WTI Holds Losses After Big Crude, Gasoline Build

Oil prices fell for the 3rd straight day after OPEC/EIA cut their global demand growth forecasts amid recession fears

“Risks are skewed to the downside, with slowing growth in the global economy,” OPEC’s Vienna-based research department said in the report.

Combined with “a possible resurgence of Covid restrictions in China and elsewhere,” the oil market may miss out on the typical seasonal uptick in consumption, it said.

Still, the demand revision from OPEC is eclipsed by the size of the cut announced by the cartel.

"This combination, in our view, probably supports elevated crude oil prices over the next 12 months -- but recession risk remains," said Stewart Glickman, analyst at CFRA, in a note.

For now, we look at signs of demand destruction in the API data...

API

- Crude +7.054mm (+2.2mm exp)

- Cushing -750k

- Gasoline +2.008mm (-2.1mm exp) - biggest build since July

- Distillates -4.560mm (-2.3mm exp) - biggest draw since March 2022

We suspect some of this data is affected by Hurricane Ian, but for now, Crude stocks surged over 7mm barrels last week (well above expectations) - remember there was a 7.7mm drain from SPR. Gasoline inventories built (notably different from the draw expected) and distillates drew down more than expected...

Source: Bloomberg

WTI was hovering around $87 ahead of the API print and rallied modestly on the data then gave it all back...

(Click on image to enlarge)

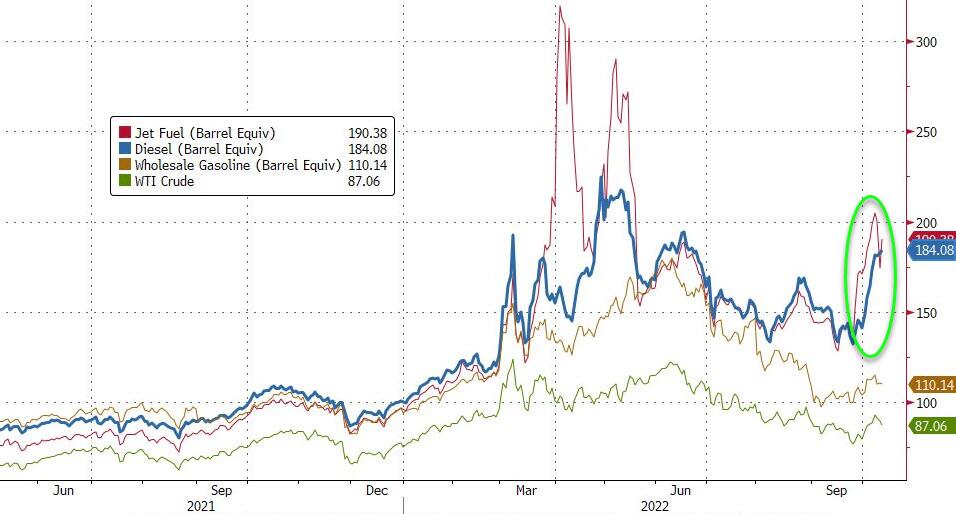

Interestingly Diesel and Jet Fuel crack spreads are exploding higher (wholesale gasoline not so much) as refinery supplies struggle to refill inventories...

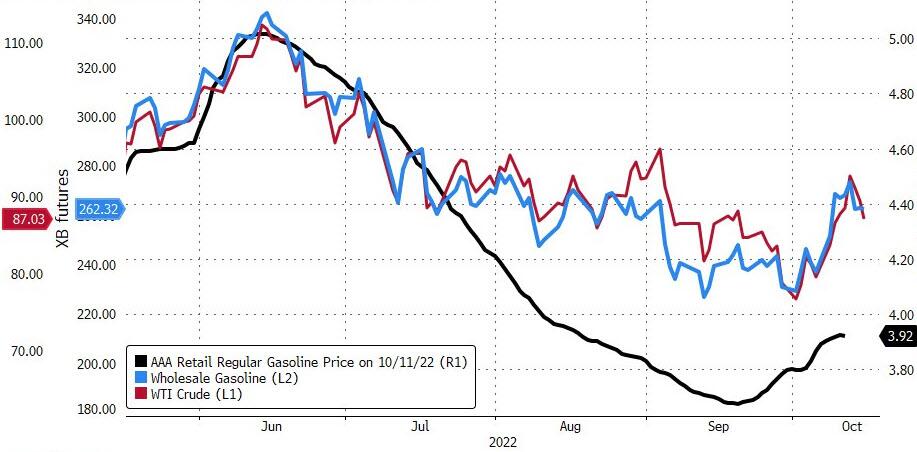

And finally, prices at the pump are up for 9 straight days and given where crude and wholesale gasoline prices are, we should expect prices to keep rising ahead of the Midterms...

The only chance for lower prices is continued concerns about future global demand and the bleak economic outlook which will "raise the possibility that supply issues will be less of an issue than demand destruction," said Michael Hewson, chief market analyst at CMC Markets UK, in a market update.

More By This Author:

This Is The Worst Run For 'Dip-Buyers' Since Greenspan Unleashed The 'Fed Put'

PepsiCo's Average Product Prices Spike 17% Year-Over-Year

Food Cost Jump Sparks Hotter Than Expected US Producer Price Inflation

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more