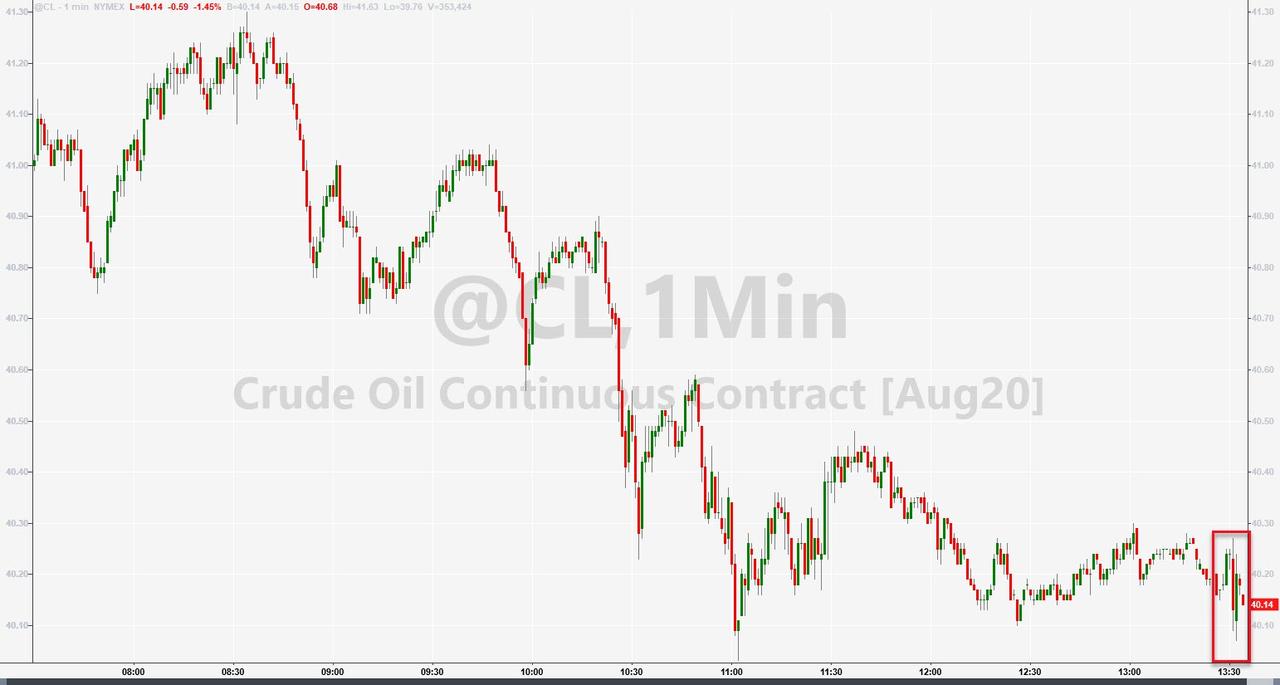

WTI Holds Losses After Bigger Than Expected Crude Build

Oil prices rolled over today (with WTI testing down to $40.00 towards the close after hitting a three-month high) which followed a volatile overnight session thanks to confusing China trade headlines.

“Crude has had a draw only three weeks since mid-January, so I wouldn’t be surprised to see another build from this week’s report,” said Michael Hiley, head of over-the-counter energy trading at New York-based LPS Futures.

Additionally, while the market has been buoyed in recent days by signs that demand is coming back, renewed fears of a second wave of the coronavirus is spurring some caution.

The demand outlook for oil is "less clear given the uneven recovery thus far as some states are experiencing spikes in new cases," said Marshall Steeves, energy markets analyst at IHS Markit.

API

- Crude +1.749mm (+1.5mm exp, Platts -100k exp)

- Cushing -2.605mm

- Gasoline -325k (-1.9mm exp)

- Distillates -3.856mm (+100k exp)

After last week's product draws and small crude build, expectations were very mixed this week but API reports that crude stocks rose by 1.3mm barrels last week - more than expected.

(Click on image to enlarge)

Source: Bloomberg

(Click on image to enlarge)

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more