weakest level in two years, pointing to ample near-term supply.

More By This Author:

Russia Unveils Oil Price-Floor Plan To Counter G-7 Cap

PepsiCo To Lay Off Hundreds After Price-Hikes As Consumer 'Strength' Questioned

Saudis Double-Down On Credit Suisse Bailout

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more