WTI Holds Losses After Second Straight Weekly Crude Build

Oil prices gave up early gains - which neared post-Putin-invasion highs (which were largely triggered by supply disruptions in Libya) - and ended the day notably in the red as traders weighed news developments linked to the Iran nuclear deal, a waiver extension allowing U.S. banks to process Russian energy transactions, and a report that a U.S. senator intends to propose a federal surtax on certain oil companies in a move to curb inflation.

“Energy traders are bracing for some type of action to come from the Biden administration to help Americans at the pump, even if it will have little long-term effect,” said Ed Moya, senior market analyst at Oanda.

The news comes after Biden announced he will travel to Saudi Arabia next month and will discuss energy production.

Also, the U.S. Energy Department announced contract awards related to the Strategic Petroleum Reserve on Tuesday, as well as a fourth emergency sale of crude oil from the reserve.

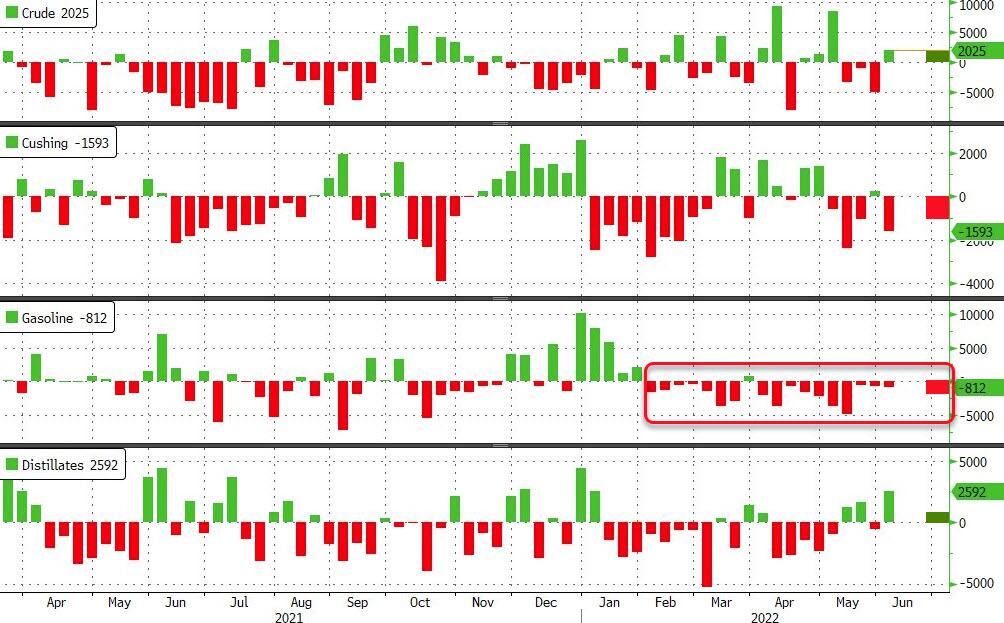

API

- Crude +763k (-1.2mm exp)

- Cushing -1.067mm

- Gasoline -2.159mm

- Distillates +234k

US Crude stocks rose for the second week in a row. Cushing stocks fell and Gasoline inventories drew down once again)...

(Click on image to enlarge)

Source: Bloomberg

WTI was hovering around $118.50 ahead of the API print and managed a very small bounce on the data...

(Click on image to enlarge)

Finally, we note that demand risks still persist in the market as producer group OPEC said it sees oil demand growth halving next year.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more